New Saudi Rules Set To Revolutionize The Asset-Backed Securities (ABS) Market

Table of Contents

Key Changes in Saudi ABS Regulations

The previous regulatory environment for Asset-Backed Securities in Saudi Arabia presented several limitations. Issuance processes were often complex and time-consuming, deterring potential issuers. Eligibility criteria for underlying assets were restrictive, limiting the types of transactions that could be securitized. Transparency levels were comparatively low, hindering investor confidence. Furthermore, robust investor protection measures were lacking.

The new regulations introduce several key improvements:

- Relaxation of eligibility criteria for underlying assets: A wider range of assets, including previously ineligible ones, are now eligible for securitization. This includes, for example, certain types of receivables and real estate assets, significantly broadening the scope of ABS issuance.

- Streamlined approval processes for ABS issuance: The new rules aim to simplify and expedite the approval process, reducing the time and cost associated with bringing ABS to market. This is achieved through clearer guidelines and a more efficient regulatory framework.

- Increased transparency and disclosure requirements: Enhanced disclosure requirements provide investors with more comprehensive information about the underlying assets and the structure of the ABS, fostering greater confidence and reducing information asymmetry.

- Enhanced investor protection measures: Stronger investor protection mechanisms, including clear guidelines on investor rights and dispute resolution, are designed to protect investor interests and maintain market integrity.

- Introduction of new structuring options for ABS: The regulations allow for more flexible structuring options, catering to a wider range of issuer needs and investor preferences. This allows for more tailored ABS products to be developed.

These changes directly address previous challenges, promoting market growth by making ABS issuance more accessible, efficient, and attractive to both issuers and investors. The expansion of eligible assets, for example, opens doors for companies in sectors such as real estate and infrastructure to access a wider range of financing options.

Impact on Investment and Liquidity

The anticipated impact of these new Saudi ABS regulations on investment and liquidity is substantial. The improved regulatory framework is expected to significantly increase investment in the Saudi ABS market. Enhanced transparency and standardization will boost liquidity, allowing investors to more easily buy and sell ABS.

The potential benefits are manifold, attracting both domestic and international investors:

- Lower issuance costs: Streamlined processes translate into lower costs for issuers.

- Access to a wider range of investment opportunities: The expanded range of eligible underlying assets creates more diverse investment opportunities.

- Improved risk management tools: Enhanced transparency and disclosure improve risk assessment and management for investors.

The potential for attracting both domestic and international investors is substantial. Institutional investors will be drawn to the improved transparency and the wider range of investment options, while retail investors may find access to more diversified and potentially higher-yielding opportunities. This influx of capital will further stimulate economic growth in Saudi Arabia.

Opportunities for Growth and Development

The new regulations are expected to have a positive ripple effect throughout the Saudi economy. Sectors like real estate and infrastructure will benefit significantly from improved access to ABS financing. This injection of capital will facilitate major projects and boost economic activity.

Furthermore, the regulatory changes will foster innovation within the financial sector:

- Growth of the Saudi Fintech sector: The streamlined issuance process and increased transparency will likely lead to the development of innovative Fintech solutions supporting the ABS market.

- Development of new securitization techniques: The more flexible structuring options will encourage innovation in securitization techniques, leading to more tailored and efficient financing solutions.

- Improved access to credit for SMEs: The increased availability of ABS financing could improve access to credit for small and medium-sized enterprises (SMEs), boosting their growth and contribution to the economy.

Saudi Arabia has the potential to become a regional hub for ABS issuance, attracting issuers from across the Middle East and North Africa. The development of new financial products and services based on ABS will further strengthen its position as a leading financial center.

Challenges and Considerations

While the new regulations present significant opportunities, several challenges and considerations must be addressed. The successful implementation of the new rules requires careful planning and execution. Robust monitoring and enforcement mechanisms are crucial to ensure compliance and prevent potential abuse. Furthermore, educating market participants about the new regulations and their implications is essential for smooth adoption. Potential risks associated with ABS, such as the concentration of risk in the underlying assets, must be carefully managed through appropriate risk mitigation strategies.

Conclusion

The new Saudi regulations governing Asset-Backed Securities represent a significant step towards modernizing the Kingdom's financial markets. By streamlining processes, enhancing transparency, and increasing investor protection, these changes are poised to revolutionize the ABS market, unlocking significant opportunities for growth and attracting substantial investment, both domestically and internationally. The impact on liquidity and the expansion of financing options for various sectors will be transformative.

Call to Action: Stay informed about the evolving landscape of Asset-Backed Securities in Saudi Arabia and seize the opportunities presented by these groundbreaking new regulations. Learn more about how these changes can benefit your investment strategy and explore the potential of the burgeoning Saudi ABS market. Understanding the implications of these new financial regulations is crucial for anyone interested in investing in or operating within the Saudi Arabian financial sector.

Featured Posts

-

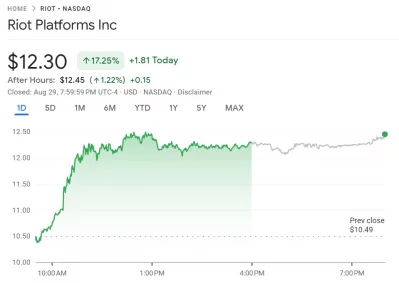

Whats Driving The Recent Volatility In Riot Platforms Riot Stock

May 03, 2025

Whats Driving The Recent Volatility In Riot Platforms Riot Stock

May 03, 2025 -

Photo Editing Controversy Christina Aguilera Faces Backlash Over Altered Photos

May 03, 2025

Photo Editing Controversy Christina Aguilera Faces Backlash Over Altered Photos

May 03, 2025 -

Watch The Lionesses Belgium Vs England Tv Guide And Kick Off Time

May 03, 2025

Watch The Lionesses Belgium Vs England Tv Guide And Kick Off Time

May 03, 2025 -

Epic Games Takes Fortnite Offline Update 34 40 Server Maintenance

May 03, 2025

Epic Games Takes Fortnite Offline Update 34 40 Server Maintenance

May 03, 2025 -

Epanidrysi Toy Kratoys I Antimetopisi Tis Diafthoras Stis Poleodomies

May 03, 2025

Epanidrysi Toy Kratoys I Antimetopisi Tis Diafthoras Stis Poleodomies

May 03, 2025