Microsoft: A Safe Haven In The Software Stock Market Amidst Tariff Uncertainty

Table of Contents

Microsoft's Diversified Revenue Streams Minimize Tariff Risk

Microsoft's diversified business model is a key factor in its resilience. Unlike companies heavily reliant on single products or specific geographical markets, Microsoft operates across various sectors, mitigating the impact of any single tariff. This diversification across cloud computing, software licensing, gaming, and other areas significantly reduces its vulnerability to trade wars.

- Azure's global reach: Microsoft's cloud computing platform, Azure, boasts a significant global presence. This broad reach minimizes dependence on any single region, insulating it from localized tariff impacts.

- Office 365's recurring revenue: The subscription-based model of Office 365 generates consistent recurring revenue streams, less susceptible to the immediate shocks of trade disputes. This predictable income flow provides stability even during periods of market uncertainty.

- Gaming and other divisions: Xbox, LinkedIn, and other divisions contribute to Microsoft's overall revenue diversification. This strategy spreads risk, preventing the company from being overly reliant on any one segment.

According to Microsoft's financial reports, Intelligent Cloud (including Azure) accounts for a significant portion of its revenue, while Productivity and Business Processes (including Office 365) contribute another substantial chunk. This balanced portfolio demonstrates its strategic diversification.

Strong Brand Recognition and Customer Loyalty Insulate Microsoft

Microsoft's long-standing brand recognition and substantial customer loyalty provide an additional layer of protection against market volatility. The switching costs for enterprise clients using Microsoft products, such as Windows and Office, are considerable. This entrenched position creates a significant barrier to entry for competitors, further solidifying Microsoft's market dominance.

- High switching costs: Businesses invested heavily in Microsoft’s ecosystem face significant costs and disruption in migrating to alternative solutions. This loyalty translates into stable demand.

- Essential software: The continued, consistent demand for Windows, Office, and other essential Microsoft software ensures consistent revenue streams, regardless of broader market fluctuations.

- Strong brand reputation: Microsoft's established reputation contributes to its market resilience. Customers trust the brand and are less likely to switch during periods of uncertainty.

Microsoft maintains a leading market share in operating systems and productivity software, highlighting its dominant position within the industry. This market leadership strengthens its resistance to external pressures like tariff uncertainty.

Microsoft's Strategic Investments in Growth Areas

Microsoft’s proactive investments in high-growth sectors like AI, cloud computing, and cybersecurity are strategically future-proofing the company. These strategic moves demonstrate a commitment to long-term growth and stability.

- Azure expansion: Microsoft continues to aggressively expand Azure, aiming to further strengthen its competitive position against AWS and Google Cloud. This ongoing investment ensures its continued dominance in the cloud computing market.

- AI research and development: Significant investments in AI research and development are positioning Microsoft at the forefront of technological innovation. This innovative approach ensures its adaptability to evolving market demands.

- Cybersecurity solutions: The growing demand for robust cybersecurity solutions creates a lucrative growth opportunity for Microsoft, aligning its future with a crucial and ever-expanding market.

Recent acquisitions and strategic partnerships further highlight Microsoft's commitment to innovation and growth in these key sectors, bolstering its position as a leader in technology.

Analyzing Microsoft's Stock Performance Compared to Competitors

A comparison of Microsoft's stock performance against other technology companies during periods of tariff uncertainty reveals its relative stability. While other tech companies experienced significant fluctuations, Microsoft’s stock demonstrated notable resilience, highlighting its inherent strength as a safe haven investment. (Charts and graphs comparing Microsoft's stock performance to competitors would be included here) This comparative analysis underscores the company's ability to weather market storms.

Conclusion: Investing in Microsoft as a Safe Haven During Tariff Uncertainty

In summary, Microsoft's diversified revenue streams, strong brand loyalty, strategic investments in growth sectors, and relatively stable stock performance during periods of market uncertainty make it a compelling investment option. Its resilience to tariff impacts and market volatility positions it as a robust "safe haven" investment. The arguments presented reinforce Microsoft’s position as a relatively secure choice in the current climate. Consider adding Microsoft to your portfolio as a safe haven investment during this period of tariff uncertainty, diversifying your holdings and mitigating the risks associated with market volatility. Investing in Microsoft offers a path to mitigating risk while participating in the growth of a technology leader.

