Market Analysis: Connecting Elon Musk's Influence To Tesla And Dogecoin Price Changes

Table of Contents

Elon Musk's Twitter Influence and Market Sentiment

Elon Musk boasts a massive following on Twitter, wielding unprecedented influence over market sentiment. His tweets, even those seemingly casual or whimsical, can trigger significant buying or selling frenzies, impacting both Tesla's stock price and the value of Dogecoin. This influence stems from his status as a visionary leader, coupled with the inherent unpredictability of his online interactions. His pronouncements are amplified by the echo chambers of social media, resulting in rapid dissemination and widespread market reaction.

- Example 1: On [Date of Tweet], Musk tweeted "[Insert Tweet Content Related to Tesla]", leading to a [Percentage]% increase in Tesla's stock price within [Timeframe]. News sources like [News Source 1] and [News Source 2] extensively covered this event.

- Example 2: His [Date of Tweet] Dogecoin tweet, "[Insert Tweet Content Related to Dogecoin]", caused a [Percentage]% surge in Dogecoin's value, as reported by [News Source 3] and [News Source 4]. Trading volume spiked dramatically during this period.

This phenomenon is further fueled by the "fear of missing out" (FOMO) effect. Investors, fearing they might miss out on potential gains, often jump on the bandwagon, exacerbating price volatility.

Tesla Stock Price and Musk's Actions

Tesla's stock price is intrinsically linked to its performance, product launches, production numbers, and regulatory landscape. However, Musk's leadership style and decisions significantly influence investor confidence. His pronouncements on production timelines, new product reveals, and even his personal life can impact the stock's trajectory. This creates both opportunity and risk.

- Example 1: The launch of the [Tesla Model Name] resulted in a [Percentage]% increase in Tesla's stock price due to [Reason].

- Example 2: Production delays for the [Tesla Model Name], announced by Musk, led to a [Percentage]% decrease in the stock price, reflecting investor concerns about [Reason].

- Example 3: Controversies surrounding Musk's leadership, such as [Specific Controversy], also impacted Tesla's stock value negatively.

The intertwined nature of Musk's ventures – SpaceX, Neuralink, The Boring Company – also impacts Tesla's valuation. Investor perception of his overall success influences their assessment of Tesla's future potential. This diversified influence presents a complex challenge for traditional market analysis.

Dogecoin's Volatility and Musk's Endorsements

Dogecoin, a meme cryptocurrency, owes a significant portion of its existence and price volatility to Elon Musk's endorsements. Initially created as a joke, Dogecoin's value has been dramatically influenced by Musk's tweets and public statements, highlighting the power of social media influence on financial markets.

- Example 1: Musk's tweet on [Date], stating "[Insert Tweet Content]", caused a [Percentage]% increase in Dogecoin's price. The trading volume during this period was [Volume Data].

- Example 2: Another instance of significant price movement occurred on [Date] following [Musk's Action or Statement], resulting in a [Percentage]% change.

The ethical implications of such influence on a volatile asset like Dogecoin are undeniable. Concerns around market manipulation and the potential for unsuspecting investors to lose money due to Musk's pronouncements are valid and warrant further discussion.

Analyzing the Correlation – Statistical Methods and Limitations

Statistical methods like correlation coefficients and regression analysis could be employed to analyze the correlation between Musk's actions and price changes in Tesla and Dogecoin. However, isolating Musk's influence as the sole factor is challenging. Numerous other market forces – overall market trends, regulatory changes, news events, and general investor sentiment – simultaneously influence these price fluctuations.

Any statistical analysis must account for these confounding variables to provide a meaningful interpretation. While correlations might be observed, establishing direct causation solely from Musk's influence would be an oversimplification.

Conclusion: Understanding the Complex Relationship between Elon Musk, Tesla, and Dogecoin

This market analysis: connecting Elon Musk's influence to Tesla and Dogecoin price changes reveals a complex and dynamic relationship. Elon Musk's actions and statements demonstrably impact the price volatility of both Tesla and Dogecoin. Understanding this interplay is crucial for investors seeking to make informed decisions in this evolving market landscape. The future implications of this dynamic warrant close attention, considering potential regulatory responses and the ever-changing landscape of social media's influence on financial markets. Continue your research into market analysis: connecting Elon Musk's influence to Tesla and Dogecoin price changes by following reputable financial news sources and analysts for updates on this evolving story.

Featured Posts

-

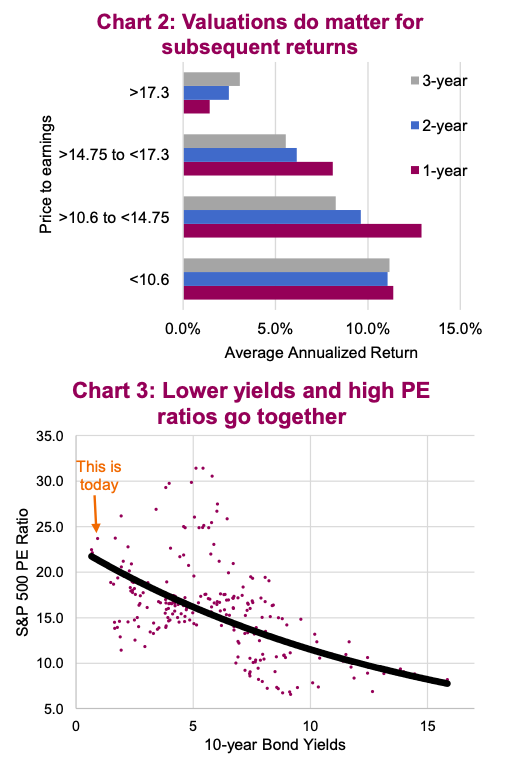

Why High Stock Market Valuations Shouldnt Deter Investors A Bof A Analysis

May 09, 2025

Why High Stock Market Valuations Shouldnt Deter Investors A Bof A Analysis

May 09, 2025 -

Nottingham Attack Survivors First Interview I Wish He D Taken Me Instead

May 09, 2025

Nottingham Attack Survivors First Interview I Wish He D Taken Me Instead

May 09, 2025 -

Kimbal Musk Elons Brother Takes A Stand Against Trumps Tariffs

May 09, 2025

Kimbal Musk Elons Brother Takes A Stand Against Trumps Tariffs

May 09, 2025 -

Sensex Jumps 200 Points Nifty Hits 18 600 Stock Market Update

May 09, 2025

Sensex Jumps 200 Points Nifty Hits 18 600 Stock Market Update

May 09, 2025 -

9 Maya V Kieve Bez Starmera Makrona Mertsa I Tuska

May 09, 2025

9 Maya V Kieve Bez Starmera Makrona Mertsa I Tuska

May 09, 2025