Investing In Microsoft: A Strategy For Navigating Tariff Volatility

Table of Contents

Microsoft's Diversified Revenue Streams as a Hedge Against Tariff Risks

Microsoft's resilience in the face of tariff volatility stems largely from its remarkably diversified revenue streams. Unlike companies heavily reliant on manufacturing or specific geographic markets, Microsoft's business model offers significant protection against localized tariff impacts.

Cloud Computing Dominance (Azure):

Microsoft's Azure cloud platform is a global behemoth, less susceptible to localized tariff impacts. Its global reach and recurring revenue model provide a significant buffer against trade disruptions.

- Global customer base: Azure serves clients worldwide, mitigating reliance on any single market.

- Recurring revenue model: The subscription-based nature of cloud services provides predictable and consistent income.

- Strong growth potential: The cloud computing market continues to expand rapidly, ensuring Azure's long-term growth trajectory.

- Reduced dependence on physical goods: Unlike many industries, Azure's infrastructure minimizes reliance on the physical transportation of goods, reducing tariff exposure.

Keywords: Azure, Cloud Computing, Microsoft Cloud, SaaS (Software as a Service), recurring revenue, global reach, cloud infrastructure

Enterprise Software Solutions:

Microsoft's suite of enterprise software solutions, including Office 365 and Dynamics 365, represent another pillar of stability. These essential business tools boast sticky customer relationships and recurring subscriptions, providing consistent revenue streams regardless of tariff fluctuations.

- Essential business tools: These products are vital for businesses globally, ensuring consistent demand.

- Sticky customer relationships: Businesses are often locked into long-term contracts, providing predictable revenue.

- Recurring subscriptions: The subscription model ensures consistent revenue even during economic downturns.

- Less vulnerable to trade disruptions: The digital nature of these products minimizes vulnerability to physical trade barriers.

Keywords: Office 365, Dynamics 365, Enterprise Software, B2B Software, subscription model, business software

Gaming and Consumer Products (Xbox, Windows):

While subject to some supply chain pressures, Microsoft's gaming and consumer product lines offer diversification, mitigating the impact of any single tariff shock.

- Global gaming market: The gaming industry is a global phenomenon, offering resilience against localized tariff impacts.

- Diverse product portfolio: Microsoft's range of products minimizes reliance on any single offering.

- Brand loyalty: Strong brand recognition and loyalty provide a solid foundation for consistent sales.

Keywords: Xbox, Windows, Gaming Industry, Consumer Electronics, brand diversification, gaming market

Assessing Microsoft's Financial Strength and Stability

Beyond its diversified revenue streams, Microsoft's financial strength significantly contributes to its ability to withstand economic uncertainties.

Strong Balance Sheet and Cash Flow:

Microsoft boasts a remarkably strong balance sheet and robust cash flow, enabling it to navigate economic downturns and absorb potential tariff-related impacts with ease.

- High cash reserves: Substantial cash reserves provide a financial cushion against unexpected events.

- Low debt: Minimal debt reduces financial vulnerability.

- Consistent profitability: A history of consistent profitability demonstrates the company's enduring financial health.

Keywords: Financial Stability, Balance Sheet Strength, Cash Flow, Debt-to-Equity Ratio, financial health

Consistent Earnings Growth:

A history of consistent earnings growth demonstrates Microsoft's adaptability and resilience in various market conditions, including periods of significant global economic uncertainty.

- Long-term growth trajectory: Microsoft’s consistent growth reflects its strong market position and adaptability.

- Robust revenue streams: Multiple revenue streams contribute to consistent earnings.

- Market leadership: Microsoft’s market leadership across multiple sectors strengthens its position.

Keywords: Earnings Growth, Revenue Growth, Profitability, Market Leadership, consistent growth

Incorporating Microsoft into a Diversified Investment Portfolio

Investing in Microsoft is not just about mitigating tariff risks; it’s about enhancing overall investment strategy.

Reducing Overall Portfolio Volatility:

Including Microsoft, a large-cap tech stock, in a diversified portfolio helps reduce overall volatility caused by tariff uncertainties affecting other sectors. This diversification provides stability.

- Diversification strategy: Spreading investments across different asset classes reduces risk.

- Risk mitigation: Diversification is a fundamental risk management technique.

- Asset allocation: Strategic asset allocation helps manage risk and maximize returns.

Keywords: Portfolio Diversification, Risk Management, Asset Allocation, Investment Portfolio, diversification strategy

Long-Term Investment Strategy:

Investing in Microsoft is often viewed as a long-term strategy, minimizing the impact of short-term tariff fluctuations.

- Buy-and-hold strategy: A long-term approach reduces the influence of short-term market volatility.

- Long-term growth potential: Microsoft's ongoing innovation ensures continued growth prospects.

