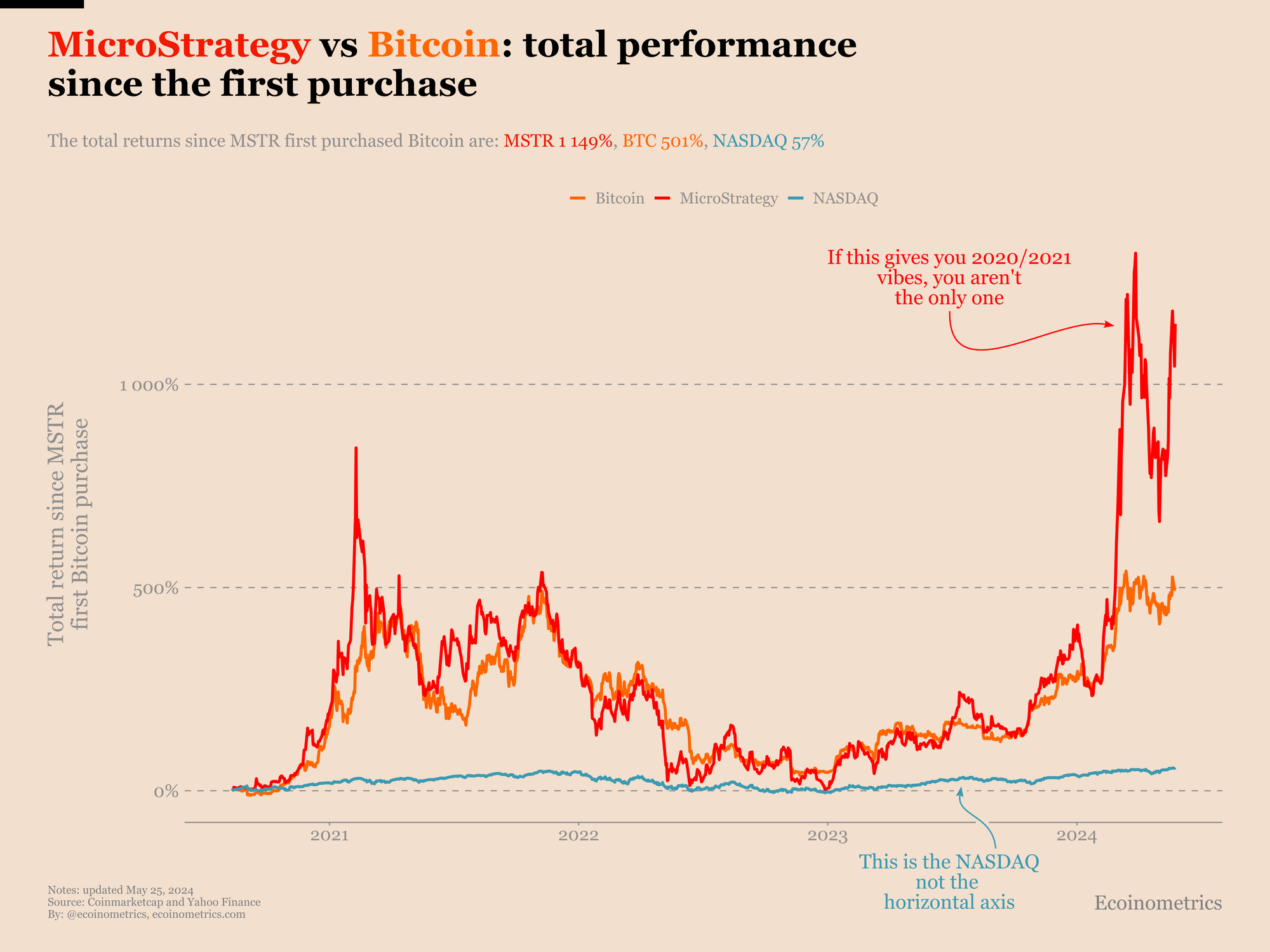

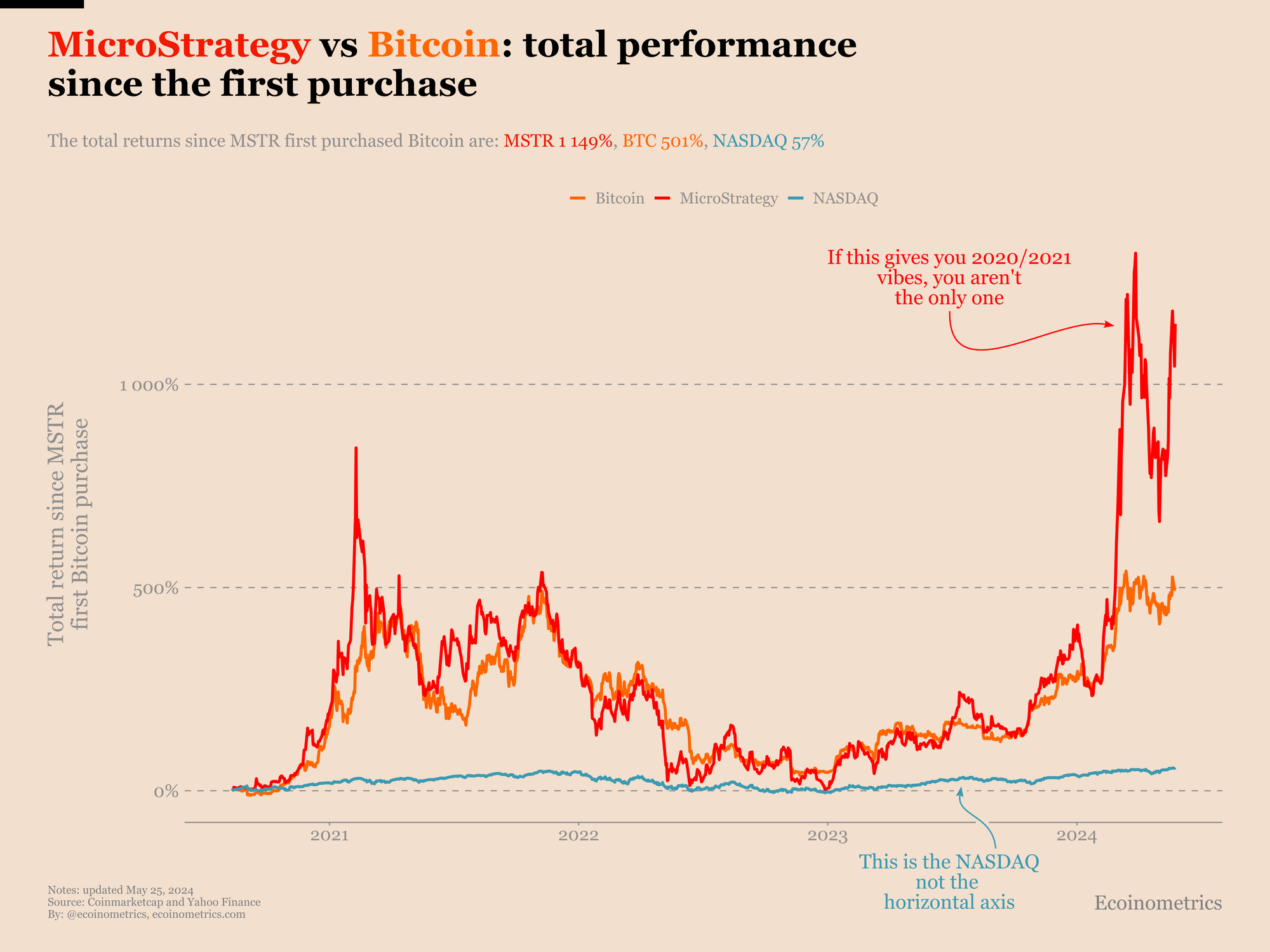

MicroStrategy Stock Vs. Bitcoin: A 2025 Investment Comparison

Table of Contents

Understanding MicroStrategy's Bitcoin Strategy

MicroStrategy's investment in Bitcoin has fundamentally altered its profile, making a comparison with direct Bitcoin investment particularly interesting. Let's dissect the company's approach.

MicroStrategy's Business Model

MicroStrategy's core business revolves around providing enterprise analytics and business intelligence software. Their offerings help organizations gain insights from their data.

- Software Sales: A significant portion of their revenue comes from the sale of licenses for their software.

- Recurring Revenue Streams: They also generate revenue through maintenance, support, and cloud-based subscription services. This creates a degree of predictable income.

- Competition in the Market: The enterprise analytics market is competitive, with players like Tableau, Qlik, and SAP posing significant challenges.

Bitcoin as a Corporate Asset

MicroStrategy's most defining characteristic is its substantial Bitcoin holdings. This makes the company’s performance closely tied to Bitcoin's price.

- Total Bitcoin Owned: As of [Insert Latest Data - Find the most up-to-date number of Bitcoins held by MicroStrategy], MicroStrategy holds a significant amount of Bitcoin.

- Average Purchase Price: Knowing MicroStrategy's average purchase price is crucial for assessing their potential profit or loss depending on Bitcoin's future value.

