Microsoft-Activision Deal: FTC's Appeal And What It Means

Table of Contents

The FTC's Case Against the Merger

The Federal Trade Commission (FTC) filed a lawsuit to block the Microsoft-Activision deal, arguing it would substantially lessen competition within the video game market. Their primary concern centers on the potential anti-competitive effects of Microsoft acquiring such a significant player in the industry.

- Undue Market Power: The FTC argues the merger would grant Microsoft undue market power, particularly in the console gaming market and cloud gaming services. They claim this consolidated power could stifle innovation and harm consumers.

- Call of Duty Exclusivity: A central point of contention is the fate of Call of Duty. The FTC fears Microsoft could make Call of Duty exclusive to its Xbox ecosystem, harming competitors like PlayStation and potentially damaging the overall gaming landscape. This would represent a significant blow to competitors and limit consumer choice.

- Market Consolidation: The FTC's broader concern extends to the general trend of market consolidation in the video game industry. They argue that allowing this merger would exacerbate this issue, leading to less competition and potentially higher prices for gamers.

- Relevant Legal Citations: The FTC's case relies heavily on precedents set in previous antitrust cases, such as United States v. AT&T and United States v. Microsoft Corp., to bolster their arguments.

Key Arguments Presented by the FTC

The FTC’s arguments are multifaceted, building a case around the potential for Microsoft to leverage its newly acquired power to harm competitors and consumers. Their evidence includes internal Microsoft communications, market share data, and expert testimony illustrating the potential for anti-competitive behavior. They highlight the unique position of Call of Duty as a major franchise and the potential for its exclusivity to significantly alter the competitive balance. The FTC’s legal strategy emphasizes the potential for future anti-competitive practices, arguing that preventing the merger is necessary to safeguard the competitive landscape.

Microsoft's Defense and Counterarguments

Microsoft vehemently denies the FTC's accusations, arguing the merger will benefit gamers and the industry as a whole. Their defense strategy focuses on several key points:

- Competitive Gaming Market: Microsoft points to the already robust and competitive nature of the gaming market, arguing that the merger wouldn't create a monopoly. They highlight the presence of numerous successful gaming platforms and developers.

- Call of Duty's Continued Availability: Microsoft has pledged to keep Call of Duty available on PlayStation and other platforms for at least 10 years, a key concession aimed at alleviating FTC concerns. This agreement involves contractual obligations to ensure continued access for players on various platforms.

- Benefits for Gamers: Microsoft emphasizes the potential benefits of the merger, including increased investment in game development, broader access to games, and innovative features for gamers across different platforms.

- Concessions and Remedies: Microsoft has offered various concessions to the FTC in an attempt to address their concerns, including the long-term Call of Duty agreement and other commitments aimed at preserving competition.

The Implications of the FTC's Appeal

The FTC's appeal carries significant implications for the gaming industry and beyond:

- Delayed Merger Completion: The appeal creates further uncertainty and delays the already prolonged merger process. This uncertainty affects both Microsoft and Activision Blizzard's business planning and stock prices.

- Potential Reversal of Initial Court Decision: A successful appeal could reverse the initial court decision that allowed the merger to proceed. This would constitute a major victory for the FTC and a significant setback for Microsoft.

- Impact on Future Mergers & Acquisitions: The outcome will set a crucial precedent for future mergers and acquisitions in the gaming and tech industries. This will impact how regulators approach similar deals in the future.

- Stock Market Impact: The ongoing legal battle has created volatility in the stock prices of both Microsoft and Activision Blizzard, reflecting the uncertainty surrounding the merger's outcome.

- Consumer Effects: The ultimate impact on consumers depends on the outcome of the appeal. A blocked merger might maintain competition, while a completed merger might lead to benefits (such as improved games) or disadvantages (such as less choice).

The Broader Context: Antitrust Law and the Gaming Industry

This case highlights the evolving challenges of applying antitrust law in the rapidly changing digital landscape.

- Precedent for Future Mergers: The Microsoft-Activision case sets a vital precedent for how regulators approach mergers and acquisitions in the tech industry, particularly concerning the complexities of digital markets and platform dominance.

- Regulatory Role in Gaming: The case underscores the crucial role of regulatory bodies like the FTC in shaping the competitive landscape of the gaming industry and preventing anti-competitive practices.

