Investing In 2025: MicroStrategy Stock Vs. Bitcoin - A Detailed Analysis

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy, a publicly traded business intelligence company, has made a bold bet on Bitcoin, accumulating a substantial amount of the cryptocurrency. This strategy fundamentally intertwines the performance of its stock with the price of Bitcoin. Understanding this relationship is crucial for any potential investor.

MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's core business revolves around providing enterprise analytics, mobility, cloud, and other related software services. However, its significant Bitcoin holdings, amassed through strategic purchases over several years, have become a defining characteristic. This significant Bitcoin investment directly impacts its stock price.

- Correlation between Bitcoin and MicroStrategy Stock: A positive correlation exists; when Bitcoin's price rises, MicroStrategy's stock price tends to follow, and vice versa. This tight coupling makes the stock a leveraged play on Bitcoin's price movements.

- Risks associated with MicroStrategy's Bitcoin strategy: The primary risk is Bitcoin's inherent volatility. A sharp decline in Bitcoin's price could severely impact MicroStrategy's stock value, potentially leading to significant losses for investors.

- Potential benefits of MicroStrategy's Bitcoin strategy: Should Bitcoin's price appreciate significantly in the coming years, MicroStrategy's substantial holdings could translate into substantial gains for its shareholders. This makes the stock attractive to those bullish on Bitcoin's long-term prospects.

Analyzing MicroStrategy Stock Performance

While Bitcoin's price significantly influences MicroStrategy's stock performance, it's crucial to consider the company's fundamental business health independently.

- Financial health and revenue streams: Analyzing MicroStrategy's financial statements, including revenue growth, profitability, and debt levels, provides a more comprehensive picture of its overall financial strength.

- Growth prospects beyond Bitcoin: Assessing MicroStrategy's progress in its core business areas – enterprise analytics and software – is vital for evaluating its long-term sustainability and potential for growth irrespective of Bitcoin's price fluctuations.

- Comparison to the broader market: Benchmarking MicroStrategy's stock performance against relevant industry indices helps determine whether its performance is outperforming or underperforming its peers.

Bitcoin's Potential as an Investment in 2025

Bitcoin, the pioneering cryptocurrency, continues to attract significant attention as a potential investment asset. Its decentralized nature, scarcity, and growing institutional adoption fuel its long-term growth potential. However, its price volatility remains a significant factor.

