Investing In Uber's Self-Driving Technology: An ETF Approach

Table of Contents

Understanding Uber's Autonomous Vehicle Initiatives

Uber's Advanced Technologies Group (ATG) represents a significant investment in the future of transportation. Since its inception, Uber has poured billions into developing self-driving technology, aiming to revolutionize ride-sharing and logistics. This commitment includes substantial research and development, strategic partnerships, and the acquisition of relevant companies. Key collaborations with industry players further bolster Uber's position in this competitive landscape.

The potential market impact of autonomous vehicles is enormous. Analysts project a massive growth in the autonomous vehicle market over the next decade, driven by increasing demand for efficient and safe transportation solutions. Uber's self-driving technology is positioned to capture a significant share of this market, potentially transforming its business model and generating substantial returns for investors.

- Uber ATG's technological advancements: Uber ATG continuously refines its self-driving software and hardware, focusing on improvements in sensor technology, mapping accuracy, and decision-making algorithms.

- Uber's strategic goals regarding autonomous vehicles: Uber aims to integrate self-driving technology into its ride-hailing platform, offering a more cost-effective and efficient service to its customers. Beyond ride-sharing, the company also envisions applications in food delivery and freight transportation.

- Regulatory hurdles and challenges: The deployment of self-driving vehicles faces significant regulatory challenges, including safety standards, liability issues, and data privacy concerns. Navigating these legal and regulatory hurdles is crucial for Uber's success in this sector.

The Advantages of an ETF Approach to Investing

While direct investment in Uber offers exposure to its self-driving initiatives, it also carries significant risk. An ETF approach offers several key advantages:

-

Diversification: ETFs provide diversification by investing in a basket of companies involved in the autonomous vehicle sector, reducing reliance on the performance of a single company like Uber. This mitigates risk significantly compared to concentrating your investment in just one entity.

-

Reduced Risk: Diversification inherently lowers risk. If one company in the ETF underperforms, the impact on your overall investment is lessened due to the presence of other companies in the portfolio.

-

Ease and Accessibility: ETFs are easily traded through brokerage accounts, making them accessible to a wide range of investors, including beginners. They're generally simpler to understand and manage than individual stocks.

-

Lower transaction costs: Compared to repeatedly trading individual stocks, ETFs often have lower transaction costs, leading to greater returns over time.

-

Reduced risk through diversification across multiple companies: ETFs spread your investment across numerous companies, mitigating the risk associated with a single company's failure or underperformance.

-

Simplified investment process for beginners: ETFs provide a straightforward way for novice investors to participate in the autonomous vehicle sector.

