Joe Biden And The Economy: Assessing The Current Economic Slowdown

Table of Contents

Inflation Under the Biden Administration

Rising Prices and Consumer Spending

Inflation has significantly impacted American households. Rising prices for essential goods and services – from gasoline and groceries to housing and healthcare – are eroding purchasing power. This is evident in the decline of consumer confidence indices, reflecting growing concerns about the economy.

- Inflation Rate: The Consumer Price Index (CPI) has shown persistent increases, exceeding the Federal Reserve's target rate for several months.

- Purchasing Power: The real value of wages has decreased for many Americans, meaning their income buys less than it did previously.

- Consumer Confidence: Indices like the Consumer Confidence Index have fallen, indicating reduced optimism about future economic prospects.

The Role of Government Spending

The Biden administration has implemented significant government spending programs, including the American Rescue Plan and the Bipartisan Infrastructure Law. While proponents argue these investments are necessary for long-term economic growth and social welfare, critics contend that they have contributed to inflationary pressures by increasing demand without a corresponding increase in supply.

- American Rescue Plan: This massive stimulus package aimed to alleviate the economic fallout from the COVID-19 pandemic.

- Bipartisan Infrastructure Law: This law invests billions of dollars in upgrading infrastructure across the nation.

- Economic Models: Differing economic models offer contrasting views on the impact of these spending programs on inflation. Some argue that increased demand fueled inflation, while others highlight supply chain disruptions as a primary driver.

Federal Reserve Response

The Federal Reserve (Fed) has responded to rising inflation by implementing a series of interest rate hikes. These aim to cool down the economy by making borrowing more expensive, potentially slowing down spending and investment. However, these actions also carry the risk of triggering a recession.

- Monetary Policy: The Fed's monetary policy tightening involves increasing the federal funds rate, impacting borrowing costs for consumers and businesses.

- Future Fed Actions: The Fed's future actions will depend on the trajectory of inflation and economic growth. Further rate hikes are possible, but the pace may slow depending on economic data.

- Potential Consequences: Higher interest rates could lead to slower economic growth, potentially increasing unemployment. Finding the right balance is crucial for the Fed.

Unemployment and Job Growth

Current Unemployment Rates and Trends

The unemployment rate under President Biden has fluctuated, showing both improvements and challenges. While job growth has been positive in many sectors, certain demographics, such as young adults, may still face higher unemployment rates.

- Unemployment Rate: The current unemployment rate needs to be referenced with the most up-to-date data from reliable sources like the Bureau of Labor Statistics.

- Job Creation Numbers: Track the monthly job creation numbers to assess the strength of the job market.

- Types of Jobs Created: Analyze the types of jobs being created – are they high-paying, skilled jobs, or lower-paying service sector jobs?

Impact of Biden's Policies on Employment

President Biden's policies, particularly investments in infrastructure and clean energy, are intended to create jobs. The long-term impact of these initiatives on employment is still unfolding.

- Infrastructure Investments: These projects create jobs directly in construction and related industries, and indirectly in supporting sectors.

- Clean Energy Initiatives: Investments in renewable energy sources are expected to create jobs in manufacturing, installation, and maintenance.

- Projected Job Growth: Analysis of economic models provides projections for job growth in various sectors over the coming years.

Wage Growth vs. Inflation

A key concern is whether wage growth is keeping pace with inflation. If wages lag behind rising prices, real wages decline, squeezing household budgets.

- Wage Growth Statistics: Compare wage growth across different sectors to the overall inflation rate.

- Wage-Price Spiral: Economists monitor the potential for a wage-price spiral, where rising wages lead to further price increases, creating a vicious cycle.

GDP Growth and Economic Outlook

Recent GDP Growth Figures

GDP growth figures provide a measure of the overall health of the economy. Recent data should be analyzed to assess the current trajectory of economic growth.

