InterRent REIT Acquisition: Sovereign Wealth Fund And Executive Chair's Bid

Table of Contents

The Bidders: Sovereign Wealth Fund and Executive Chair

This compelling bid involves a unique partnership: a powerful sovereign wealth fund and InterRent REIT's own executive chair. Understanding the roles and motivations of each player is crucial to comprehending the acquisition's significance.

The Sovereign Wealth Fund's Role

While the specific sovereign wealth fund involved may not be publicly disclosed for confidentiality reasons, we can speculate on their motivations based on typical sovereign wealth fund investment strategies. These funds often seek diversification within their investment portfolios, aiming for stable, long-term returns.

Their interest in InterRent REIT likely stems from several factors:

- Investment portfolio diversification: Adding a well-established Canadian real estate portfolio like InterRent's diversifies risk and provides exposure to a stable and growing market.

- Strategic interest in Canadian real estate: Canada's robust economy and stable political landscape make it an attractive location for real estate investment, particularly in the multi-family rental sector.

- Strength of financial resources: Sovereign wealth funds possess significant capital, enabling them to make substantial acquisitions and compete effectively in the real estate market.

The Executive Chair's Involvement

The executive chair's participation adds another layer of complexity. Their involvement likely stems from a combination of personal financial gain and a strategic vision for the future of InterRent REIT.

- Personal financial stake: The executive chair likely holds a substantial personal stake in InterRent REIT, making the acquisition financially beneficial.

- Long-term vision for the company: Their involvement might signal a belief in a long-term strategic plan for InterRent REIT that aligns with the sovereign wealth fund's objectives.

- Influence on decision-making process: Their insider knowledge and influence within the company will undoubtedly play a significant role in shaping the post-acquisition strategy. This could involve navigating potential conflicts of interest, which require careful management and transparent disclosure.

Financial Implications and Valuation of InterRent REIT

The financial aspects of this acquisition are complex and warrant close scrutiny. A thorough understanding of the bid price, funding sources, and transaction structure is essential for assessing its overall viability.

The Bid Price and its Analysis

The offered price per share and the overall acquisition value are key factors determining the success of the bid. A detailed analysis requires comparing the offered price to InterRent REIT's current market valuation, historical performance, and future earnings projections. A premium offered over the market price signifies the bidders' confidence in InterRent REIT's future prospects.

- Premium offered compared to market price: A significant premium might suggest a belief that InterRent REIT is undervalued.

- Valuation methodologies used: Understanding the valuation methodologies employed (discounted cash flow analysis, comparable company analysis, etc.) provides insights into the rationale behind the bid price.

- Financial projections for post-acquisition performance: The bidders' financial models and future performance projections are critical for assessing the long-term value of the acquisition.

Funding Sources and Transaction Structure

The acquisition's financing and structure will have a significant impact on its likelihood of success.

- Debt-to-equity ratio of the bid: A higher debt component introduces greater financial risk.

- Contingency plans: The bidders' contingency plans for unforeseen circumstances are crucial for assessing the deal's robustness.

- Regulatory approval timeline: Navigating the regulatory approval process will likely determine the timeline for completing the acquisition. Potential delays could affect the overall value proposition.

Potential Impacts and Future Outlook for InterRent REIT

The InterRent REIT acquisition will have significant impacts on shareholders, the company's property portfolio, and the broader Canadian multifamily rental market.

Impact on Shareholders

The bid price will directly affect existing shareholders. However, the potential for long-term value creation under new ownership needs careful consideration.

- Shareholder voting process: The shareholder voting process will be crucial in determining the acquisition's success.

- Potential for alternative bids: The possibility of competing bids could drive up the price and benefit existing shareholders.

- Long-term growth prospects: The long-term growth prospects under the new ownership structure must be evaluated against the potential short-term gains from the acquisition.

Future of InterRent REIT's Property Portfolio

The acquisition could significantly alter InterRent REIT's investment strategy and its property portfolio.

