Is An Angry Elon Musk Good For Tesla Stock?

Table of Contents

The Positive Impact of Musk's "Aggressive" Leadership on Tesla's Innovation

Musk's leadership style, often described as "aggressive" or even "disruptive," has undeniably driven Tesla's success. His relentless pursuit of innovation and willingness to challenge established norms have propelled the company to the forefront of the electric vehicle (EV) revolution.

Driving Innovation Through Disruption

Musk's unconventional approach has fostered a culture of rapid innovation. This is evident in Tesla's:

- Groundbreaking battery technology: Constant improvements in battery range and charging times have redefined the EV landscape.

- Autopilot and Full Self-Driving capabilities: Tesla's advancements in autonomous driving technology, despite ongoing challenges, maintain a leading position in the sector.

- Innovative manufacturing processes: Tesla's Gigafactories represent a paradigm shift in automotive production, pushing for automation and efficiency.

This disruptive innovation has translated into impressive market share. Tesla consistently ranks as a top seller of electric vehicles globally, demonstrating the effectiveness of Musk’s visionary leadership in driving sales and capturing market share. Data from reputable sources consistently positions Tesla as a market leader in EV technology and sales. This dominance attracts top engineering and software talent who are drawn to the challenge and the opportunity to work at the forefront of technological advancement. A "disruptive" leadership style, while demanding, can be a powerful magnet for ambitious individuals.

Cultivating a Culture of High Performance

Musk's demanding leadership style, characterized by long hours and high expectations, undeniably fosters a high-pressure environment. This can lead to:

- Rapid development cycles: Tesla's ability to bring new products and features to market quickly demonstrates the effectiveness of this intense work culture. Ambitious targets push teams to achieve breakthroughs at an unprecedented pace.

- Rapid scaling of production: The ability to rapidly ramp up production at Gigafactories is a testament to the high-performance culture.

- Strong investor sentiment: Investors often respond positively to perceived strong leadership, even if controversial. The belief in Musk’s vision and drive can be a major driver of stock value.

However, this high-pressure environment also carries potential drawbacks, including high employee turnover and potential burnout. Balancing the need for rapid innovation with the well-being of employees remains a significant challenge.

The Negative Impact of Musk's Public Outbursts on Tesla's Brand and Stock Price

Despite the undeniable positive impacts, Musk's public outbursts and controversial actions carry significant risks. His unpredictable behavior can negatively impact Tesla’s brand and stock price.

Brand Reputation and Investor Confidence

Musk's controversial tweets and public statements frequently generate negative headlines and uncertainty, impacting investor confidence:

