Millions Could Be Owed HMRC Refunds: Check Your Payslip Now

Table of Contents

Who Might Be Entitled to an HMRC Refund?

Many people are unaware they might be entitled to an HMRC refund. Understanding the potential areas where errors can occur is the first step to reclaiming your money.

Understanding Tax Credits

Tax credits, such as Child Tax Credit and Working Tax Credit, are designed to help families and low-income workers. However, errors in calculating these credits can lead to significant underpayments over time.

- Common Errors:

- Incorrect income reported to HMRC.

- Changes in circumstances (e.g., marriage, birth of a child, change of address) not reported promptly.

- Errors in processing applications.

- Incorrect tax code applied.

For more detailed information on tax credits and eligibility, visit the official UK government website: [Insert Link to Gov.uk Tax Credits Page]

National Insurance Contributions (NICs)

Errors in National Insurance (NI) calculations can also lead to underpayments and potential HMRC refunds. This is especially true for:

- Scenarios with potential for NIC errors:

- Self-employed individuals.

- Individuals with multiple employers.

- Those with gaps in employment.

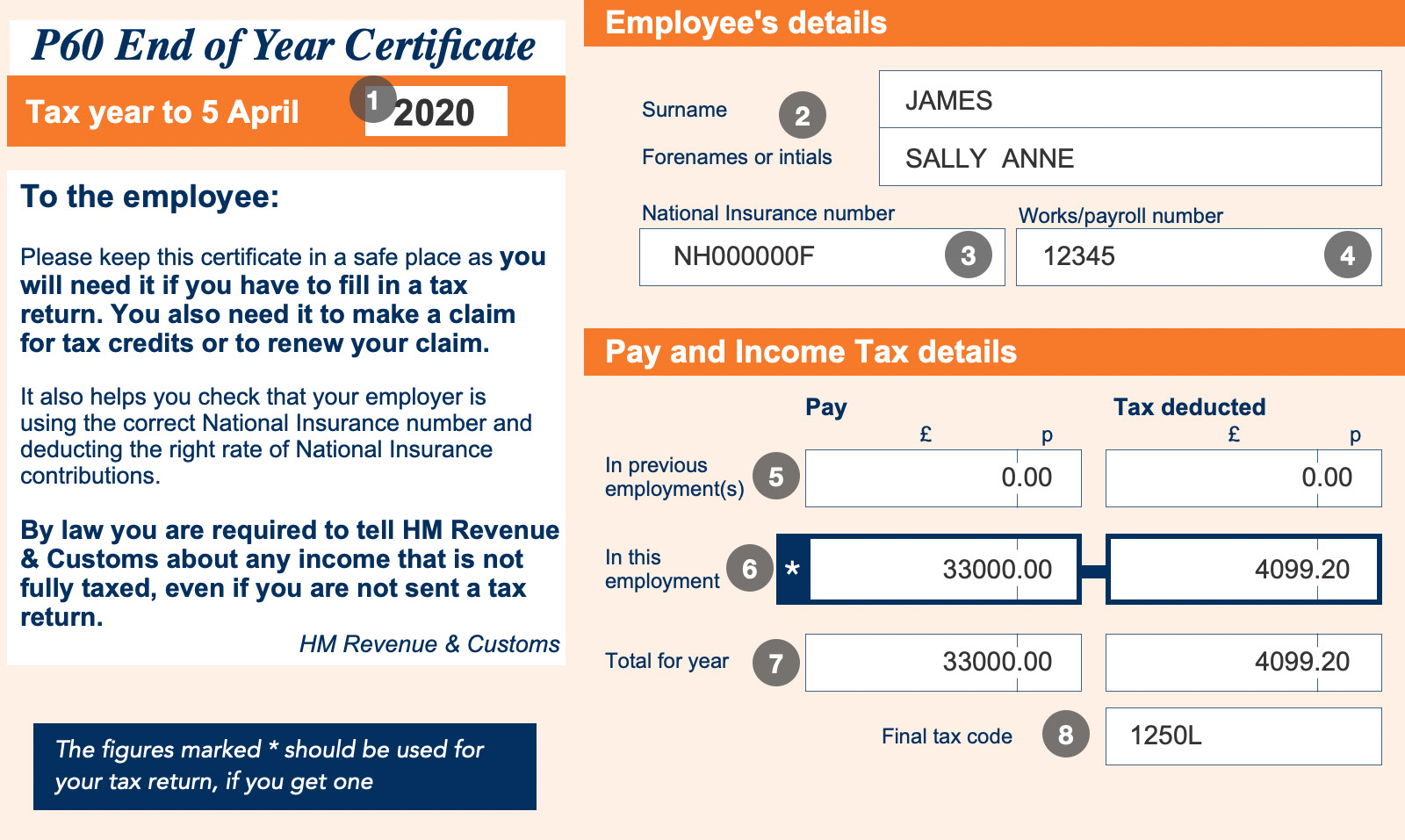

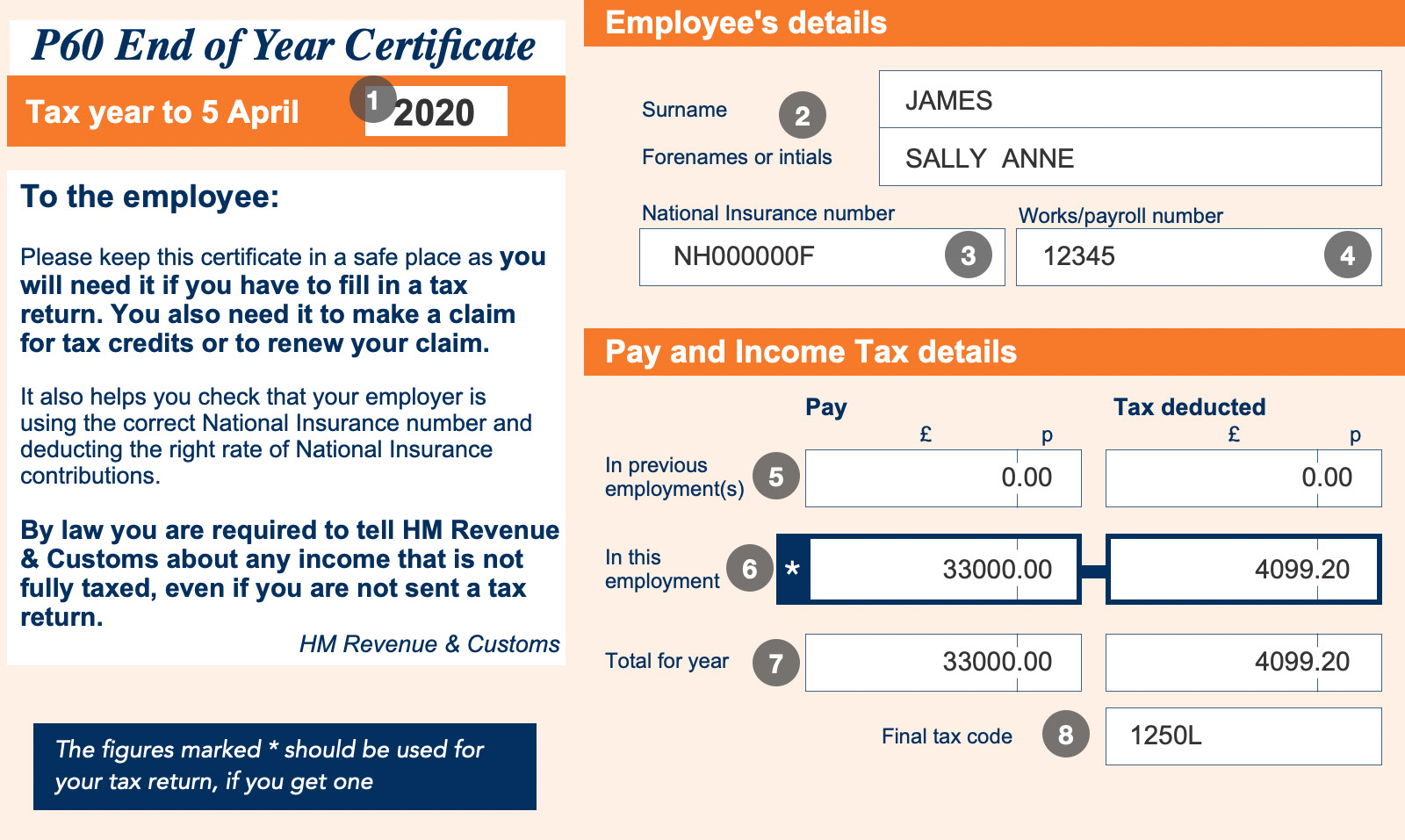

Accurate P45 and P60 forms are crucial for correct NI calculations. If you suspect any inaccuracies, it's vital to investigate further.

