Market Crash? Magnificent Seven Stocks Lose $2.5 Trillion In Value

Table of Contents

Analyzing the $2.5 Trillion Drop: A Deep Dive into Individual Stock Performances

The $2.5 trillion loss isn't evenly distributed; each Magnificent Seven company experienced unique challenges impacting its market capitalization. Let's delve into the individual stock performances:

Apple's Stock Decline: Reasons and Impact

Apple, once a beacon of stability, saw a significant drop in its stock price. Contributing factors include:

- Slowing iPhone Sales: Demand for iPhones, a cornerstone of Apple's revenue, has softened due to global economic slowdown and increased competition.

- Supply Chain Issues: Persistent supply chain disruptions impacted production and availability, further affecting sales.

- High Inflation: Increased prices have reduced consumer spending power, impacting demand for premium electronics like iPhones.

The percentage drop in Apple stock reflects these challenges, impacting investor confidence and raising concerns about future growth. This "Apple stock" decline significantly contributed to the overall market volatility.

Microsoft's Market Capitalization Shift: Cloud Computing Concerns

Microsoft, a dominant player in cloud computing, also experienced a market capitalization shift. While its cloud services (Azure) remain strong, concerns exist regarding:

- Increased Competition: Intense competition from Amazon Web Services (AWS) and Google Cloud Platform continues to pressure Microsoft's market share.

- Economic Slowdown: Businesses, facing economic uncertainty, are re-evaluating their cloud spending, impacting Microsoft's revenue growth.

- Slowing PC Sales: A decline in PC sales negatively impacted Microsoft's Windows licensing revenue.

These factors contributed to the "Microsoft stock" price fluctuations, highlighting the vulnerability of even the largest tech companies to macroeconomic headwinds.

Amazon, Alphabet, and Meta's Struggles: Advertising and Regulatory Headwinds

Amazon, Alphabet (Google), and Meta (Facebook) face overlapping challenges, primarily related to:

- Advertising Revenue Decline: A slowdown in digital advertising spending due to the economic slowdown significantly impacted their revenue streams.

- Regulatory Scrutiny: Increased regulatory scrutiny regarding data privacy and anti-competitive practices created uncertainty and impacted investor confidence. "Google stock," "Amazon stock," and "Meta stock" all felt this pressure.

- Increased Competition: Fierce competition in the digital advertising space further eroded their market share and profitability.

These issues highlight the risks associated with relying heavily on advertising revenue in a volatile economic climate.

Nvidia's GPU Market Volatility: Impact of Supply Chain and Economic Slowdown

Nvidia, a leading producer of graphics processing units (GPUs), experienced volatility due to:

- Supply Chain Disruptions: Continued supply chain issues impacted GPU production and availability, affecting revenue growth.

- Economic Slowdown: Reduced demand for GPUs from gamers and data centers contributed to the slowdown.

- Cryptocurrency Market Decline: The decline in the cryptocurrency market negatively impacted demand for high-end GPUs used in cryptocurrency mining.

The impact on "Nvidia stock" underscores the semiconductor industry's sensitivity to both macroeconomic factors and specific market shifts.

Tesla's Rollercoaster Ride: Elon Musk's Influence and EV Market Competition

Tesla's stock performance is unique, heavily influenced by:

