US Stock Market Outlook: Analyzing Dow Futures Amidst China's Economic Plans

Table of Contents

Understanding China's Economic Plans and Their Global Implications

China's economic policies significantly influence global markets, and understanding these plans is paramount for assessing the US Stock Market Outlook.

China's Economic Growth Targets and Policies

China's government sets ambitious economic growth targets each year, employing various policies to achieve them. These policies have far-reaching global consequences, impacting everything from commodity prices to global supply chains.

- Infrastructure Spending: Massive investments in infrastructure projects stimulate domestic demand and create opportunities for global companies involved in construction, materials, and technology.

- Technological Advancements: China's focus on technological self-reliance, particularly in areas like artificial intelligence and semiconductors, shapes global technological competition and investment flows.

- Regulatory Changes: Changes in Chinese regulations, such as those impacting foreign investment or data privacy, can create both opportunities and challenges for international businesses. These regulatory shifts often influence investor sentiment and market volatility. Understanding these changes is key to analyzing the Chinese economic policy impact on global markets.

Potential Risks and Uncertainties in the Chinese Economy

While China's economic growth is impressive, several risks and uncertainties exist that could significantly impact global markets.

- Property Market Risks: The Chinese real estate sector faces significant debt challenges, and a potential downturn could have ripple effects across the global economy. This risk is a critical factor in assessing the Chinese economic risk and its impact on global market volatility.

- High Debt Levels: China's corporate and local government debt levels remain high, presenting a vulnerability in times of economic slowdown. This high debt could affect global credit markets.

- Geopolitical Tensions: Rising geopolitical tensions involving China could lead to increased uncertainty and market volatility, impacting investor confidence and impacting the US stock market outlook.

Analyzing the Impact on Dow Futures

The relationship between Dow futures and Chinese economic indicators is complex but demonstrably important when assessing the US stock market outlook.

Correlation Between Dow Futures and Chinese Economic Indicators

Historically, Dow futures have shown a degree of correlation with key Chinese economic indicators.

- GDP Growth: Strong Chinese GDP growth tends to positively correlate with Dow futures, reflecting increased global demand and positive sentiment.

- Manufacturing PMI: The Chinese Manufacturing Purchasing Managers' Index (PMI) serves as a leading indicator of economic activity. A strong PMI generally points towards a positive outlook for Dow futures, while a weak PMI can signal potential downside risks. Analyzing this correlation is crucial for market forecasting.

