Investor Concerns About Stock Market Valuations: BofA's View

Table of Contents

BofA's Stance on Current Stock Market Valuations

BofA's recent reports suggest a cautious outlook on current stock market valuations. While not outright declaring a market bubble, their analysis indicates that valuations in certain sectors are stretched, warranting careful consideration. They haven't issued a blanket "sell" signal, but rather a call for selectivity and strategic portfolio adjustments.

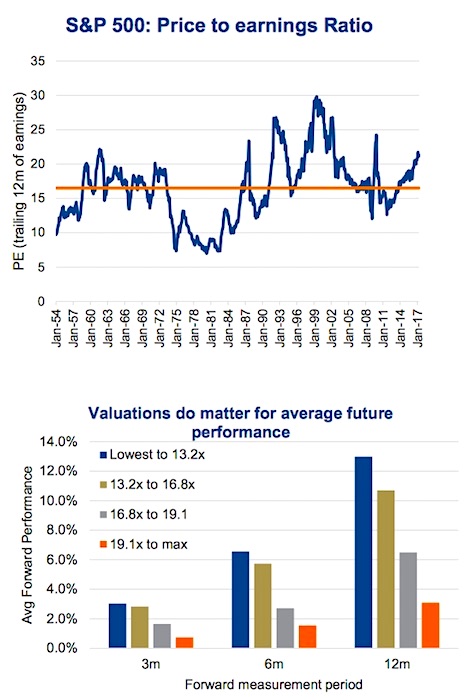

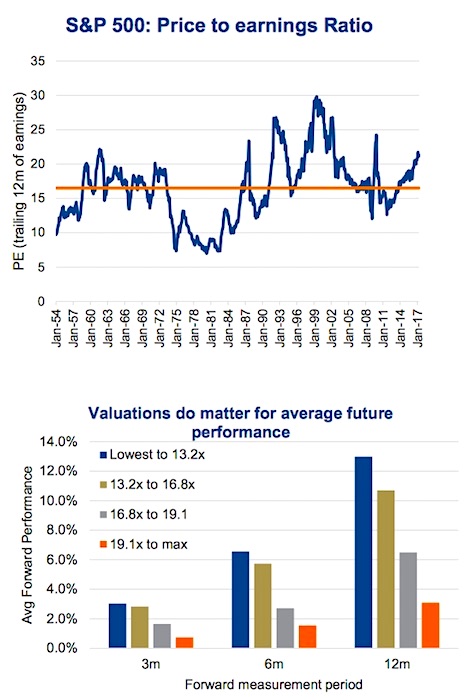

- Valuation Metrics: BofA utilizes a range of metrics to assess valuations, including the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE), to provide a comprehensive view. High P/E ratios, for instance, suggest that investors are paying a premium for earnings, raising concerns about potential overvaluation.

- Overvalued and Undervalued Sectors: BofA's research often highlights specific sectors or individual stocks they deem overvalued or undervalued. Recent reports may point to certain technology stocks as potentially overvalued given their high growth expectations, while certain value stocks in more stable sectors might be presented as comparatively undervalued. Specific examples and details would need to be drawn from the latest BofA reports.

- Market Predictions: BofA's predictions for future market movements are typically nuanced and conditional, depending on macroeconomic factors. They might project moderate growth under certain scenarios, but also outline potential downside risks if certain negative economic indicators materialize. Their projections should be carefully examined and understood within their stated assumptions and limitations.

Key Factors Driving Investor Concerns

Several macroeconomic factors are fueling investor apprehension and impacting stock market valuations. These concerns are interconnected and create a complex picture for investors to analyze.

- Inflationary Pressures: Persistent inflation erodes purchasing power and increases the cost of borrowing, impacting corporate profits and potentially slowing economic growth. This can lead to lower stock prices as investors reassess future earnings potential.

- Interest Rate Hikes: Central banks raising interest rates to combat inflation increase borrowing costs for businesses and consumers, potentially slowing economic activity and decreasing corporate earnings. Higher interest rates also make bonds more attractive relative to stocks, potentially shifting investor allocations.

