Microsoft-Activision Deal: FTC's Appeal Challenges Merger Approval

Table of Contents

The FTC's Arguments Against the Merger

The FTC's core argument centers on antitrust concerns and the potential for Microsoft to gain undue market dominance, particularly within the console gaming market. Their case rests on several key pillars:

-

Call of Duty Exclusivity: The FTC argues that Microsoft could leverage its acquisition of Activision Blizzard to make popular titles like Call of Duty exclusive to the Xbox ecosystem. This, they claim, would severely harm competition by disadvantaging PlayStation and other platforms. This exclusivity could lock players into the Xbox ecosystem and stifle innovation from competitors forced to compete without one of the industry’s most successful franchises.

-

Market Dominance and Stifled Innovation: The commission alleges that the merger would consolidate excessive power in Microsoft's hands, allowing them to dictate prices, limit choices for consumers, and ultimately stifle innovation within the broader gaming industry. This could lead to reduced competition, slowing down the development of new technologies and game experiences.

-

Anti-Competitive Behavior: The FTC's appeal highlights concerns about the potential for Microsoft to engage in anti-competitive practices, leveraging its newfound market power to disadvantage competitors. This includes potentially predatory pricing strategies, exclusive deals that lock out rivals, and other tactics designed to solidify Microsoft's dominance.

The FTC cites several legal precedents supporting its claims, arguing that allowing the merger to proceed unchecked would set a dangerous precedent for future mergers and acquisitions in the tech industry. They point to the potential for long-term harm to consumers, reduced competition, and a less dynamic gaming market.

Microsoft's Defense of the Merger

Microsoft counters the FTC's claims by emphasizing the benefits of the merger for gamers and the broader gaming industry. Their defense rests on these key points:

-

Continued Availability of Call of Duty: Microsoft repeatedly insists that Call of Duty will remain available on PlayStation and other platforms, pointing to binding contractual agreements to ensure continued access for players. They’ve even proposed long-term contracts to guarantee access for Sony.

-

Increased Competition and Innovation: Microsoft argues that the merger will actually foster greater competition and innovation by enabling them to invest more heavily in game development and expand access to gaming content across different platforms. They emphasize that the gaming market is dynamic and competitive, with many successful players already present.

-

Consumer Benefits: Microsoft’s central argument focuses on the benefits to consumers, citing potential improvements in game quality, expanded game libraries through Game Pass, and the creation of new game development opportunities. They claim the merger will result in a better, more vibrant gaming ecosystem for everyone.

Microsoft has also offered concessions and remedies to address some of the FTC's concerns, highlighting their commitment to addressing competition concerns while realizing the potential benefits of the acquisition. This proactive approach forms a significant part of their legal strategy.

The Potential Outcomes of the Appeal

The FTC's appeal could have several potential outcomes, each with significant implications:

-

Complete Block of the Merger: The most drastic outcome would be a complete reversal of the initial court decision, effectively blocking the merger entirely. This would be a major victory for the FTC and a significant setback for Microsoft and Activision Blizzard.

-

Modified Merger Agreement: Alternatively, the appellate court could uphold parts of the initial ruling but require modifications to the merger agreement to address the FTC's concerns. This might involve concessions from Microsoft, such as stricter commitments regarding Call of Duty availability or other stipulations designed to promote fair competition.

-

Setting Regulatory Precedents: Regardless of the specific outcome, the appeal will likely set important legal precedents for future mergers and acquisitions in the tech and gaming industries. The court's ruling will have a significant bearing on how regulators approach similar mergers in the future.

The legal battle is expected to be lengthy and costly, with significant financial and reputational stakes for all parties involved. The uncertainty surrounding the outcome creates considerable instability within the gaming industry.

The Role of Other Regulatory Bodies

The FTC's appeal isn't operating in isolation. The European Union has already approved the merger, highlighting the differing approaches to antitrust regulation across different jurisdictions. This global variation in regulatory landscapes underscores the international implications of the case:

-

Influence on Global Regulations: The outcome of the FTC appeal will likely influence regulatory decisions in other countries, potentially setting a precedent for future regulatory reviews of similar mergers globally.

-

International Implications: The differing stances of the US and EU on the merger demonstrate the complexities of navigating international antitrust regulations. The case has international ramifications and will influence how other regulatory bodies view future acquisitions within the gaming and tech sectors.

This highlights the need for a comprehensive understanding of global antitrust regulations, and underscores the complex interplay between national regulatory approaches.

