Is Gold A Safe Haven During Trade Wars? Record Rally Explained

Table of Contents

H2: Gold's Historical Performance During Trade Wars

H3: Examining Past Trade Disputes

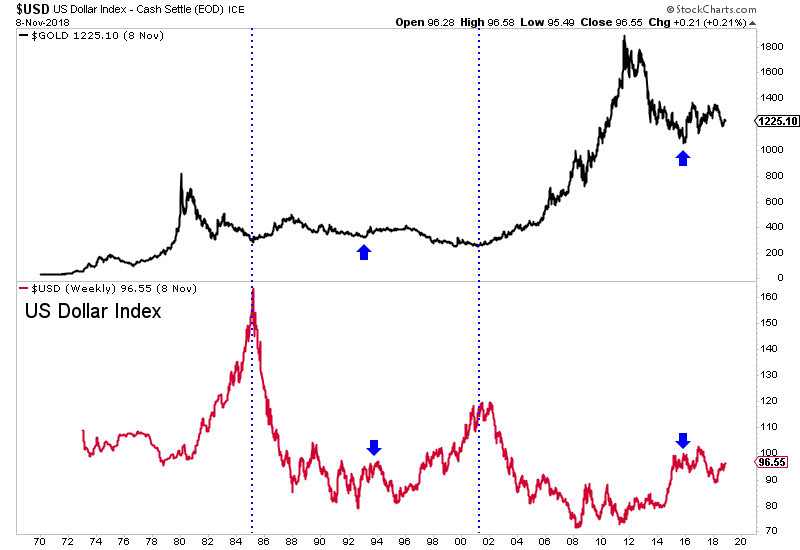

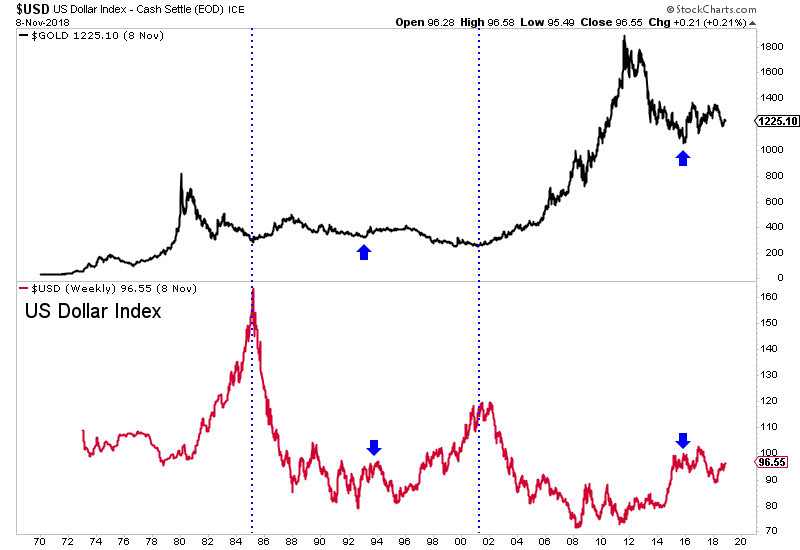

Throughout history, periods of significant trade friction have often coincided with increased demand for gold. Examining historical data reveals a complex relationship. While gold hasn't always surged immediately during the onset of trade wars, a closer look reveals trends. The Great Depression of the 1930s, marked by protectionist policies and trade restrictions, saw gold prices rise significantly as investors sought refuge from economic uncertainty. Similarly, the trade disputes of the 1970s, amidst global economic instability, also witnessed a strengthening of gold's value. However, it's crucial to consider that other factors, such as inflation and currency fluctuations, often played a concurrent role. Analyzing historical charts clearly shows periods of correlation, but rarely a direct, immediate causation.

- Highlight instances where gold performed well as a safe haven: The 1970s oil crisis and subsequent stagflation saw gold prices skyrocket, partially driven by trade anxieties and inflationary pressures.

- Note any instances where gold's performance was less pronounced or even negative: In some cases, other market forces may have overshadowed the impact of trade disputes on gold prices. For instance, technological advancements impacting gold mining efficiency could momentarily suppress prices despite ongoing trade tensions.

- Discuss potential confounding factors influencing gold's price during those periods: Currency devaluations, changes in interest rates, and overall macroeconomic conditions all impact gold's price and often obscure the direct impact of trade disputes alone.

H2: The Current Gold Rally: A Deeper Dive

H3: Factors Beyond Trade Wars

While trade wars undoubtedly contribute to market uncertainty, attributing the current gold rally solely to this factor would be an oversimplification. Several other interconnected elements are at play:

- Inflationary pressures: Rising inflation erodes the purchasing power of fiat currencies, making gold, a tangible asset, an attractive alternative.