- Geopolitical Risks: Global conflicts, political instability, and supply chain disruptions introduce significant uncertainty into the market, impacting investor confidence and causing market volatility. These unpredictable events can trigger sudden price swings.

- Recessionary Scenarios: Concerns about a potential recession weigh heavily on investor sentiment. A recession would likely lead to lower corporate earnings and decreased consumer spending, potentially triggering a significant market correction. The probability and severity of a recession remain subjects of ongoing debate and analysis.

BofA's Strategies for Navigating Current Market Conditions

Given their assessment of stock market valuations, BofA recommends several strategies for investors to navigate the current market environment. These strategies emphasize risk management and diversification.

- Portfolio Diversification: BofA likely advocates for a well-diversified portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate risk. This reduces reliance on any single investment and helps weather market downturns.

- Sector Allocation: BofA's recommendations on sector allocation often shift based on their valuation analysis. They might suggest favoring value stocks over growth stocks in periods of high valuations, or vice versa depending on their outlook.

- Asset Allocation: Adjusting asset allocation involves changing the proportion of your investment portfolio dedicated to different asset classes. BofA might advise reducing equity exposure and increasing exposure to less volatile assets like bonds during periods of heightened uncertainty.

- Defensive Strategies: Defensive strategies aim to protect against market downturns. These might include holding cash, investing in defensive sectors (utilities, consumer staples), or employing hedging techniques.

Alternative Perspectives and Counterarguments

It's crucial to acknowledge that BofA's perspective is not universally accepted. Other financial institutions and market analysts may offer contrasting viewpoints on stock market valuations.

- Contrasting Viewpoints: Some analysts might argue that current valuations are justified by strong corporate earnings growth or low interest rates (relative to historical norms), pointing to a different set of economic indicators.

- Supporting Indicators: Alternative perspectives might highlight positive economic data, such as robust employment figures or strong consumer spending, as evidence that the market is not overvalued.

- Future Events: Unforeseen events, like a breakthrough in technology or a significant geopolitical shift, could significantly alter the market outlook and invalidate current valuation models. Such events are difficult to predict, adding to the uncertainty.

Conclusion

BofA's analysis reveals concerns regarding certain sectors' stock market valuations, urging investors to exercise caution and adopt a selective approach. Key factors influencing their outlook include inflationary pressures, interest rate hikes, geopolitical risks, and recessionary concerns. BofA suggests strategies such as portfolio diversification, careful sector allocation, adjusting asset allocation, and implementing defensive strategies to mitigate potential risks. However, it's vital to remember that this is just one perspective. Understanding stock market valuations is crucial for informed investment decisions. Conduct thorough research, consider diverse viewpoints, and consult with financial advisors before making any investment choices. Further reading of BofA's reports and other reputable market analyses will help you stay informed and make strategic choices to navigate the market effectively.

Featured Posts

-

Macron Et La Francafrique Un Nouveau Chapitre Pour L Afrique Francophone

May 03, 2025

Macron Et La Francafrique Un Nouveau Chapitre Pour L Afrique Francophone

May 03, 2025 -

Nigel Farages Reform Uk Faces Rift Ex Deputy Hints At New Party

May 03, 2025

Nigel Farages Reform Uk Faces Rift Ex Deputy Hints At New Party

May 03, 2025 -

6aus49 Ergebnisse Mittwoch 9 April 2025 Alle Gewinnzahlen Im Ueberblick

May 03, 2025

6aus49 Ergebnisse Mittwoch 9 April 2025 Alle Gewinnzahlen Im Ueberblick

May 03, 2025 -

Lotto Plus 1 And Lotto Plus 2 Results Check The Latest Draw Numbers

May 03, 2025

Lotto Plus 1 And Lotto Plus 2 Results Check The Latest Draw Numbers

May 03, 2025 -

Reform Party Defections The Tories Accusations Against Nigel Farage

May 03, 2025

Reform Party Defections The Tories Accusations Against Nigel Farage

May 03, 2025