Is Betting On Natural Disasters Like The LA Wildfires The New Normal?

Table of Contents

The Rise of Disaster Betting Markets

The mechanics of disaster betting are surprisingly straightforward. Prediction markets, often utilizing derivatives, allow individuals to wager on the likelihood, intensity, and location of various natural events. These markets aren't limited to wildfires; they encompass hurricanes, earthquakes, floods, and other catastrophic occurrences. The LA Wildfires, for example, saw a significant surge in betting activity, with platforms offering bets on factors such as the total acreage burned, the number of structures destroyed, and the overall economic impact.

The accessibility and growth of these markets are alarming. Previously relegated to niche financial circles, disaster betting is becoming increasingly mainstream, driven by readily available online platforms and sophisticated data analytics.

- Examples of platforms: While many platforms remain unregulated and operate in a legal gray area, several online betting sites are increasingly offering options for wagering on natural disasters.

- Types of bets: Bets range from simple binary options (will a hurricane hit X city?) to complex derivatives based on the precise intensity and duration of an event. For example, one might bet on the specific wind speed of a hurricane or the total rainfall during a flood.

- Regulations: The regulatory landscape is fragmented and largely inconsistent across jurisdictions. Many countries lack specific legislation addressing disaster betting, creating a significant regulatory gap.

Ethical Concerns and Societal Implications

The ethical implications of betting on natural disasters are profound. Profiting from the devastation and suffering of others is inherently problematic, raising questions about sensitivity and moral responsibility.

- Insensitive and exploitative: Critics argue that disaster betting trivializes human suffering and exploits the vulnerability of those affected by natural disasters.

- Exacerbating inequalities: The potential for wealth concentration amongst those who successfully predict and profit from these events is concerning, potentially widening existing socio-economic disparities.

- Media's role: Sensationalized media coverage of natural disasters can inadvertently fuel betting activity by increasing public awareness and influencing betting behavior.

The Role of Data and Prediction Models

Sophisticated data analysis and predictive modeling are central to disaster betting. Climate data, historical records, satellite imagery, and other sources feed into complex algorithms designed to forecast the likelihood and severity of natural events.

- Types of data: Data used includes historical weather patterns, geological data (for earthquakes), deforestation rates (for wildfires), and population density.

- Climate change impact: Climate change significantly complicates prediction, introducing greater uncertainty and potentially impacting the accuracy of models.

- Limitations: Predicting complex events like wildfires, which are influenced by a multitude of interacting factors, remains a significant challenge. Bias in data collection and interpretation can further skew predictions.

Legal and Regulatory Frameworks

The current legal framework surrounding disaster betting is a patchwork. While some jurisdictions have regulations governing general gambling activities, specific rules pertaining to betting on natural disasters are often lacking.

- International variations: Legal approaches to disaster betting vary significantly across countries. Some may have outright bans, while others may have limited or no regulations.

- Legal challenges: The legality of disaster betting is likely to face increasing scrutiny and legal challenges as the practice becomes more prevalent.

- Calls for stricter oversight: There are growing calls for stricter oversight, licensing, and regulation to address ethical concerns and prevent market manipulation.

The Future of Disaster Betting

The future of disaster betting markets is uncertain but potentially transformative.

- AI and machine learning: Advances in artificial intelligence and machine learning are likely to enhance the accuracy and sophistication of prediction models.

- Increased prediction accuracy: This could lead to more precise bets and potentially even higher stakes.

- Responsible innovation: The need for responsible innovation and ethical guidelines is paramount to prevent the exploitation of vulnerable populations and ensure the integrity of these markets.

Is Betting on Natural Disasters Like the LA Wildfires the New Normal? – A Call to Action

This article has explored the complex ethical and societal implications of betting on natural disasters. While the practice is undeniably growing, its normalization is far from assured. The potential for exploitation, market manipulation, and the insensitive commodification of human suffering are significant concerns that require careful consideration.

