Investors Defy Market Gloom: Are Higher Prices Sustainable?

Table of Contents

Factors Driving Higher Prices Despite Market Gloom

Several key factors are contributing to the surprising resilience of prices in the face of market gloom. Let's delve into the most significant contributors.

Resilient Consumer Spending

Despite inflation and economic anxieties, consumer spending remains surprisingly robust. This resilience is supporting higher prices across various sectors. Several factors explain this:

- Strong Employment Numbers: Low unemployment rates provide consumers with the confidence and financial means to continue spending.

- Pent-Up Demand: The pandemic-induced lockdowns created pent-up demand for goods and services, which continues to fuel consumption.

- Government Stimulus Effects: While tapering, the lingering effects of previous government stimulus packages continue to bolster consumer spending power.

However, this resilience isn't without potential downsides. High inflation could erode purchasing power, eventually leading to a decline in consumer spending. Furthermore, rising interest rates may cool consumer enthusiasm for large purchases like homes and vehicles.

Corporate Earnings Surprisingly Strong

Many companies have reported surprisingly strong corporate earnings, exceeding market expectations. This positive news is bolstering investor confidence and supporting higher stock prices.

- Examples of Exceeding Expectations: Several technology giants, along with companies in the consumer staples sector, have recently reported better-than-anticipated earnings. (Specific company examples would be added here in a real-world article.)

- Reasons for Exceeding Earnings: Strong sales, effective cost management, and strategic investments have all played a role in these positive results.

- Future Projections: While current earnings are strong, future projections are less certain, given the overall economic uncertainty.

It's important to note that relying solely on corporate earnings reports can be misleading. These reports often represent a snapshot in time and don't always accurately reflect the long-term health and sustainability of a company or the overall market.

Influx of Institutional Investment

Large institutional investors, such as hedge funds and pension funds, are playing a significant role in driving up prices. Their considerable financial resources and investment strategies are influencing market trends.

- Types of Institutional Investors: Hedge funds, actively seeking high returns, are one prominent example. Pension funds, tasked with managing long-term retirement savings, are another.

- Investment Strategies: These institutions utilize a variety of strategies, including value investing, growth investing, and quantitative trading.

- Impact on Market Trends: The sheer volume of capital controlled by these institutions can significantly impact asset prices, pushing them higher regardless of broader market sentiment.

However, this level of institutional involvement carries inherent risks. A sudden shift in investment strategies could lead to a sharp market correction.

Challenges to the Sustainability of Higher Prices

While several factors are currently pushing prices higher, several significant challenges threaten the sustainability of this trend.

Inflationary Pressures

Persistent inflation remains a major threat. Rising prices erode purchasing power and can ultimately dampen consumer demand, leading to lower price growth or even a decline.

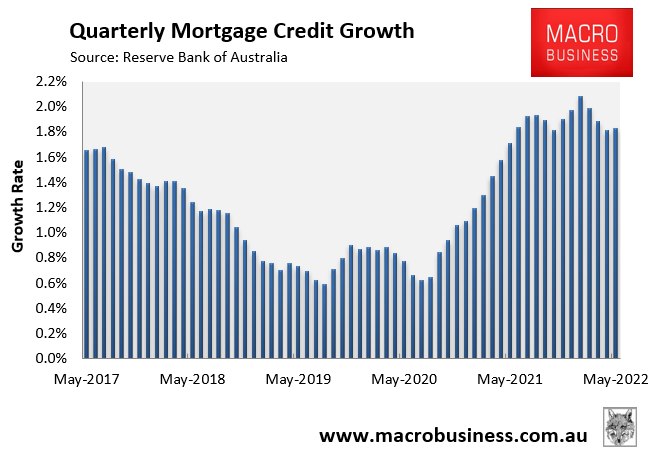

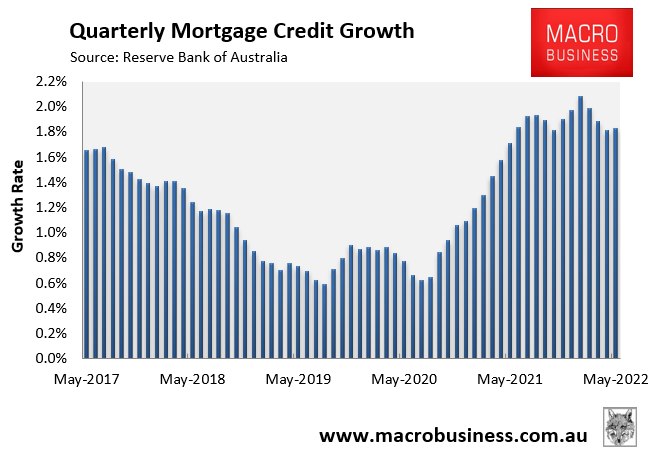

- Current Inflation Rates: (Include current inflation data here, sourced from a reliable authority).

- Central Bank Responses: Central banks are actively trying to combat inflation through interest rate hikes and other monetary policy tools.

- Potential for Further Price Increases: The effectiveness of these measures remains to be seen, and further price increases due to inflation are a real possibility.

Geopolitical Uncertainty

Geopolitical events introduce significant uncertainty into the market, impacting investor confidence and potentially leading to price volatility.

- Specific Examples of Geopolitical Events: (Mention relevant ongoing geopolitical conflicts and their potential market impacts here).

- Potential Impact on Markets: Geopolitical instability can disrupt supply chains, increase commodity prices, and negatively affect investor sentiment.

- Investor Adaptation: Investors are adapting by diversifying portfolios and seeking assets perceived as safe havens during times of uncertainty.

Interest Rate Hikes

Rising interest rates increase borrowing costs for businesses and consumers, potentially dampening economic activity and impacting investment decisions.

- Current Interest Rate Levels: (Include current interest rate data here from a reliable source).

- Impact on Borrowing Costs: Higher interest rates make it more expensive for businesses to invest and expand, potentially slowing economic growth.

- Influence on Investment Strategies: Investors may shift towards less risky investments with lower returns, potentially slowing price growth in riskier assets.

Conclusion

While investors are currently defying market gloom and driving prices higher, the sustainability of this trend is far from guaranteed. Resilient consumer spending, strong corporate earnings, and significant institutional investment are supporting higher prices. However, persistent inflationary pressures, geopolitical uncertainty, and rising interest rates pose considerable challenges. Understanding the interplay of these factors is crucial for determining whether higher prices are truly sustainable. Stay informed about market trends and consult with a financial advisor to make sound investment decisions in this complex environment. Don’t let market gloom dictate your investment strategy; understand the nuances of whether higher prices are truly sustainable.

Featured Posts

-

Secret Service Investigation Concludes Cocaine Found At White House

Apr 22, 2025

Secret Service Investigation Concludes Cocaine Found At White House

Apr 22, 2025 -

Mark Zuckerbergs Challenges In The Age Of Trump

Apr 22, 2025

Mark Zuckerbergs Challenges In The Age Of Trump

Apr 22, 2025 -

Harvard Faces 1 Billion Funding Cut Trump Administrations Ire

Apr 22, 2025

Harvard Faces 1 Billion Funding Cut Trump Administrations Ire

Apr 22, 2025 -

A Pan Nordic Defense Integrating Swedish Armor And Finnish Infantry

Apr 22, 2025

A Pan Nordic Defense Integrating Swedish Armor And Finnish Infantry

Apr 22, 2025 -

Assessing The Impact Of Trumps Trade Actions On Us Financial Power

Apr 22, 2025

Assessing The Impact Of Trumps Trade Actions On Us Financial Power

Apr 22, 2025