Is David Solomon A Banker Or A Private Equity Mogul? Goldman's Pay Dispute Explained

Table of Contents

David Solomon's Background and Career Trajectory

From Investment Banking to CEO

David Solomon's journey to the CEO's office at Goldman Sachs is a compelling narrative. His career exemplifies a climb through the ranks, marked by key roles and significant contributions:

- Early Career Focus: Solomon began his career at Goldman Sachs in 1999, initially focusing on investment banking.

- Rise Through the Ranks: He steadily progressed through various leadership roles within the firm, showcasing his expertise and management skills.

- Global Head of Fixed Income: Solomon's appointment as Global Head of Fixed Income demonstrated his growing influence within the institution.

- Partner and Co-President: Achieving partnership and co-presidency positions marked crucial steps on his path to the CEO's office.

- CEO Appointment: Ultimately, Solomon's ascension to CEO in 2018 signaled a potential shift in Goldman Sachs's strategic trajectory.

The Rise of the Consumer and Wealth Management Division

Under Solomon's leadership, Goldman Sachs has significantly invested in its consumer and wealth management division. This strategic shift represents a divergence from the firm's traditional investment banking roots:

- Marcus Launch: The introduction of Marcus, Goldman Sachs's online consumer banking platform, marked a bold move into a new market segment.

- GreenSky Acquisition: The acquisition of GreenSky further broadened Goldman Sachs's reach in the consumer lending space.

- Strategic Diversification: These initiatives signal a move towards diversification and a reduced reliance on traditional investment banking activities.

- Shifting Risk Profile: Consumer banking carries a different risk profile compared to traditional investment banking, implying a strategic change in the firm's approach.

Goldman Sachs's Strategic Shift Under Solomon's Leadership

Emphasis on Consumer Banking and Diversification

Solomon's tenure has been characterized by a significant push into consumer banking and other diversified areas. This strategic repositioning raises questions about Goldman Sachs's future identity:

- Beyond Wall Street: The expansion into consumer banking signals an attempt to reach a broader customer base beyond traditional Wall Street clientele.

- Acquisitions and Partnerships: Strategic acquisitions and partnerships have expanded Goldman Sachs's presence in diverse sectors.

- Technological Investments: Substantial investments in technology are integral to supporting these new ventures and improving efficiency.

- Comparison to Private Equity: This strategic diversification mirrors tactics employed by private equity firms, aiming for broader revenue streams and less reliance on specific market conditions.

The Impact on Profitability and Stock Performance

The financial results of these strategic shifts have been mixed, sparking debate among investors and analysts:

- Increased Revenue Streams: While diversification has led to new revenue streams, profitability in the consumer banking division has been inconsistent.

- Stock Performance Volatility: Goldman Sachs's stock performance has been volatile during Solomon's leadership, reflecting market uncertainty and shifts in investor sentiment.

- Market Reaction: The market's reaction to these changes has been mixed, with investors expressing concerns about the financial performance of some new initiatives.

The Goldman Sachs Pay Dispute and its Significance

Details of the Compensation Controversy

The compensation package awarded to David Solomon and other top executives at Goldman Sachs has generated substantial controversy:

- High Compensation Levels: Solomon's compensation has been significantly higher than some of his peers at other investment banks.

- Shareholder Concerns: Several shareholders have voiced concerns about the level of executive compensation, arguing it's excessive given the firm's performance.

- Performance-Based Pay: The argument for performance-based pay centers around Solomon's successful diversification efforts.

- Justification for Compensation: Goldman Sachs has justified the compensation by highlighting Solomon's contributions and the risks associated with his strategic initiatives.

Interpretations and Criticisms

The pay dispute highlights differing perspectives on Solomon's leadership and the firm's direction:

- Criticism of Compensation: Critics argue that Solomon's compensation is excessive relative to the firm's performance and inconsistent with pay practices at other financial institutions.

- Impact on Employee Morale: The large disparity in compensation between executives and other employees could potentially impact overall employee morale.

- Shareholder Activism: The controversy has spurred shareholder activism, pressuring the firm to reconsider its compensation practices.

Comparing Solomon's Approach to Traditional Banking and Private Equity

Traditional Investment Banking Models

Traditional investment banking focuses on specific activities:

- Underwriting: Assisting corporations in issuing securities.

- Mergers & Acquisitions (M&A): Advising companies on mergers, acquisitions, and divestitures.

- Trading: Facilitating the buying and selling of securities.

Private Equity Strategies

Private equity firms employ distinct strategies:

- Leveraged Buyouts (LBOs): Acquiring companies using significant debt financing.

- Portfolio Management: Managing a portfolio of investments for maximum returns.

- Value Creation: Implementing operational improvements to increase the value of acquired companies.

Solomon's Leadership Style

Solomon's leadership style blends elements of both traditional banking and private equity:

- Diversification Efforts: His emphasis on diversification is a hallmark of private equity, aiming for less dependence on specific market cycles.

- Investment in Technology: Heavy investments in technology resemble private equity's focus on operational efficiency and scalability.

