Invest In Elon Musk's Private Companies: A New Investment Opportunity

Table of Contents

Understanding the Appeal of Investing in Elon Musk's Private Companies

Elon Musk's track record speaks for itself. His companies consistently push technological boundaries, leading to rapid growth and disruption across multiple sectors. The appeal of investing in Elon Musk's private companies stems from several key factors:

-

High-growth potential: Musk's ventures have a history of exponential growth. Early investors in his public companies have seen phenomenal returns. This success fuels the belief that his private companies hold similar potential.

-

Disruptive technologies: SpaceX is revolutionizing space exploration and commercialization; Neuralink is pioneering brain-computer interfaces with potentially transformative implications for healthcare; and The Boring Company is tackling transportation infrastructure with innovative tunnel-boring technology. These are not incremental improvements; they are paradigm shifts.

-

Future market dominance: Many believe these companies are poised to become dominant players in their respective fields. Early investment could yield significant returns as these ventures mature and capture larger market shares.

-

Bullet points highlighting key ventures:

- SpaceX: Securing contracts with NASA and developing reusable rockets positions SpaceX for a dominant role in the burgeoning space tourism and commercial space launch markets.

- Neuralink: Successful development of brain-computer interfaces could revolutionize treatment of neurological disorders and unlock new frontiers in human-computer interaction.

- The Boring Company: Its innovative approach to urban transportation could alleviate traffic congestion and reshape city planning worldwide.

Accessing Investment Opportunities in Musk's Private Companies

While the potential rewards are enticing, accessing investment opportunities in Musk's private companies is challenging. Their private nature limits public access.

-

Challenges: These companies are not publicly traded, meaning shares aren't available on stock exchanges. Investment requires navigating complex private investment channels.

-

Investment vehicles: Several routes exist, though they are not easy to access:

- Venture capital funds: Many prominent venture capital firms invest heavily in private companies like those in Musk’s portfolio. Investing in these funds provides indirect exposure.

- Private equity: Similar to venture capital, private equity firms often participate in later-stage funding rounds of high-growth private companies.