- Changes in investment priorities: The sovereign wealth fund might prioritize different investment strategies, potentially leading to portfolio restructuring.

- Potential acquisitions or dispositions of properties: The new owners might focus on specific geographic areas or property types, leading to acquisitions or dispositions of properties.

- Impact on rental rates and market competition: The acquisition could potentially impact rental rates and market competition within the Canadian multifamily rental sector.

Conclusion

The InterRent REIT acquisition is a complex transaction with far-reaching implications. Analyzing the motivations of the bidders, the financial details of the bid, and the potential impacts on shareholders and the broader real estate market is vital for a comprehensive understanding of this significant event. The outcome will profoundly shape the future of InterRent REIT and its position within the Canadian real estate landscape. Stay informed about the developments in this unfolding story to gain a clearer perspective on the implications of this impactful InterRent REIT acquisition. Keep following for updates on this significant InterRent REIT acquisition.

Featured Posts

-

Cuaca Semarang Besok 22 4 Peringatan Hujan Siang Di Jawa Tengah

May 29, 2025

Cuaca Semarang Besok 22 4 Peringatan Hujan Siang Di Jawa Tengah

May 29, 2025 -

The Xx Million Hudsons Bay Deal Unveiling Weihong Lius Strategy

May 29, 2025

The Xx Million Hudsons Bay Deal Unveiling Weihong Lius Strategy

May 29, 2025 -

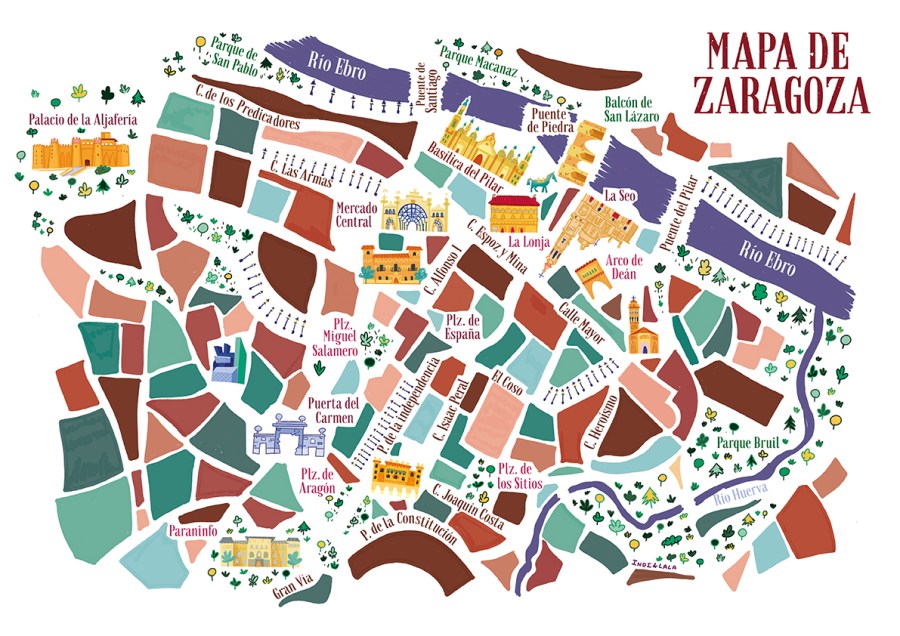

Guia Definitiva De Radares En Zaragoza Para 2025

May 29, 2025

Guia Definitiva De Radares En Zaragoza Para 2025

May 29, 2025 -

Broadcoms V Mware Deal A 1050 Price Increase Sparks Outrage From At And T

May 29, 2025

Broadcoms V Mware Deal A 1050 Price Increase Sparks Outrage From At And T

May 29, 2025 -

Liberty Poole Red Hot In A Mini Dress After Love Island

May 29, 2025

Liberty Poole Red Hot In A Mini Dress After Love Island

May 29, 2025