NCLH Stock: Is It A Good Investment Based On Hedge Fund Activity?

Table of Contents

Understanding Hedge Fund Interest in NCLH Stock

Hedge funds are investment firms employing sophisticated strategies to manage large sums of money for wealthy individuals and institutional investors. They often invest in a wide range of asset classes, including stocks, bonds, and derivatives. In volatile sectors like the cruise industry, tracking their investment decisions can offer valuable insights. Analyzing their movements within the NCLH stock market can provide a glimpse into the potential future performance of the stock.

- Potential Benefits of Following Hedge Fund Moves: Access to expert analysis, early market signals, and insights into potential undervalued or overvalued assets. Following large institutional investors, like hedge funds, can offer some indication of future price movements.

- Limitations of Relying Solely on Hedge Fund Activity: Hedge fund activity is not a guaranteed predictor of future performance. Conflicts of interest can exist, and their strategies may not always align with long-term investors' goals. Furthermore, understanding the why behind their actions is critical, not just the what.

- Financial Metrics Used to Analyze Hedge Fund Activity: The primary source of information regarding hedge fund holdings is through their 13F filings with the Securities and Exchange Commission (SEC). These filings disclose their equity holdings on a quarterly basis, providing a snapshot of their portfolio composition.

Analyzing Recent Hedge Fund Activity in NCLH

Analyzing recent SEC 13F filings reveals a complex picture of hedge fund involvement in NCLH. While specific fund names and exact share numbers change frequently, analyzing the overall trend is key. For example, in Q[Insert Quarter], we might observe a decrease in NCLH holdings by some prominent funds, potentially due to concerns regarding the industry's recovery from the pandemic or increased fuel costs impacting profitability. Conversely, other funds may have increased their positions, potentially betting on a strong rebound in tourism and a sustained increase in passenger demand.

- Specific Examples (Hypothetical): Let's assume Fund X reduced its NCLH holdings by 10% in Q3 2024, while Fund Y increased its holdings by 5% in the same period. This divergence suggests differing viewpoints on NCLH's future prospects.

- Volume and Timing: Tracking the volume of shares traded and the timing of these transactions is crucial. A large, sudden sell-off might signal a more significant shift in market sentiment than small, incremental changes.

- Implications for NCLH's Future Price Movement: The net effect of these actions from multiple hedge funds will influence the overall price movement of NCLH stock. A widespread increase in holdings might indicate bullish sentiment, while the opposite might indicate bearish sentiment. However, external factors will significantly impact the final outcome.

NCLH Stock Performance and Future Outlook

NCLH's stock performance has been a volatile journey, reflecting the challenges and opportunities within the cruise industry. [Insert chart or graph showcasing NCLH's stock performance over the relevant period]. Several factors contribute to this volatility.

- Key Performance Indicators (KPIs): Revenue growth, occupancy rates, profit margins, and debt levels are critical indicators of NCLH's financial health and future prospects. Analyzing these KPIs against industry benchmarks provides a more comprehensive picture.

- Industry Trends: The cruise industry faces evolving challenges, including increased fuel costs, stricter environmental regulations (pushing sustainable cruising initiatives), and intense competition from other cruise lines. These factors directly influence NCLH's profitability and long-term growth.

- Potential Risks: Investing in NCLH stock carries inherent risks, including potential economic downturns, geopolitical instability, and the possibility of future health crises significantly impacting travel demand. These are crucial factors to consider.

Alternative Investment Strategies for the Cruise Sector

Diversification is key to mitigating risk. While NCLH stock presents an opportunity, focusing solely on one company in a volatile sector is unwise.

- Other Cruise Line Stocks: Consider diversifying across other major cruise lines like Carnival Corporation (CCL) or Royal Caribbean Cruises (RCL) to reduce the impact of sector-specific risks.

- ETFs and Mutual Funds: Investing in exchange-traded funds (ETFs) or mutual funds that focus on the travel and leisure sector offers broader exposure to the industry without the concentration risk of holding individual stocks.

- Portfolio Diversification: A well-diversified investment portfolio, spread across various asset classes and sectors, minimizes the impact of a single investment performing poorly.

Conclusion

Analyzing NCLH stock based solely on hedge fund activity provides only a partial picture. While tracking hedge fund movements can offer valuable insights, it's crucial to conduct thorough due diligence, considering NCLH's financial performance, industry trends, and overall market conditions. Investing in NCLH stock carries both potential rewards and significant risks. Before making any investment decisions, further research is crucial. Consider consulting with a financial advisor and reviewing financial news websites and SEC filings for up-to-date information. Remember to carefully consider all factors before investing in NCLH stock or any other related investment.