- Weakening US dollar: A weaker dollar typically increases the price of dollar-denominated commodities like gold, making it cheaper for investors holding other currencies.

- Negative real interest rates: When real interest rates (nominal rates minus inflation) are negative, the opportunity cost of holding gold decreases, making it a more appealing investment.

- Geopolitical uncertainty beyond trade: Regional conflicts and political instability in various parts of the world further fuel demand for safe haven assets like gold.

- Increased investor demand for safe-haven assets: As investors seek to protect their portfolios from market volatility, they increasingly turn to gold as a reliable store of value.

H3: Quantifying the Impact of Trade Wars

Precisely quantifying the impact of trade war anxieties on the current gold price is challenging. Economic models often struggle to isolate the effects of a single factor like trade disputes amidst a complex web of economic variables. However, anecdotal evidence and expert opinions frequently link escalating trade tensions to increased gold investment, suggesting a non-negligible contribution.

H2: Alternative Safe Haven Assets

H3: Comparing Gold to Other Assets

Gold is not the only asset considered a safe haven. US Treasury bonds, the Swiss Franc, and the Japanese Yen are also frequently sought during times of uncertainty.

- Compare and contrast their performance relative to gold during recent trade disputes: While gold has seen significant gains, other safe haven assets have shown varying degrees of success, depending on the specific circumstances of each trade dispute.

- Analyze the strengths and weaknesses of each asset as a safe haven: Treasury bonds offer a relatively predictable yield, while currencies like the Swiss Franc and Japanese Yen benefit from their perceived stability. However, these assets are subject to interest rate changes and currency fluctuations.

- Discuss diversification strategies involving these assets: Diversification across various safe haven assets can help mitigate risk and improve overall portfolio resilience.

H2: Investing in Gold During Trade Wars: Strategies and Considerations

H3: Different Ways to Invest in Gold

Several avenues exist for investing in gold, each with its own set of advantages and disadvantages:

-

Physical gold: Owning physical gold provides tangible ownership but involves storage and security concerns.

-

Gold ETFs: Exchange-Traded Funds offer a convenient and cost-effective way to invest in gold without directly holding the physical asset.

-

Gold mining stocks: Investing in gold mining companies provides leverage to gold price movements but introduces additional company-specific risks.

-

Gold futures: Futures contracts allow for speculation on future gold prices, carrying higher risk but potentially greater reward.

-

Discuss the pros and cons of each investment method: Each method has different risk/reward profiles. Consider your investment goals, risk tolerance, and time horizon.

-

Mention the associated risks and rewards: Investing in gold, like any asset, carries inherent risks, including price volatility and potential losses.

-

Provide advice on responsible gold investment: Diversify, conduct thorough research, and avoid making impulsive investment decisions based solely on short-term market fluctuations.

3. Conclusion

While the relationship between gold prices and trade wars is complex and not always directly proportional, historical data and current market trends suggest gold can act as a safe haven asset during periods of heightened trade tensions. However, it’s crucial to remember that multiple factors influence gold prices, and trade wars are only one piece of the puzzle. Inflation, currency movements, and broader geopolitical uncertainty all play significant roles. Therefore, a holistic view is essential for informed investment decisions. Understanding the interplay of these factors is crucial for effectively using gold as part of a diversified investment strategy during periods of trade uncertainty. Learn more about how to incorporate gold into your investment portfolio during times of trade uncertainty. Understanding the complexities of gold as a safe haven asset in the face of future trade wars is crucial for building a resilient investment strategy.

Featured Posts

-

Seven Years Possible The Federal Fraud Case Against George Santos

Apr 26, 2025

Seven Years Possible The Federal Fraud Case Against George Santos

Apr 26, 2025 -

Last Ditch Defense For George Santos Analyzing His Strategy

Apr 26, 2025

Last Ditch Defense For George Santos Analyzing His Strategy

Apr 26, 2025 -

Engineer Soltan Kazimov Oversees Damen Csd 650s Maiden Voyage

Apr 26, 2025

Engineer Soltan Kazimov Oversees Damen Csd 650s Maiden Voyage

Apr 26, 2025 -

Us Stock Market Outlook Analyzing Dow Futures Amidst Chinas Economic Plans

Apr 26, 2025

Us Stock Market Outlook Analyzing Dow Futures Amidst Chinas Economic Plans

Apr 26, 2025 -

Harvard Universitys Transformation Insights From A Conservative Professor

Apr 26, 2025

Harvard Universitys Transformation Insights From A Conservative Professor

Apr 26, 2025