Nifty At 22,600, Sensex Up 200 Points: Key Stock Market Highlights

Table of Contents

Nifty's Ascent to 22,600: Analyzing the Surge

The Nifty reaching 22,600 is a significant milestone, reflecting robust growth and investor confidence in the Indian stock market. Several factors contributed to this impressive surge.

Positive Global Cues

Positive global market trends significantly impacted the Indian indices.

- Strong performance of US markets: The robust performance of US markets injected optimism into global markets, influencing investor sentiment positively.

- Positive economic data from other major economies: Positive economic indicators from key global economies, such as Europe and Asia, further bolstered investor confidence.

- Easing global inflation concerns: Signs of easing inflation in several major economies reduced fears of aggressive interest rate hikes, creating a more favorable investment environment.

These global factors influenced investor confidence, leading to increased capital inflow into the Indian market and pushing the Nifty upwards. The positive global sentiment spilled over into the Indian stock market, boosting investor appetite for Indian equities.

Domestic Economic Indicators

Positive domestic economic data played a crucial role in the Nifty's rise.

- Improved GDP growth projections: Upward revisions in India's GDP growth projections indicated a healthy and expanding economy.

- Positive manufacturing PMI: A strong manufacturing Purchasing Managers' Index (PMI) signaled robust growth in the industrial sector.

- Strong corporate earnings reports: Positive corporate earnings announcements from several major companies further fueled investor optimism.

These positive indicators boosted investor sentiment, driving stock prices higher and contributing to the Nifty's impressive performance. The strength of the Indian economy directly translates into increased profitability for listed companies, making them attractive investment options.

Sector-Specific Performance

Certain sectors performed exceptionally well, contributing significantly to the overall market gains.

- IT Sector: The IT sector saw substantial gains, fueled by strong quarterly results and a positive outlook for the industry.

- Banking Sector: The banking sector also performed strongly, reflecting confidence in the financial health of Indian banks and the overall economic stability.

- FMCG Sector: The fast-moving consumer goods (FMCG) sector demonstrated resilience, indicating strong consumer spending and demand.

The robust performance of these sectors reflects the diverse strengths of the Indian economy and underlines the positive sentiment across various industry segments. This sector-specific growth contributes significantly to the overall strength of the market indices like Nifty and Sensex.

Sensex's 200-Point Gain: Factors Contributing to the Rise

The Sensex's 200-point gain is a testament to the overall positive market sentiment and investor confidence. Several factors were instrumental in this rise.

Robust Foreign Institutional Investor (FII) Activity

Foreign Institutional Investors (FIIs) played a significant role in the market's upward trajectory.

- Net FII inflow figures: Substantial net inflows from FIIs demonstrated their strong belief in the Indian economy's future growth potential.

- Positive outlook on Indian economy: This inflow suggests a positive outlook on the Indian economy and its long-term growth prospects.

FII investment is a crucial driver of market momentum, injecting significant liquidity and influencing index performance. Their participation is a key indicator of global confidence in the Indian market.

Domestic Institutional Investor (DII) Participation

Domestic Institutional Investors (DIIs) also contributed to the market's strength.

- Net DII inflow figures: Positive net inflows from DIIs indicated strong domestic participation and confidence in the market.

- Investment strategies: Their investment strategies likely involved a combination of long-term and short-term approaches, contributing to market stability.

DII participation reinforces the overall positive sentiment within the Indian market, suggesting a strong belief in its future potential. This domestic confidence complements the positive sentiment driven by global investors.

Impact of Government Policies

Positive government policies and announcements played a supportive role.

- Infrastructure development initiatives: Announcements related to infrastructure development boosted investor confidence in long-term economic growth.

- Tax reforms: Positive tax reforms further enhanced the investment climate and encouraged both domestic and foreign investments.

Government policies aimed at fostering economic growth and creating a favorable investment environment are crucial in driving market sentiment and investor confidence.

Implications and Outlook for the Future

While the current market trend is positive, it is important to consider potential future fluctuations.

Potential Market Corrections

The market is subject to corrections. Several factors could trigger a downturn.

- Global economic slowdown: A potential global economic slowdown could negatively impact investor sentiment and lead to market corrections.

- Geopolitical uncertainties: Geopolitical events and uncertainties could create volatility in the market.