Conclusion

The FTC's appeal against the Microsoft-Activision merger represents a pivotal moment for the gaming industry and antitrust law. The outcome will have far-reaching implications for competition, innovation, and consumer choice. The arguments presented by both sides showcase the complex balance between preventing market dominance and fostering innovation and consumer benefit. The intricate legal battle highlights the ever-evolving landscape of antitrust regulations in the rapidly growing digital marketplace.

Call to Action: Stay informed about the developments in this landmark Microsoft-Activision merger case. Understanding the intricacies of this legal battle is crucial for anyone interested in the future of the gaming industry and the evolving landscape of antitrust regulation. Follow this case closely to stay updated on the implications of this landmark Microsoft-Activision deal.

Featured Posts

-

Xrp Future Post Sec Lawsuit Price Prediction And Analysis

May 01, 2025

Xrp Future Post Sec Lawsuit Price Prediction And Analysis

May 01, 2025 -

Xrp Price Prediction 2024 Analyzing The Potential For A 10 Surge

May 01, 2025

Xrp Price Prediction 2024 Analyzing The Potential For A 10 Surge

May 01, 2025 -

Michael Sheens Port Talbot Home Paying Off Neighbours 1m Debt

May 01, 2025

Michael Sheens Port Talbot Home Paying Off Neighbours 1m Debt

May 01, 2025 -

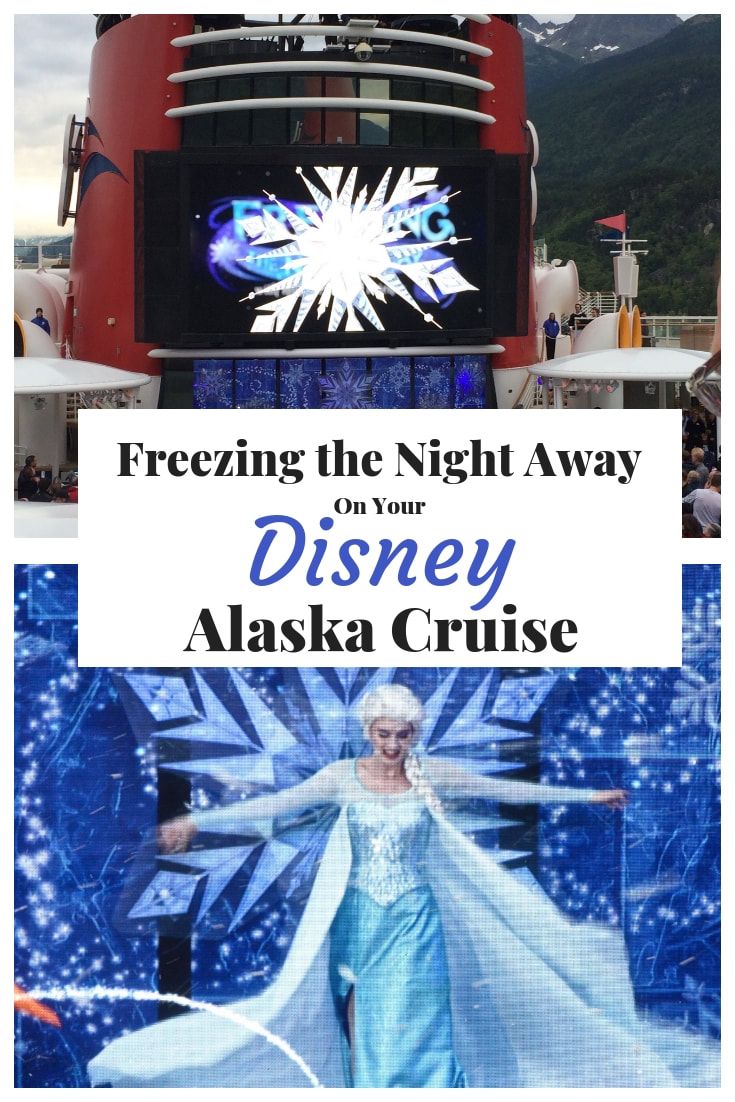

Two Disney Cruise Ships Headed To Alaska In Summer 2026

May 01, 2025

Two Disney Cruise Ships Headed To Alaska In Summer 2026

May 01, 2025 -

Shrimp Ramen Stir Fry A Quick And Easy Recipe

May 01, 2025

Shrimp Ramen Stir Fry A Quick And Easy Recipe

May 01, 2025