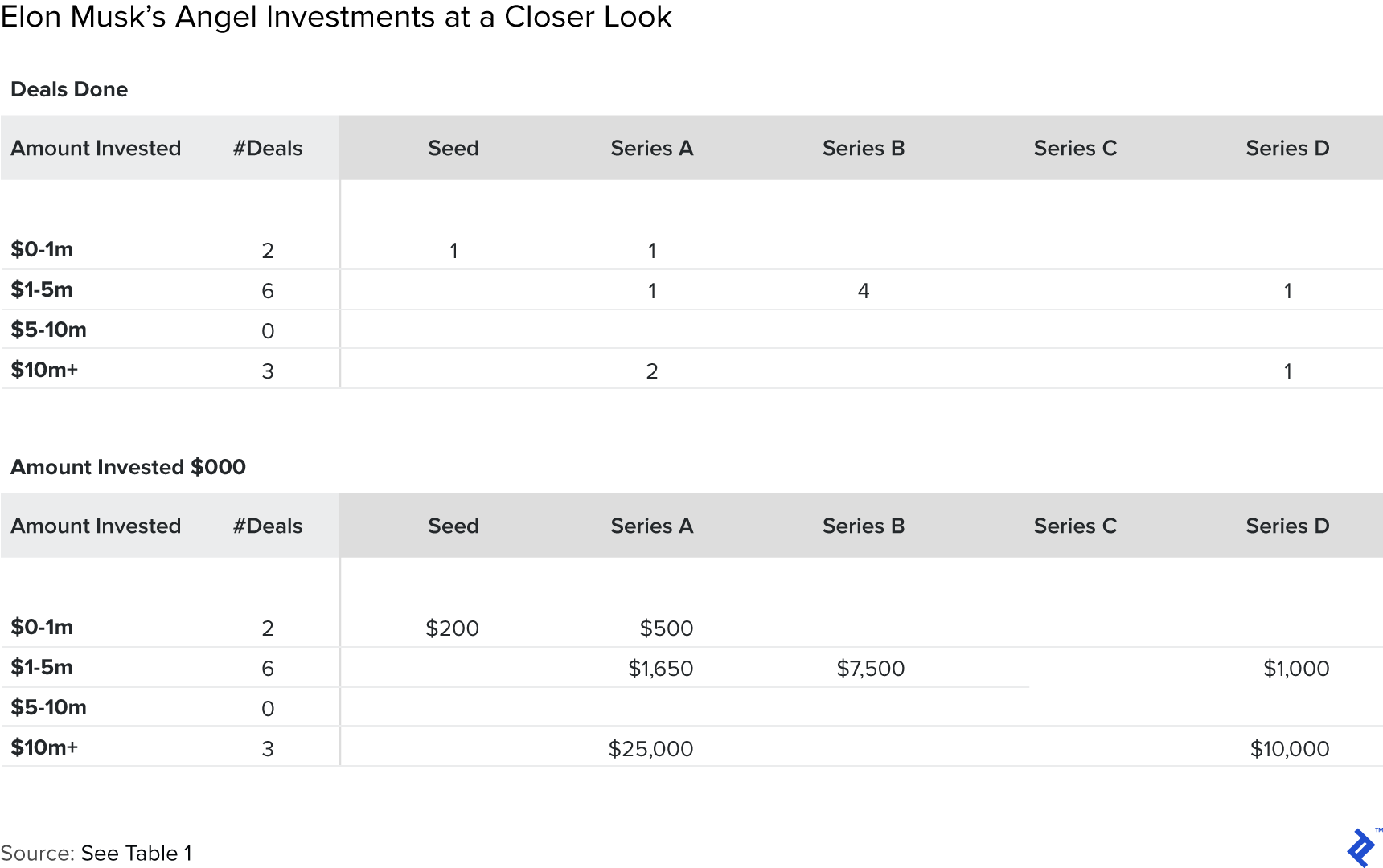

- Angel investing: Direct investment as an angel investor is possible but incredibly competitive and requires significant capital and experience.

-

Due diligence: Before considering any investment, conducting thorough due diligence is paramount. Understanding the company's financials, technology, market position, and competitive landscape is crucial to making an informed decision.

Understanding the Risks Involved in Investing in Private Companies

Investing in private companies, especially those associated with high-growth, high-risk ventures, carries significant risks:

-

Liquidity risk: Private company investments are illiquid; selling your shares quickly is difficult, if not impossible, without a pre-arranged buyer.

-

Valuation challenges: Accurately valuing a private company is complex. Unlike publicly traded companies with readily available market data, valuation relies on projections and internal metrics.

-

Company failure risk: Even with a visionary leader like Elon Musk, the risk of business failure remains. Not all ventures succeed, and significant capital loss is a possibility.

-

Bullet points emphasizing risk mitigation:

- Musk's past successes and failures: While Musk has a stellar track record, remember that some of his ventures haven't met expectations. Understanding these past failures is crucial for informed decision-making.

- Diversification: Diversifying your investment portfolio across multiple asset classes is vital to mitigate risk associated with private investments.

Alternative Investment Strategies for Exposure to Musk's Ventures

While direct investment in Musk's private companies is difficult, alternative strategies provide indirect exposure:

- Publicly traded companies: Investing in publicly traded companies that benefit from or collaborate with Musk's ventures (e.g., suppliers or partners) offers a more accessible route to indirect exposure.

- ETFs: Exchange-traded funds (ETFs) focusing on specific sectors like space exploration or renewable energy might offer exposure to companies indirectly linked to Musk's activities.

- Future IPOs: Keep an eye out for potential initial public offerings (IPOs) from Musk's private companies. Investing early in an IPO can yield substantial returns, though this requires timing and access.

Conclusion: Final Thoughts on Investing in Elon Musk's Private Companies

Investing in Elon Musk's private companies presents a high-risk, high-reward proposition. The potential for significant returns is undeniable, fueled by Musk's track record and the transformative nature of his ventures. However, the challenges of access, liquidity, and valuation necessitate a cautious and well-informed approach. Thorough research and understanding the inherent risks are paramount. Considering your risk tolerance and diversifying your portfolio are essential before exploring investment opportunities with Elon Musk’s ventures. Remember, carefully weigh the potential rewards against the considerable risks involved before considering private investment in Musk's companies. Further research into venture capital and private equity investment strategies is recommended.

Featured Posts

-

Cassidy Hutchinson Plans Memoir Detailing January 6th Testimony

Apr 26, 2025

Cassidy Hutchinson Plans Memoir Detailing January 6th Testimony

Apr 26, 2025 -

Experience Hues Charm Dong Duong Hotel A Fusion Property

Apr 26, 2025

Experience Hues Charm Dong Duong Hotel A Fusion Property

Apr 26, 2025 -

Gaining Access To Elon Musks Private Company Investments

Apr 26, 2025

Gaining Access To Elon Musks Private Company Investments

Apr 26, 2025 -

Fastest Bike In The Peloton Analyzing Pogacars Colnago Y1 Rs Performance

Apr 26, 2025

Fastest Bike In The Peloton Analyzing Pogacars Colnago Y1 Rs Performance

Apr 26, 2025 -

Hollywood Shut Down The Impact Of The Dual Writers And Actors Strike

Apr 26, 2025

Hollywood Shut Down The Impact Of The Dual Writers And Actors Strike

Apr 26, 2025