Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist: What You Need To Know

Table of Contents

What is the Amundi MSCI World II UCITS ETF Dist and Why is its NAV Important?

The Amundi MSCI World II UCITS ETF Dist is an exchange-traded fund that aims to track the performance of the MSCI World Index. This index represents a broad range of large and mid-cap companies across developed markets globally, offering investors diversified exposure to the global equity market. The NAV, or Net Asset Value, is the value of all the assets held within the ETF, divided by the number of outstanding shares. It reflects the intrinsic value of the ETF's holdings. Understanding the NAV is crucial because it represents the true underlying value of your investment. While the market price of the ETF might fluctuate throughout the trading day, the NAV provides a more stable measure of the ETF's worth. Discrepancies between the market price and NAV can occur due to supply and demand forces in the market.

- Investment Objective: To provide investors with exposure to a diversified portfolio of global equities, mirroring the MSCI World Index.

- Asset Type: Primarily invests in global equities across various sectors and industries.

- NAV Calculation Frequency: Daily, typically at the close of market trading.

- Where to Find the NAV: Amundi's official website, major financial news websites (such as Bloomberg, Yahoo Finance), and your brokerage account.

Factors Affecting the Net Asset Value (NAV) of Amundi MSCI World II UCITS ETF Dist

Several factors influence the daily NAV of the Amundi MSCI World II UCITS ETF Dist. These include:

- Market Fluctuations: Global market trends, economic news, and geopolitical events significantly impact the value of the underlying assets within the ETF, directly affecting its NAV. A bull market generally increases the NAV, while a bear market decreases it.

- Currency Exchange Rates: As the ETF holds assets denominated in various currencies, fluctuations in exchange rates can influence the NAV, particularly for investors holding the ETF in a different currency.

- Dividends and Distributions: Dividend payments made by the underlying companies held within the ETF will typically reduce the NAV, but the investor receives this distribution as a separate payment.

Here are some specific examples:

- Global Market Trends: A global recession could lead to a decrease in the NAV, while strong economic growth might boost it.

- Sector Performance: Strong performance in specific sectors (e.g., technology) represented within the ETF's holdings will positively impact the NAV. Conversely, underperformance in a major sector will negatively affect it.

- Interest Rate Changes: Interest rate hikes or cuts can affect the valuation of the underlying companies and thus the ETF's NAV.

- Capital Gains and Losses: Capital gains on the sale of assets within the ETF will increase the NAV while capital losses will decrease it.

How to Interpret the NAV of Amundi MSCI World II UCITS ETF Dist for Investment Decisions

Interpreting the NAV allows you to track the Amundi MSCI World II UCITS ETF Dist's performance effectively.

- Performance Monitoring: By calculating the percentage change in NAV over time, you can assess the ETF's growth or decline.

- Benchmark Comparison: Compare the NAV's performance against its benchmark, the MSCI World Index, to evaluate how effectively the ETF tracks its target.

- Historical Analysis: Analyzing historical NAV data can help identify trends and patterns, aiding in forecasting potential future performance.

- Value Proposition: Compare the NAV performance and expense ratio with similar ETFs to determine which offers better value.

Remember to consider the NAV alongside other important metrics, like the expense ratio, before making investment decisions. While a high NAV might seem attractive, a high expense ratio could erode returns over time.

Where to Find the NAV and Other Key Information for Amundi MSCI World II UCITS ETF Dist

Reliable sources for NAV data and other crucial information include:

-

Amundi Website: [Insert Link to Amundi Website - ETF Page] – Look for the specific ETF page for the latest NAV and key facts.

-

Financial Data Providers: Major financial news sources like Bloomberg, Yahoo Finance, and Google Finance usually provide real-time or delayed NAV data.

-

Brokerage Account: Your brokerage platform will show the NAV of your holdings.