Identifying Relevant ETFs

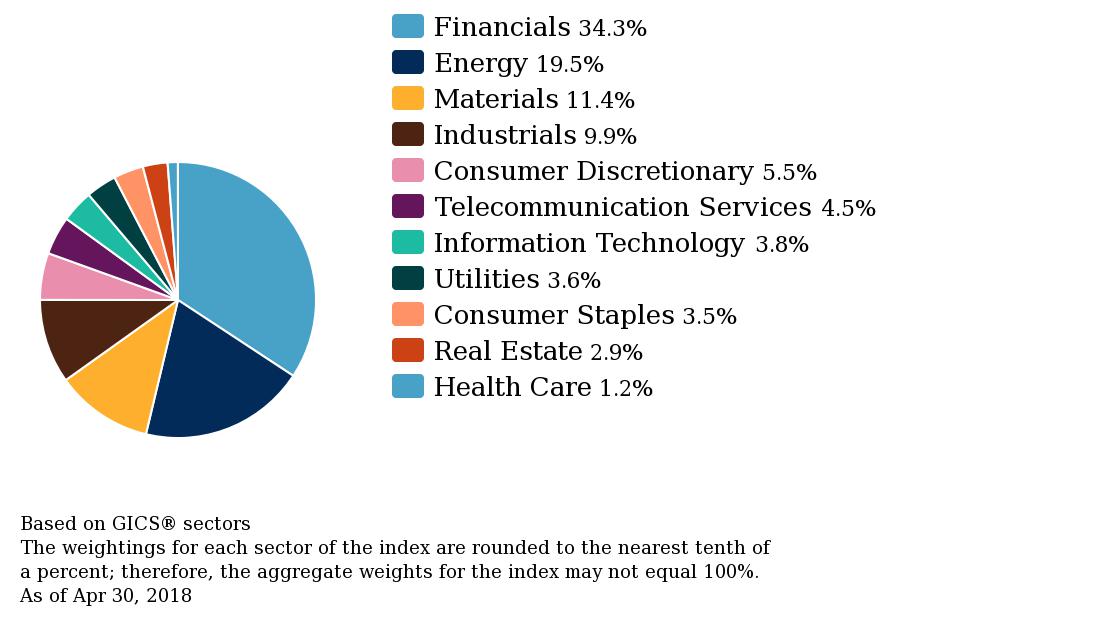

Several ETFs offer exposure to the autonomous vehicle sector, either directly or indirectly through holdings in technology companies involved in its development. These ETFs often focus on broader themes like technology, transportation, or robotics.

- Specific ETF tickers: Examples include ETFs focusing on technology (e.g., QQQ, VGT), or those with significant holdings in companies like Google (Alphabet Inc.), Tesla, and other key players in autonomous vehicle technology. (Note: Specific ETF tickers should be researched independently as market conditions change.)

- ETF fact sheets and websites: Always consult the prospectus and fact sheet of any ETF before investing to understand its investment strategy, holdings, and expense ratio.

- ETF performance comparison: Compare the past performance of different ETFs to identify those that align with your investment goals and risk tolerance. Remember that past performance is not indicative of future results.

Assessing Risk and Return

Investing in the autonomous vehicle sector carries both potential rewards and risks.

-

Potential Risks: Technological challenges, regulatory uncertainty, intense competition, and unexpected economic downturns can all negatively impact the performance of companies in this sector. Regulatory changes could significantly affect the adoption and profitability of autonomous vehicles.

-

Assessing Risk Tolerance: Before investing, carefully assess your risk tolerance. This involves considering your investment timeframe, financial goals, and comfort level with potential losses.

-

Potential Returns: The long-term growth potential of the autonomous vehicle market is substantial, potentially offering significant returns for investors who can withstand the inherent risks.

-

Volatility Analysis: Analyze the historical volatility of relevant ETFs to gauge the potential for price fluctuations.

-

Long-term growth prospects: The autonomous vehicle market is expected to experience significant growth in the coming decades, driving potential long-term returns.

-

Risks related to regulatory changes and technological failures: Regulatory delays or changes, as well as technological setbacks, could significantly impact the profitability of companies in this sector.

Conclusion

Investing in Uber's self-driving technology's future potential can be achieved effectively and with reduced risk through a diversified ETF strategy. This approach offers exposure to the broader autonomous vehicle sector without the concentrated risk of investing directly in a single company. By carefully considering the advantages of ETFs, researching relevant options, and assessing your risk tolerance, you can participate in the exciting growth potential of this transformative technology.

Call to Action: Learn more about suitable ETFs for exposure to the autonomous vehicle market and begin your investment journey in this exciting sector. Research thoroughly and consider consulting a financial advisor before making any investment decisions related to investing in Uber's self-driving technology through ETFs. Remember that all investments carry risk, and past performance is not a guarantee of future results.

Featured Posts

-

Exclusive Near Miss Averted Air Traffic Controller Shares His Story

May 17, 2025

Exclusive Near Miss Averted Air Traffic Controller Shares His Story

May 17, 2025 -

10 Popular Tv Shows That Ended Too Early A Fans Lament

May 17, 2025

10 Popular Tv Shows That Ended Too Early A Fans Lament

May 17, 2025 -

Record High For Canadas S And P Tsx Composite Index Intraday Update

May 17, 2025

Record High For Canadas S And P Tsx Composite Index Intraday Update

May 17, 2025 -

Chinas Auto Industry The Difficulties Faced By International Brands Including Bmw And Porsche

May 17, 2025

Chinas Auto Industry The Difficulties Faced By International Brands Including Bmw And Porsche

May 17, 2025 -

Mikal Bridges Advocates For Reduced Playing Time For Knicks Starters

May 17, 2025

Mikal Bridges Advocates For Reduced Playing Time For Knicks Starters

May 17, 2025