Microsoft-Activision Deal: FTC's Appeal And Future Implications

Table of Contents

The FTC's Arguments Against the Microsoft-Activision Merger

The FTC's core argument against the Microsoft-Activision merger hinges on its potential to stifle competition and create a monopoly. Their concerns extend across multiple sectors within the gaming ecosystem.

Concerns about Market Domination

The FTC fears that Microsoft, already a major player with Xbox, will gain undue market power by acquiring Activision Blizzard. This concern extends beyond consoles to encompass subscription services like Game Pass and the rapidly expanding cloud gaming market. The FTC's worries include:

- Increased prices for games: Reduced competition could lead to higher prices for consumers across various platforms.

- Reduced competition: The merger could significantly lessen competition, giving Microsoft an unfair advantage over other game publishers and developers.

- Limited consumer choice: A dominant Microsoft could restrict the availability of Activision Blizzard titles on competing platforms, limiting consumer choice.

- Exclusion of rival game developers and publishers: Microsoft's increased market share could be used to leverage exclusive deals, potentially pushing out smaller rivals.

Impact on Call of Duty and other Activision Franchises

A central focus of the FTC's concern is Call of Duty, one of the world's most popular video game franchises. Making Call of Duty exclusive to Xbox, the FTC argues, would severely harm competitors like Sony PlayStation and damage the overall gaming market. Their specific concerns include:

- Loss of access for PlayStation users: Millions of PlayStation users could lose access to Call of Duty, a significant blow to PlayStation's appeal.

- Harm to competitors like Sony: Losing a flagship franchise like Call of Duty could significantly weaken Sony's position in the market.

- Effects on the overall gaming market: The potential for exclusive titles could set a dangerous precedent, impacting innovation and market diversity.

The Role of Cloud Gaming

The FTC also highlights the growing importance of cloud gaming, emphasizing Microsoft’s potential dominance in this sector post-merger. They argue that:

- Microsoft's potential dominance in cloud gaming: The merger would give Microsoft a substantial lead in cloud gaming, potentially shutting out smaller competitors.

- Restrictions on access for rival cloud gaming services: Microsoft could use its control over Activision Blizzard's titles to restrict access for rival cloud gaming platforms.

- The importance of cloud gaming in the future of the industry: The FTC believes that maintaining competition in the cloud gaming market is crucial for the future of the industry.

Microsoft's Defense and Counterarguments

Microsoft has vehemently defended the merger, presenting counterarguments to the FTC’s claims. Their strategy focuses on showcasing the benefits of the acquisition for consumers and maintaining a competitive landscape.

Promises of Continued Multi-Platform Releases

Microsoft has committed to continuing Call of Duty releases on PlayStation and other platforms, emphasizing its commitment to fair competition. These commitments include:

- Long-term agreements for Call of Duty on PlayStation: Microsoft has publicly offered long-term contracts to ensure Call of Duty remains available on PlayStation.

- Commitment to fair competition: Microsoft has consistently maintained that the merger will not harm competition, instead fostering innovation and growth.

- Statements regarding the continued availability of Activision Blizzard games on other platforms: Microsoft has repeatedly stated its intention to maintain the availability of Activision Blizzard games across multiple platforms.

Benefits of the Merger for Consumers

Microsoft argues the merger will benefit consumers by:

- Faster game development: Increased resources could lead to quicker development cycles and more frequent releases of high-quality games.

- Enhanced game quality: Combining resources and expertise could lead to improvements in game graphics, gameplay, and overall experience.

- Integration of services: The merger could lead to better integration between services like Xbox Game Pass and Activision Blizzard's games.

Microsoft's Perspective on Cloud Gaming Competition

Microsoft counters the FTC’s cloud gaming concerns by arguing that:

- Emphasis on open cloud gaming platforms: Microsoft emphasizes its commitment to open cloud gaming platforms, ensuring access for various developers and services.

- Focus on fostering innovation: Microsoft argues the merger will drive innovation and competition in the cloud gaming space.

Potential Outcomes and Implications of the FTC Appeal

The FTC's appeal presents several possible scenarios with wide-ranging implications.

Scenarios Following the Appeal

The appeal could result in:

- FTC victory: The FTC could overturn the initial decision, blocking the merger entirely.

- Microsoft victory: A court could uphold the initial decision, allowing the merger to proceed.

- A negotiated settlement: Both parties might reach a compromise, potentially involving concessions from Microsoft.

These outcomes will have significant ripple effects:

- Impact on future mergers and acquisitions in the gaming industry: The ruling will set a precedent for future mergers and acquisitions in the gaming sector, potentially influencing regulatory scrutiny.

- Potential for regulatory changes: The outcome could lead to changes in antitrust regulations and enforcement in the gaming industry.

- Effects on stock prices and investor confidence: The decision will undoubtedly impact the stock prices of Microsoft and Activision Blizzard, as well as investor confidence in the gaming market.

Wider Implications for the Gaming Industry

The ultimate outcome of the FTC's appeal will profoundly shape the future of the gaming industry:

- Changes to game development and distribution: The ruling could lead to shifts in game development practices and distribution models.

- Impact on consumer behavior: The availability and pricing of games could significantly impact consumer spending habits.

- Evolution of the regulatory environment: The legal battle will influence the regulatory landscape, potentially increasing scrutiny of future mergers and acquisitions.