-

Specific URLs (Example): [Insert Example URLs if available]

-

Amundi Website Navigation: Usually found under the "Funds" or "ETFs" section, search for "Amundi MSCI World II UCITS ETF Dist"

-

Regulatory Filings: The Amundi website will typically have links to the ETF's fact sheet, prospectus, and other regulatory filings.

Conclusion: Mastering the Net Asset Value (NAV) of Amundi MSCI World II UCITS ETF Dist

Understanding the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF Dist investments is crucial for making well-informed decisions. By regularly monitoring the NAV and comparing it to the benchmark index, you gain insights into the ETF’s performance. Remember to use the NAV in conjunction with other financial metrics to get a complete picture of your investment. Stay informed about the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF Dist investments to make well-informed decisions. Regularly check the official sources for the most up-to-date information on your ETF’s performance.

Featured Posts

-

Understanding Sses 3 Billion Spending Cut

May 25, 2025

Understanding Sses 3 Billion Spending Cut

May 25, 2025 -

Will A Resurgent Wall Street Undermine The Daxs Strong Performance

May 25, 2025

Will A Resurgent Wall Street Undermine The Daxs Strong Performance

May 25, 2025 -

Is Armando Iannuccis Work Losing Its Bite

May 25, 2025

Is Armando Iannuccis Work Losing Its Bite

May 25, 2025 -

El Estilo En El Baile De La Rosa 2025 Alexandra De Hannover Y Los Mejores Atuendos

May 25, 2025

El Estilo En El Baile De La Rosa 2025 Alexandra De Hannover Y Los Mejores Atuendos

May 25, 2025 -

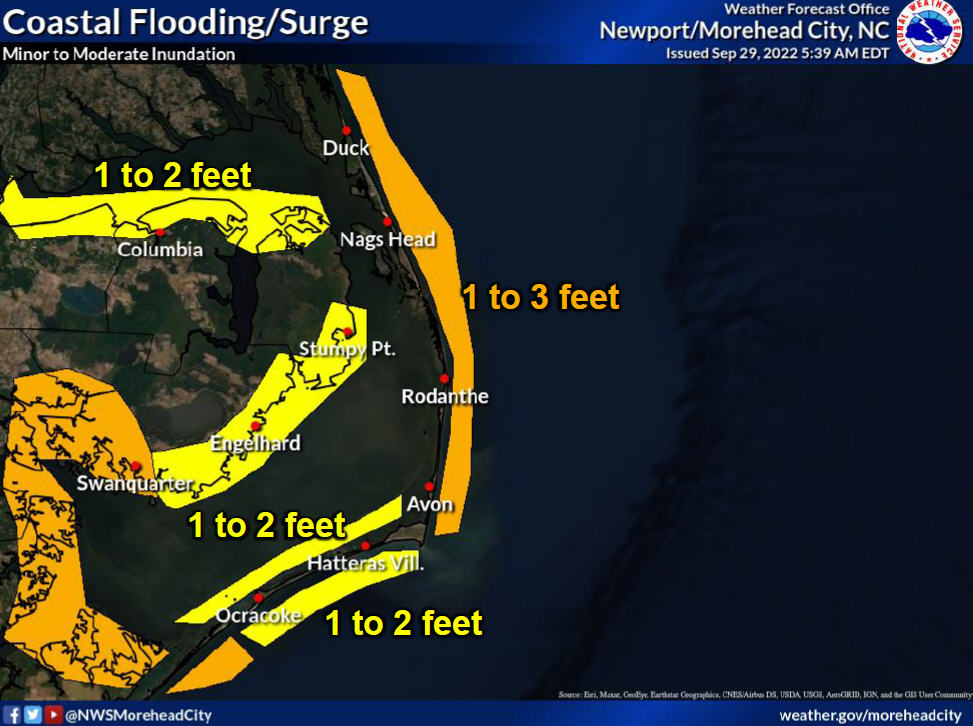

Coastal Flood Advisory Southeast Pa Wednesday Update

May 25, 2025

Coastal Flood Advisory Southeast Pa Wednesday Update

May 25, 2025