Featured Posts

-

Andor Season 2 The Probability Of Rebels Characters Joining The Cast

May 15, 2025

Andor Season 2 The Probability Of Rebels Characters Joining The Cast

May 15, 2025 -

Positive Monsoon Forecast To Boost Indian Agriculture And Consumption

May 15, 2025

Positive Monsoon Forecast To Boost Indian Agriculture And Consumption

May 15, 2025 -

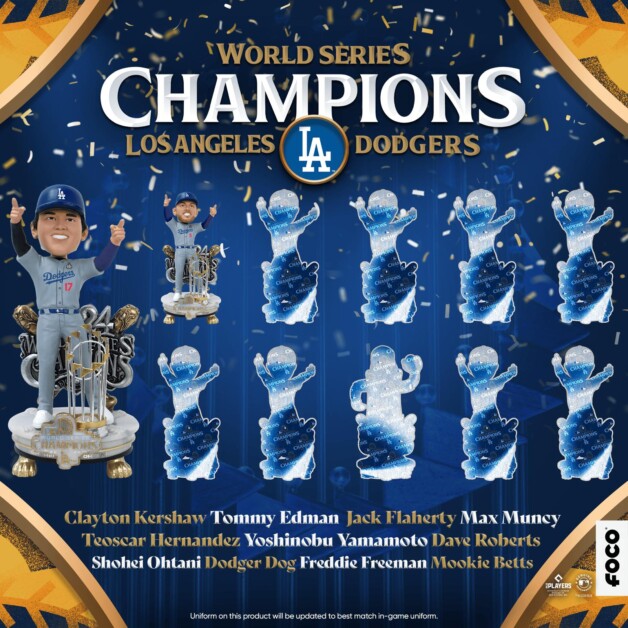

Analyzing The Los Angeles Dodgers 2024 Offseason

May 15, 2025

Analyzing The Los Angeles Dodgers 2024 Offseason

May 15, 2025 -

Roma Monza Partido En Directo

May 15, 2025

Roma Monza Partido En Directo

May 15, 2025 -

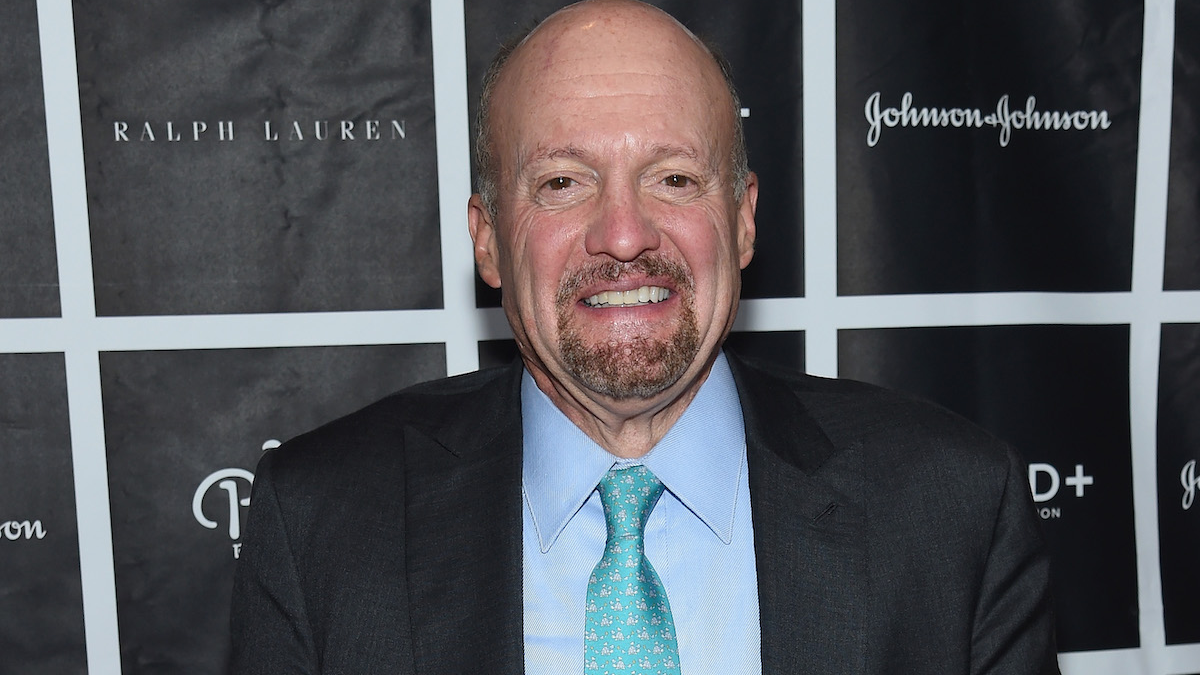

Foot Locker Inc Fl Jim Cramers Winning Stock Pick Analysis

May 15, 2025

Foot Locker Inc Fl Jim Cramers Winning Stock Pick Analysis

May 15, 2025