Why High Stock Market Valuations Shouldn't Deter Investors: A BofA Analysis

Table of Contents

Understanding Current Stock Market Valuations

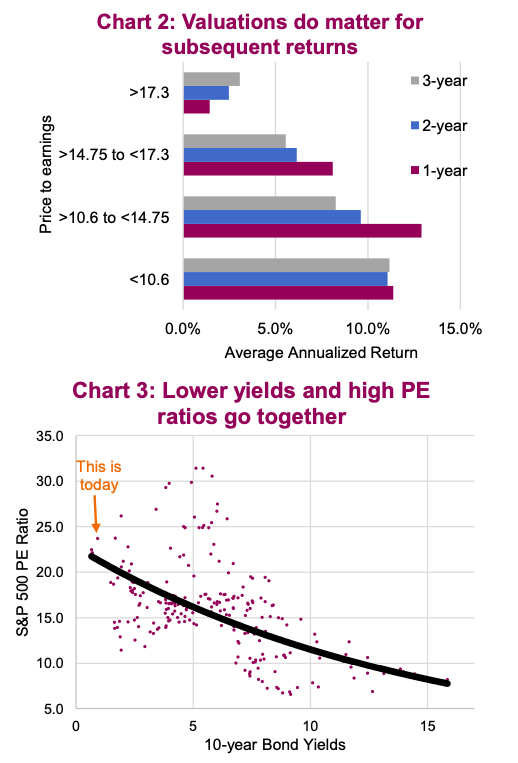

The term "high valuations" often refers to elevated metrics like the Price-to-Earnings (P/E) ratio and the Shiller P/E (CAPE) ratio. Understanding these is key to interpreting market conditions.

-

P/E Ratio: This is calculated by dividing a company's stock price by its earnings per share (EPS). A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, potentially indicating higher growth expectations or market optimism.

-

CAPE Ratio (Cyclically Adjusted Price-to-Earnings Ratio): Developed by Nobel laureate Robert Shiller, the CAPE ratio smooths out earnings fluctuations over a 10-year period, providing a longer-term perspective on valuation. It's considered a more robust indicator than the standard P/E ratio, especially for long-term investors.

-

Historical Context: While current valuations may appear high compared to historical averages, they are not unprecedented. Previous bull markets have also seen periods of elevated valuations before experiencing further growth. Comparing current levels to past market cycles, including periods of high growth and subsequent corrections, provides essential context. Remember to factor in things like inflation adjustments when comparing historical data to present day.

-

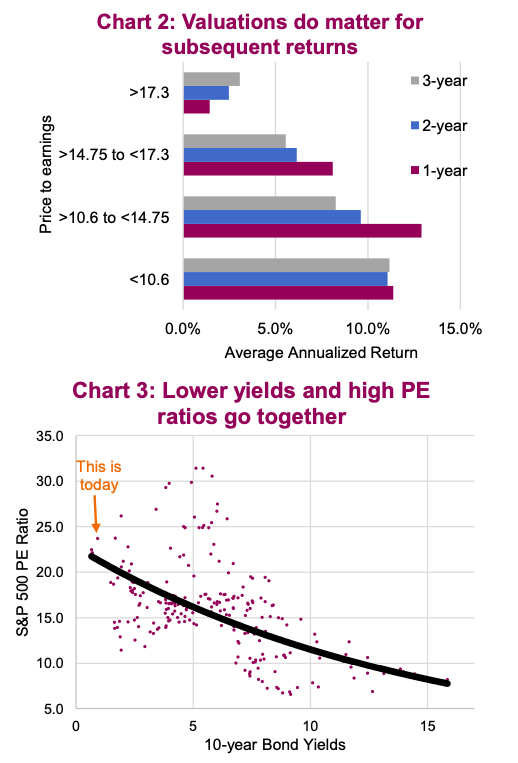

Influencing Factors: Several factors contribute to current valuations, including historically low interest rates, robust corporate earnings driven by innovation and efficiency, and positive economic growth projections, at least for the near future. These positive influences help to support higher stock prices and P/E ratios.