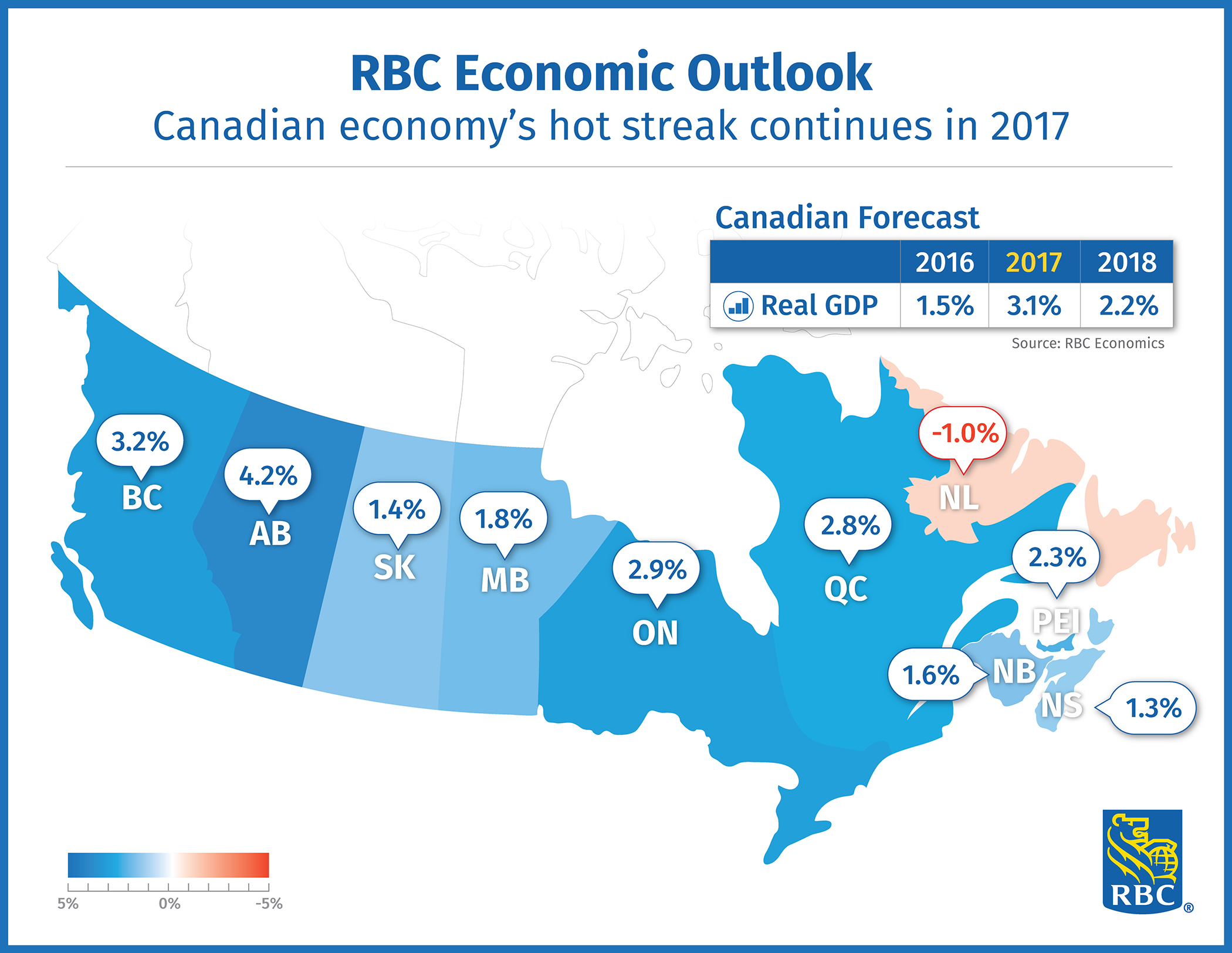

- GDP Growth Statistics: Reference the most recent GDP growth figures from reliable sources.

- Contributing Factors: Identify the factors contributing to GDP growth or decline (e.g., consumer spending, investment, government spending, net exports).

- Forecast Models: Various economic forecasting models offer projections for future GDP growth.

Long-Term Economic Projections

Economists use different models to project long-term economic growth under various scenarios. These projections offer a range of possible outcomes, highlighting both potential risks and opportunities.

- Different Economic Forecasts: Compare forecasts from different reputable sources.

- Underlying Assumptions: Understand the underlying assumptions of each forecast model.

- Potential Risks and Opportunities: Identify the potential risks and opportunities that could influence the economy's trajectory.

Global Economic Factors

Global economic events significantly impact the US economy. Factors like the war in Ukraine and ongoing supply chain disruptions have contributed to inflationary pressures and economic uncertainty.

- Explanation of Global Economic Factors: Explain the impact of global events on the US economy.

- Impact on US Economy: Analyze how global events have influenced inflation, employment, and GDP growth.

- Potential Mitigation Strategies: Discuss potential strategies to mitigate the impact of global economic challenges.

Conclusion

The current economic slowdown presents a complex picture, with inflation, unemployment, and GDP growth all playing significant roles. The impact of President Biden's economic policies is a subject of ongoing debate, with differing interpretations of the data and its implications. While job growth has been positive in some sectors, inflation continues to erode purchasing power for many Americans. The long-term economic outlook remains uncertain, influenced by both domestic and global factors. Continue exploring the complexities of the US economy under President Biden, examining the various perspectives and data to form your own informed opinion. Stay informed on the evolving relationship between Joe Biden's economic policies and the current economic situation.

Featured Posts

-

Clayton Keller Of Utah 500 Points And Counting

May 02, 2025

Clayton Keller Of Utah 500 Points And Counting

May 02, 2025 -

David Dodge On Canadas Economic Outlook Ultra Low Growth Forecast For Next Year

May 02, 2025

David Dodge On Canadas Economic Outlook Ultra Low Growth Forecast For Next Year

May 02, 2025 -

Charity Swim Graeme Souness Takes On Double Channel Challenge For Isla

May 02, 2025

Charity Swim Graeme Souness Takes On Double Channel Challenge For Isla

May 02, 2025 -

Federal Investigation Millions Lost In Executive Office365 Data Breach

May 02, 2025

Federal Investigation Millions Lost In Executive Office365 Data Breach

May 02, 2025 -

Fortnite Leak Reveals Lara Crofts Imminent Return

May 02, 2025

Fortnite Leak Reveals Lara Crofts Imminent Return

May 02, 2025