Bitcoin's Price Volatility and Market Predictions

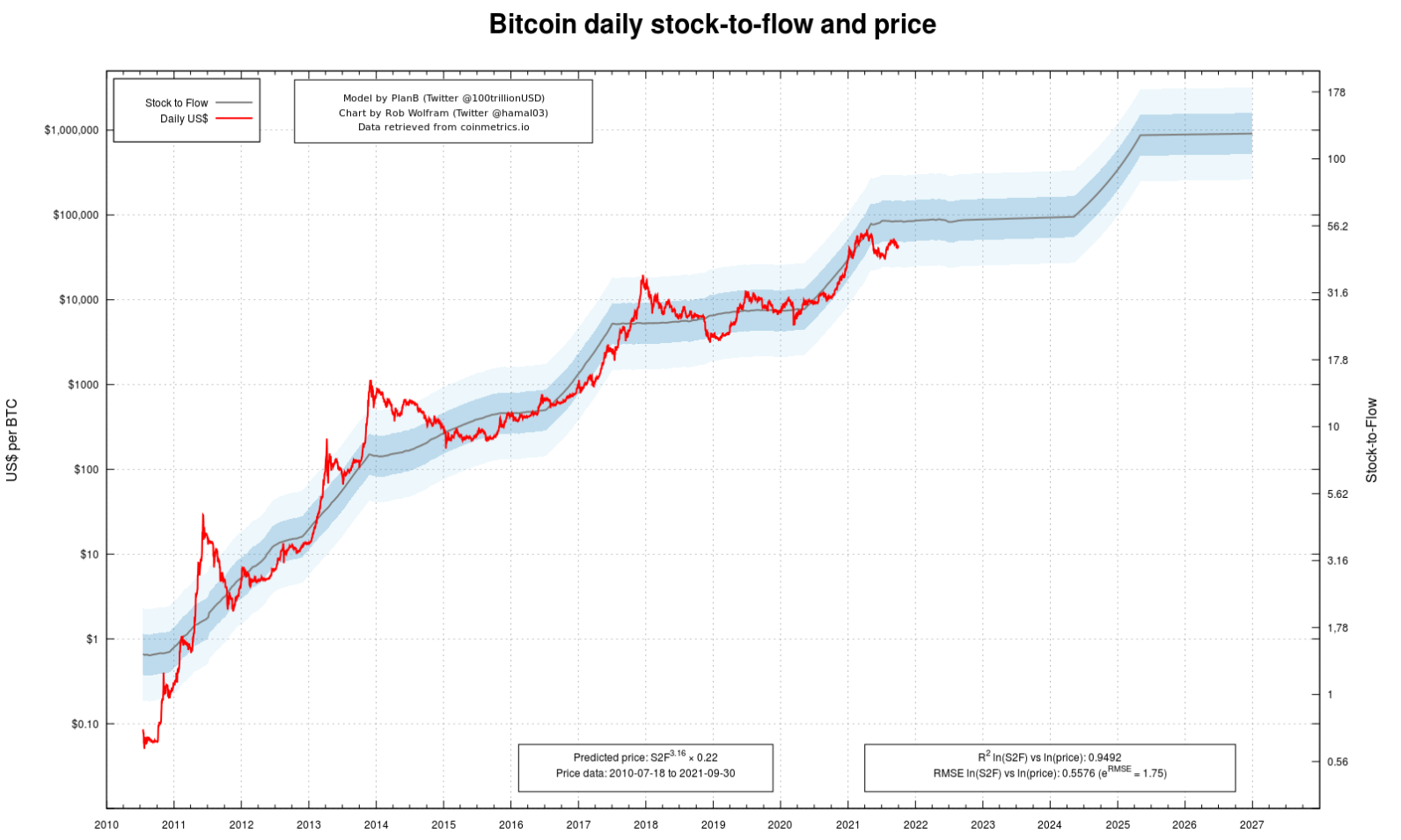

Predicting Bitcoin's price is inherently challenging due to its highly volatile nature. Numerous factors influence its price, making accurate forecasting difficult.

- Factors influencing Bitcoin's price: Regulatory changes, institutional adoption (such as further investments from large corporations), technological advancements (like the Lightning Network improving transaction speed), and overall market sentiment all impact its value.

- Potential risks associated with Bitcoin investment: Regulatory crackdowns, market manipulation, and security breaches remain potential threats to Bitcoin's price and overall stability.

- Potential rewards of Bitcoin investment: The potential for substantial returns remains a key driver for investment, driven by its limited supply and growing acceptance as a store of value and potential medium of exchange.

Bitcoin's Long-Term Growth Potential and Adoption

Bitcoin's long-term potential rests on its unique characteristics and its growing adoption across various sectors.

- Factors contributing to long-term growth: Its decentralized and immutable nature, limited supply (only 21 million Bitcoin will ever exist), and growing institutional interest support its potential as a long-term store of value.

- Challenges to Bitcoin's long-term growth: Scalability issues, environmental concerns related to energy consumption for mining, and regulatory uncertainty remain significant challenges.

- Bitcoin's position within the cryptocurrency market: Bitcoin's dominance in the cryptocurrency market gives it a significant first-mover advantage. However, the emergence of alternative cryptocurrencies presents both competition and potential for diversification.

MicroStrategy Stock vs. Bitcoin: A Comparative Analysis

Choosing between MicroStrategy stock and Bitcoin involves carefully considering your risk tolerance and investment goals. Both investments carry different risk profiles and suit distinct investor profiles.

Risk Tolerance and Investment Goals

- Risk/Reward Profiles: MicroStrategy stock offers a somewhat less volatile investment compared to directly holding Bitcoin due to its diversified revenue streams, but still carries significant risk tied to Bitcoin's price. Bitcoin's potential for higher returns comes with proportionally higher risk.

- Suitable Investor Profiles: Risk-averse investors might find MicroStrategy stock more palatable, as it offers some diversification. Risk-tolerant investors comfortable with high volatility might prefer the potentially higher returns of direct Bitcoin investment.

