Navigate The Private Credit Boom: 5 Essential Do's And Don'ts

Table of Contents

Do Your Due Diligence: Understanding Private Credit Investments

Before diving into the world of private credit, thorough due diligence is paramount. This involves a comprehensive evaluation of both the borrower and the specific investment opportunity.

Thoroughly Research the Borrower and the Deal:

- Financial Health: Conduct a meticulous analysis of the borrower's financial statements, including balance sheets, income statements, and cash flow statements. Look for consistent profitability, healthy debt-to-equity ratios, and strong cash flows.

- Credit History: Investigate the borrower's credit history to assess their repayment track record. Look for any signs of past defaults or delinquencies.

- Management Team: Evaluate the experience and expertise of the management team. A strong management team is crucial for the success of the business and the repayment of the loan.

- Collateral: Carefully assess the value and quality of the underlying collateral securing the loan. This could include real estate, equipment, or intellectual property. Ensure the collateral is sufficient to cover the loan amount in case of default.

- Loan Documentation: Meticulously review all loan documentation, including covenants, terms, and conditions. Understand the implications of each clause and ensure they align with your investment strategy. Seek independent legal counsel to review these documents.

Diversify Your Private Credit Portfolio:

Diversification is key to mitigating risk in any investment strategy, and private credit is no exception. Don't concentrate your investments in a single borrower or industry.

- Borrower Diversification: Spread your investments across a range of borrowers with varying credit profiles and industries. This reduces the impact of a single default.

- Industry Diversification: Avoid over-exposure to any single industry. Economic downturns can disproportionately impact specific sectors.

- Geographic Diversification: Consider investing in private credit opportunities across different regions to further reduce risk.

- Loan Structure Diversification: A balanced portfolio should include a mix of senior secured loans (lower risk, lower return), mezzanine debt (medium risk, medium return), and subordinated debt (higher risk, higher potential return).

Understand the Risks of Private Credit Investing

While private credit offers attractive yields, it's crucial to acknowledge the inherent risks.

Liquidity Risk:

Private credit investments are typically illiquid, meaning they cannot be easily bought or sold on a public exchange. This means you may need to hold your investments for a longer period than anticipated. Plan your investment horizon accordingly.

Credit Risk:

The primary risk in private credit is the possibility of borrower default. Even with thorough due diligence, there's always a chance the borrower may fail to repay the loan. This underscores the importance of robust underwriting and risk assessment.

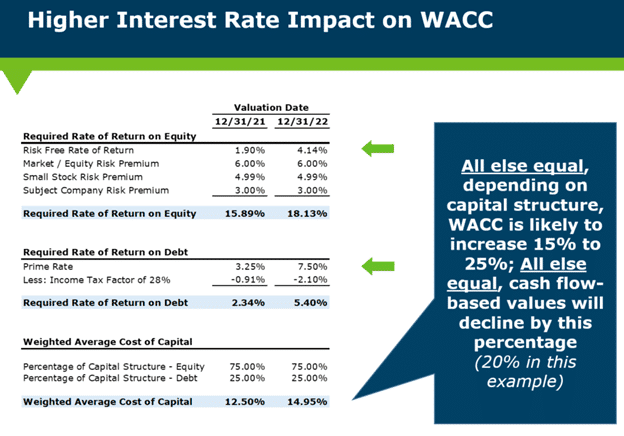

Market Risk:

Broader economic conditions and interest rate fluctuations can significantly impact the value of private credit investments. Stay informed about macroeconomic trends and adjust your portfolio as needed.

Do: Leverage Professional Expertise

Navigating the complexities of the private credit market is easier with the help of experienced professionals.

Utilize Private Credit Fund Managers:

Consider partnering with experienced private credit fund managers. They possess the expertise to source attractive investment opportunities, conduct thorough due diligence, and actively manage investments.

Seek Legal and Financial Advice:

Engage legal and financial professionals specializing in private credit to ensure proper structuring, compliance, and tax optimization of your investments.

Build a Strong Network:

Networking with other investors and professionals in the private credit market can provide valuable insights, deal flow, and opportunities for collaboration.

Don't: Overlook the Importance of Monitoring

Ongoing monitoring is crucial to managing your private credit portfolio effectively.

Regularly Monitor Your Investments:

Keep a close eye on the performance of your investments, including borrower financial health, industry trends, and market conditions. Regular reporting from fund managers is essential.

Stay Informed About Market Developments:

Stay abreast of changes in the private credit market, including regulatory changes, economic shifts, and emerging trends. This proactive approach helps you adapt your strategy and mitigate potential risks.

Neglect Early Warning Signs:

Be vigilant in identifying and responding to early warning signs of borrower distress. Prompt action can help mitigate potential losses.

Do: Develop a Long-Term Strategy

A well-defined, long-term strategy is crucial for success in private credit investing.

Align Investments with Your Overall Financial Goals:

Define your investment objectives, risk tolerance, and time horizon before investing in private credit. This ensures your investments align with your broader financial plans.

Create a Diversified Portfolio:

Remember that diversification is critical to managing risk and achieving better returns over the long run. Don't put all your eggs in one basket.