- Antitrust Law in the Digital Age: The case showcases the need for antitrust law to adapt to the unique characteristics of digital markets, including network effects, data control, and platform power.

Conclusion

The FTC's appeal against the Microsoft-Activision deal represents a pivotal moment for antitrust law and the gaming industry. Both sides present strong arguments, with the FTC highlighting concerns about market dominance and the potential for anti-competitive practices, while Microsoft emphasizes the benefits for gamers and the competitive nature of the market. The appeal's outcome remains uncertain, but it will undoubtedly shape the future of mergers and acquisitions in the tech sector. While predicting the outcome is difficult, a prolonged legal battle is highly likely.

Call to action: Stay informed about the ongoing developments in the Microsoft-Activision deal and its implications for the gaming industry by following this blog/website for updates on the Microsoft-Activision deal and similar antitrust cases. Learn more about the FTC's role in regulating mergers and acquisitions.

Featured Posts

-

Lab Owner Pleads Guilty To Covid Test Result Fraud

Apr 24, 2025

Lab Owner Pleads Guilty To Covid Test Result Fraud

Apr 24, 2025 -

Bitcoin Price Climbs Amidst Easing Trade Tensions And Fed Uncertainty

Apr 24, 2025

Bitcoin Price Climbs Amidst Easing Trade Tensions And Fed Uncertainty

Apr 24, 2025 -

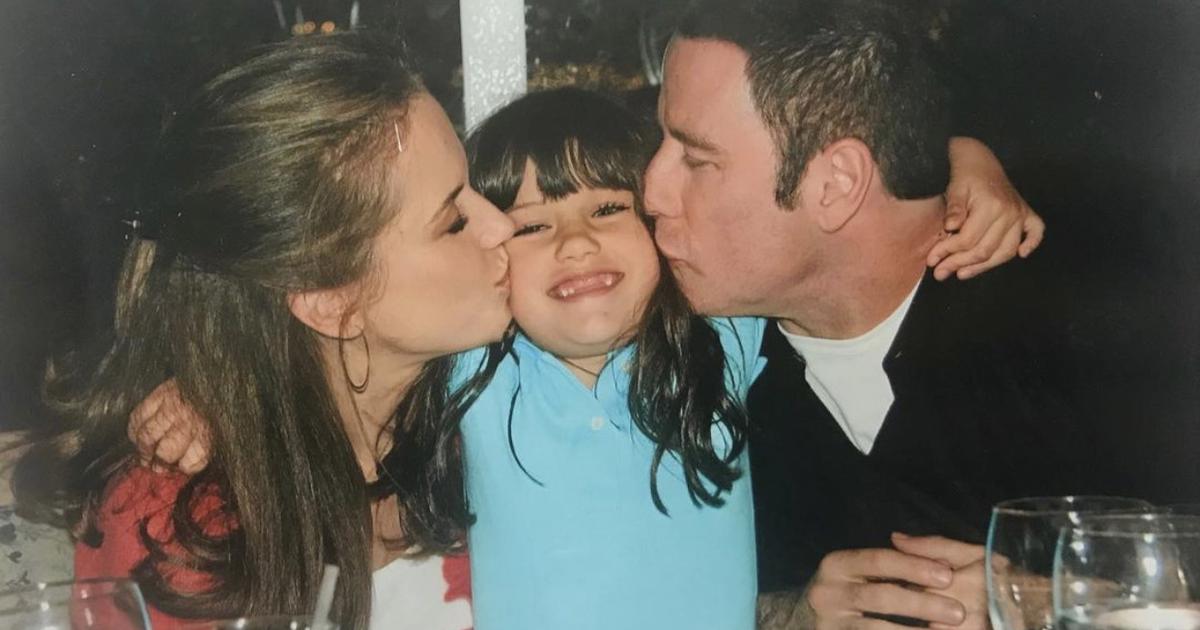

Kci Johna Travolte Ella Bleu Prerasla Je U Pravu Ljepoticu

Apr 24, 2025

Kci Johna Travolte Ella Bleu Prerasla Je U Pravu Ljepoticu

Apr 24, 2025 -

Nba 3 Point Contest Herros Road To Victory

Apr 24, 2025

Nba 3 Point Contest Herros Road To Victory

Apr 24, 2025 -

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025