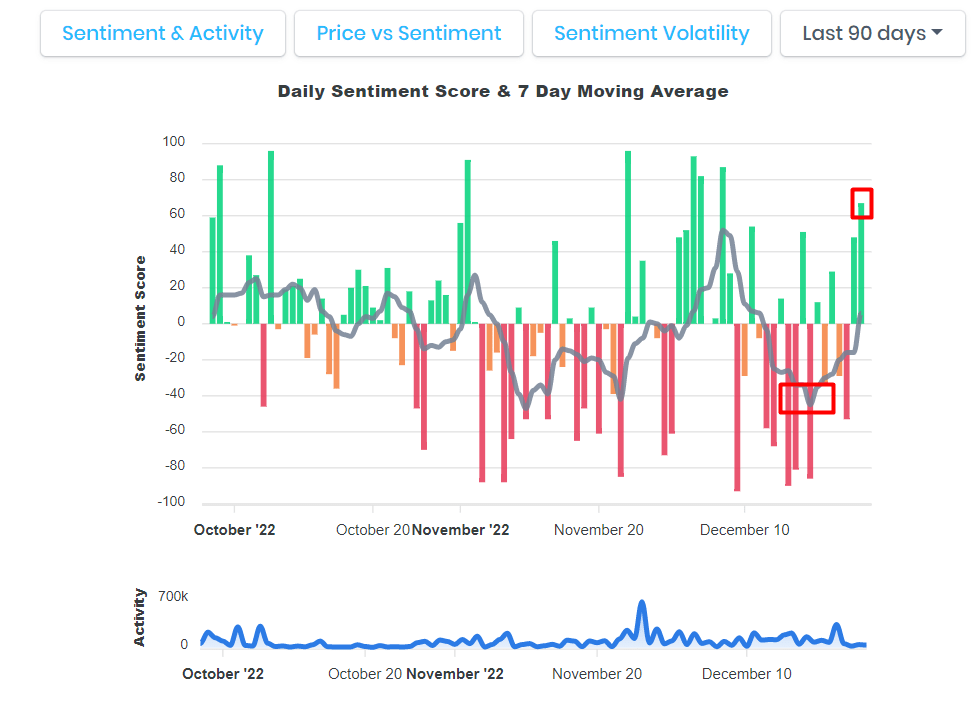

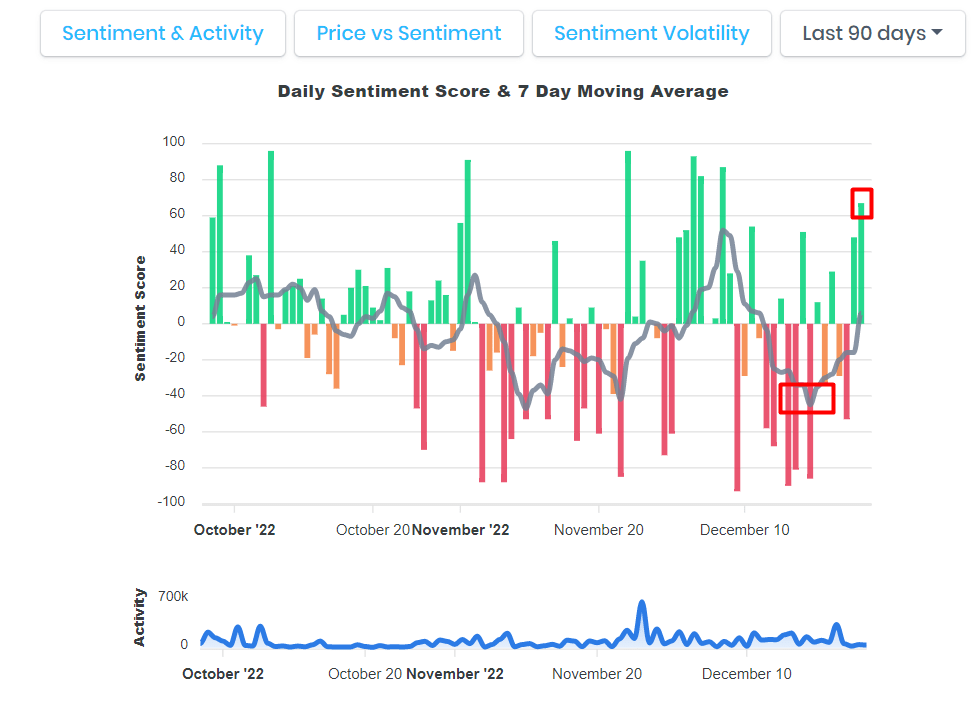

- Market volatility: Sudden drops in Tesla's stock price often coincide with controversial tweets or public pronouncements.

- Damaged brand image: Negative publicity can damage Tesla's carefully cultivated brand image, particularly among environmentally conscious consumers.

- Erosion of trust: Consistent erratic behavior can erode trust among investors and customers alike, leading to hesitancy regarding Tesla investments and purchases.

The risks associated with a highly publicized CEO are significant; one impulsive tweet can wipe millions off the company's market capitalization. This volatility is a direct consequence of the high visibility of Elon Musk and his influence on Tesla's public perception.

Regulatory Scrutiny and Legal Ramifications

Musk's outspoken nature has also led to increased regulatory scrutiny and legal challenges:

- SEC investigations: Musk has faced multiple investigations by the Securities and Exchange Commission (SEC) related to his tweets and public statements.