Conclusion: The Future of the Microsoft-Activision Deal and its Impact

The FTC's appeal of the Microsoft-Activision Deal is a watershed moment for the gaming industry. The arguments presented by both sides highlight crucial issues related to market dominance, competition, and the future of gaming. The potential outcomes—ranging from a complete block of the merger to its full approval—carry far-reaching consequences. The decision will not only impact the giants involved but will also significantly reshape the gaming landscape for developers, publishers, and, most importantly, gamers. Stay tuned for further updates on the Microsoft-Activision Deal as this crucial legal battle unfolds and shapes the future of the gaming industry.

Featured Posts

-

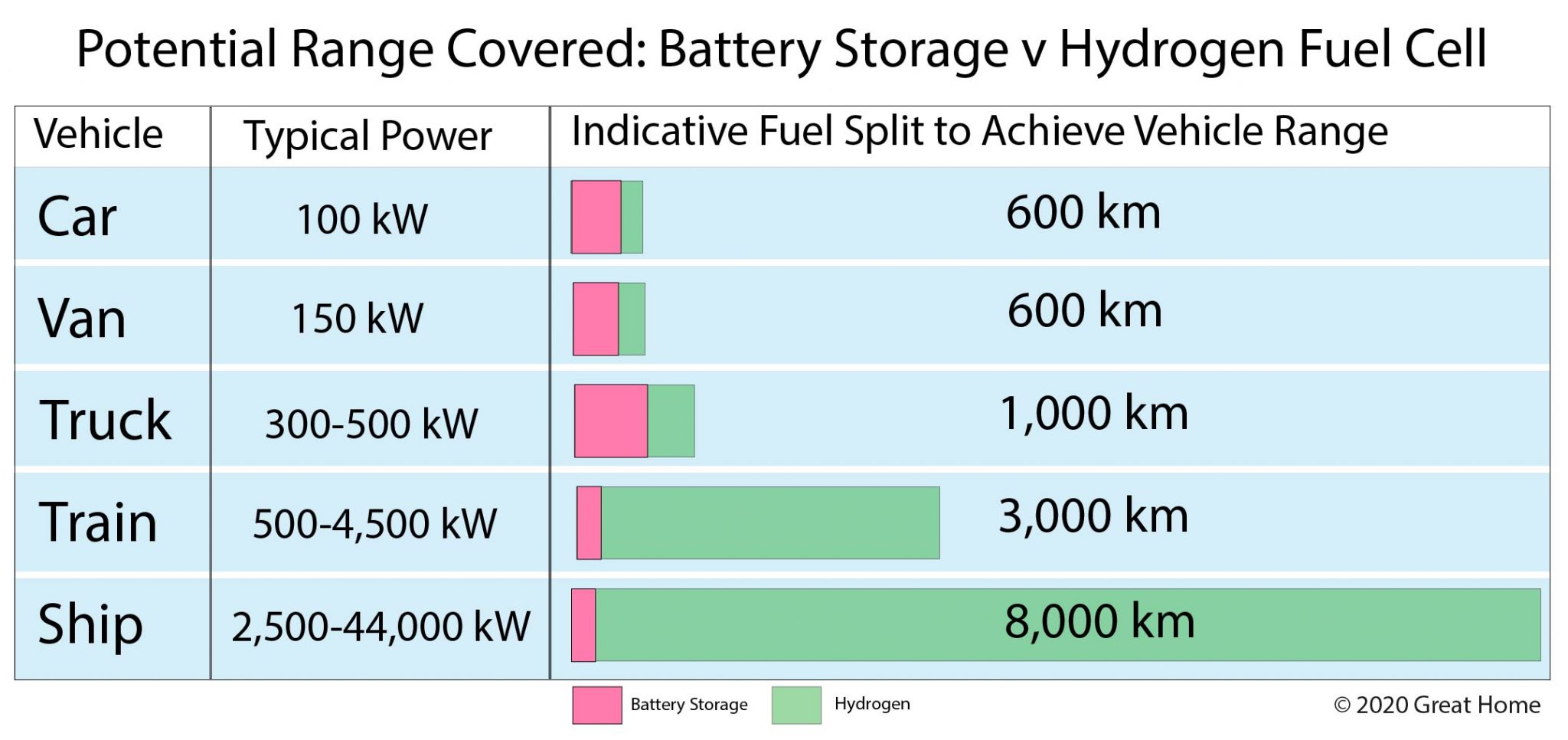

European Public Transport A Deep Dive Into Hydrogen And Battery Bus Technologies

May 07, 2025

European Public Transport A Deep Dive Into Hydrogen And Battery Bus Technologies

May 07, 2025 -

Grayscales Xrp Etf Filing Impact On Xrp Price And Market Dominance Over Bitcoin

May 07, 2025

Grayscales Xrp Etf Filing Impact On Xrp Price And Market Dominance Over Bitcoin

May 07, 2025 -

Should The Wolves Trade For Julius Randle A Thorough Analysis

May 07, 2025

Should The Wolves Trade For Julius Randle A Thorough Analysis

May 07, 2025 -

Fakt W Onet Premium Promocyjna Cena I Korzysci

May 07, 2025

Fakt W Onet Premium Promocyjna Cena I Korzysci

May 07, 2025 -

Jenna Ortega Raconte Son Experience Avec Lady Gaga Sur Le Tournage De Mercredi

May 07, 2025

Jenna Ortega Raconte Son Experience Avec Lady Gaga Sur Le Tournage De Mercredi

May 07, 2025