The question remains: is betting on natural disasters the new normal? The answer, based on the current trajectory, is a cautious "possibly." However, the future depends on informed public discourse, robust regulatory frameworks, and a commitment to responsible innovation. We must engage in open conversations about the ethical considerations and regulatory needs surrounding disaster betting, promoting awareness and advocating for responsible behavior regarding this emerging trend. Further research into the topic of natural disaster prediction markets and the potential for ethical and responsible innovation is crucial.

Featured Posts

-

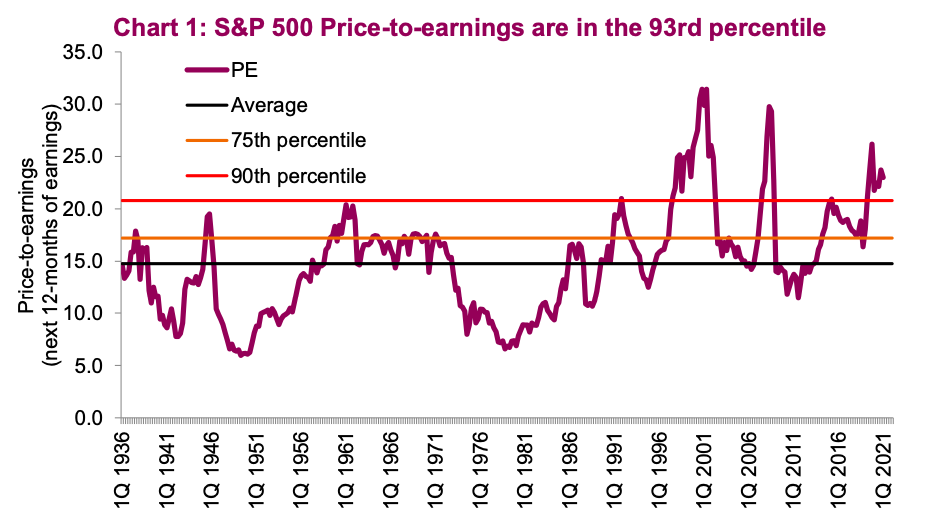

Understanding Stock Market Valuations Bof As Argument For Investor Calm

Apr 27, 2025

Understanding Stock Market Valuations Bof As Argument For Investor Calm

Apr 27, 2025 -

Kanopys Hidden Gems Free Movies And Shows Worth Watching

Apr 27, 2025

