Market Reaction: Trump's Assurance On Fed Chair Powell's Position

Table of Contents

Immediate Market Response to Trump's Statement

The immediate market reaction to Trump's assurance on Fed Chair Powell was mixed, reflecting the inherent uncertainty surrounding the situation.

Stock Market Fluctuations

The announcement triggered a flurry of activity across major indices.

- Dow Jones Industrial Average: Experienced a [Insert Percentage]% [increase/decrease] immediately following the statement, with trading volume [increased/decreased] significantly.

- S&P 500: Showed a [Insert Percentage]% [increase/decrease], indicating a [positive/negative] investor sentiment.

- Nasdaq Composite: Reacted with a [Insert Percentage]% [increase/decrease], with technology stocks exhibiting [more/less] volatility than other sectors. For example, [mention specific technology company and its stock performance]. The financial sector, often sensitive to Fed policy changes, saw a [Insert Percentage]% [increase/decrease].

- [Include a chart visually representing the immediate stock market fluctuations.]

Bond Market Reaction

Treasury yields displayed a [rise/fall] following the announcement. This [indicates/suggests] a shift in investor sentiment towards [risk-on/risk-off] behavior.

- The 10-year Treasury yield moved from [Previous Yield]% to [New Yield]%, reflecting [investor confidence/uncertainty].

- This movement indicates that investors perceived Trump's statement as [positive/negative] for long-term economic prospects.

- [Include a chart showing the bond yield changes.]

Currency Market Impact

The US dollar's performance against other major currencies reflected the market's interpretation of Trump's assurance.

- USD/EUR: The dollar [strengthened/weakened] against the Euro, indicating [increased/decreased] demand for the dollar.

- USD/JPY: The dollar [strengthened/weakened] against the Japanese Yen, suggesting a shift in [risk appetite/aversion].

- [Include bullet points for other major currency pairs and their movements, along with a brief explanation of the implications].

- [Include a chart depicting the currency market movements.]

Analyst Interpretation of Trump's Assurance

Analyst opinions on Trump's assurance were sharply divided, highlighting the inherent ambiguity of the situation.

Positive Interpretations

Some analysts viewed the statement as a positive sign, emphasizing the potential for reduced uncertainty.

- “[Quote from a prominent analyst expressing a positive outlook and the reasoning behind it]”, stated [Analyst's Name], [Analyst's Title] at [Institution Name].

- The emphasis on stability was seen as beneficial for long-term investment planning.

Negative Interpretations or Cautious Outlooks

Other analysts remained skeptical, highlighting the potential for future volatility.

- “[Quote from an analyst expressing concerns and reservations]”, warned [Analyst's Name], [Analyst's Title] at [Institution Name].

- Concerns focused on the potential for future policy conflicts between the President and the Fed.

Uncertainty and Volatility

Despite Trump's assurance, considerable uncertainty remains in the market.

- The ongoing trade disputes continue to impact investor confidence.

- The future trajectory of interest rates remains uncertain.

- Lingering political uncertainty contributes to market volatility.

Long-Term Implications for the Economy and Markets

The long-term consequences of Trump's assurance on Powell's position remain to be seen.

Impact on Monetary Policy

Trump's statement could indirectly influence the Fed's future policy decisions.

- A perception of presidential support might embolden the Fed to maintain its current course.

- Conversely, continued political pressure could lead to alterations in monetary policy.

Investor Confidence and Risk Appetite

The event's overall impact on investor confidence and risk appetite is a key factor.

- Continued uncertainty might lead to reduced investment.

- Conversely, a renewed sense of stability could boost economic growth.

Political Uncertainty and Market Stability

Political uncertainty remains a significant factor impacting market stability.

- [Mention any ongoing political events that might affect market sentiment].

- The long-term impact on investor confidence will depend on the resolution of these issues.