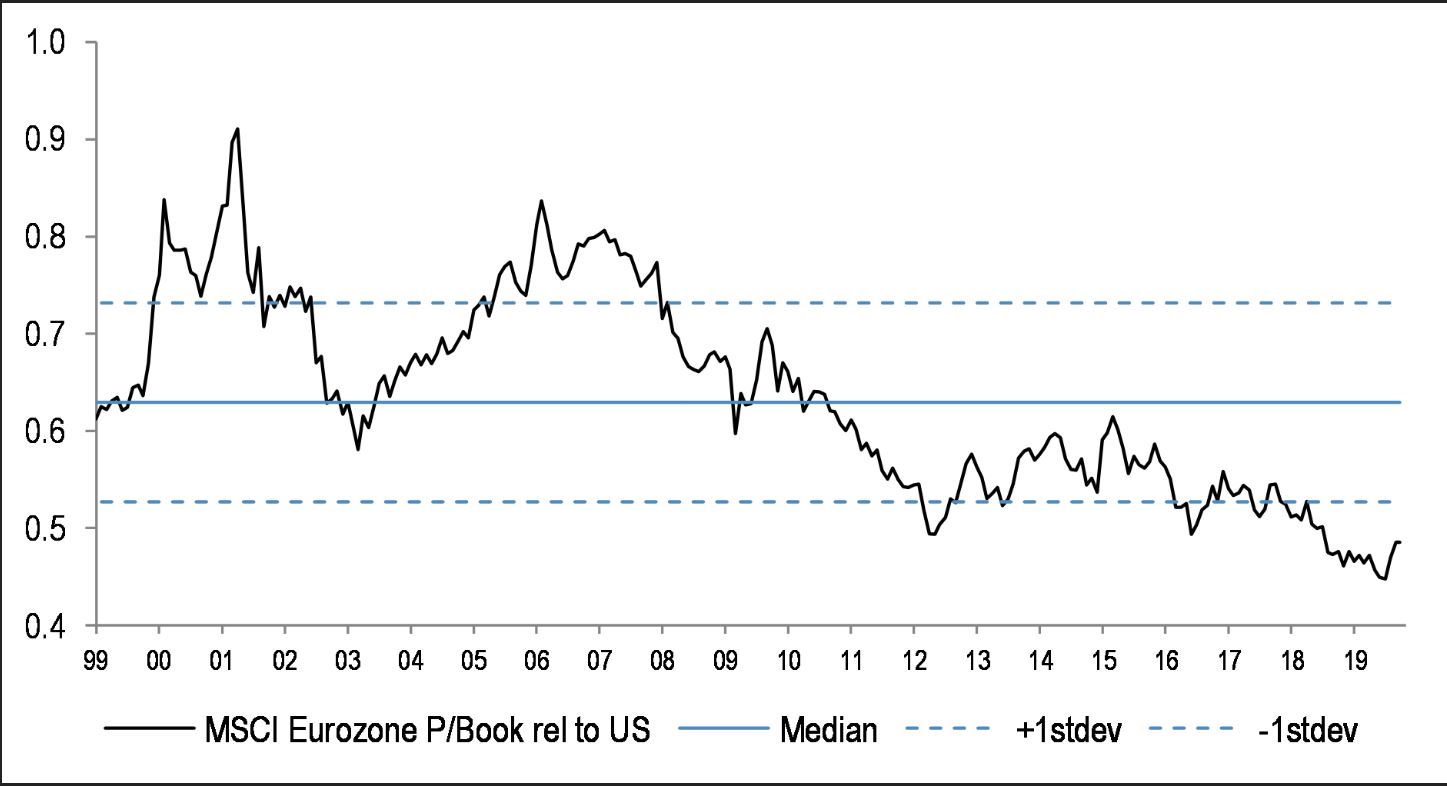

Data and charts illustrating this correlation would be beneficial here (visual aids would enhance the article if included).

Predicting Dow Futures Movement Based on China's Economic Outlook

Predicting Dow futures movement requires considering various scenarios based on China's economic performance.

- Bullish Scenario: If China achieves its economic growth targets and maintains stability, it could lead to positive sentiment in global markets, potentially pushing Dow futures higher.

- Bearish Scenario: If China experiences a significant economic slowdown or faces major challenges, it could negatively impact global markets, leading to a decline in Dow futures.

Different levels of Chinese economic growth and stability significantly influence this prediction and therefore the Dow futures prediction.

Strategies for Investors Amidst Uncertainty

Navigating the uncertainty surrounding China's economic plans requires a robust investment strategy.

Risk Management and Portfolio Diversification

Effective risk management is crucial in this environment. Diversification is key to mitigating potential losses.

- Asset Allocation: Diversifying across different asset classes (stocks, bonds, real estate, etc.) can help reduce overall portfolio volatility.

- Hedging Strategies: Employing hedging strategies, such as using options or futures contracts, can help protect against potential downside risks.

- Alternative Investments: Consider allocating a portion of your portfolio to alternative investments, such as private equity or commodities, to further diversify and potentially reduce correlation with traditional markets.

Monitoring Key Economic Indicators

Closely monitoring key economic indicators from both the US and China is vital for informed investment decisions.

- Inflation Rates: Tracking inflation rates in both countries is essential for understanding monetary policy responses and their potential impact on markets.

- Interest Rates: Changes in interest rates in the US and China can significantly affect investment decisions and market valuations.

- Unemployment Figures: Unemployment data provides insights into the overall health of the economies and potential future economic activity.

Conclusion: US Stock Market Outlook: Analyzing Dow Futures Amidst China's Economic Plans

This analysis highlights the significant impact of China's economic plans on Dow futures and the broader US stock market outlook. Understanding China's economic policies, monitoring key economic indicators, and employing effective risk management strategies are crucial for navigating this complex landscape. Key takeaways include the importance of recognizing the interconnectedness of the US and Chinese economies, understanding the risks and opportunities presented by China's economic growth, and diversifying your investment portfolio to mitigate risks.

Stay updated on the US Stock Market Outlook: Analyzing Dow Futures Amidst China's Economic Plans by consistently monitoring key indicators and adapting your investment strategy accordingly. For deeper analysis, explore resources from reputable financial news outlets and economic research institutions.

Featured Posts

-

European Stock Market Forecast Strategists Concerns Grow Over Trumps Trade Policies

Apr 26, 2025

European Stock Market Forecast Strategists Concerns Grow Over Trumps Trade Policies

Apr 26, 2025 -

The Portnoy Newsom Dispute Analyzing The Controversy

Apr 26, 2025

The Portnoy Newsom Dispute Analyzing The Controversy

Apr 26, 2025 -

King Day At Millcreek Common A Lively Dutch Street Party Atmosphere

Apr 26, 2025

King Day At Millcreek Common A Lively Dutch Street Party Atmosphere

Apr 26, 2025 -

Michael Clifford On Daughters Future Anything She Wants She Ll Have

Apr 26, 2025

Michael Clifford On Daughters Future Anything She Wants She Ll Have

Apr 26, 2025 -

Invest In Elon Musks Private Companies A New Investment Opportunity

Apr 26, 2025

Invest In Elon Musks Private Companies A New Investment Opportunity

Apr 26, 2025