Is Gold's Rally Over? Analyzing Two Straight Weeks Of Losses In 2025

Table of Contents

The Recent Decline: A Detailed Look at the Two-Week Drop

The gold market witnessed a significant downturn during the weeks of October 27th and November 3rd, 2025. The price of gold fell by approximately 4%, a notable drop considering its previous steady performance. This decline followed a period of relative stability and even growth, leaving many investors questioning the future trajectory of gold prices.

- Daily price fluctuations: Daily price swings during these two weeks ranged from a low of $1,850 per ounce to a high of $1,920 per ounce, indicating substantial volatility.

- Comparison to previous drops: This 4% drop is relatively significant compared to smaller, more gradual price corrections seen earlier in 2025. Previous declines were typically less than 1% per week.

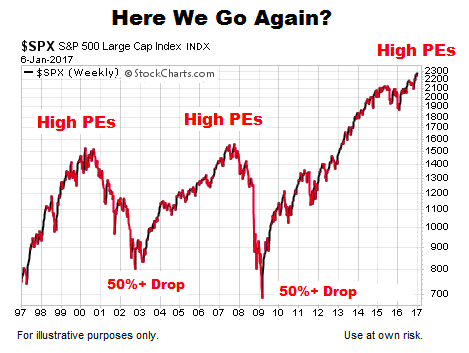

- Technical analysis charts: Technical analysis charts clearly show a bearish trend, with key indicators like moving averages crossing downwards and breaking through significant support levels. This downward trend reinforces the concerns about a potential end to the gold rally.

Macroeconomic Factors Influencing Gold Prices

Several macroeconomic factors have played a significant role in influencing gold prices and contributing to the recent decline.

-

Interest rate hikes: The Federal Reserve's continued interest rate hikes have increased the attractiveness of dollar-denominated assets, reducing the relative appeal of non-yielding gold. Higher interest rates offer investors better returns on bonds and other investments, diverting funds away from gold.

-

Strengthening US dollar: The strengthening US dollar has also put downward pressure on gold prices. A strong dollar makes gold more expensive for investors holding other currencies, thus reducing demand. This inverse relationship between the dollar and gold is well-established.

-

Inflation expectations: While inflation remains a concern, recent data suggesting a potential slowing of inflation has reduced the perceived need for gold as an inflation hedge. Lower inflation expectations lessen the urgency for investors to seek refuge in gold.

-

Correlation between interest rate changes and gold price movement: Historical data shows a strong negative correlation between interest rate increases and gold prices. As interest rates rise, gold prices tend to fall.

-

Inverse relationship between the US dollar and gold: A stronger dollar generally leads to lower gold prices, as it becomes more expensive to purchase gold for international investors.

-

Changing inflation predictions: Shifting expectations about future inflation directly impact investor sentiment. If inflation is perceived as less of a threat, the demand for gold as a hedge decreases.

Geopolitical Events and Gold's Safe Haven Status

Geopolitical events significantly impact gold's performance as a safe haven asset. While there have been ongoing geopolitical tensions, their impact on gold's price in this instance has been less pronounced than expected.

- Specific geopolitical events and their influence: Although geopolitical uncertainty persists, recent events haven't triggered a significant flight to safety in gold, suggesting that investors may be finding alternative safe havens.

- Comparison to past geopolitical events: Historically, significant geopolitical events have often led to a surge in gold prices, however, this recent decline suggests a shift in investor behavior.

- Investor behavior and diversification strategies: Investors may be diversifying their portfolios beyond gold, allocating funds to other assets perceived as less volatile or offering potentially higher returns. This reduced reliance on gold as the primary safe haven contributes to the price decline.

Technical Analysis and Future Price Predictions

Technical analysis suggests a bearish short-term outlook for gold.

- Key technical indicators: Moving averages are currently pointing downwards, and the price has broken below key support levels, indicating a weakening trend.

- Potential support and resistance levels: While predicting future prices is inherently uncertain, potential support levels might be found around $1,800-$1,850 per ounce, while resistance levels may lie near $1,900-$1,950.

- Different price scenarios: Three potential scenarios exist: a continued decline, a period of consolidation around current levels, or a renewed rally should macroeconomic factors change significantly. The likelihood of each scenario depends on future economic data and geopolitical developments.

Conclusion

The recent two-week drop in gold prices is a complex issue influenced by macroeconomic conditions, including interest rate hikes and a strengthening US dollar, as well as a shift in investor sentiment towards gold's safe-haven status. Geopolitical events, while still present, have not triggered the expected surge in gold demand. Technical analysis currently points towards a bearish short-term outlook. While predicting future gold prices is uncertain, it is crucial to monitor these influencing factors closely. Stay informed about market trends and consult financial professionals before making any investment decisions regarding gold. Continuously analyze gold market movements to effectively manage your investment in this precious metal. Stay updated on the latest news concerning gold prices and market analysis for informed decision-making. Understanding the factors impacting gold's price is key to navigating the precious metals market successfully.

Featured Posts

-

Understanding Stock Market Valuations Bof As Perspective On Investor Concerns

May 06, 2025

Understanding Stock Market Valuations Bof As Perspective On Investor Concerns

May 06, 2025 -

The Rise Of Otc Birth Control Redefining Reproductive Rights Post Roe

May 06, 2025

The Rise Of Otc Birth Control Redefining Reproductive Rights Post Roe

May 06, 2025 -

Is Golds Rally Over Analyzing Two Straight Weeks Of Losses In 2025

May 06, 2025

Is Golds Rally Over Analyzing Two Straight Weeks Of Losses In 2025

May 06, 2025 -

Sabrina Carpenters Fortnite Concert Fans React

May 06, 2025

Sabrina Carpenters Fortnite Concert Fans React

May 06, 2025 -

Gregg Popovich Troisieme Entraineur Le Plus Titre De L Histoire Analyse De Sa Carriere

May 06, 2025

Gregg Popovich Troisieme Entraineur Le Plus Titre De L Histoire Analyse De Sa Carriere

May 06, 2025