Navigate The Private Credit Boom: 5 Dos And 5 Don'ts To Get Hired

Table of Contents

5 Dos to Secure a Private Credit Job

Do Your Research: Understanding the Private Credit Landscape

Before even crafting your resume, you need a solid understanding of the private credit market. This goes beyond simply knowing it's a booming sector. You must demonstrate a deep understanding of its nuances.

- Different Private Credit Strategies: Familiarize yourself with direct lending, fund investing, mezzanine financing, and other strategies. Understand the differences in risk profiles, return expectations, and investor bases.

- Market Trends: Stay abreast of current interest rates, regulatory changes (like the impact of Dodd-Frank), and macroeconomic factors affecting the private credit market. Understanding these trends shows you're not just applying for a job, but actively engaging with the industry.

- Key Players: Research prominent private credit firms, their investment strategies, and recent deals. Knowing who the major players are – both lenders and borrowers – showcases your dedication and initiative. Understanding the different types of private debt will be beneficial as well. Keywords such as "alternative lending" and "private debt" should be incorporated into your resume and cover letter.

Network Strategically: Building Connections in Private Credit

Networking is paramount in the private credit industry. It's not just about who you know, but also about building genuine relationships.

- Industry Events: Attend conferences, seminars, and networking events focused on private credit, private equity, and alternative lending. These events provide excellent opportunities to meet professionals and learn about new opportunities.

- Leverage LinkedIn: Optimize your LinkedIn profile to showcase your private credit skills and experience. Actively engage with industry professionals, join relevant groups, and participate in discussions.

- Informational Interviews: Reach out to people working in private credit for informational interviews. This is a great way to learn more about specific roles and gain valuable insights.

- Professional Organizations: Consider joining organizations such as the CFA Institute or the ACA (Association for Corporate Growth) to expand your network and stay informed about industry trends.

Tailor Your Resume and Cover Letter: Showcasing Private Credit Expertise

Generic applications won't cut it in the competitive private credit market. You need to highlight your relevant skills and experience for each specific role.

- Highlight Relevant Skills: Focus on skills such as financial modeling, credit analysis, due diligence, portfolio management, and risk assessment. Quantify your achievements whenever possible.

- Keyword Optimization: Use keywords from the job description throughout your resume and cover letter. This helps applicant tracking systems (ATS) identify your application as a good match.

- Showcase Experience: Even internships or relevant projects can significantly strengthen your application. Frame your experience to highlight transferable skills.

Ace the Interview: Demonstrating Private Credit Knowledge and Skills

Private credit interviews are rigorous. You need to demonstrate both technical expertise and strong interpersonal skills.

- Prepare for Common Questions: Practice answering common interview questions, including technical questions on financial statement analysis, valuation methodologies, and credit risk assessment, as well as behavioral questions assessing your teamwork, problem-solving abilities, and communication skills.

- Showcase Understanding: Be prepared to discuss your understanding of various private credit strategies, market trends, and regulatory changes.

- Problem-Solving Skills: Demonstrate your analytical abilities by providing examples of how you've solved complex problems in the past.

Follow Up Professionally: Maintaining Momentum in the Private Credit Hiring Process

Following up after interviews is crucial. It demonstrates your continued interest and professionalism.

- Send Thank-You Notes: Send personalized thank-you notes to each interviewer within 24 hours of the interview.

- Follow Up on Timeline: If you haven't heard back within the timeframe discussed, a polite follow-up email is acceptable.

- Show Continued Interest: Express your continued enthusiasm for the position and the firm.

5 Don'ts to Avoid in Your Private Credit Job Search

Don't Neglect the Fundamentals: Mastering Core Financial Concepts

A strong foundation in finance is non-negotiable.

- Financial Statement Analysis: Thoroughly understand balance sheets, income statements, and cash flow statements.

- Valuation Methodologies: Master discounted cash flow (DCF) analysis, comparable company analysis, and precedent transaction analysis.

- Credit Risk Assessment: Develop a deep understanding of credit risk assessment methodologies, including credit scoring, covenant analysis, and financial modeling.

Don't Underestimate the Importance of Soft Skills: Communication and Teamwork in Private Credit

Technical skills alone won't suffice. Private credit requires strong teamwork and communication.

- Communication: Practice clear and concise communication, both written and verbal.

- Teamwork: Highlight your ability to collaborate effectively within a team.

- Professionalism: Maintain a professional demeanor throughout the entire job search process.

Don't Submit Generic Applications: Tailoring is Key in Private Credit

Each application should be meticulously tailored to the specific firm and role.

- Research the Firm: Thoroughly research each firm's investment strategy, portfolio, and recent activities before submitting your application.

- Customize Your Materials: Adjust your resume and cover letter to highlight the skills and experiences most relevant to each specific position.

Don't Be Afraid to Negotiate: Securing the Best Possible Offer in Private Credit

Know your worth and be prepared to negotiate.