- Emphasis on Returns: Similar to private equity, there's a strong focus on achieving high returns on investments.

Conclusion: David Solomon's Legacy: Banker, Private Equity Mogul, or Both?

David Solomon's leadership at Goldman Sachs presents a complex case study. While rooted in traditional investment banking, his strategic shifts towards consumer banking and diversification borrow heavily from private equity strategies. The significant pay dispute further complicates the narrative, raising questions about aligning executive compensation with the firm's performance and overall strategic direction. Whether these moves ultimately prove successful remains to be seen, but the debate surrounding his leadership and compensation undeniably shapes the future of Goldman Sachs. What are your thoughts on David Solomon's leadership and the future of Goldman Sachs? Join the conversation using #GoldmanSachs #DavidSolomon #PrivateEquity #InvestmentBanking.

Featured Posts

-

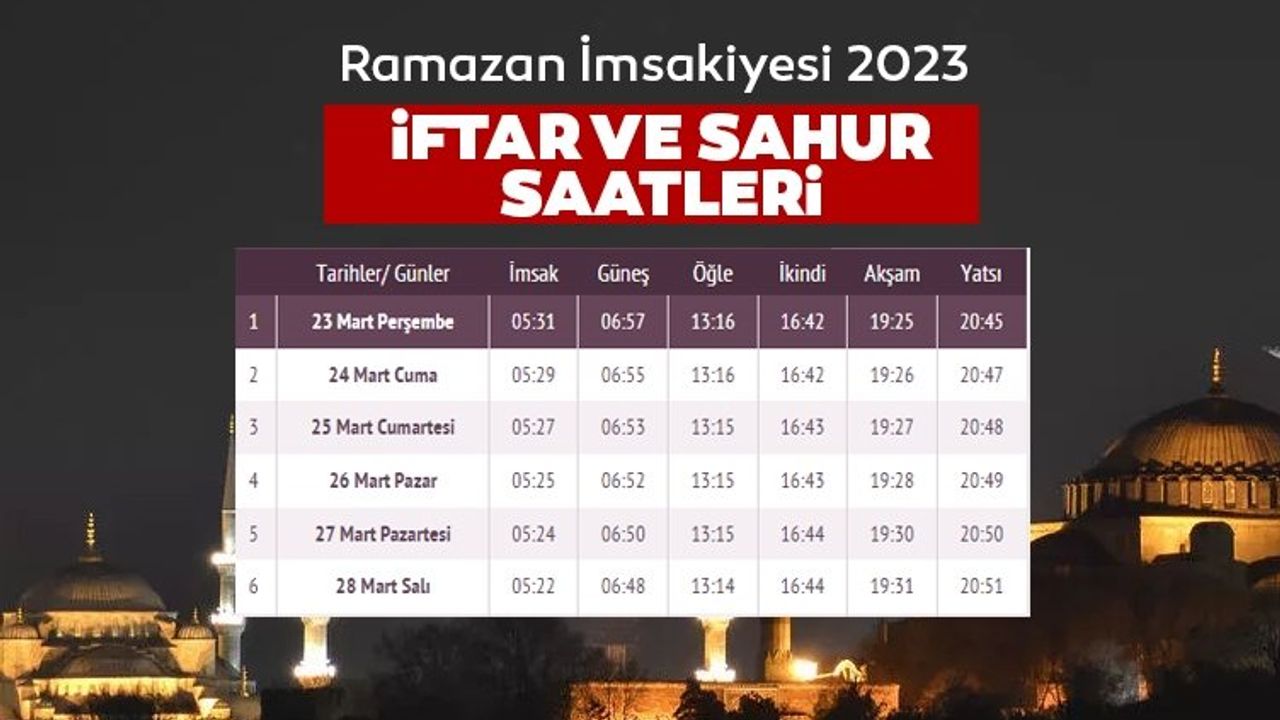

Iftar Ve Sahur Saatleri 2024 Ramazan Imsakiyesi Istanbul Ankara Izmir

Apr 23, 2025

Iftar Ve Sahur Saatleri 2024 Ramazan Imsakiyesi Istanbul Ankara Izmir

Apr 23, 2025 -

Guemueshane Kar Tatilinin Son Durumu Okullar Kapali Mi

Apr 23, 2025

Guemueshane Kar Tatilinin Son Durumu Okullar Kapali Mi

Apr 23, 2025 -

Suriye De Ramazan Bayrami Ne Zaman Pazartesi Kutlamalari Basliyor

Apr 23, 2025

Suriye De Ramazan Bayrami Ne Zaman Pazartesi Kutlamalari Basliyor

Apr 23, 2025 -

Tonglings Warning Us Tariffs Impact Copper Market

Apr 23, 2025

Tonglings Warning Us Tariffs Impact Copper Market

Apr 23, 2025 -

2025 Calendar Of Us Holidays Federal And Non Federal

Apr 23, 2025

2025 Calendar Of Us Holidays Federal And Non Federal

Apr 23, 2025