Los Angeles Wildfires: A Reflection Of Societal Attitudes Through Betting Markets

Table of Contents

The Rise of Wildfire Prediction Markets

The emergence of prediction markets related to wildfire occurrences in Los Angeles is a fascinating development. These markets, often operating online, allow individuals to bet on various aspects of wildfires, transforming complex predictions into quantifiable probabilities. This gamification of wildfire risk assessment is fueled by several factors:

-

Increased accuracy of wildfire prediction models influencing betting odds: Advances in data analytics, AI, and meteorological modeling provide increasingly accurate predictions, making these markets more attractive to bettors. Sophisticated algorithms analyze factors like weather patterns, vegetation density, and historical fire data to generate odds.

-

Different types of markets (e.g., predicting the acreage burned, the number of structures destroyed, the timing of wildfires): The diversity of markets reflects the multifaceted nature of wildfire risk. Bettors can speculate on the total acreage affected, the number of homes destroyed, the specific areas impacted, and even the precise timing of wildfire outbreaks.

-

The role of data analytics and AI in these prediction markets: The accuracy and sophistication of these markets are directly tied to the power of data analytics and AI. These technologies are crucial in processing vast amounts of data to predict wildfire behavior and inform betting odds.

The implications of these markets extend beyond mere speculation. The aggregated betting patterns can potentially inform risk assessment and resource allocation, guiding emergency response teams and policymakers towards a more proactive approach. By analyzing the collective wisdom of the crowd, valuable insights can be gleaned into areas deemed high-risk, which would allow for more efficient deployment of resources for prevention and response.

Public Perception and Betting Behavior

Betting patterns in wildfire prediction markets offer a revealing glimpse into public perception of wildfire risk in Los Angeles. Analyzing these patterns allows us to understand how well-informed the public is and how their perception aligns with actual risk.

-

Do betting patterns accurately reflect the actual risk? Explain any discrepancies: A comparison between betting odds and actual wildfire events can reveal discrepancies. Overestimation of risk in certain areas might reflect media hype or localized anxieties, while underestimation could indicate a lack of awareness or complacency.

-

Correlation between media coverage of wildfires and betting activity: Increased media coverage of wildfires, particularly during periods of high risk, is likely to correlate with increased betting activity and potentially skewed odds. This points to the influence of media narratives shaping public perception.

-

The influence of factors like social media and expert opinions on betting behavior: Social media discussions and expert opinions (e.g., from fire scientists or emergency officials) play a significant role in influencing betting behavior, potentially driving market movements beyond purely statistical analysis.

However, ethical considerations arise when individuals profit from predicting the devastation caused by natural disasters. The line between informed speculation and insensitive profiteering needs careful consideration.

Wildfire Prevention and Investment: A Betting Market Perspective

Interestingly, wildfire betting markets might inadvertently incentivize investment in wildfire prevention strategies in Los Angeles. By providing a quantifiable measure of risk, these markets can influence decision-making on several levels:

-

Could prediction markets stimulate investment in brush clearance and improved firebreaks? Areas deemed high-risk by the betting market might attract greater investment in preventative measures like brush clearance and the creation of firebreaks, thereby reducing potential losses.

-

The potential for insurance companies to use betting market data to assess risk and set premiums: Insurance companies could leverage betting market data to refine their risk assessments, allowing for more accurate pricing of insurance premiums. This could encourage homeowners to invest in fire-resistant landscaping and other mitigation strategies.

-

The role of government incentives and regulations in influencing both wildfire prevention and betting markets: Government regulations and incentives could play a crucial role in promoting both wildfire prevention and responsible development of these markets. This might involve tax breaks for preventative measures or stricter regulations on speculative betting.

This data-driven approach offers the potential for a more proactive and potentially cost-effective strategy for wildfire management, moving away from a purely reactive response to a more preventative one based on market signals.

The Limitations and Challenges of Wildfire Betting Markets

While offering valuable insights, wildfire betting markets are not without limitations and ethical concerns:

-

The potential for manipulation and market inefficiencies: Like any market, these are susceptible to manipulation and inefficiencies. Insiders with privileged information could distort the market, making it unreliable as a purely objective measure of risk.