- Impact on Market Capitalization: The value of MicroStrategy's Bitcoin holdings significantly influences its overall market capitalization, creating volatility.

Risks and Rewards of Investing in MicroStrategy Stock

Investing in MicroStrategy stock means exposure to both its software business and its Bitcoin holdings.

- Volatility Linked to Bitcoin: The price of MicroStrategy stock is highly correlated with the price of Bitcoin. A drop in Bitcoin's price directly impacts MicroStrategy's valuation.

- Software Business Performance: The success of MicroStrategy's core software business independently influences its stock price. Strong software sales can offset some Bitcoin-related losses.

- Overall Market Conditions: Macroeconomic factors, such as interest rates and inflation, will influence both Bitcoin's price and the overall stock market, impacting MicroStrategy's valuation.

Bitcoin's Price Prediction and Market Factors

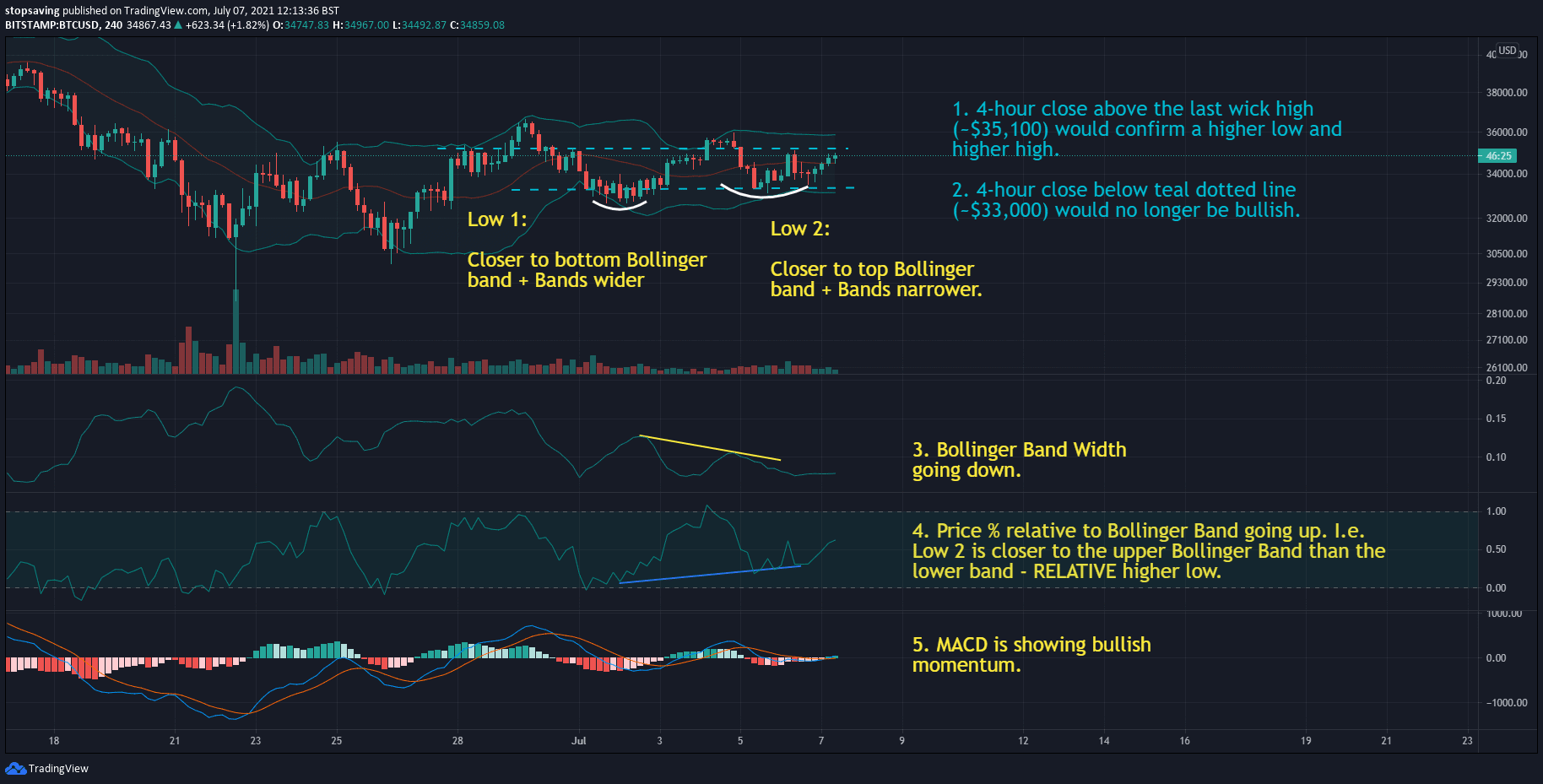

Bitcoin's inherent volatility is a key factor in any investment decision.

