Private Credit Jobs: 5 Do's And Don'ts To Secure Your Position

Table of Contents

Landing your dream job in the competitive world of private credit requires more than just a strong resume. This guide outlines five crucial dos and don'ts to significantly increase your chances of securing a private credit position. We'll explore the key skills, networking strategies, and interview techniques that set successful candidates apart in the challenging private credit job market.

<h2>DO: Network Strategically Within the Private Credit Industry</h2>

Networking is paramount in the private credit industry. Building strong relationships with professionals in the field can open doors to unadvertised opportunities and provide valuable insights.

<h3>Target Key Players:</h3>

- Attend industry conferences: SuperReturn, ACG conferences, and smaller, niche events are excellent places to meet potential employers and learn about industry trends. Actively participate in discussions and workshops to demonstrate your knowledge and engage with attendees.

- Join relevant professional organizations: The CFA Institute, Private Equity International, and other similar organizations provide networking opportunities and access to industry resources. Attend their events and actively participate in online forums.

- Leverage LinkedIn: Optimize your LinkedIn profile with keywords relevant to private credit jobs (e.g., "credit analyst," "fund manager," "debt financing"). Connect with professionals in the field and engage with their posts and articles.

- Informational interviews: Reach out to individuals working in private credit for informational interviews. This is a valuable way to learn about their experiences, gain insights into the industry, and potentially make a connection that leads to a job opportunity. Prepare thoughtful questions beforehand.

<h3>Cultivate Meaningful Relationships:</h3>

- Focus on building genuine relationships: Networking isn't about collecting business cards; it's about forging authentic connections based on mutual respect and shared interests. Show genuine interest in the other person's work and experiences.

- Follow up consistently: After meeting someone, send a personalized thank-you note or email. Keep in touch periodically with updates on your job search or insights from the industry.

- Attend industry events: Networking events offer valuable opportunities to build rapport with professionals in a relaxed setting. Engage in conversations, share your experiences, and learn from others.

<h2>DO: Highlight Relevant Skills and Experience</h2>

Your resume and interview performance must showcase your qualifications for private credit jobs. Highlighting specific skills and quantifying achievements is crucial.

<h3>Showcase Financial Acumen:</h3>

- Emphasize relevant skills: Highlight experience in financial modeling, valuation (DCF, comparable company analysis, precedent transactions), due diligence, credit analysis, and portfolio management.

- Quantify your achievements: Instead of simply stating your responsibilities, use numbers to demonstrate your impact. For example, "increased portfolio returns by 15%" or "reduced loan defaults by 10%."

- Demonstrate proficiency in relevant software: Mention your expertise in Excel, Bloomberg Terminal, Argus, and other industry-standard software.

<h3>Tailor Your Resume and Cover Letter:</h3>

- Customize for each application: Don't use a generic resume and cover letter. Tailor each application to the specific requirements and keywords mentioned in the job description.

- Use keywords effectively: Incorporate keywords from the job posting into your resume and cover letter to improve your chances of getting past Applicant Tracking Systems (ATS).

- Highlight transferable skills: Even if your prior experience isn't directly in private credit, highlight transferable skills like analytical thinking, problem-solving, and communication that are valuable in the industry.

<h2>DO: Prepare Thoroughly for Private Credit Interviews</h2>

Thorough preparation is key to succeeding in private credit interviews. This includes researching the firm and practicing your responses.

<h3>Research the Firm and Interviewers:</h3>

- Understand the firm's investment strategy: Research the firm's investment focus, target sectors, and recent transactions. Demonstrate your understanding during the interview.

- Research the interviewers: Use LinkedIn to learn about the interviewers' backgrounds, experience, and areas of expertise. This will help you tailor your responses and ask relevant questions.

- Prepare insightful questions: Asking insightful questions shows your interest and engagement. Prepare questions about the firm's culture, investment strategy, and future plans.

<h3>Practice Behavioral and Technical Questions:</h3>

- Practice behavioral questions: Prepare for common behavioral interview questions using the STAR method (Situation, Task, Action, Result) to structure your answers effectively. Examples include "Tell me about a time you failed" or "Describe a challenging team project."

