Bitcoin Price Climbs Amidst Easing Trade Tensions And Fed Uncertainty

Table of Contents

Easing Trade Tensions Boost Bitcoin's Appeal

Reduced global trade conflicts have created a more positive investment climate, significantly impacting the cryptocurrency market. This decrease in international friction translates to a decreased "risk-off" sentiment among investors. With less fear surrounding global instability, capital is flowing into alternative assets, including Bitcoin. This renewed investor confidence is a major driver behind the recent Bitcoin price climb.

- Decreased uncertainty leads to increased investor confidence: When trade wars and geopolitical tensions ease, investors feel more comfortable taking on risk, leading to a greater appetite for investments previously considered volatile.

- Safe-haven assets, including Bitcoin, become less attractive during times of reduced global conflict: While Bitcoin is often considered a safe haven asset during times of economic or political uncertainty, the reduced global risk appetite makes other investment options appear more attractive leading to reduced demand in the short term. However, the long term appeal remains, and other factors drive prices upward.

- Potential for increased cross-border transactions using Bitcoin: As trade barriers diminish, the use of Bitcoin for facilitating seamless cross-border transactions becomes even more appealing, boosting its overall demand and contributing to the Bitcoin price climb.

The easing of global trade tensions contributes to a positive feedback loop: increased investor confidence leads to increased investment in Bitcoin, and this increased investment further strengthens the overall perception of the cryptocurrency and the market in general. This effect is particularly noticeable in the context of "Bitcoin investment" strategies.

Fed Uncertainty and Bitcoin's Safe-Haven Status

The Federal Reserve's monetary policy decisions significantly influence Bitcoin's price. Uncertainty about future interest rate hikes creates a ripple effect, impacting investor behavior and driving demand for alternative assets like Bitcoin. The potential for inflation, driven by unpredictable monetary policy, is a key factor in the current Bitcoin price climb.

- Increased inflation expectations drive demand for Bitcoin as a store of value: Many investors see Bitcoin as a hedge against inflation, believing its limited supply and decentralized nature protect it from the devaluation that can accompany inflationary pressures.

- Unpredictable monetary policy can lead investors to seek refuge in alternative assets: When traditional financial markets become volatile due to uncertainty in monetary policy, investors often turn to less correlated assets like Bitcoin, driving up demand and ultimately its price.

- Bitcoin's decentralized nature makes it less susceptible to central bank manipulation: Unlike fiat currencies, Bitcoin's decentralized nature protects it from the potential negative impacts of central bank actions, increasing its appeal as a store of value.

Keywords like "Federal Reserve," "interest rates," "inflation hedge," and "Bitcoin as a store of value" highlight the crucial role of macroeconomic factors in the recent Bitcoin price climb.

Technical Analysis of the Bitcoin Price Climb

A look at technical indicators provides further evidence supporting the recent price surge. Several bullish chart patterns, coupled with significant increases in trading volume, indicate strong upward momentum.

- Chart patterns indicating bullish momentum: Technical analysts have identified various bullish signals on the Bitcoin chart, suggesting a sustained upward trend.

- Increase in trading volume confirming price movement: High trading volumes accompanying the price increase confirm the strength of the upward movement, and indicate strong investor interest in the cryptocurrency.

- Breaking of key resistance levels: The recent price surge has seen Bitcoin break through several key resistance levels, reinforcing the bullish trend and setting the stage for potentially further gains.

- Potential for further price appreciation or consolidation: While the future is always uncertain, the current indicators point towards a potential for further price appreciation or at least a period of price consolidation before a further climb.

Understanding "technical analysis," including factors like "Bitcoin chart," "trading volume," "support and resistance," and "bullish trend," is essential for interpreting the current price movement and potential future price predictions.

Impact on the Broader Cryptocurrency Market

Bitcoin's price climb has a significant ripple effect on the broader cryptocurrency market. Often acting as a market leader, Bitcoin's performance heavily influences other cryptocurrencies (altcoins).

- Bitcoin often acts as a market leader, influencing other cryptocurrencies: A positive trend in Bitcoin frequently results in a positive sentiment across the entire cryptocurrency market.

- Increased investor interest in Bitcoin can spill over into the altcoin market: As investor confidence in the cryptocurrency market grows due to Bitcoin's price increase, investors often become more willing to invest in altcoins, increasing the overall market capitalization.