- Patience: Long-term investing requires patience and a focus on consistent growth.

Keywords: Long-term investment, Buy and Hold, Growth Stock, long-term growth

Conclusion:

Investing in Microsoft offers a strategic approach to navigating the uncertainties of tariff volatility. Its diversified revenue streams, strong financial position, and consistent growth make it a relatively safe haven in turbulent global markets. By incorporating Microsoft into a well-diversified investment portfolio and adopting a long-term perspective, investors can mitigate risks associated with tariff fluctuations and potentially achieve substantial returns. Consider adding Microsoft to your investment strategy today as part of a broader plan for mitigating tariff volatility and building a robust investment portfolio. Start exploring the opportunities of investing in Microsoft and building a more resilient investment strategy.

Featured Posts

-

Nba Play In Tournament Warriors Vs Grizzlies Preview And Prediction

May 15, 2025

Nba Play In Tournament Warriors Vs Grizzlies Preview And Prediction

May 15, 2025 -

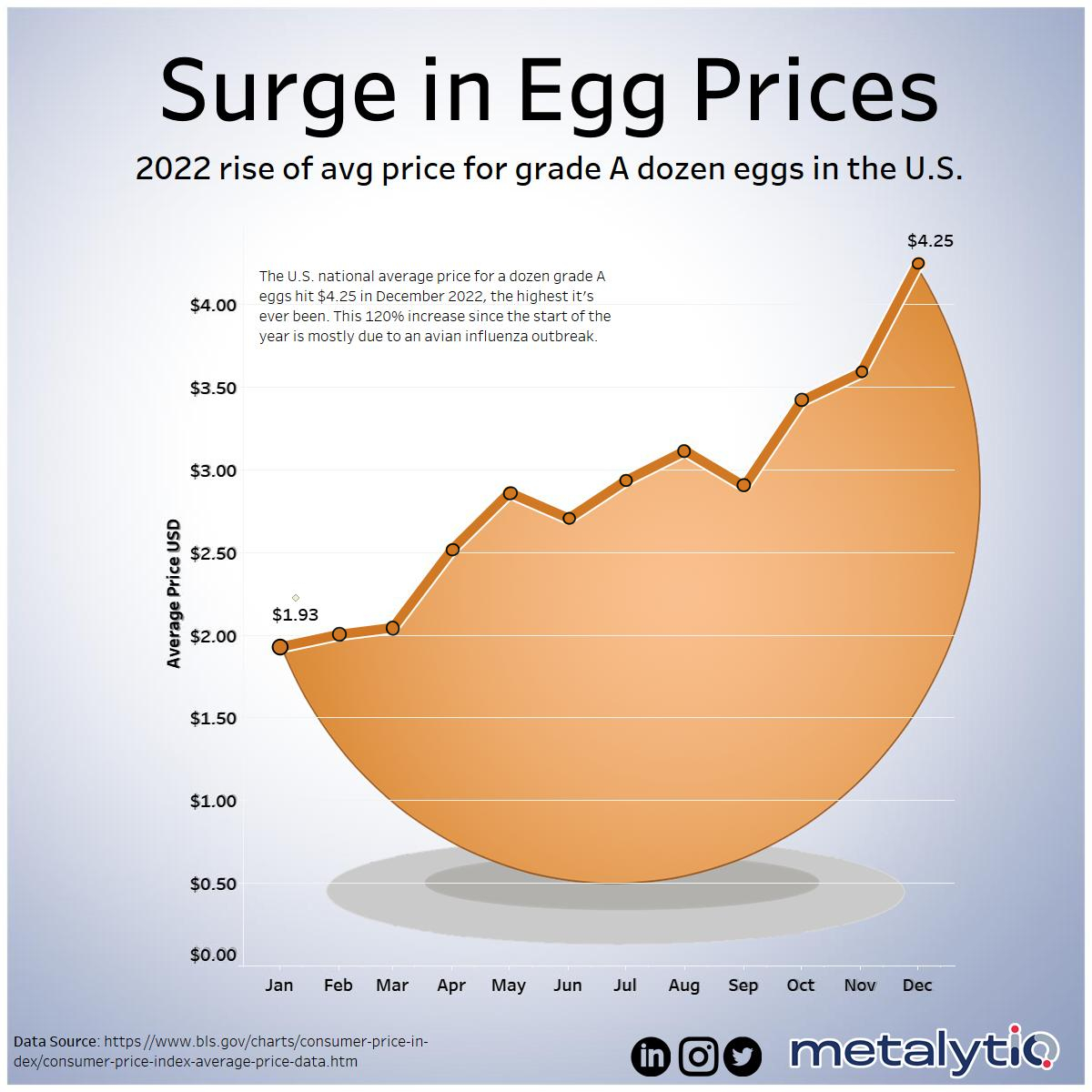

Sharp Decline In Egg Prices Now 5 A Dozen Across The Us

May 15, 2025

Sharp Decline In Egg Prices Now 5 A Dozen Across The Us

May 15, 2025 -

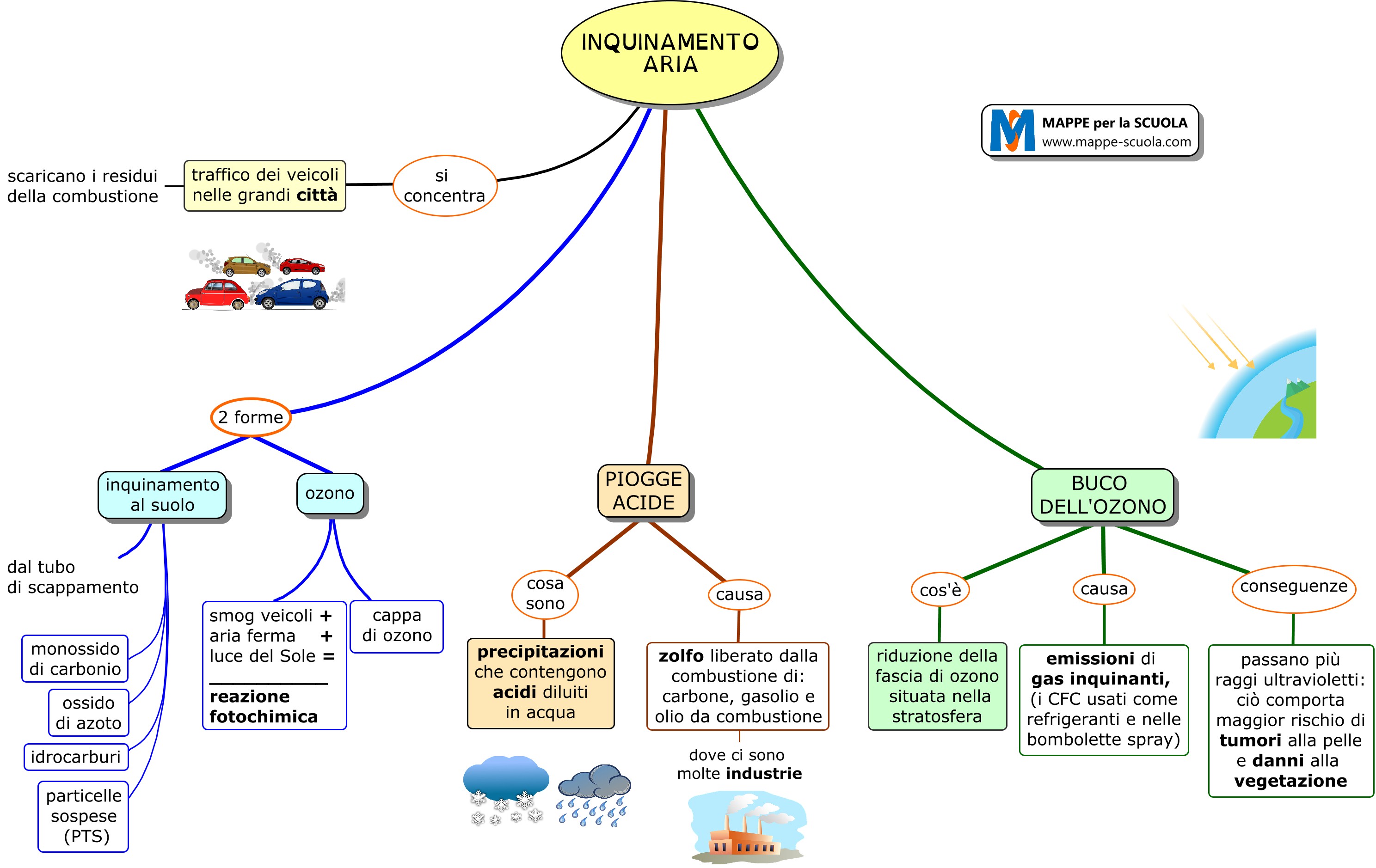

Acqua E Microplastiche Una Mappa Dell Inquinamento

May 15, 2025

Acqua E Microplastiche Una Mappa Dell Inquinamento

May 15, 2025 -

Dijital Isguecue Piyasasi Rehberi Kibris Ta Yeni Bir Kaynak

May 15, 2025

Dijital Isguecue Piyasasi Rehberi Kibris Ta Yeni Bir Kaynak

May 15, 2025 -

Unexpected Drop In Pboc Yuan Support Analysis And Outlook

May 15, 2025

Unexpected Drop In Pboc Yuan Support Analysis And Outlook

May 15, 2025