- Research Market Rates: Research salary ranges for similar positions in the private credit industry.

- Negotiate Confidently: Be prepared to negotiate your salary, benefits, and other compensation components.

Don't Give Up: Persistence in the Private Credit Job Search

The private credit job market is competitive. Persistence is key.

- Stay Positive: Don't let rejections discourage you. Learn from each experience and continue to refine your approach.

- Network Actively: Continue to network and build relationships within the industry.

- Adapt Your Approach: Be willing to adjust your job search strategy as needed.

Successfully Navigating the Private Credit Boom: Your Next Career Move

Securing a job in the thriving private credit industry requires preparation, networking, and persistence. By following the "dos" and avoiding the "don'ts" outlined above, you significantly increase your chances of landing your dream job. Don't delay – start your private credit job search today and leverage these strategies to launch your private credit career, or explore exciting private debt opportunities!

Featured Posts

-

El Gozo De Alcaraz En Montecarlo Un Analisis De Su Victoria

May 17, 2025

El Gozo De Alcaraz En Montecarlo Un Analisis De Su Victoria

May 17, 2025 -

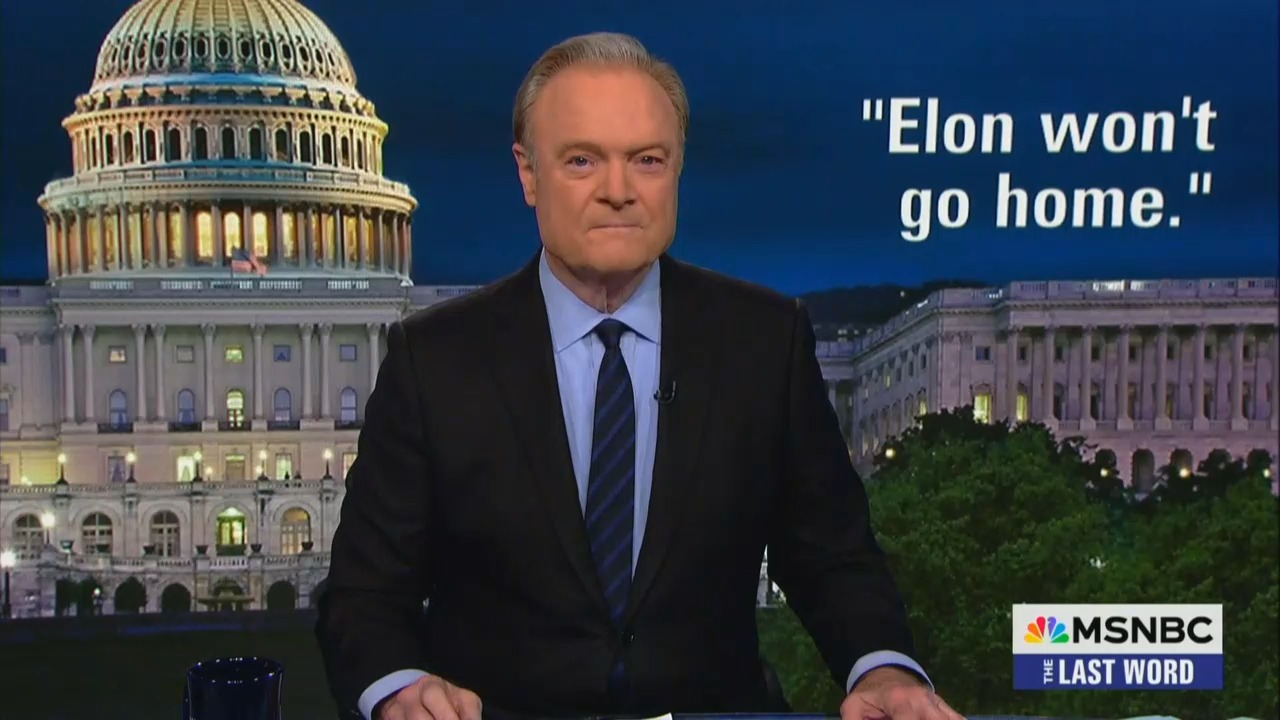

Lawrence O Donnell Trumps Humiliating Live Tv Moment

May 17, 2025

Lawrence O Donnell Trumps Humiliating Live Tv Moment

May 17, 2025 -

Andor Season 2 Timeline The Possibility Of Rebels Crossovers

May 17, 2025

Andor Season 2 Timeline The Possibility Of Rebels Crossovers

May 17, 2025 -

Missed Student Loan Payments The Potential Impact On Your Credit Rating

May 17, 2025

Missed Student Loan Payments The Potential Impact On Your Credit Rating

May 17, 2025 -

Que Espera A Los Deudores De Prestamos Estudiantiles Con Trump De Nuevo En La Presidencia

May 17, 2025

Que Espera A Los Deudores De Prestamos Estudiantiles Con Trump De Nuevo En La Presidencia

May 17, 2025