Factor in the Illiquidity of Private Credit:

Be prepared to hold your investments for the longer term, recognizing that private credit investments are typically illiquid.

Conclusion:

The private credit boom presents significant opportunities for investors seeking higher yields and diversification. However, it's essential to approach this market with caution and a well-defined strategy. By following these do's and don'ts—thorough due diligence, robust risk management, leveraging professional expertise, consistent monitoring, and developing a long-term strategy—investors can successfully navigate the complexities of the private credit market and potentially unlock substantial returns. Don't delay; start navigating the private credit boom today and build a successful investment portfolio. Understanding the intricacies of alternative lending and direct lending within the private credit market is key to your success.

Featured Posts

-

Zuckerbergs Next Chapter Navigating A Trump Presidency

Apr 24, 2025

Zuckerbergs Next Chapter Navigating A Trump Presidency

Apr 24, 2025 -

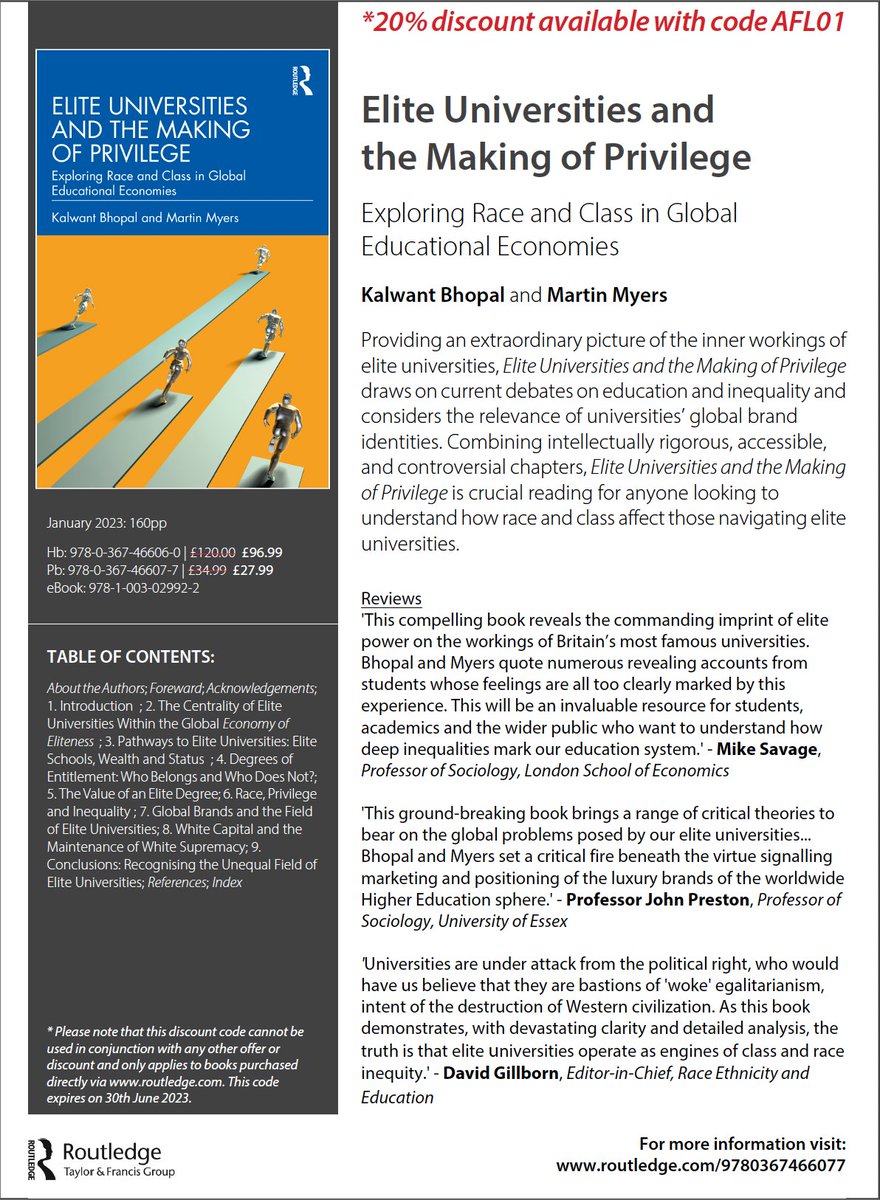

Funding The Future How Elite Universities Are Responding To Political Challenges

Apr 24, 2025

Funding The Future How Elite Universities Are Responding To Political Challenges

Apr 24, 2025 -

Chinas Rare Earth Crackdown Stalls Teslas Optimus Humanoid Robot Project

Apr 24, 2025

Chinas Rare Earth Crackdown Stalls Teslas Optimus Humanoid Robot Project

Apr 24, 2025 -

Are High Stock Market Valuations A Concern Bof A Says No Heres Why

Apr 24, 2025

Are High Stock Market Valuations A Concern Bof A Says No Heres Why

Apr 24, 2025 -

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025

John Travolta Honors Late Son Jetts 33rd Birthday With Moving Photo

Apr 24, 2025