Featured Posts

-

Legacy Systems And Ai A Recipe For Disaster

May 01, 2025

Legacy Systems And Ai A Recipe For Disaster

May 01, 2025 -

Aj Ywm Ykjhty Kshmyr Hqwq Ky Bhaly Ke Lye Ealmy Awaz

May 01, 2025

Aj Ywm Ykjhty Kshmyr Hqwq Ky Bhaly Ke Lye Ealmy Awaz

May 01, 2025 -

How Middle Management Drives Employee Engagement And Productivity

May 01, 2025

How Middle Management Drives Employee Engagement And Productivity

May 01, 2025 -

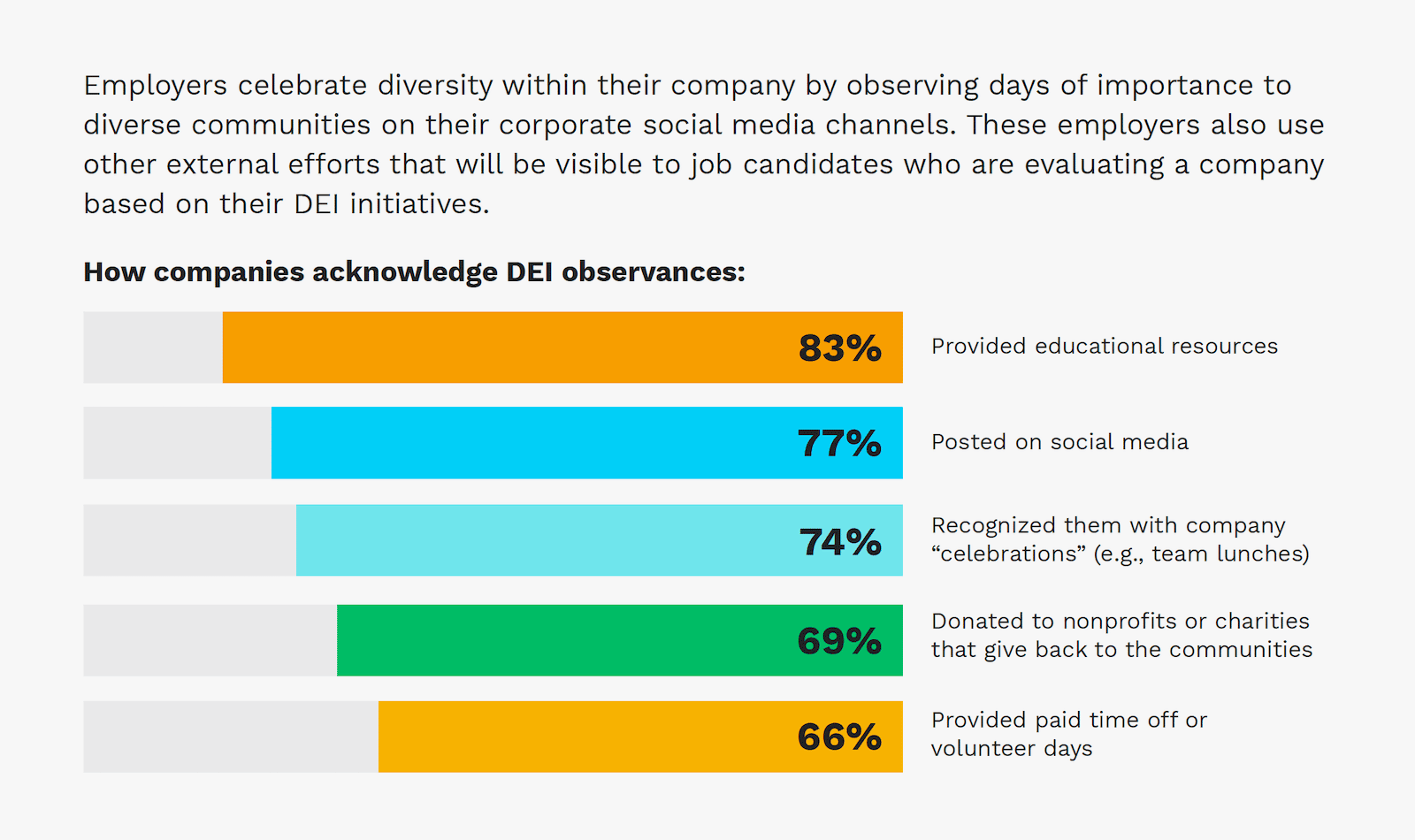

The Business Implications Of Targets Backtracking On Dei Efforts

May 01, 2025

The Business Implications Of Targets Backtracking On Dei Efforts

May 01, 2025 -

Airbnb Reports 20 Increase In Canadian Domestic Searches

May 01, 2025

Airbnb Reports 20 Increase In Canadian Domestic Searches

May 01, 2025