Minnesota Film Production: The Effectiveness Of Tax Credit Programs

Table of Contents

Economic Impact of Minnesota Film Production Tax Credits

The Minnesota film production tax credit program has a demonstrably positive effect on the state's economy. This impact is multifaceted, extending beyond direct spending on film sets to ripple through various sectors.

Job Creation and Local Spending

Film production is a significant job creator, encompassing a wide range of roles. From actors and directors to camera operators, gaffers, and support staff, numerous individuals find employment in the industry. Furthermore, film productions inject significant capital into local economies. Hotels, restaurants, transportation services, and countless other businesses benefit from the increased demand generated by film crews and production teams. Studies show that for every dollar spent on film production, an additional $1.50 is generated in the local economy through this multiplier effect.

- Increased employment: Film productions create jobs not only for those directly involved in filmmaking but also for individuals in related industries like catering, transportation, and construction.

- Revenue generation: Local businesses experience a surge in revenue as they cater to the needs of film productions. This increased demand stimulates growth and prosperity within communities.

- Stimulation of the overall state economy: The influx of funds from film production projects contributes to the overall economic health of the state, stimulating growth and investment across multiple sectors.

Attracting Productions to Minnesota

The availability of generous Minnesota film production tax credits makes the state a more attractive filming location compared to its neighbors. These incentives level the playing field, allowing Minnesota to compete effectively for film projects that might otherwise go to states with similar programs. This has resulted in a diverse range of productions choosing Minnesota as their filming location, including independent films, commercials, and even segments of television shows.

- Increased competitiveness: Tax credits significantly enhance Minnesota's competitiveness in attracting film productions. They help offset the costs associated with filming, making Minnesota a more financially viable option.

- Attraction of high-profile productions: The success of the tax credit program has attracted high-profile productions, raising the state's profile within the filmmaking community and attracting further investment.

- Potential for long-term investment: The influx of film projects fosters long-term investment in film infrastructure, including studios, equipment rental facilities, and skilled crew training programs.

Types of Minnesota Film Production Tax Credits and Eligibility

Understanding the specifics of Minnesota film production tax credits and eligibility criteria is crucial for producers considering filming in the state. The program offers a range of incentives designed to support various types of productions.

Breakdown of Available Incentives

Minnesota offers a variety of tax credits, including percentage-based credits and potentially refundable credits (depending on the specific program guidelines). Eligibility criteria typically involve minimum spending requirements within the state, as well as mandates for in-state hiring to maximize the local economic benefits.

- Specific percentage offered: The percentage of tax credits offered varies depending on the type of production and may be subject to change; always consult the official resources.

- Qualifications for receiving the tax credits: Producers must meet specific criteria regarding spending thresholds, hiring practices, and project type to qualify for the tax credits.

- Application process and deadlines: The application process involves submitting detailed proposals and documentation; deadlines exist and should be strictly adhered to. For the most up-to-date information, visit the [insert link to official Minnesota film office website].

Challenges and Potential Improvements

While the Minnesota film production tax credit program has proven effective, there are areas for potential improvement.

- Areas for improvement in the application process: Streamlining the application process could make it more efficient and accessible for producers.

- Potential for expanding eligibility criteria: Expanding eligibility to encompass a wider range of productions could further stimulate growth within the industry.

- Suggestions for increasing transparency and accountability: Strengthening transparency and accountability mechanisms could ensure the program's funds are used effectively and efficiently.

The Future of Minnesota Film Production and Tax Credits

Minnesota film production tax credits have demonstrably boosted the state's economy by creating jobs and attracting film projects. Continued investment in the film industry, including the maintenance and improvement of these tax credit programs, is essential for fostering long-term growth and establishing Minnesota as a premier filming destination. This strategic approach ensures that Minnesota remains competitive and continues to attract a thriving film industry.

Explore the possibilities of Minnesota film production tax credits and discover how your next project can thrive in our state. Visit [insert link to relevant website] to learn more.

Featured Posts

-

The Automotive Landscape In China A Look At The Difficulties Faced By Premium Brands

Apr 29, 2025

The Automotive Landscape In China A Look At The Difficulties Faced By Premium Brands

Apr 29, 2025 -

The Magnificent Sevens 2 5 Trillion Plunge Understanding The Market Downturn

Apr 29, 2025

The Magnificent Sevens 2 5 Trillion Plunge Understanding The Market Downturn

Apr 29, 2025 -

Tragedy At North Carolina University Seven Shot One Fatality

Apr 29, 2025

Tragedy At North Carolina University Seven Shot One Fatality

Apr 29, 2025 -

Beyond Bmw And Porsche The Broader Challenges Facing Automakers In China

Apr 29, 2025

Beyond Bmw And Porsche The Broader Challenges Facing Automakers In China

Apr 29, 2025 -

Assessing The Economic Impact Of Film Tax Credits In Minnesota

Apr 29, 2025

Assessing The Economic Impact Of Film Tax Credits In Minnesota

Apr 29, 2025

Latest Posts

-

Ryan Reynolds Celebrates Wrexham Afcs Historic Promotion To The Football League

Apr 29, 2025

Ryan Reynolds Celebrates Wrexham Afcs Historic Promotion To The Football League

Apr 29, 2025 -

Israeli Military Operation In Beirut Airstrike And Evacuation Notice

Apr 29, 2025

Israeli Military Operation In Beirut Airstrike And Evacuation Notice

Apr 29, 2025 -

Southern Beirut Targeted In Israeli Airstrike Residents Urged To Evacuate

Apr 29, 2025

Southern Beirut Targeted In Israeli Airstrike Residents Urged To Evacuate

Apr 29, 2025 -

Beirut Rocked By Israeli Airstrike Following Evacuation Order

Apr 29, 2025

Beirut Rocked By Israeli Airstrike Following Evacuation Order

Apr 29, 2025 -

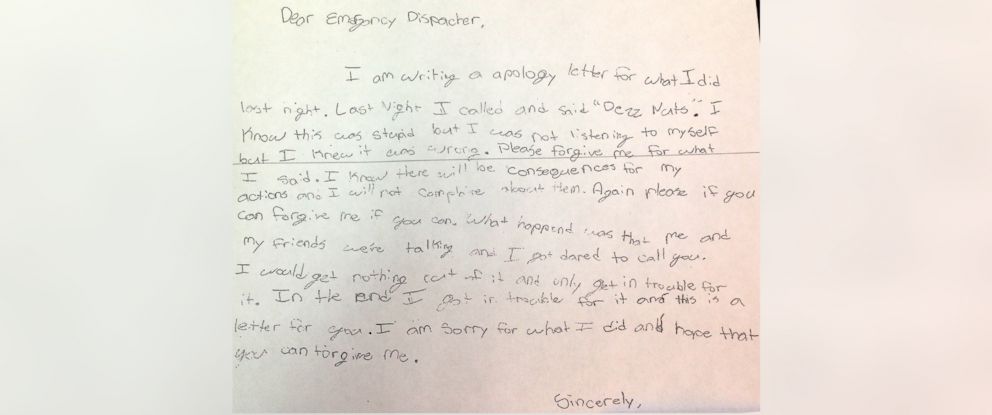

Atlanta Falcons Dcs Sons Apology For Prank Call To Shedeur Sanders

Apr 29, 2025

Atlanta Falcons Dcs Sons Apology For Prank Call To Shedeur Sanders

Apr 29, 2025