Other Potential Areas for Refunds

Beyond tax credits and NICs, there are other situations where you might be owed an HMRC refund:

- Overpayment of tax: You might have overpaid income tax due to an incorrect tax code or other administrative error.

- Marriage Allowance: If you're married or in a civil partnership, you might be eligible for the marriage allowance, which could reduce your tax bill.

How to Check if You're Owed an HMRC Refund

Identifying potential HMRC refunds requires a thorough review of your financial records. Here's how:

Review Your Payslips

Carefully scrutinize your payslips from at least the last four years. Look for inconsistencies, such as:

- Tips for reviewing payslips:

- Use a spreadsheet to compare tax deducted across different payslips.

- Look for discrepancies in tax code applications.

- Check for inconsistencies in reported earnings.

- Use online tools to help organize and analyze your payslip data.

Access Your HMRC Online Account

Your HMRC online account provides a comprehensive overview of your tax records. Accessing it is a crucial step in checking for potential underpayments.

- Steps to access your online account:

- Visit the HMRC website.

- Log in using your Government Gateway ID.

- Navigate to your tax history and review your tax returns and payments.

- Ensure your personal information is up-to-date.

Contacting HMRC Directly

If you discover discrepancies in your records or have questions, contact HMRC directly for clarification.

- Contacting HMRC:

- Phone: [Insert HMRC Phone Number]

- Email: [Insert HMRC Email Address, if applicable]

- Post: [Insert HMRC Postal Address]

Be prepared to provide relevant information and documentation to support your enquiry.

Claiming Your HMRC Refund

Once you've identified a potential underpayment, gather the necessary documentation and complete the relevant forms to claim your refund.

Gathering Necessary Documentation

To support your claim, you'll need the following:

- Required documents checklist:

- Payslips (for the relevant tax years).

- P45s and P60s.

- Any other relevant documentation supporting your claim.

Keeping accurate records throughout the year is essential for a smooth claims process.

Completing the Necessary Forms

The specific forms required will depend on the nature of your claim. Visit the HMRC website for detailed guidance and downloadable forms: [Insert Link to Relevant HMRC Forms Page]

- Completing the forms:

- Read the instructions carefully.

- Ensure all information is accurate and complete.

- Keep a copy of your completed forms for your records.

Incomplete or inaccurate forms can lead to significant delays.

Expected Processing Time

Processing times for HMRC refund claims can vary.

- Factors affecting processing times:

- Complexity of the claim.

- Volume of claims HMRC is currently processing.

Conclusion

Millions of pounds in HMRC refunds are unclaimed each year. By carefully reviewing your payslips, accessing your HMRC online account, and following the steps outlined above, you can identify and claim any money that's rightfully yours. Don't miss out on your potential HMRC refund! Check your payslips and tax records now! Claim your HMRC refund today! Visit the HMRC website for more information and to start your claim. [Insert Link to HMRC Website]

Featured Posts

-

Jennifer Lawrence Tweede Kind Verwelkomd

May 20, 2025

Jennifer Lawrence Tweede Kind Verwelkomd

May 20, 2025 -

I Kroyz Azoyl Kai O Giakoymakis Ston Teliko Toy Champions League I Odos Pros Ti Niki

May 20, 2025

I Kroyz Azoyl Kai O Giakoymakis Ston Teliko Toy Champions League I Odos Pros Ti Niki

May 20, 2025 -

Pro D2 Biarritz Lasbh Un Match De Mental

May 20, 2025

Pro D2 Biarritz Lasbh Un Match De Mental

May 20, 2025 -

Bbai Stock Takes A Hit Following Below Expectations Q1 Report

May 20, 2025

Bbai Stock Takes A Hit Following Below Expectations Q1 Report

May 20, 2025 -

Us Typhon Missile System In The Philippines Alarming China

May 20, 2025

Us Typhon Missile System In The Philippines Alarming China

May 20, 2025