Kanopys Hidden Gems Free Movies And Shows Worth Watching

Apr 27, 2025 -

Car Dealerships Intensify Pressure Against Ev Sales Quotas

Apr 27, 2025

Car Dealerships Intensify Pressure Against Ev Sales Quotas

Apr 27, 2025 -

Ariana Grandes Hair And Tattoo Reveal A Professional Stylists Work

Apr 27, 2025

Ariana Grandes Hair And Tattoo Reveal A Professional Stylists Work

Apr 27, 2025 -

February 20 2025 Your Guide To A Happy Day

Apr 27, 2025

February 20 2025 Your Guide To A Happy Day

Apr 27, 2025

Latest Posts

-

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025

Pace Of Rent Increases Slows In Metro Vancouver Housing Costs Still High

Apr 28, 2025 -

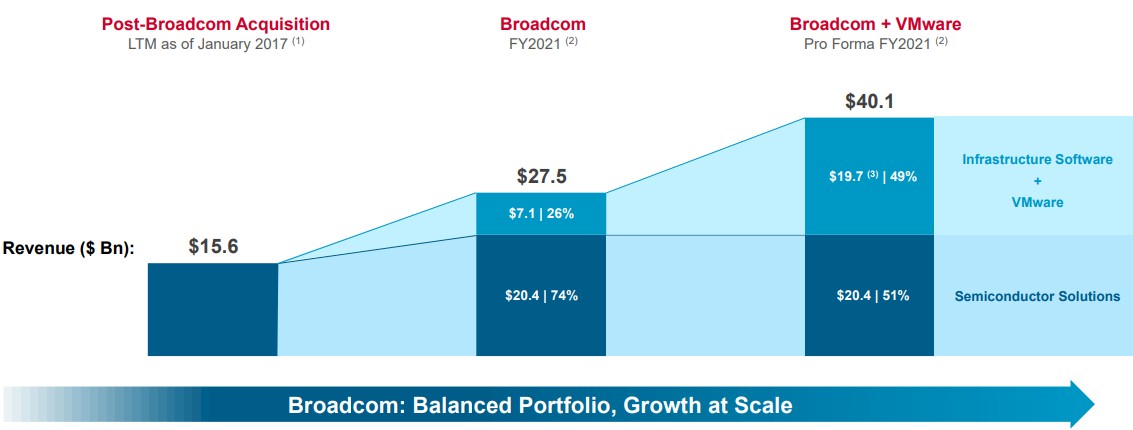

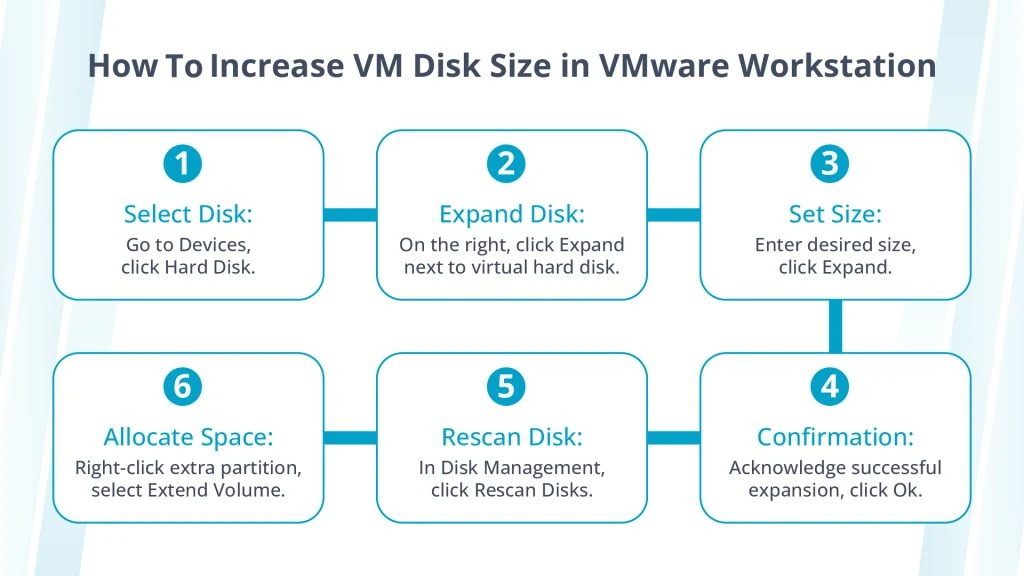

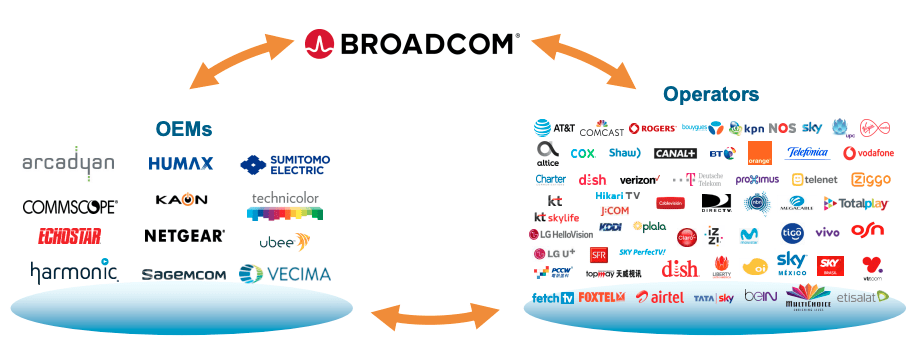

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025 -

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025 -

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025