MicroStrategy Stock And Bitcoin: Predicting The Best Investment For 2025

Table of Contents

Analyzing MicroStrategy Stock (MSTR) in 2025

MicroStrategy's Business Model and Bitcoin Holdings

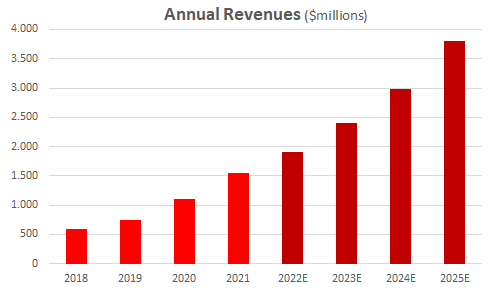

MicroStrategy (MSTR) is a business intelligence company, but its stock price is heavily influenced by its substantial Bitcoin holdings. The company has made a bold strategic move by accumulating a significant amount of Bitcoin, making it one of the largest corporate holders of the cryptocurrency. This means Bitcoin's price directly impacts MSTR's valuation; a rising Bitcoin price generally boosts MSTR's stock price, and vice versa. While MicroStrategy generates revenue through its software solutions, analysts closely monitor its financial health considering factors like revenue growth, earnings per share, and debt levels. These metrics, alongside the Bitcoin holdings, paint a comprehensive picture of MSTR's financial standing.

- Key Risks: Bitcoin price volatility, regulatory changes impacting cryptocurrency, potential write-downs on Bitcoin holdings.

- Key Opportunities: Further Bitcoin price appreciation, increased institutional adoption of Bitcoin, expansion of MicroStrategy's core business.

Market Sentiment and Future Predictions for MSTR

Current market sentiment towards MSTR is complex and fluctuates with Bitcoin's price. Many investors view MSTR as a leveraged play on Bitcoin, meaning its price movements are amplified by Bitcoin's performance. Predicting MSTR's price in 2025 requires considering several factors:

- Regulatory Changes: Increased regulatory clarity (or uncertainty) surrounding Bitcoin could significantly impact MSTR's stock price.

- Bitcoin Adoption: Widespread Bitcoin adoption by institutions and individuals would likely be positive for MSTR.

- Macroeconomic Conditions: Global economic factors like inflation, interest rates, and recessionary fears will play a role.

Experts' forecasts on MSTR vary widely, reflecting the inherent uncertainty in the cryptocurrency market. Some analysts predict significant growth, driven by increased Bitcoin adoption, while others express caution due to the risks associated with Bitcoin's volatility.

- Positive Impacts: Increased Bitcoin adoption, positive regulatory developments, strong performance in MicroStrategy's core business.

- Negative Impacts: Sharp decline in Bitcoin price, negative regulatory changes, economic downturn impacting software sales.

Bitcoin's Potential in 2025: A Crypto Investment Perspective

Bitcoin's Price Volatility and Long-Term Growth

Bitcoin's price has historically been highly volatile, exhibiting significant ups and downs. Despite this volatility, many believe Bitcoin has long-term growth potential. Several factors influence its price:

-

Adoption Rate: Increased global adoption by individuals and businesses drives demand and potentially higher prices.

-

Institutional Investment: Growing investment from large institutions legitimizes Bitcoin and boosts demand.

-

Technological Advancements: Improvements in Bitcoin's underlying technology enhance its scalability and efficiency.

-

Inflation Hedge: Many investors view Bitcoin as a hedge against inflation, potentially increasing demand during periods of economic uncertainty.

-

Potential Risks: Regulatory uncertainty, security breaches, competition from other cryptocurrencies.

Bitcoin Adoption and Institutional Interest

Bitcoin adoption is growing steadily, fueled by increased institutional interest. Many large corporations and financial institutions are now holding Bitcoin on their balance sheets, viewing it as a potential asset diversification strategy. The emergence of Bitcoin ETFs and other financial instruments makes it easier for institutional investors to gain exposure to Bitcoin.

- Factors Driving Adoption: Increased awareness, institutional investment, development of user-friendly wallets and exchanges, regulatory clarity in some jurisdictions.

MicroStrategy Stock vs. Bitcoin: A Comparative Analysis

Risk Tolerance and Investment Strategies

Investing in MSTR stock and investing directly in Bitcoin carry different risk profiles. MSTR offers some diversification through its core business, but its stock price is still heavily reliant on Bitcoin's performance. Direct Bitcoin investment exposes investors to the full volatility of the cryptocurrency market.

- MSTR: Moderate to high risk, depending on Bitcoin's price.

- Bitcoin: High risk, due to extreme price volatility.

Investors should choose their investment based on their risk tolerance and investment goals. Diversification is crucial, and investors might consider allocating a portion of their portfolio to both MSTR and Bitcoin, or use alternative investment strategies, such as dollar-cost averaging, to mitigate risk.

- Key Differences: MSTR provides some diversification but is highly correlated with Bitcoin; direct Bitcoin investment offers higher potential returns but also higher risk.

Predicting the Best Investment for 2025

Predicting the "best" investment is challenging and depends on numerous factors. However, considering the potential for continued Bitcoin adoption, alongside positive regulatory developments and a generally bullish macroeconomic outlook (though this is highly speculative), we predict that Bitcoin may outperform MSTR in 2025. However, MSTR's core business provides a degree of stability not found in a direct Bitcoin investment.

- Key Factors Influencing Prediction: Bitcoin adoption rate, regulatory landscape, macroeconomic conditions, technological advancements in the cryptocurrency space.

Conclusion: MicroStrategy Stock and Bitcoin: Making Informed Investment Decisions

This analysis highlights the complexities of investing in both MicroStrategy stock and Bitcoin. While Bitcoin presents higher risk and reward potential, MSTR provides a less volatile, albeit still Bitcoin-correlated, investment option. Our prediction leans towards Bitcoin outperforming MSTR in 2025, but this is not a guaranteed outcome. Thorough research and understanding of your own risk tolerance are critical. Before investing in either MicroStrategy stock or Bitcoin, conduct further research and seek professional financial advice tailored to your individual circumstances and investment goals. Remember, successful investing in MicroStrategy Stock and effective Bitcoin investment strategies require careful planning and risk management.

Featured Posts

-

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Automakers

May 09, 2025

The China Factor Analyzing The Struggles Of Bmw Porsche And Other Automakers

May 09, 2025 -

Post 2025 Nhl Trade Deadline A Look At Potential Playoff Contenders

May 09, 2025

Post 2025 Nhl Trade Deadline A Look At Potential Playoff Contenders

May 09, 2025 -

Rimeyk Na Stivn King Ot Netflix Kakvo Znaem Dosega

May 09, 2025

Rimeyk Na Stivn King Ot Netflix Kakvo Znaem Dosega

May 09, 2025 -

Puolivaelieraet Mestarien Liigassa Bayern Inter Ja Psg Etenevaet

May 09, 2025

Puolivaelieraet Mestarien Liigassa Bayern Inter Ja Psg Etenevaet

May 09, 2025 -

Is 40 Palantir Stock Growth In 2025 Achievable Investment Analysis

May 09, 2025

Is 40 Palantir Stock Growth In 2025 Achievable Investment Analysis

May 09, 2025