- Legal battles: Tesla has also faced numerous lawsuits related to various aspects of its operations.

- Reputational damage: These investigations and lawsuits can damage Tesla's reputation and create uncertainty, further affecting investor sentiment.

The potential for significant financial and reputational damage from legal challenges underlines the risks associated with Musk's public persona. Investor confidence is directly impacted by any legal uncertainties surrounding the company and its leadership.

Separating the Person from the Company: The Long-Term Outlook for Tesla Stock

While Musk's personality is inextricably linked to Tesla's current trajectory, assessing the long-term prospects requires separating the person from the company's inherent value and market position.

The Influence of External Factors

Tesla's stock performance is influenced by factors beyond Musk's control:

- Macroeconomic conditions: Global economic downturns, inflation, and interest rate changes all impact investor sentiment and Tesla's stock price.

- Competition: The EV market is becoming increasingly competitive, with established automakers launching their own electric vehicle lines.

- Technological advancements: Rapid technological changes in battery technology, autonomous driving, and other areas will continue to shape Tesla's future.

The competitive landscape and macroeconomic trends significantly impact Tesla stock, irrespective of Musk's behavior. Long-term projections for the EV market will play a crucial role in determining Tesla's future valuation.

The Future of Tesla's Leadership

The long-term sustainability of Tesla’s success depends on its ability to develop a strong leadership structure independent of any single individual.

- Succession planning: Tesla needs a robust succession plan to ensure smooth leadership transitions in the future.

- Organizational structure: A well-defined organizational structure can mitigate the risks associated with a highly centralized leadership style.

- Long-term strategy: Tesla needs a clear long-term strategic vision that is adaptable to changing market conditions and independent of any single CEO.

The ultimate success of Tesla is contingent upon building a leadership structure that can guide the company through future challenges, regardless of Musk's continued involvement. The long-term outlook for Tesla stock depends heavily on the company’s ability to adapt and innovate beyond a single charismatic but unpredictable leader.

Conclusion

This article explored the complex relationship between Elon Musk's personality and Tesla's stock performance. While his "aggressive" leadership has undoubtedly spurred innovation and driven Tesla’s market dominance, his public outbursts have created significant risks to the company's brand and stock price. Separating the person from the company is crucial in assessing Tesla's long-term investment potential. The company's future hinges on its capacity to cultivate a strong, stable leadership structure that can navigate future challenges effectively.

Call to Action: Understanding the multifaceted impact of Elon Musk on Tesla is vital for making informed investment decisions. Continue to research and analyze Tesla stock, paying close attention to both the company's performance and the ongoing influence of Elon Musk on its trajectory. Stay informed about news concerning Elon Musk and his impact on Tesla, and carefully consider these factors when evaluating the long-term prospects of Tesla stock.

Featured Posts

-

The Woody Allen Controversy New Light On Sexual Abuse Claims Following Sean Penns Support

May 25, 2025

The Woody Allen Controversy New Light On Sexual Abuse Claims Following Sean Penns Support

May 25, 2025 -

Naomi Campbells Reported Ban From Met Gala 2025 The Anna Wintour Angle

May 25, 2025

Naomi Campbells Reported Ban From Met Gala 2025 The Anna Wintour Angle

May 25, 2025 -

Enimerosi Bathmologias Euroleague I Niki Tis Monako Sto Parisi

May 25, 2025

Enimerosi Bathmologias Euroleague I Niki Tis Monako Sto Parisi

May 25, 2025 -

Understanding And Interpreting The Net Asset Value Of The Amundi Djia Ucits Etf

May 25, 2025

Understanding And Interpreting The Net Asset Value Of The Amundi Djia Ucits Etf

May 25, 2025 -

Cheapest And Busiest Flight Days Around Memorial Day 2025

May 25, 2025

Cheapest And Busiest Flight Days Around Memorial Day 2025

May 25, 2025