-

The lack of readily available and reliable data on wildfire-related events: Accurate and comprehensive data on past wildfires is crucial for reliable prediction models. Data gaps and inconsistencies could significantly hamper the accuracy of these markets.

-

The complexities of predicting wildfires accurately due to various environmental factors: The unpredictable nature of wildfires, influenced by complex interactions between weather, topography, and vegetation, makes accurate prediction inherently challenging.

Therefore, responsible regulation and transparency are vital to ensure the integrity and ethical use of these emerging markets.

Conclusion

The analysis of betting markets surrounding Los Angeles wildfires offers a unique perspective on societal attitudes towards risk, preparedness, and environmental responsibility. While these markets present valuable insights into risk perception and potential incentives for prevention, it's crucial to acknowledge their limitations and promote ethical and responsible development. Further research into the implications of wildfire betting markets is needed to foster a better understanding of risk perception and to develop more effective strategies for wildfire prevention and mitigation in Los Angeles and beyond. Understanding Los Angeles Wildfires and their connection to these emerging betting markets provides vital data for creating a safer future for all.

Featured Posts

-

I Teleti Toy Ieroy Niptiros Sta Ierosolyma Istoria Kai Simasia

May 19, 2025

I Teleti Toy Ieroy Niptiros Sta Ierosolyma Istoria Kai Simasia

May 19, 2025 -

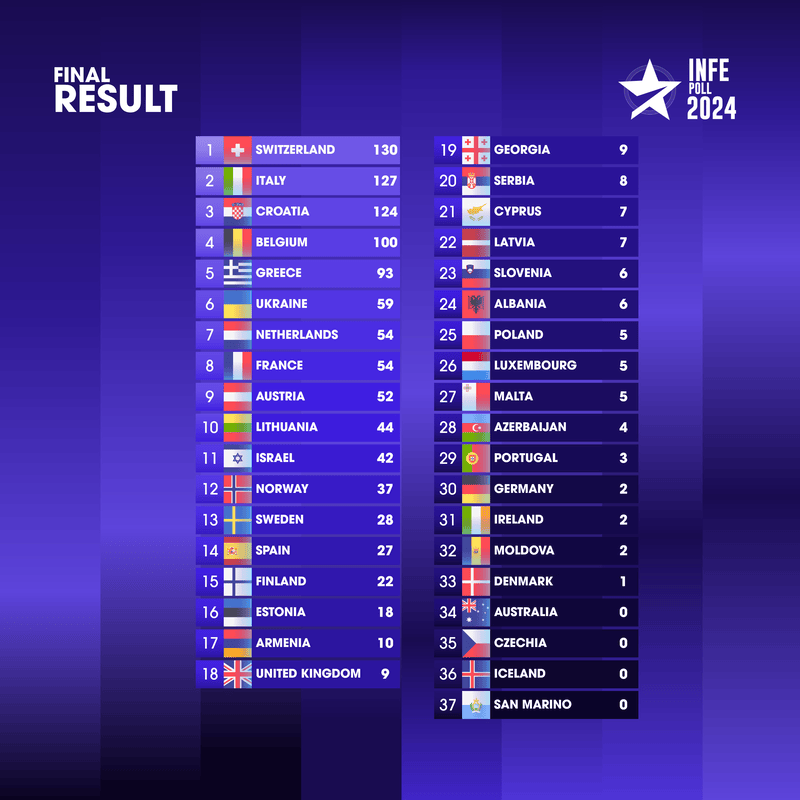

Esc Todays 9th Annual Eurovision 2024 Infe Poll Is Here

May 19, 2025

Esc Todays 9th Annual Eurovision 2024 Infe Poll Is Here

May 19, 2025 -

Job Candidate Approved Latest News From The Sanibel Captiva Cepd

May 19, 2025

Job Candidate Approved Latest News From The Sanibel Captiva Cepd

May 19, 2025 -

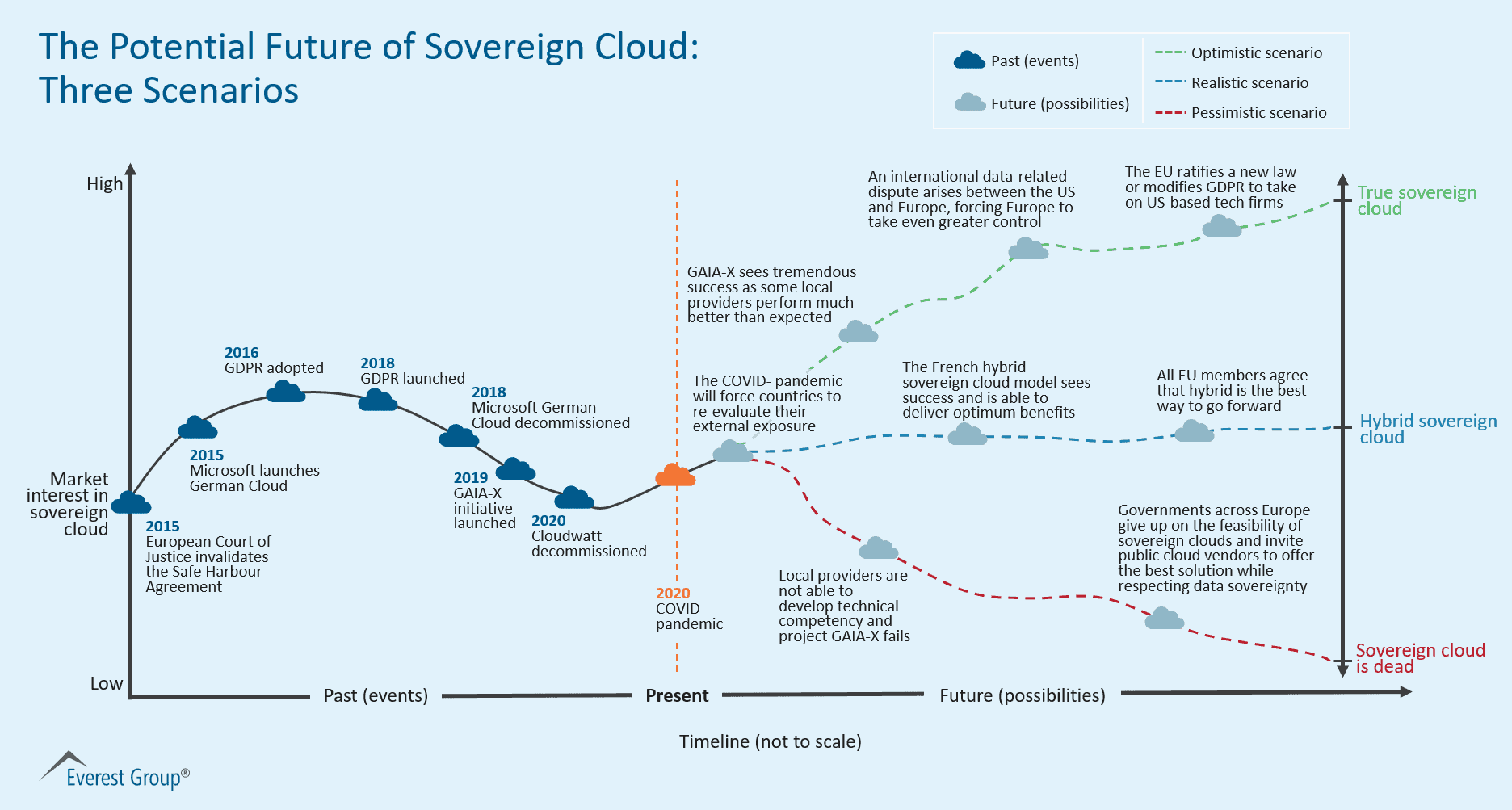

Investment Strategies Swissquote Banks Sovereign Bond Market Insights

May 19, 2025

Investment Strategies Swissquote Banks Sovereign Bond Market Insights

May 19, 2025 -

Your Place In The Sun Practical Advice For Buying Property Abroad

May 19, 2025

Your Place In The Sun Practical Advice For Buying Property Abroad

May 19, 2025