Is XRP A Good Investment? Understanding The Risks And Rewards

Table of Contents

Understanding XRP's Technology and Functionality

XRP's functionality is deeply intertwined with RippleNet, a global payment network utilized by financial institutions worldwide.

RippleNet and its Role in Cross-Border Payments

RippleNet leverages XRP to facilitate faster and cheaper international transactions. This technology has the potential to disrupt the traditional banking system, which often relies on slow, expensive, and opaque processes.

- Speed: XRP transactions are significantly faster than traditional bank transfers, often completing within seconds.

- Cost: Transactions using XRP are considerably cheaper due to lower processing fees.

- Transparency: The blockchain technology behind XRP offers a degree of transparency, allowing for better tracking of payments.

- Partnerships: Ripple has forged partnerships with numerous major financial institutions, indicating growing adoption of its technology and potentially increasing XRP's value. These partnerships provide a degree of stability often lacking in other cryptocurrencies.

XRP's Decentralization and Consensus Mechanism

While often touted as decentralized, XRP's decentralization is a point of contention. Unlike cryptocurrencies employing Proof-of-Work (PoW) or Proof-of-Stake (PoS) consensus mechanisms, XRP uses a unique consensus mechanism. This impacts its scalability and security.

- Consensus Mechanism: XRP's mechanism is designed for speed and efficiency, prioritizing transaction processing speed over the rigorous consensus processes found in PoW and PoS systems.

- Scalability: This tailored mechanism allows for a high transaction throughput, potentially addressing scalability challenges faced by other cryptocurrencies. However, centralization concerns remain a discussion point amongst investors.

- Security: While Ripple claims strong security measures, the unique consensus mechanism raises questions compared to more established protocols like PoW and PoS. Security audits and independent analysis are crucial for determining this risk level.

Assessing the Risks Associated with XRP Investment

Investing in XRP involves significant risks, and potential investors must carefully consider these before committing capital.

Regulatory Uncertainty and Legal Battles

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) casts a significant shadow over XRP's future. The SEC alleges that XRP is an unregistered security, which, if proven, could have devastating consequences for XRP's price and overall viability.

- Key Arguments: The core of the SEC's case revolves around whether XRP sales constituted investment contracts, a key definition in securities law.

- Potential Scenarios: A ruling against Ripple could lead to a significant drop in XRP's price, potential delisting from exchanges, and major legal ramifications for the company. A favorable ruling, however, could significantly boost its price and market standing. These potential outcomes highlight the uncertainty in any XRP investment.

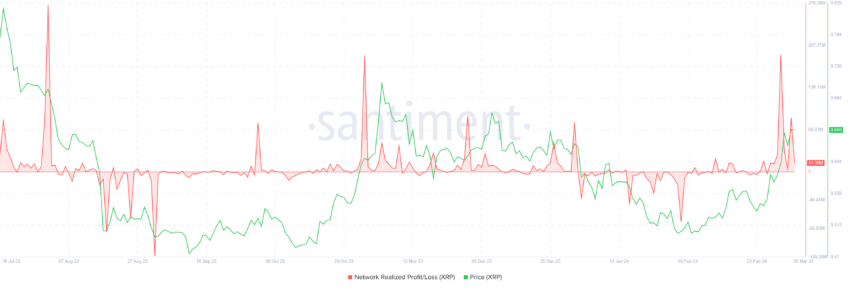

Market Volatility and Price Fluctuations

The cryptocurrency market is inherently volatile, and XRP is no exception. Its price is subject to significant fluctuations influenced by various factors.

- Past Price Performance: XRP has experienced periods of dramatic price increases and equally sharp declines, demonstrating the high-risk nature of the investment.

- Influencing Factors: Market sentiment, regulatory news (such as the Ripple vs. SEC case), technological developments within the Ripple ecosystem, and overall cryptocurrency market trends all heavily impact XRP's price.

Security Risks and Exchange Vulnerabilities

Like all cryptocurrencies, XRP is susceptible to security risks, particularly when stored on exchanges. Hacks and security breaches are a real possibility.

- Secure Storage: Utilizing secure hardware wallets and practicing robust security measures are crucial to mitigate these risks. Exchanges are never truly secure.

- Exchange Risks: Storing XRP on exchanges exposes it to the risks of exchange vulnerabilities, hacks, and potential insolvency.

Weighing the Potential Rewards of XRP Investment

Despite the risks, there are potential rewards to consider when evaluating an XRP investment.

Long-Term Growth Potential

Many believe XRP has significant long-term growth potential. Wider adoption of RippleNet and growing institutional interest could drive substantial price appreciation.

- Future Use Cases: The potential for XRP to become a widely used currency for cross-border payments and other financial transactions is a key driver of its potential value.

- Partnerships and Collaborations: Continued partnerships with financial institutions could validate Ripple's technology and increase demand for XRP.

Passive Income Opportunities (Staking/Yield Farming)

While not as established as with other cryptocurrencies, some platforms offer opportunities to earn passive income through yield farming or staking with XRP. However, this often comes with inherent risks.

- Staking/Yield Farming Mechanics: These typically involve locking up your XRP for a period to earn rewards, but they vary wildly between providers.

- Risks and Returns: High potential returns come with significant risks, including smart contract vulnerabilities and platform instability.

Diversification Benefits

Adding XRP to a diversified investment portfolio can potentially mitigate overall risk. However, it's crucial to remember that diversification alone does not eliminate risk, particularly in such a volatile asset class.

- Diversification Principles: Diversification reduces reliance on any single asset, cushioning the impact of potential losses. This only works effectively when diversified across low-correlation assets.

Conclusion

XRP presents a complex investment proposition. Its potential as a bridge currency for faster and cheaper cross-border payments is undeniable. However, the significant risks associated with regulatory uncertainty, market volatility, and security concerns cannot be overlooked. The ongoing Ripple vs. SEC case is a major factor influencing the risk profile of any XRP investment. A thorough understanding of these risks and potential rewards is essential for any investor. Ultimately, the decision of whether or not XRP is a good investment for you depends on a thorough understanding of its potential and its inherent risks. Continue your research on XRP investment and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Remembering Priscilla Pointer A Centenarian Actresss Life And Work

May 01, 2025

Remembering Priscilla Pointer A Centenarian Actresss Life And Work

May 01, 2025 -

A Simple Recipe For Crab Stuffed Shrimp In Lobster Sauce

May 01, 2025

A Simple Recipe For Crab Stuffed Shrimp In Lobster Sauce

May 01, 2025 -

Dalys Late Try Steals The Show As England Beats France In Six Nations Clash

May 01, 2025

Dalys Late Try Steals The Show As England Beats France In Six Nations Clash

May 01, 2025 -

Understanding The Dragons Den Judges Perspectives And Investment Criteria

May 01, 2025

Understanding The Dragons Den Judges Perspectives And Investment Criteria

May 01, 2025 -

Experience The Merrie Monarch Festival Hoikes Pacific Island Heritage

May 01, 2025

Experience The Merrie Monarch Festival Hoikes Pacific Island Heritage

May 01, 2025