Understanding And Interpreting The Net Asset Value Of The Amundi DJIA UCITS ETF

Table of Contents

What is the Net Asset Value (NAV) of an ETF?

The Net Asset Value (NAV) of an ETF represents the total value of all the assets held within the fund, divided by the number of outstanding shares. Think of it as the underlying worth of each share in the ETF. For the Amundi DJIA UCITS ETF, the NAV is directly tied to the value of the 30 companies that comprise the Dow Jones Industrial Average. The fund aims to mirror the DJIA's composition and performance as closely as possible.

The NAV is calculated daily by Amundi, the fund manager. This calculation considers:

- The current market prices of all the DJIA stocks held by the ETF.

- Any dividends received from these underlying holdings. These dividends are usually reinvested, increasing the overall NAV.

- Management fees and other expenses associated with running the fund. These reduce the NAV.

- Currency fluctuations: If the ETF is not denominated in your local currency, exchange rate variations will impact the NAV.

It's crucial to distinguish between NAV and the market price of the ETF. The market price is the price at which the ETF is currently trading on the exchange. While ideally, these two figures should be very close, short-term market fluctuations can cause temporary discrepancies.

How to Find the Amundi DJIA UCITS ETF NAV

Finding the daily NAV of the Amundi DJIA UCITS ETF is straightforward. Reliable sources include:

- Amundi's Official Website: The fund manager's website is the most accurate and authoritative source for NAV information.

- Financial News Websites: Major financial news outlets often provide ETF data, including NAVs.

- Brokerage Platforms: If you hold the ETF through a brokerage account, the platform will usually display the current NAV.

Typically, the NAV is reported in the ETF's base currency (likely Euros for a UCITS ETF) and is usually calculated at the close of the market on each trading day. You can expect daily updates of this crucial investment metric.

Interpreting the NAV and its Significance for Investors

Changes in the NAV directly reflect the investment performance of the Amundi DJIA UCITS ETF. A rising NAV suggests positive performance, while a falling NAV indicates negative performance. This information is essential for making informed investment decisions.

- Monitoring NAV trends over time helps you assess the long-term performance of your investment.

- Short-term NAV fluctuations are common and usually don't signal a cause for immediate concern. Focus on the long-term trend.

- Comparing the NAV to the DJIA index allows you to evaluate how effectively the ETF is tracking its benchmark.

The NAV is a key tool for:

- Performance Tracking: Monitor your investment's growth or decline.

- Benchmark Comparison: Assess the ETF's performance against the DJIA.

- Risk Assessment: Understand the volatility of your investment.

- Buy/Sell Decisions: Inform your investment strategy based on NAV trends.

Factors Affecting the Amundi DJIA UCITS ETF NAV Beyond the DJIA

While the DJIA is the primary driver of the Amundi DJIA UCITS ETF's NAV, other factors also play a role:

- Expense Ratios: The fund's expense ratio, which covers management and operational costs, directly impacts the NAV. These fees are deducted from the fund's assets.

- Currency Fluctuations: If you are investing in the ETF in a currency other than the base currency (e.g., investing in a Euro-denominated ETF from a US Dollar account), exchange rate changes will influence the value of your investment in your local currency.

- Management Fees & Other Costs: Any additional fees or costs associated with the fund will also affect the NAV, though typically these are minimal compared to the expense ratio.

Conclusion: Mastering the Amundi DJIA UCITS ETF NAV

Understanding and interpreting the NAV of the Amundi DJIA UCITS ETF is crucial for effective investment management. By regularly monitoring the NAV and understanding the factors that influence it, you can track your investment's performance, compare it to benchmarks, assess risks, and make informed buy and sell decisions. Stay informed about your Amundi DJIA UCITS ETF NAV for optimal investment strategies. Remember to consult Amundi's official website and your brokerage statements for the most up-to-date NAV information. Learn more about ETF investing and the Amundi DJIA UCITS ETF by visiting [link to Amundi's website].

