Is XRP Ready To Explode? 3 Indicators Pointing To A Parabolic Rally

Table of Contents

- Increased Institutional Adoption and Interest in XRP

- Growing partnerships and collaborations

- Regulatory Clarity (or Lack Thereof) as a Catalyst

- Technological Advancements and RippleNet Expansion

- Enhanced scalability and efficiency of RippleNet

- New features and integrations

- Growing On-Chain Activity and Market Sentiment

- Increased trading volume and on-chain metrics

- Positive shift in market sentiment and social media engagement

- Conclusion

Increased Institutional Adoption and Interest in XRP

Growing institutional interest is a crucial factor influencing XRP's price potential. Increased adoption by major financial players could significantly boost XRP's value and liquidity.

Growing partnerships and collaborations

Ripple has been actively forging partnerships with major financial institutions globally, significantly impacting XRP's adoption. These partnerships demonstrate the growing confidence in Ripple's technology and XRP's potential within the financial sector.

- Key Partnerships: Ripple boasts partnerships with major banks like Santander, SBI Holdings, and several other significant players in the global financial ecosystem. These partnerships facilitate cross-border payments using XRP, streamlining transactions and reducing costs.

- Positive News: Recent announcements regarding successful pilot programs and expanded collaborations signal ongoing growth and acceptance of XRP within the institutional landscape. Successful implementations of RippleNet often translate to increased XRP transaction volume.

- Increased Transaction Volume: Data indicates a clear upward trend in XRP transaction volume correlated with increased institutional activity. This surge underscores the practical application of XRP and its growing relevance in the real-world financial system.

Regulatory Clarity (or Lack Thereof) as a Catalyst

The ongoing legal battle between Ripple and the SEC casts a shadow over XRP's short-term prospects, yet a positive resolution could act as a powerful catalyst.

- Current Legal Status: The SEC alleges that XRP is an unregistered security, a claim Ripple strongly contests. The outcome of this case remains uncertain but carries significant implications for XRP's future.

- Potential Outcomes: A favorable ruling could unlock significant investor confidence, leading to a substantial price surge. Conversely, an unfavorable outcome could temporarily suppress the price, although long-term implications are debated amongst experts.

- Expert Opinions: Many market analysts believe that a positive resolution could lead to XRP being listed on major US exchanges, significantly increasing liquidity and driving price appreciation. The uncertainty, however, contributes to volatility.

Technological Advancements and RippleNet Expansion

RippleNet's ongoing development and expansion play a crucial role in fueling XRP's potential for growth. Improvements in scalability and functionality enhance its appeal to financial institutions and individual users.

Enhanced scalability and efficiency of RippleNet

RippleNet, Ripple's payment network, continues to improve its scalability and efficiency. These advancements enable it to handle a significantly larger transaction volume, making it a more viable solution for global payments.

- Technological Upgrades: Recent upgrades focus on enhancing speed, reducing transaction fees, and improving the overall user experience. These improvements are designed to attract more users and partners.

- RippleNet Growth: Statistics show a consistent increase in the number of financial institutions joining RippleNet, demonstrating growing adoption and confidence in its capabilities. This expansion directly impacts the demand and utility of XRP.

- Competitive Advantage: Compared to other blockchain payment solutions, RippleNet offers a faster, cheaper, and more reliable system, establishing a clear competitive edge in the market.

New features and integrations

RippleNet's evolution is not limited to performance improvements; new features and integrations are constantly being introduced.

- New Features: The addition of enhanced security protocols, improved cross-border payment solutions, and streamlined integration processes are continuously improving the platform's functionality.

- Strategic Alliances: Partnerships with other technology providers expand RippleNet's capabilities and further enhance its utility within the financial ecosystem.

- Impact on XRP: These developments increase XRP's utility, as it becomes an increasingly integral part of the RippleNet ecosystem. This increased utility, in turn, contributes to higher demand and potentially drives price appreciation.

Growing On-Chain Activity and Market Sentiment

Analyzing on-chain metrics and market sentiment provides valuable insights into XRP's potential for a parabolic rally. Positive trends in these indicators suggest growing confidence in the cryptocurrency.