- Prepare technical questions: Practice answering technical questions related to financial modeling, valuation, credit analysis, and industry-specific topics. Be prepared to discuss your understanding of different credit metrics and risk assessment.

- Use the STAR method: This structured approach ensures your answers are concise, focused, and impactful, helping you effectively communicate your skills and experience.

<h2>DON'T: Neglect the Importance of Soft Skills</h2>

Technical skills are essential, but soft skills are equally important in private credit. Demonstrate your ability to work collaboratively and communicate effectively.

<h3>Communication and Teamwork:</h3>

- Collaboration is crucial: Many private credit roles involve working closely with diverse teams, including portfolio managers, legal counsel, and operations staff.

- Practice clear communication: Be able to articulate complex financial information clearly and concisely, both verbally and in writing.

- Demonstrate teamwork: Highlight your experience working effectively in team environments and contributing to shared goals.

<h3>Problem-Solving and Analytical Skills:</h3>

- Analyze complex information: Demonstrate your ability to analyze complex financial data, identify key risks and opportunities, and provide well-supported recommendations.

- Practice critical thinking: Showcase your ability to think critically, solve problems creatively, and make sound judgments under pressure.

- Highlight problem-solving experience: Provide specific examples from your previous roles where you successfully solved challenging problems.

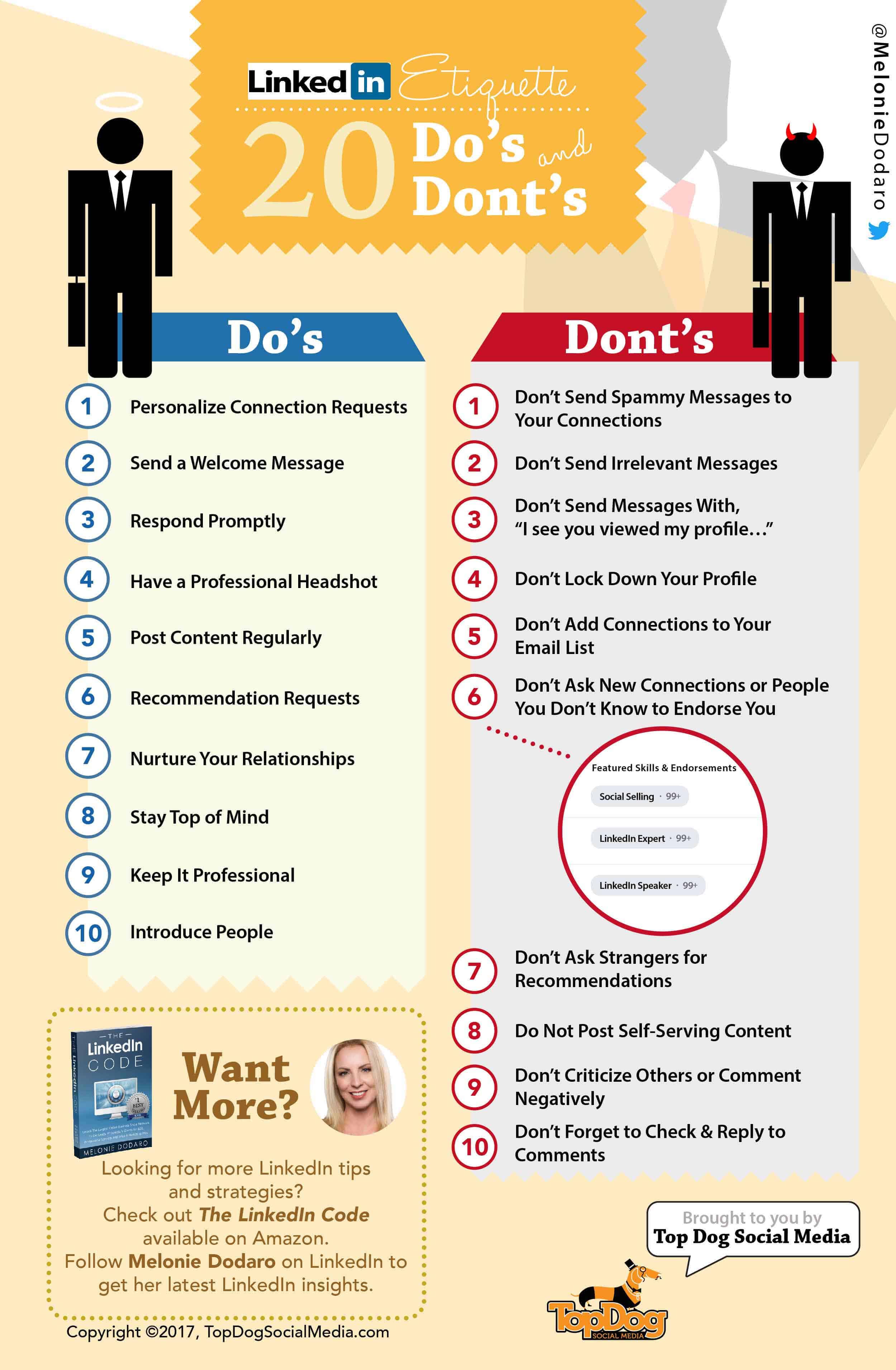

<h2>DON'T: Underestimate the Power of a Strong Online Presence</h2>

Your online presence can significantly impact your job search. A well-optimized LinkedIn profile and a professional online image are crucial.

<h3>Optimize Your LinkedIn Profile:</h3>

- Use relevant keywords: Incorporate keywords related to private credit and your target roles (e.g., "leveraged finance," "distressed debt," "private debt").