Featured Posts

-

Doert Oyuncunun Gelecegi Tehlikede Kuluep Skandali

May 25, 2025

Doert Oyuncunun Gelecegi Tehlikede Kuluep Skandali

May 25, 2025 -

Sharp Drop In Amsterdam Stock Market Down 7 As Trade War Fears Rise

May 25, 2025

Sharp Drop In Amsterdam Stock Market Down 7 As Trade War Fears Rise

May 25, 2025 -

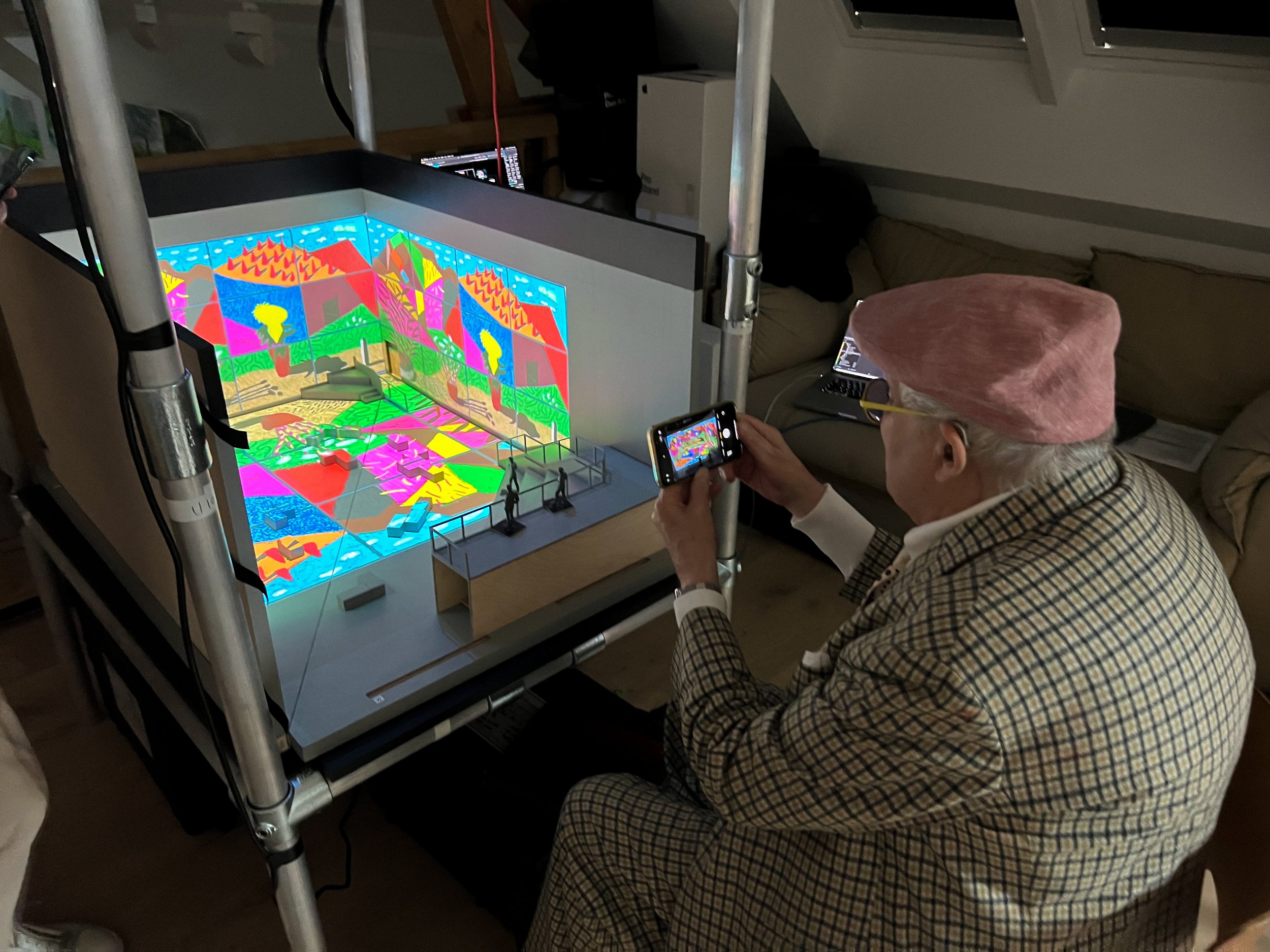

David Hockney A Bigger Picture Exploring The Artists Vision

May 25, 2025

David Hockney A Bigger Picture Exploring The Artists Vision

May 25, 2025 -

Frankfurt Stock Market Dax Remains Stable Following Record Growth

May 25, 2025

Frankfurt Stock Market Dax Remains Stable Following Record Growth

May 25, 2025 -

Dow Jones Index Cautious Climb Continues After Pmi Surprise

May 25, 2025

Dow Jones Index Cautious Climb Continues After Pmi Surprise

May 25, 2025