Increased trading volume and on-chain metrics

Key on-chain metrics provide valuable data points for assessing XRP's growth trajectory. These metrics can reveal potential bullish patterns indicative of a price surge.

- On-Chain Data: Charts illustrating growth in transaction volume, active addresses, and market capitalization compared to historical data show a clear upward trend.

- Correlation with Price: Historically, increases in on-chain activity have correlated positively with XRP price movements. This correlation suggests that current on-chain trends could precede a price rally.

- Expert Analysis: Financial analysts often use on-chain data to predict market movements. The observed trends in XRP's on-chain activity suggest a positive outlook.

Positive shift in market sentiment and social media engagement

Positive market sentiment, reflected in social media engagement and news coverage, is a significant factor influencing XRP's price.

- Positive News: Positive news and events related to Ripple, its partnerships, and the RippleNet ecosystem contribute to a more favorable market sentiment.

- Social Media Sentiment: Analysis of social media mentions, sentiment scores, and Google Trends data reveals a positive shift in investor confidence.

- Fueling Price Increases: Positive market sentiment can create a self-fulfilling prophecy, as increased confidence attracts more investors, driving demand and subsequently pushing up the price.

Conclusion

While predicting the future price of any cryptocurrency is inherently speculative, the confluence of increased institutional adoption, technological advancements within RippleNet, and positive shifts in on-chain activity and market sentiment suggests that XRP might be positioned for a significant price rally. The ongoing legal battle remains a wildcard, but a positive resolution could act as a powerful catalyst. Whether or not XRP is ready to explode remains to be seen, but these three indicators offer compelling reasons for continued monitoring and analysis of this cryptocurrency. Keep a close eye on the developments surrounding XRP and stay informed about the potential for future parabolic rallies. Understanding the factors driving XRP's price is crucial for any investor considering adding this cryptocurrency to their portfolio.

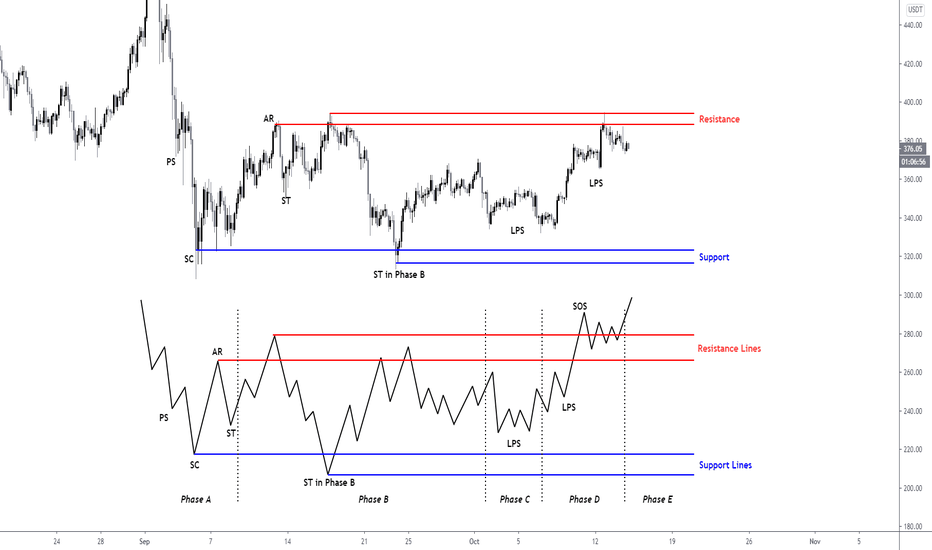

Ethereum Nears 2 700 Wyckoff Accumulation Analysis

Ethereum Nears 2 700 Wyckoff Accumulation Analysis

The European Digital Identity Wallet What You Need To Know Before Launch

The European Digital Identity Wallet What You Need To Know Before Launch

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

355 000 Face Dwp Benefit Cuts 3 Month Warning Issued

Dwp Updates Significant Changes To Universal Credit Verification

Dwp Updates Significant Changes To Universal Credit Verification

Abc Promo Features Hilarious Tnt Commentary On Jayson Tatum Lakers Vs Celtics

Abc Promo Features Hilarious Tnt Commentary On Jayson Tatum Lakers Vs Celtics