A balanced perspective acknowledges both the positive and negative factors that could influence future market trends. Understanding potential risks is vital for effective investment management.

Investment Strategies for the Coming Weeks

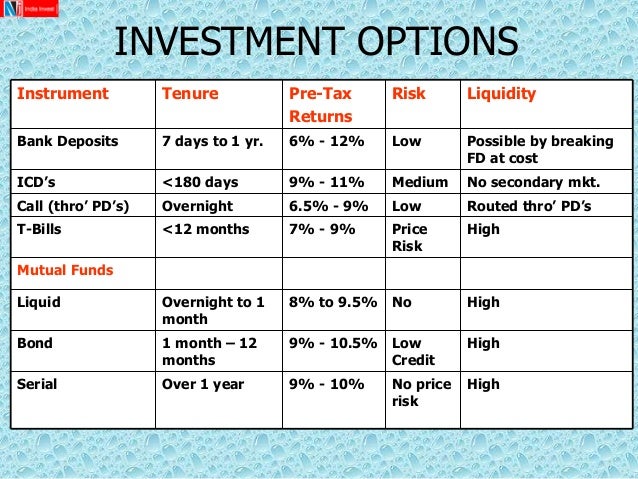

It's crucial to adopt a balanced and diversified investment strategy.

- Diversified investment portfolios: A diversified portfolio helps mitigate risk by spreading investments across different asset classes and sectors.

- Risk management strategies: Implementing effective risk management strategies is crucial to protect investments during market fluctuations.

Remember to conduct thorough research and seek professional financial advice before making any investment decisions.

Conclusion

The Nifty reaching 22,600 and the Sensex gaining 200 points reflects a strong and positive day for the Indian stock market. This surge was driven by a confluence of global cues, strong domestic economic indicators, robust FII and DII activity, and supportive government policies. However, it's crucial to remember the inherent volatility of the market and to consider potential market corrections. Adopt a balanced investment approach and stay informed about developments affecting the Nifty and Sensex.

Call to Action: Stay informed on the latest developments in the Indian stock market to make informed investment decisions. Keep a close watch on the Nifty and Sensex movements, and consider consulting a financial advisor before making any significant investment choices related to Nifty, Sensex, and other key stock market indicators. Learn more about today’s Nifty and Sensex performance and upcoming market trends to optimize your investment strategy.

Featured Posts

-

Analyzing Figmas Ai Powered Design Tools A Competitive Landscape Review

May 10, 2025

Analyzing Figmas Ai Powered Design Tools A Competitive Landscape Review

May 10, 2025 -

Is It A Real Safe Bet Evaluating Low Risk Investment Options

May 10, 2025

Is It A Real Safe Bet Evaluating Low Risk Investment Options

May 10, 2025 -

Trumps Kennedy Center Attendance Potential Les Miserables Boycott

May 10, 2025

Trumps Kennedy Center Attendance Potential Les Miserables Boycott

May 10, 2025 -

Aoc Vs Pirro A Fact Check Showdown On Fox News

May 10, 2025

Aoc Vs Pirro A Fact Check Showdown On Fox News

May 10, 2025 -

Stiven King Obrushilsya S Kritikoy Na Ilona Maska V Sotsseti X

May 10, 2025

Stiven King Obrushilsya S Kritikoy Na Ilona Maska V Sotsseti X

May 10, 2025

Latest Posts

-

Uk Government Announces Stricter Visa Policies For Nigeria And Pakistan

May 10, 2025

Uk Government Announces Stricter Visa Policies For Nigeria And Pakistan

May 10, 2025 -

New Uk Visa Regulations For Nigerians And Pakistanis

May 10, 2025

New Uk Visa Regulations For Nigerians And Pakistanis

May 10, 2025 -

Stringent New Asylum Rules Impact Migrants From Three Specific Countries

May 10, 2025

Stringent New Asylum Rules Impact Migrants From Three Specific Countries

May 10, 2025 -

Three Nations Targeted In Uks New Asylum Policy

May 10, 2025

Three Nations Targeted In Uks New Asylum Policy

May 10, 2025 -

Upcoming Changes To Uk Visa Policy Restrictions For Certain Nationalities Predicted

May 10, 2025

Upcoming Changes To Uk Visa Policy Restrictions For Certain Nationalities Predicted

May 10, 2025