Conclusion: Market Reaction: Trump's Assurance on Fed Chair Powell's Position

In conclusion, the market reaction to Trump's assurance on Fed Chair Powell's position was initially mixed, with stock, bond, and currency markets exhibiting varying degrees of volatility. Analyst interpretations were divided, reflecting the inherent uncertainties. The long-term implications for the economy and markets will depend on several factors, including the resolution of ongoing trade disputes and the overall level of political uncertainty. Key takeaways include the immediate fluctuations in major indices, changes in Treasury yields, and the US dollar's movement against other currencies. Stay tuned for further updates on the market reaction to Trump's stance on Fed Chair Powell, and continue analyzing the market reaction to Trump's influence on the Federal Reserve's decisions. Understanding the interplay between political pronouncements and market dynamics is crucial for informed investment strategies. The significance of monitoring the market reaction to such pronouncements cannot be overstated.

Featured Posts

-

Disappearance And Discovery A Shark Infested Beachs Dark Turn

Apr 24, 2025

Disappearance And Discovery A Shark Infested Beachs Dark Turn

Apr 24, 2025 -

White House Cocaine Incident Secret Service Investigation Concludes

Apr 24, 2025

White House Cocaine Incident Secret Service Investigation Concludes

Apr 24, 2025 -

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025

Trumps Transgender Sports Ban Faces Legal Challenge From Minnesota Ag

Apr 24, 2025 -

Blue Origin Launch Scrubbed Details On Vehicle Subsystem Issue

Apr 24, 2025

Blue Origin Launch Scrubbed Details On Vehicle Subsystem Issue

Apr 24, 2025 -

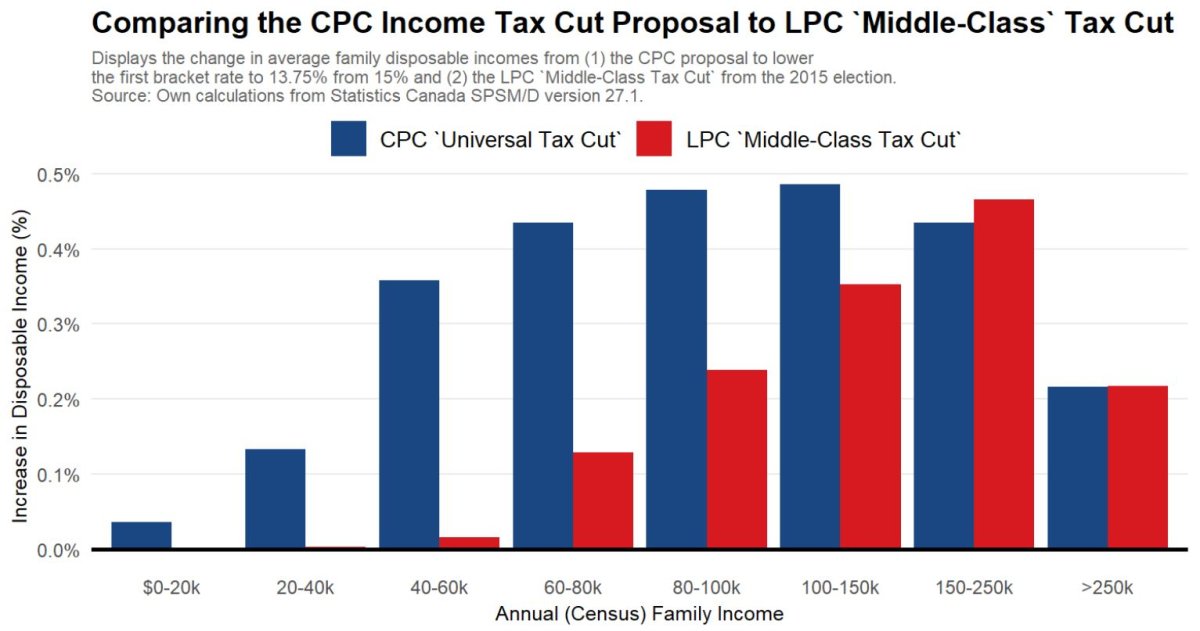

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025