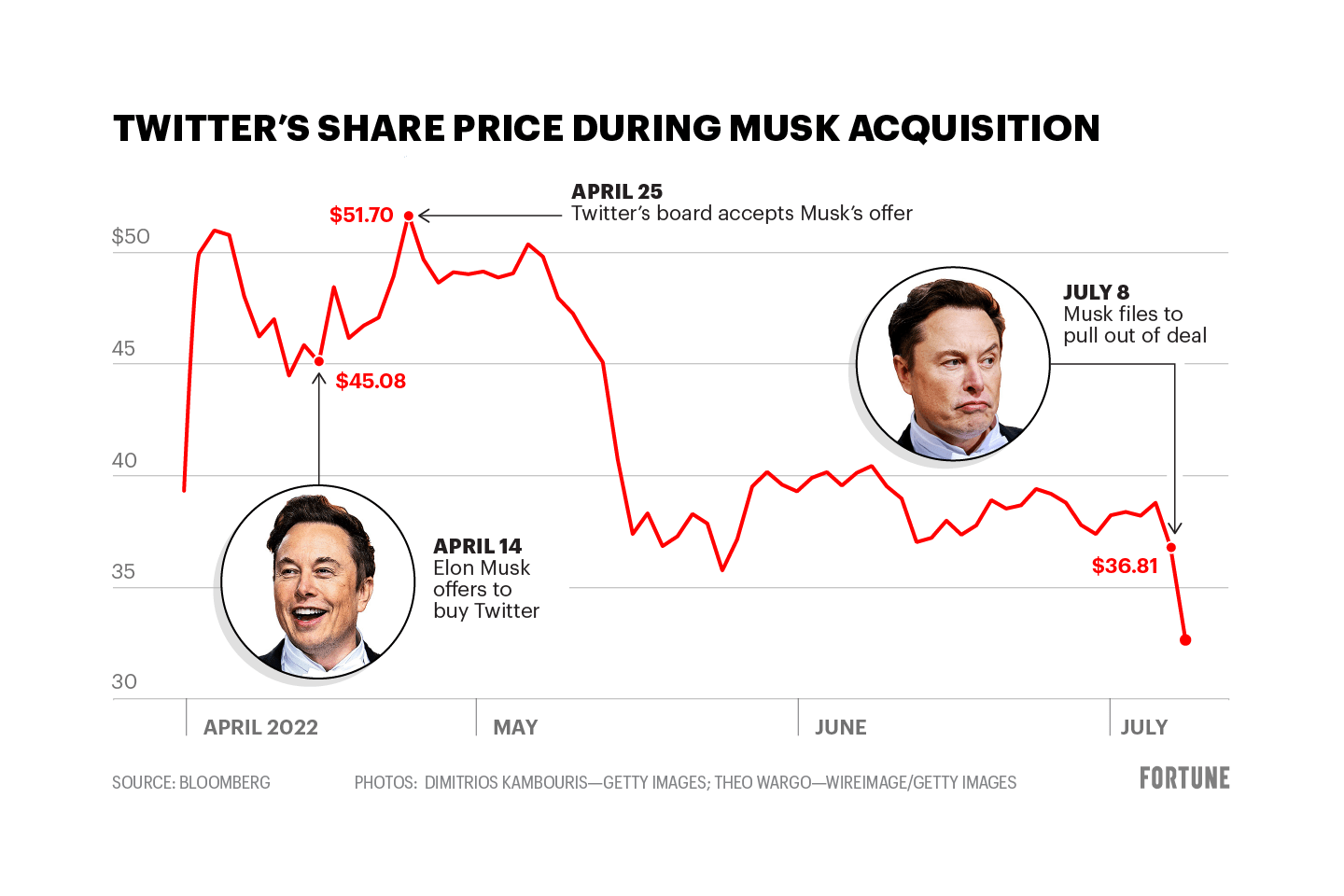

- Elon Musk's Actions: Elon Musk's actions, including his acquisition of Twitter and controversial tweets, significantly impacted investor sentiment and stock price volatility.

- Increased EV Competition: Growing competition in the electric vehicle (EV) market is pressuring Tesla's market share and pricing power.

- Supply Chain Challenges: Tesla also faced supply chain disruptions, impacting production and delivery timelines.

These factors created a "Tesla stock" rollercoaster, emphasizing the influence of leadership and market competition on even the most innovative companies.

What Caused the Magnificent Seven's Plummet? Macroeconomic Factors at Play

The Magnificent Seven's plummet isn't solely attributable to company-specific issues. Broader macroeconomic factors played a significant role:

- Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes increased borrowing costs for businesses and consumers, dampening economic activity.

- High Inflation: Persistent inflation eroded consumer purchasing power, reducing demand for discretionary goods and services.

- Recessionary Fears: Growing fears of a recession further dampened investor sentiment and led to a flight to safety.

- Geopolitical Instability: Geopolitical uncertainties, including the war in Ukraine, contributed to global economic instability.

These macroeconomic headwinds created a perfect storm, significantly impacting the "Magnificent Seven" and the broader market.

Investor Sentiment and the Future of the Magnificent Seven

Investor sentiment towards the Magnificent Seven remains cautious. The future outlook is uncertain, with potential scenarios ranging from a slow recovery to a more prolonged downturn. Expert opinions vary, but several recovery strategies are being considered, including cost-cutting measures, diversification, and strategic acquisitions.

Conclusion: Navigating the Market Volatility: Understanding the Magnificent Seven's Losses

The $2.5 trillion loss in the Magnificent Seven's market capitalization underscores significant market instability driven by a confluence of macroeconomic factors and company-specific challenges. Understanding these forces is critical for navigating the current market environment. Staying informed about market trends, diversifying your investment portfolio, and considering professional financial advice are crucial steps in mitigating risks associated with significant "Magnificent Seven" stock losses and broader market volatility. Continue your research into market analysis and investment strategies to make informed decisions in this dynamic landscape.

Featured Posts

-

100 Immigrants Detained In Underground Nightclub Raid Cnn Footage

Apr 29, 2025

100 Immigrants Detained In Underground Nightclub Raid Cnn Footage

Apr 29, 2025 -

Technical Glitch Blue Origin Postpones Rocket Launch Due To Subsystem Problem

Apr 29, 2025

Technical Glitch Blue Origin Postpones Rocket Launch Due To Subsystem Problem

Apr 29, 2025 -

Car Plows Into Crowd At Vancouver Filipino Festival Leaving Nine Dead

Apr 29, 2025

Car Plows Into Crowd At Vancouver Filipino Festival Leaving Nine Dead

Apr 29, 2025 -

New X Financials After Musks Debt Sale A Detailed Look

Apr 29, 2025

New X Financials After Musks Debt Sale A Detailed Look

Apr 29, 2025 -

2024 Metais Porsche Pardavimai Lietuvoje Soktelejo Trecdaliu

Apr 29, 2025

2024 Metais Porsche Pardavimai Lietuvoje Soktelejo Trecdaliu

Apr 29, 2025