Internal GOP Strife Threatens Trump's Tax Legislation

Table of Contents

Factional Divisions Within the Republican Party

The Republican party is not a monolithic entity. Instead, it comprises several distinct factions, each with its own priorities and perspectives on Trump's tax legislation. These internal divisions are significantly hindering the bill's progress. The main factions include fiscal conservatives, social conservatives, and libertarian-leaning Republicans. Their differing stances on the tax plan create a complex and often conflicting legislative landscape.

-

Fiscal Conservatives: This group prioritizes fiscal responsibility and expresses deep concern about the potential long-term deficit implications of the proposed tax cuts. They advocate for more fiscally responsible measures and scrutinize the plan's projected revenue shortfalls. Key figures within this faction often call for greater spending cuts to offset the tax reductions.

-

Social Conservatives: While generally supportive of tax cuts, social conservatives focus on ensuring the legislation incorporates provisions aligned with their values. They often push for specific tax benefits related to charitable giving, families, and religious organizations. Their influence can lead to amendments that prioritize social goals over purely economic considerations.

-

Libertarian-leaning Republicans: This faction champions lower overall tax rates and reduced government intervention in the economy. They often oppose many of the targeted tax breaks and deductions included in the original Trump tax plan, preferring a simpler, more broadly applicable system. Their influence pushes for a more laissez-faire approach to tax policy.

The power dynamics between these factions are fluid and highly influential. The ability of each group to leverage its influence within the party and Congress directly impacts the legislative process. The internal negotiations and compromises required to appease these diverse viewpoints have significantly slowed the progress of Trump's tax legislation.

Specific Points of Contention in Trump's Tax Legislation

Several key aspects of the proposed tax legislation are fueling intense internal debate and disagreement within the Republican party, creating major obstacles to its passage.

-

Debate over Corporate Tax Rates: A significant point of contention centers around the proposed reduction in the corporate tax rate. While some Republicans see this as crucial for stimulating economic growth, others express concern about the potential impact on the deficit and the fairness of such substantial tax cuts for large corporations.

-

Disagreements on Individual Tax Brackets and Deductions: The restructuring of individual tax brackets and the elimination or modification of certain deductions have also sparked fierce debate. Some argue that the proposed changes disproportionately benefit the wealthy, while others defend them as necessary for economic growth. The debate often revolves around the fairness and effectiveness of different tax provisions.

-

Concerns about the Impact on the National Debt: The projected increase in the national debt resulting from the tax cuts is a major point of concern for many Republicans, particularly fiscal conservatives. This concern fuels the internal debate and raises questions about the long-term sustainability of the plan.

-

Arguments Regarding Estate Tax Repeal or Modification: The proposed changes to or repeal of the estate tax is another controversial aspect, dividing Republicans on grounds of fairness and economic impact. Arguments about wealth distribution and inheritance contribute to this ongoing dispute.

The Role of Lobbying and Special Interests

Lobbying groups and special interests exert considerable influence over the internal GOP debate surrounding Trump's tax legislation. Their strategies and tactics significantly shape the legislative process.

-

Key Lobbying Groups Involved: Various industry associations, think tanks, and advocacy groups actively lobby lawmakers, influencing the language and provisions of the tax bill. These groups often represent specific sectors or interests that stand to gain or lose significantly from the proposed changes.

-

Strategies and Tactics: Lobbying groups utilize various strategies, including direct lobbying of lawmakers, public relations campaigns, and grassroots mobilization, to sway opinion and pressure legislators to support their preferred outcomes.

-

Influence on the Legislative Process: The influence of these special interests can lead to amendments and compromises that deviate from the original intentions of the proposed legislation, furthering the internal divisions within the Republican party and delaying its passage.

Potential Consequences of Failure to Pass Trump's Tax Legislation

Failure to pass Trump's tax legislation could have significant economic and political ramifications.

-

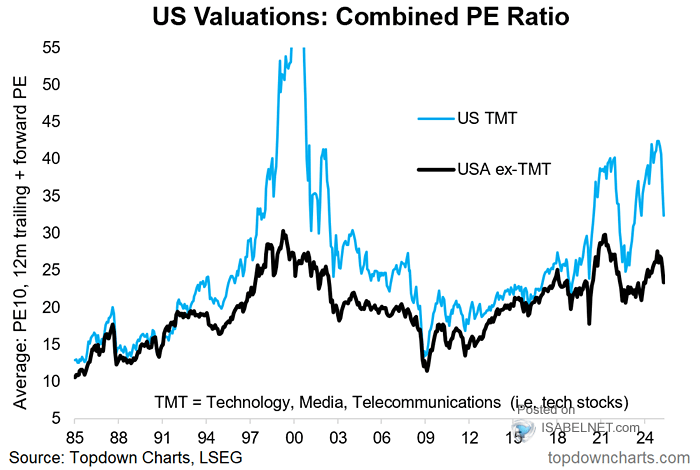

Impact on the Stock Market: The uncertainty surrounding the tax bill's fate could negatively impact investor confidence and lead to volatility in the stock market.

-

Effects on Economic Growth: The failure to pass the tax cuts could hinder economic growth, especially if the projected stimulus effect of the plan does not materialize through other means.

-

Political Consequences for President Trump and the Republican Party: The inability to deliver on a key campaign promise could significantly damage President Trump's credibility and weaken the Republican party's standing ahead of the midterm elections.

-

Potential Impact on the Midterm Elections: The failure of this legislation could significantly impact the upcoming midterm elections, possibly leading to a shift in power within Congress.

Conclusion

The internal strife within the Republican party poses a significant threat to the passage of Trump's tax legislation. Deep divisions over key provisions, combined with concerns about the bill’s long-term consequences and the influence of powerful lobbying groups, are creating a highly uncertain political environment. The failure to pass this cornerstone piece of the President's economic agenda could have serious repercussions, impacting both the economy and the Republican party's future. Understanding the complexities of this internal battle is crucial for anyone wanting to follow the progress, or lack thereof, of Trump's tax legislation and its potential impact on the future of American politics and the economy. Stay informed and follow the latest developments on this critical issue.

Featured Posts

-

Analyse Deutsche Teams In Champions League Klassikern

Apr 29, 2025

Analyse Deutsche Teams In Champions League Klassikern

Apr 29, 2025 -

North Korea Confirms Troop Deployment To Russia In Ukraine First Official Acknowledgement

Apr 29, 2025

North Korea Confirms Troop Deployment To Russia In Ukraine First Official Acknowledgement

Apr 29, 2025 -

Legal Battle Brewing Us Attorney Generals Stand Against Transgender Athletes In Mn

Apr 29, 2025

Legal Battle Brewing Us Attorney Generals Stand Against Transgender Athletes In Mn

Apr 29, 2025 -

Las Vegas Police Search For Missing British Paralympian

Apr 29, 2025

Las Vegas Police Search For Missing British Paralympian

Apr 29, 2025 -

Why Investors Shouldnt Fear High Stock Market Valuations A Bof A Perspective

Apr 29, 2025

Why Investors Shouldnt Fear High Stock Market Valuations A Bof A Perspective

Apr 29, 2025