Kentucky Facing Storm Damage Assessment Backlog: Causes And Solutions

Table of Contents

Causes of the Kentucky Storm Damage Assessment Backlog

The overwhelming Kentucky storm damage assessment backlog stems from a confluence of factors, hindering the timely processing of insurance claims and delaying much-needed disaster recovery efforts.

Insurer Capacity Issues

Insurance companies, while prepared for typical claims volumes, are often overwhelmed by the sheer magnitude of claims following widespread disasters like the recent Kentucky storms. This results in significant challenges across the board.

- Shortage of qualified adjusters: The sudden surge in claims far exceeds the available pool of trained insurance adjusters.

- Technological limitations: Outdated or inadequate claims processing systems struggle to handle the immense volume of data and information.

- Increased claim complexity: Severe weather often leads to multifaceted damage, requiring specialized expertise and prolonging assessment times.

The lack of readily available adjusters, coupled with technological hurdles and complex damage assessments, creates a bottleneck in the claims process, contributing significantly to the backlog.

Extent of Damage and Geographic Dispersion

The widespread nature of the damage across Kentucky significantly complicates assessment efforts. The geographic dispersion of impacted areas presents significant logistical challenges.

- Remote locations: Many affected areas are difficult to access, delaying on-site assessments.

- Inaccessible areas: Road closures, downed power lines, and other infrastructure damage impede access to affected properties.

- Widespread infrastructure damage: The sheer scale of damage necessitates a massive coordination effort, slowing down the assessment process.

This makes it extremely difficult for insurance adjusters to reach all affected areas efficiently, further contributing to the Kentucky storm damage assessment backlog.

Increased Claim Complexity

Severe weather events rarely result in simple, straightforward damage. The Kentucky storms were no exception, leading to a high volume of complex claims.

- Multiple types of damage: Homes and businesses often suffered from multiple types of damage (wind, water, fire, etc.), requiring multiple specialized assessments.

- Complex structural assessments: Determining the extent of structural damage often necessitates detailed engineering reports, adding time to the process.

- Disputes over coverage: Disagreements between insurers and policyholders over coverage, deductibles, and the extent of damage can lead to protracted investigations and delays.

The added complexity significantly increases the time required for each assessment, exacerbating the existing backlog.

Lack of Resources and Funding

The financial burden of processing a massive number of claims places a significant strain on both insurance companies and state/local governments.

- Insufficient funding for adjuster deployment: Insurance companies may lack the resources to rapidly deploy a sufficient number of adjusters to the affected areas.

- Limited access to technology: A lack of investment in modern, efficient claims processing systems hinders the ability to manage the volume of claims effectively.

- Delays in government aid: Delays in the disbursement of government funds further hinder the ability to address the backlog efficiently.

The lack of adequate resources and funding directly impacts the speed and efficiency of the assessment and recovery efforts.

Solutions to Address the Kentucky Storm Damage Assessment Backlog

Addressing the Kentucky storm damage assessment backlog requires a multi-pronged approach involving insurers, government agencies, and other stakeholders.

Increase Adjuster Capacity

Increasing the number of qualified adjusters is crucial to tackling the backlog. This requires a concerted effort to:

- Incentivize adjuster recruitment: Offering competitive salaries and benefits can attract more individuals to the profession.

- Invest in adjuster training programs: Accelerated training programs can help quickly increase the number of qualified adjusters.

- Utilize technology to expedite claims processing: Employing technology such as drone imagery and AI-powered claims processing tools can significantly improve efficiency.

Streamline the Claims Process

Streamlining the claims process can significantly reduce processing times. This can be achieved by:

- Developing user-friendly online portals: Providing policyholders with easy access to online portals for submitting claims and tracking their progress.

- Utilizing AI-powered tools: Employing AI to automate certain aspects of claims processing, such as initial damage assessment.

- Improving communication strategies: Ensuring clear and consistent communication between insurers and policyholders to reduce confusion and disputes.

Improve Coordination and Collaboration

Effective coordination and collaboration between all stakeholders are vital to a swift and efficient response. This includes:

- Establishing a central command center: Creating a central hub for information sharing and resource coordination.

- Utilizing shared databases: Employing a shared database to track claims and resources, ensuring transparency and efficiency.

- Improving inter-agency communication: Facilitating clear and open communication between government agencies, insurers, and other stakeholders.