BofA's Perspective on Current Market Conditions

Bank of America's recent reports offer valuable insights into the current market environment. Their analyses consistently highlight that while valuations are elevated, they don't necessarily point to an imminent market downturn.

-

Key Findings: BofA's research often emphasizes the strength of corporate earnings and the potential for continued growth in specific sectors. Their analysts often weigh the risk of high valuations against the positive factors driving market performance.

-

Market Performance Predictions: BofA's projections typically incorporate a range of scenarios, acknowledging the inherent uncertainty in market forecasting. While they may not predict explosive growth, their models generally suggest continued, albeit potentially slower, market expansion. Always consider the range of possible outcomes and potential risks.

-

Suggested Investment Strategies: BofA usually advocates for a diversified portfolio approach, suggesting investors focus on quality companies with strong fundamentals and long-term growth potential. They often emphasize the importance of a long-term investment horizon, regardless of short-term market fluctuations.

Factors Beyond Valuation Metrics

While valuation metrics like P/E and CAPE ratios provide a quantitative assessment, qualitative factors are equally important.

-

Long-Term Growth Prospects: Focusing solely on valuations can overlook the significant growth potential of specific companies and sectors. Analyzing the long-term prospects and technological advantages of individual investments is crucial.

-

Technological Innovation: Technological advancements often drive substantial shifts in valuations. Companies leveraging innovative technologies may justify higher P/E ratios due to their future earnings potential.

-

Global Macroeconomic Trends: Global economic factors, such as interest rate changes, inflation, and geopolitical events, significantly influence market performance. Understanding and monitoring these trends allows for better informed investment decisions.

-

Examples of High-Growth Sectors: Sectors such as technology, renewable energy, and biotechnology frequently exhibit high valuations due to their growth potential. However, a thorough understanding of each investment is critical.

The Importance of Diversification and Long-Term Investing

Navigating any market requires a strategic approach.

-

Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) reduces overall portfolio risk and mitigates the impact of any single investment underperforming.

-

Long-Term Investing: A long-term perspective is essential to weathering short-term market volatility and benefiting from the power of compounding returns. Short-term fluctuations should be viewed within the context of a longer-term investment plan.

-

Risk Management Strategies: Developing a risk management strategy, including setting stop-loss orders and regularly reviewing your portfolio, is crucial for mitigating potential losses.

Conclusion

High stock market valuations, while a valid concern for some, shouldn't necessarily deter investors. BofA's analysis, along with consideration of qualitative factors and a long-term investment strategy, suggests that opportunities still exist. By understanding the nuances of valuation metrics and diversifying your portfolio, you can navigate this market effectively.

Call to Action: Don't let perceived high stock market valuations prevent you from pursuing your investment goals. Learn more about BofA's insights and develop a robust investment strategy tailored to your risk tolerance and long-term objectives. Start exploring your investment options today, considering high-growth potential amidst seemingly high stock market valuations. Remember to consult a financial advisor before making any investment decisions.

Featured Posts

-

Bayern Munich Vs Fc St Pauli Match Preview And Prediction

May 09, 2025

Bayern Munich Vs Fc St Pauli Match Preview And Prediction

May 09, 2025 -

Successfully Navigating The Private Credit Job Market 5 Dos And Don Ts

May 09, 2025

Successfully Navigating The Private Credit Job Market 5 Dos And Don Ts

May 09, 2025 -

9 Maya Vladimir Zelenskiy Bez Podderzhki Soyuznikov

May 09, 2025

9 Maya Vladimir Zelenskiy Bez Podderzhki Soyuznikov

May 09, 2025 -

2025 Nhl Playoffs How The Trade Deadline Will Shape The Contenders

May 09, 2025

2025 Nhl Playoffs How The Trade Deadline Will Shape The Contenders

May 09, 2025 -

Experience Lake Charles Live Music And Events This Easter Weekend

May 09, 2025

Experience Lake Charles Live Music And Events This Easter Weekend

May 09, 2025