Portfolio Diversification Strategies

Both MicroStrategy stock and Bitcoin can be part of a well-diversified portfolio, but their inclusion requires careful consideration of asset allocation.

- Examples of diversified portfolios: A portfolio could include a small percentage allocation to both MicroStrategy stock and Bitcoin alongside traditional assets like stocks, bonds, and real estate to reduce overall portfolio risk.

- Diversification strategies to mitigate risk: Strategic diversification across asset classes is key to minimizing risk while aiming for optimal returns. The proportion of each asset in the portfolio should align with your risk tolerance and investment objectives.

Conclusion

Investing in either MicroStrategy stock or Bitcoin in 2025 requires careful consideration of the risks involved. MicroStrategy offers a leveraged play on Bitcoin's price, but also carries the risks associated with its underlying business. Direct Bitcoin investment presents potentially higher rewards, but significantly higher volatility. Understanding the inherent risks and aligning your choice with your risk tolerance and investment goals is paramount.

Call to Action: Before making any investment decisions regarding MicroStrategy stock or Bitcoin, conduct thorough independent research and seek professional financial advice if necessary. Carefully analyze both investment options, considering your personal risk tolerance, investment timeline, and overall financial goals. Remember, investing in 2025 – whether in MicroStrategy stock or Bitcoin – demands a well-informed approach to maximize potential returns while managing risk effectively.

Featured Posts

-

New Commercial Hints At Relationship Between Jayson Tatum And Ella Mai And The Birth Of Their Child

May 08, 2025

New Commercial Hints At Relationship Between Jayson Tatum And Ella Mai And The Birth Of Their Child

May 08, 2025 -

Bitcoin Price Prediction 2024 Trumps Impact On Btcs Future

May 08, 2025

Bitcoin Price Prediction 2024 Trumps Impact On Btcs Future

May 08, 2025 -

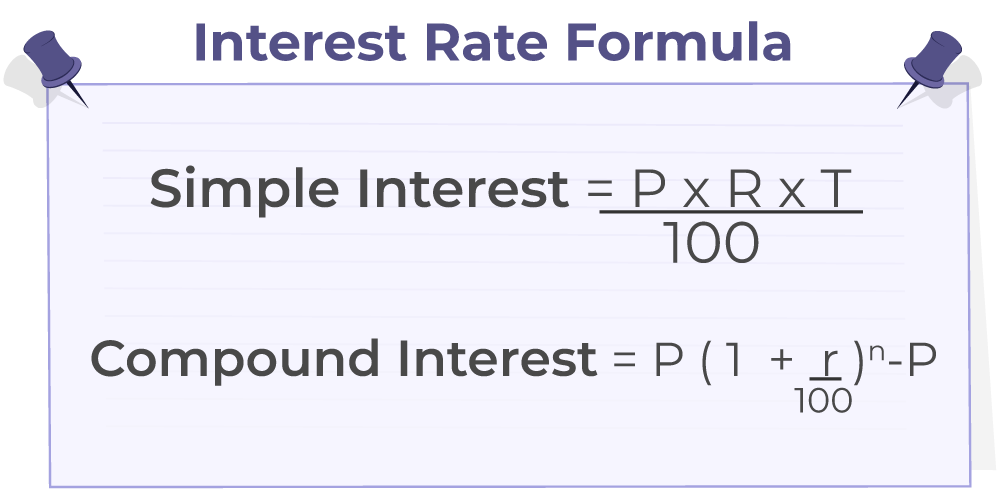

Hong Kong Dollar Interest Rate Historic Fall Following Intervention

May 08, 2025

Hong Kong Dollar Interest Rate Historic Fall Following Intervention

May 08, 2025 -

Brezilya Da Bitcoin Maas Oedemeleri Yeni Yasa Ve Etkileri

May 08, 2025

Brezilya Da Bitcoin Maas Oedemeleri Yeni Yasa Ve Etkileri

May 08, 2025 -

Ps 5 Pro Vs Ps 4 Pro Sales A Comparative Market Performance Analysis

May 08, 2025

Ps 5 Pro Vs Ps 4 Pro Sales A Comparative Market Performance Analysis

May 08, 2025