- Potential for altcoin price increases as investor confidence grows: The positive momentum from Bitcoin often translates to gains in the altcoin market, further contributing to the overall growth of the cryptocurrency ecosystem.

The correlation between Bitcoin and other cryptocurrencies, the "cryptocurrency market capitalization," and general "crypto investment" strategies are all important aspects to consider in understanding the broader implications of the recent Bitcoin price climb.

Conclusion

The recent Bitcoin price climb is largely attributable to two key factors: the easing of global trade tensions and the uncertainty surrounding the Federal Reserve's monetary policy. These factors have significantly influenced investor sentiment and capital flows, driving demand for Bitcoin as both a safe-haven asset and a potential hedge against inflation. Technical analysis further supports the bullish trend, suggesting potential for further price appreciation. To make informed investment decisions, it's crucial to monitor the Bitcoin price, stay updated on Bitcoin news, and learn more about Bitcoin investment. Understanding Bitcoin price analysis and Bitcoin market trends will be essential for navigating this exciting and dynamic market. Stay informed and make wise choices in your Bitcoin investment journey.

Featured Posts

-

Trumps Comments On Powell Stability For The Federal Reserve

Apr 24, 2025

Trumps Comments On Powell Stability For The Federal Reserve

Apr 24, 2025 -

Whataburger Video Propels Hisd Mariachi To Uil State

Apr 24, 2025

Whataburger Video Propels Hisd Mariachi To Uil State

Apr 24, 2025 -

The Business Of Deportation How One Startup Airline Is Making It Work

Apr 24, 2025

The Business Of Deportation How One Startup Airline Is Making It Work

Apr 24, 2025 -

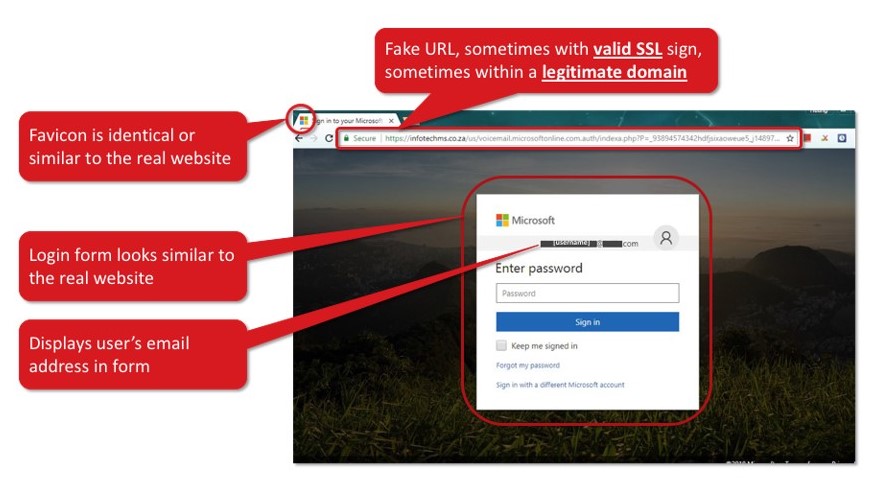

Office 365 Security Failure Leads To Multi Million Dollar Theft

Apr 24, 2025

Office 365 Security Failure Leads To Multi Million Dollar Theft

Apr 24, 2025 -

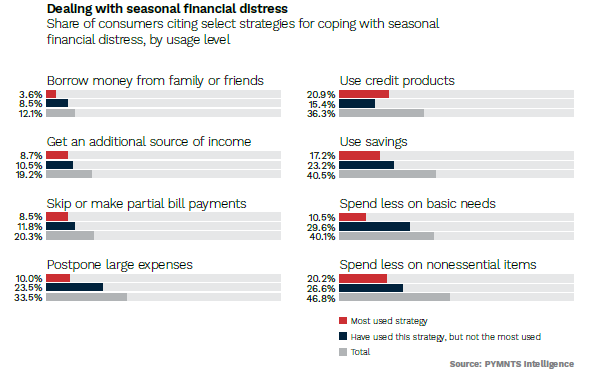

Nonessential Spending Decline A Challenge For Credit Card Companies

Apr 24, 2025

Nonessential Spending Decline A Challenge For Credit Card Companies

Apr 24, 2025