Bitcoin's Price Volatility

Bitcoin has experienced wild price swings since its inception.

- Regulatory Changes: Government regulations and policies around the world significantly influence Bitcoin's price.

- Adoption Rate: Increasing adoption by businesses and individuals fuels demand and price growth.

- Technological Advancements: Upgrades and developments in the Bitcoin network can impact its price and security.

- Macroeconomic Factors: Global economic conditions play a significant role in Bitcoin's price.

Factors Influencing Bitcoin's Future Price

Predicting Bitcoin's price is inherently speculative, but several factors could influence its value by 2025.

- Widespread Adoption: Increased institutional and individual adoption will likely drive price increases.

- Institutional Investment: Continued investment from large financial institutions adds legitimacy and boosts demand.

- Technological Upgrades: Improvements in scalability and transaction speed can enhance Bitcoin's usability.

- Potential Regulation: Clearer regulatory frameworks could increase trust and reduce volatility.

Risks and Rewards of Direct Bitcoin Investment

Investing directly in Bitcoin offers potentially high returns but also carries significant risks.

- High Volatility: Bitcoin's price is notoriously volatile, subject to rapid and substantial fluctuations.

- Security Risks: Losing access to your Bitcoin wallet due to hacking or losing your private keys could lead to irreversible loss.

- Regulatory Uncertainty: Changes in government regulations could negatively impact the value of Bitcoin.

- Potential for Complete Loss: There's always a possibility of losing your entire investment.

Direct Comparison: MicroStrategy Stock vs. Bitcoin (2025)

Let's compare the two investment options, bearing in mind that any prediction is inherently speculative.

Investment Strategies

Both MicroStrategy stock and Bitcoin require different approaches.

- Risk Tolerance: Bitcoin demands a higher risk tolerance than MicroStrategy stock, due to Bitcoin's greater volatility.

- Investment Goals: Your investment goals (short-term gains vs. long-term growth) will inform your choice.

- Diversification Strategies: Both assets can play a part in a diversified portfolio, but their proportion should depend on your risk profile.

Potential Returns and Risks

Predicting specific returns is impossible, but we can assess the potential.

- Upside Potential: Bitcoin has significantly higher upside potential than MicroStrategy stock, but this comes with greater risk.

- Downside Risk: Conversely, the downside risk is substantially higher for Bitcoin.

- Probability of Success/Failure: The probability of significant gains or losses is much higher with Bitcoin than with MicroStrategy stock.

Diversification and Portfolio Allocation

Diversification is key to managing risk.

- Asset Allocation Strategies: Neither MicroStrategy stock nor Bitcoin should constitute the entirety of your investment portfolio.

- Risk Management Techniques: Diversifying your holdings across different asset classes minimizes the impact of any single investment's underperformance.

Conclusion

Making informed decisions about MicroStrategy Stock vs. Bitcoin requires careful consideration of your risk tolerance and investment goals. MicroStrategy offers a more stable investment, partially exposed to Bitcoin's volatility, while direct Bitcoin investment carries significantly higher risk and potential reward. Both options have their place in a well-diversified portfolio, but the proportion dedicated to each should reflect your individual risk appetite. Conduct thorough research and consult with a financial advisor before making any investment decisions. Consider your risk profile before investing in either MicroStrategy stock or Bitcoin. Remember that investing in cryptocurrency and volatile stocks carries substantial risk.

Featured Posts

-

The Night Counting Crows Changed Their Snl Story

May 08, 2025

The Night Counting Crows Changed Their Snl Story

May 08, 2025 -

Bitcoin Rally Imminent Analysts May 6th Chart Analysis

May 08, 2025

Bitcoin Rally Imminent Analysts May 6th Chart Analysis

May 08, 2025 -

Gambling On Disaster The Rise Of Wildfire Betting In Los Angeles

May 08, 2025

Gambling On Disaster The Rise Of Wildfire Betting In Los Angeles

May 08, 2025 -

The End Of Ryujinx Nintendo Contact And Development Halt

May 08, 2025

The End Of Ryujinx Nintendo Contact And Development Halt

May 08, 2025 -

Celtics Vs Nets Jayson Tatums Availability Tonight

May 08, 2025

Celtics Vs Nets Jayson Tatums Availability Tonight

May 08, 2025