- Highlight achievements: Quantify your accomplishments using metrics and numbers to demonstrate your impact.

- Get recommendations: Request recommendations from previous supervisors and colleagues to strengthen your profile's credibility.

<h3>Maintain a Professional Online Image:</h3>

- Review all profiles: Review your social media profiles (LinkedIn, Twitter, Facebook, etc.) to ensure they present a professional image consistent with your resume and cover letter.

- Avoid negative content: Refrain from posting anything that could be perceived negatively by potential employers.

- Consistency is key: Ensure your online presence aligns with the image you're presenting in your job applications.

<h2>Conclusion</h2>

Securing a coveted position in the world of private credit jobs requires a strategic and multifaceted approach. By following these do's and don'ts—from networking effectively and highlighting your skills to preparing for interviews and maintaining a professional online presence—you'll significantly increase your chances of success. Don't delay; start refining your approach today and take the steps necessary to land your dream private credit job!

Featured Posts

-

Update On Jayson Tatums Wrist Celtics Head Coach Weighs In

May 08, 2025

Update On Jayson Tatums Wrist Celtics Head Coach Weighs In

May 08, 2025 -

Tuerkiye De Kripto Varliklar Spk Nin Getirdigi Yeni Duezenlemeler

May 08, 2025

Tuerkiye De Kripto Varliklar Spk Nin Getirdigi Yeni Duezenlemeler

May 08, 2025 -

Le Surprenant Talent Geometrique Des Corneilles Une Etude Comparative Avec Les Babouins

May 08, 2025

Le Surprenant Talent Geometrique Des Corneilles Une Etude Comparative Avec Les Babouins

May 08, 2025 -

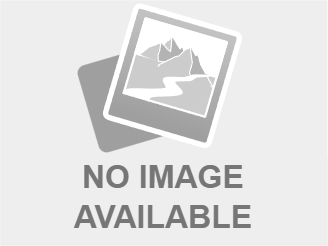

Ripple Xrp Breakout The Path To 3 40

May 08, 2025

Ripple Xrp Breakout The Path To 3 40

May 08, 2025 -

Rain Delayed Game Paris Homer Leads Angels To Victory Against White Sox

May 08, 2025

Rain Delayed Game Paris Homer Leads Angels To Victory Against White Sox

May 08, 2025