Secure Additional Funding

Securing adequate funding is paramount to support disaster relief efforts and prevent future backlogs. This requires:

- Securing federal disaster relief funds: Applying for and obtaining federal funding to support disaster relief efforts.

- Exploring public-private partnerships: Collaborating with private sector organizations to leverage their resources and expertise.

- Allocating resources for infrastructure improvements: Investing in infrastructure improvements to mitigate future damage and reduce the risk of similar backlogs.

Conclusion: Overcoming the Kentucky Storm Damage Assessment Backlog – A Call to Action

The Kentucky storm damage assessment backlog is a complex problem stemming from insurer capacity issues, the extent and complexity of the damage, and a lack of resources. Addressing this crisis requires a concerted effort to increase adjuster capacity, streamline the claims process, improve coordination and collaboration, and secure additional funding. The urgency of this situation cannot be overstated. Expediting storm damage claims is essential for the timely recovery and rebuilding of Kentucky communities. We urge everyone affected to contact their representatives, support relief efforts, and seek assistance if they are experiencing delays in their Kentucky storm damage assessment. Let’s work together to overcome this challenge and ensure a swift and just recovery for all affected by these devastating storms.

Featured Posts

-

Nba Skills Challenge 2025 A Complete Guide To Players Teams Format Rules And Tiebreakers

Apr 30, 2025

Nba Skills Challenge 2025 A Complete Guide To Players Teams Format Rules And Tiebreakers

Apr 30, 2025 -

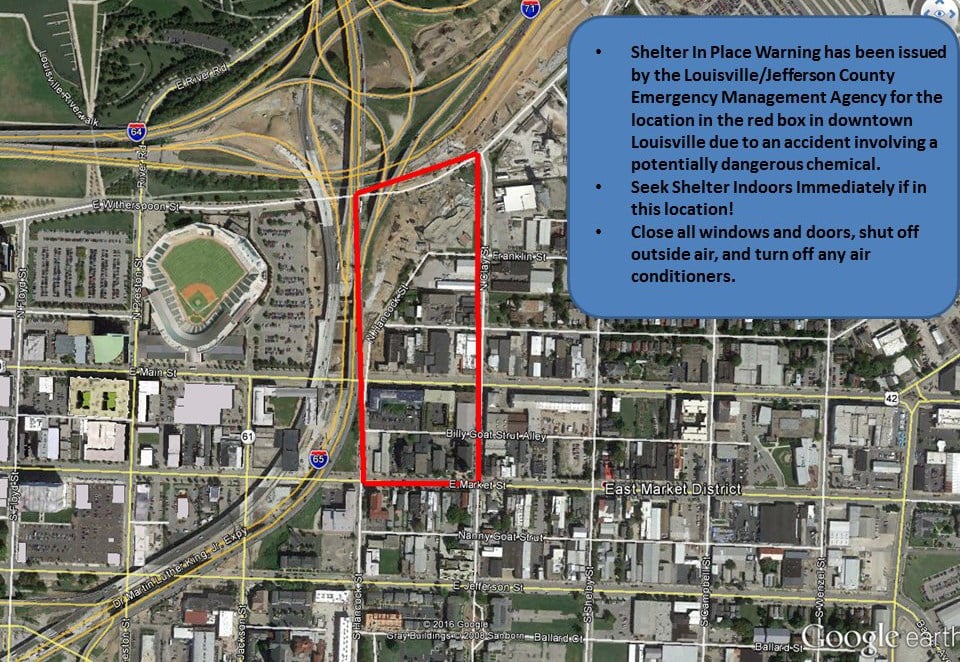

Louisville Residents Shelter In Place Remembering The Tragedy

Apr 30, 2025

Louisville Residents Shelter In Place Remembering The Tragedy

Apr 30, 2025 -

Iwd 2024 How Schneider Electric Is Empowering Women In Nigeria

Apr 30, 2025

Iwd 2024 How Schneider Electric Is Empowering Women In Nigeria

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 Episode 8 Preview Get Wicked

Apr 30, 2025

Ru Pauls Drag Race Season 17 Episode 8 Preview Get Wicked

Apr 30, 2025 -

Cassidy Hutchinsons Memoir A Jan 6 Witness Tells All

Apr 30, 2025

Cassidy Hutchinsons Memoir A Jan 6 Witness Tells All

Apr 30, 2025