Liberal Fiscal Irresponsibility: A Threat To Canada's Economic Vision

Table of Contents

Increased Government Spending and Debt Accumulation

The Liberal government's approach to fiscal policy has been characterized by increased government spending and a subsequent surge in national debt. This unsustainable path threatens to cripple future economic opportunities.

Uncontrolled Spending on Social Programs

While social programs are essential, uncontrolled spending on them has become a significant driver of Canada's growing debt. The effectiveness and long-term sustainability of these programs require careful scrutiny.

- Canada Child Benefit (CCB): While lauded for reducing child poverty, the CCB's substantial cost necessitates ongoing evaluation of its impact and potential adjustments to ensure fiscal responsibility.

- Increased Healthcare Spending: Rising healthcare costs, exacerbated by an aging population, demand innovative solutions and efficient resource allocation, rather than simply increasing spending without sufficient reform.

- Other social programs: Numerous other programs, from employment insurance to various social assistance initiatives, contribute significantly to overall government spending, requiring a thorough cost-benefit analysis.

Data comparing spending under Liberal governments to previous administrations reveals a significant increase in social program expenditures, contributing heavily to the national debt. This unsustainable trajectory necessitates a comprehensive review of program effectiveness and long-term cost implications.

Tax Policies and their Impact on Investment

Liberal tax policies, while aiming for social equity, have inadvertently discouraged private sector investment and hindered economic growth. Increased corporate taxes and higher personal income taxes in certain brackets have dampened investor confidence.

- Increased Corporate Tax Rates: Higher corporate tax rates can reduce investment in research and development, expansion, and job creation.

- Changes to Capital Gains Taxation: Modifications to capital gains taxation can negatively influence investment in the stock market and other asset classes.

- Impact on Small and Medium-sized Enterprises (SMEs): SMEs, the backbone of the Canadian economy, are particularly sensitive to changes in tax policies. Higher tax burdens can stifle their growth and limit job creation.

Economic research suggests a strong correlation between lower tax rates and increased investment, indicating a need for a more balanced approach that encourages economic growth while addressing social equity concerns.

Lack of Fiscal Responsibility and Long-Term Planning

Beyond increased spending, a fundamental lack of fiscal responsibility and long-term planning characterizes the Liberal government's approach. This short-sightedness further exacerbates the risks to Canada's economic future.

Insufficient Budgetary Controls and Transparency

The lack of transparency and accountability in Liberal government budgeting processes raises serious concerns. Long-term strategic planning seems to be lacking, leading to short-term fixes that fail to address underlying issues.

- Lack of clear fiscal targets: Ambiguous fiscal targets make it difficult to assess the government's commitment to fiscal prudence.

- Insufficient parliamentary oversight: Weaknesses in parliamentary oversight allow for less scrutiny of budgetary decisions.

- Opaque reporting of government expenditures: Lack of clear and comprehensive reporting on government spending makes it difficult to track how taxpayer money is being used.

Comparing Canada’s fiscal management practices with those of other developed nations reveals a concerning lack of robust budgetary controls and transparency.

Inadequate Measures to Address Rising Debt

The Liberal government's approach to reducing the national debt has been inadequate, leading to further accumulation of debt. Proposed solutions lack the scope and urgency needed to address the long-term consequences of high national debt.

- Lack of commitment to debt reduction: The absence of a clear and ambitious plan for debt reduction raises serious concerns about long-term fiscal sustainability.

- Insufficient focus on revenue generation: The government has not adequately explored alternative revenue streams to reduce reliance on increased borrowing.

- Potential for future credit rating downgrades: The continued growth of the national debt poses a significant risk to Canada's credit rating, potentially leading to higher borrowing costs.

The Impact on Key Economic Indicators

Liberal fiscal irresponsibility has already begun to negatively impact key economic indicators, threatening Canada’s long-term economic prosperity.

Effect on Inflation and Interest Rates

Increased government spending and high national debt contribute to inflationary pressures and rising interest rates. This impacts consumers and businesses alike, stifling economic growth.

- Increased cost of living: Higher inflation erodes purchasing power, impacting household budgets.

- Higher borrowing costs for businesses: Rising interest rates increase the cost of borrowing for businesses, hindering investment and expansion.

- Reduced consumer confidence: Economic uncertainty resulting from high inflation and interest rates can negatively impact consumer confidence and spending.

Analyzing the trends in inflation and interest rates reveals a direct link to the government’s fiscal policies.

Consequences for Job Growth and Economic Competitiveness

The current fiscal trajectory negatively impacts job growth and weakens Canada's global economic competitiveness. This threatens the long-term prosperity of the Canadian workforce.

- Reduced investment in infrastructure: Lack of investment in critical infrastructure projects hinders economic growth and job creation.

- Lower productivity growth: Higher taxes and increased regulatory burdens can negatively impact productivity.

- Erosion of Canada's global competitiveness: High national debt and economic uncertainty can damage Canada’s reputation as a stable and attractive investment destination.

Data on job growth and unemployment rates reflect the negative consequences of Liberal fiscal policies on the Canadian economy and workforce.

Conclusion

Liberal fiscal irresponsibility is a significant threat to Canada's economic vision. Increased government spending, inadequate debt management, and a lack of long-term planning have created a precarious economic situation, impacting key economic indicators such as inflation, interest rates, job growth, and global competitiveness. The unsustainable path necessitates a course correction. Demand greater fiscal responsibility from the Liberal party and advocate for sounder economic policies for Canada's future. Stay informed about the implications of Liberal fiscal policies and actively participate in shaping Canada’s economic vision. Failure to address Liberal fiscal irresponsibility will have far-reaching and detrimental consequences for Canada's long-term economic prosperity.

Featured Posts

-

The Epa Vs Elon Musk The Impact On Tesla Space X And Dogecoin

Apr 24, 2025

The Epa Vs Elon Musk The Impact On Tesla Space X And Dogecoin

Apr 24, 2025 -

Bold And The Beautiful Recap April 3 Liams Health Crisis Following Fight With Bill

Apr 24, 2025

Bold And The Beautiful Recap April 3 Liams Health Crisis Following Fight With Bill

Apr 24, 2025 -

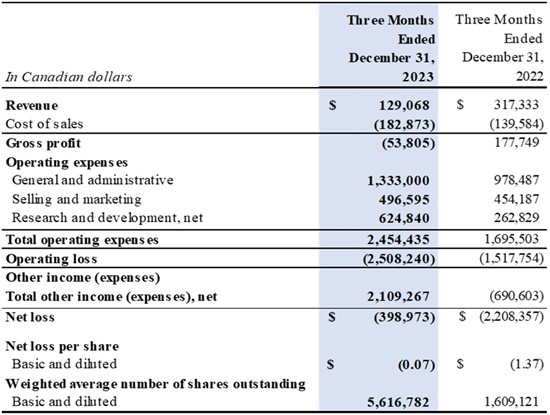

Teslas Q1 2024 Financial Results 71 Net Income Decline Explained

Apr 24, 2025

Teslas Q1 2024 Financial Results 71 Net Income Decline Explained

Apr 24, 2025 -

Microsoft Activision Deal Ftcs Appeal And What It Means

Apr 24, 2025

Microsoft Activision Deal Ftcs Appeal And What It Means

Apr 24, 2025 -

Actors Join Writers Strike A Complete Shutdown Of Hollywood Production

Apr 24, 2025

Actors Join Writers Strike A Complete Shutdown Of Hollywood Production

Apr 24, 2025