Investment News: Berkshire Hathaway Holds Long-Term In Japanese Trading Houses

Table of Contents

Understanding Berkshire Hathaway's Investment Strategy

Berkshire Hathaway's investment strategy, largely shaped by Warren Buffett's philosophy, is renowned for its long-term focus and emphasis on value investing. Buffett's approach prioritizes identifying fundamentally strong companies with durable competitive advantages and competent management teams. This contrasts sharply with short-term, speculative trading strategies prevalent in some sectors. Berkshire Hathaway typically holds investments for extended periods, often decades, allowing companies to organically grow and generate substantial returns. This "buy-and-hold" strategy is central to their success. Previous successful long-term investments, such as Coca-Cola and American Express, showcase this approach's effectiveness.

- Focus on long-term value creation: Patience is key; returns are realized over years, not days.

- Emphasis on strong management teams: Competent leadership is crucial for sustained growth.

- Preference for understandable businesses: Investments are made in companies whose business models are easily grasped.

- Patience and discipline in investment decisions: Thorough due diligence and a long-term horizon are paramount.

The Appeal of Japanese Trading Houses

Japanese sogo shosha, or general trading companies (GTCs), are unique global players. These firms are not simply trading houses; they are integrated conglomerates involved in a vast range of businesses, from resource procurement and manufacturing to logistics and infrastructure development. Their global reach, diversified portfolios, and remarkably strong financial positions make them attractive investment targets. They have weathered economic storms effectively, demonstrating resilience and a capacity for adaptation. This long history and established global network suggest considerable potential for future growth.

- Global network and supply chain expertise: Extensive international connections facilitate efficient operations across borders.

- Diversification across various sectors: Reduced risk through exposure to multiple industries.

- Strong financial fundamentals and credit ratings: Solid financial health provides a safety net.

- Long history and established reputation: Decades of experience and trust built with global partners.

Implications of Berkshire Hathaway's Investment

Berkshire Hathaway's significant investment in Japanese trading houses has already had a noticeable impact. The stock prices of the targeted companies have seen a boost, reflecting increased investor confidence. This move also signals a positive view of the Japanese economy and its potential for long-term growth, potentially attracting further foreign investment. The "Berkshire Hathaway effect," where the conglomerate's investment in a company acts as an endorsement, can be substantial.

- Increased investor confidence in Japanese trading houses: Buffett's endorsement carries significant weight in the market.

- Potential for increased foreign investment in Japan: This could stimulate economic activity and growth.

- Long-term growth opportunities for Japanese trading houses: Access to Berkshire Hathaway's resources and expertise.

- Positive impact on the Japanese economy: A boost to investor sentiment and potential for economic expansion.

Analyzing the Risk and Reward

While the potential rewards are significant, it's important to acknowledge the inherent risks. Geopolitical uncertainties, particularly those impacting global trade and the stability of the region, could influence the performance of Japanese trading houses. Economic cycles and potential downturns also pose risks. Furthermore, currency fluctuations between the Japanese Yen and other major currencies could affect the return on investment. However, Berkshire Hathaway’s long-term perspective mitigates many short-term risks.

- Geopolitical risks affecting Japan and global trade: International tensions and trade disputes could impact operations.

- Economic cycles and their potential impact on trading houses: Recessions could affect demand and profitability.

- Currency fluctuations and their influence on returns: Exchange rate movements can affect the value of investments.

- Long-term growth potential outweighing short-term volatility: A long-term outlook minimizes the impact of short-term market fluctuations.

Conclusion: The Long-Term Outlook for Berkshire Hathaway's Japanese Trading House Investments

Berkshire Hathaway's substantial and strategic long-term investment in Japanese trading houses represents a significant development in global finance. The investment highlights the resilience and potential of these often-overlooked businesses. While risks exist, including geopolitical uncertainties and economic cycles, the long-term growth potential and strong fundamentals of these companies, coupled with Berkshire Hathaway's proven investment strategy, suggest a positive outlook. This bold move reinforces the potential of Japanese trading house stocks as compelling long-term investment opportunities. Learn more about Berkshire Hathaway investments and explore the potential of Japanese trading house stocks as part of a diversified long-term investment strategy.

Featured Posts

-

Dwp Hardship Payments Reclaiming Overpaid Universal Credit

May 08, 2025

Dwp Hardship Payments Reclaiming Overpaid Universal Credit

May 08, 2025 -

Transferred Data A Comprehensive Guide To Secure Data Migration

May 08, 2025

Transferred Data A Comprehensive Guide To Secure Data Migration

May 08, 2025 -

Unprecedented Action Indias Deepest Military Strike On Pakistan Cnn

May 08, 2025

Unprecedented Action Indias Deepest Military Strike On Pakistan Cnn

May 08, 2025 -

Ethereum Forecast Rising Accumulation Signals Potential Price Increase

May 08, 2025

Ethereum Forecast Rising Accumulation Signals Potential Price Increase

May 08, 2025 -

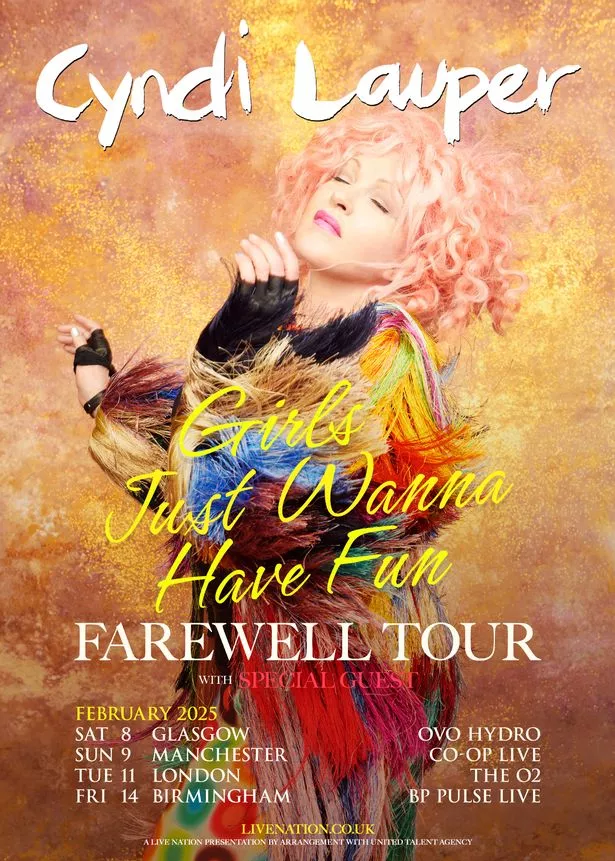

Jones Beach Concert Cyndi Lauper And Counting Crows Live

May 08, 2025

Jones Beach Concert Cyndi Lauper And Counting Crows Live

May 08, 2025