Nonessential Spending Decline: A Challenge For Credit Card Companies

Table of Contents

Reduced Transaction Volume and Revenue

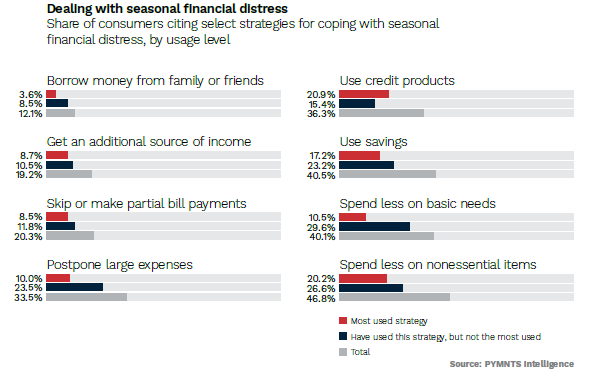

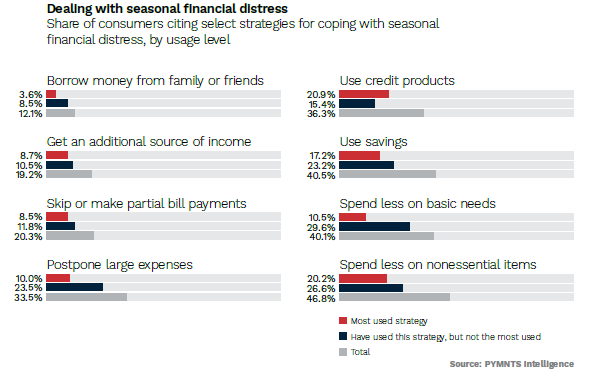

A nonessential spending decline directly translates to fewer transactions processed by credit card companies. This reduction in transaction volume significantly impacts their core revenue streams.

- Lower purchase frequency for discretionary items: Consumers are cutting back on dining out, entertainment, travel, and other non-essential purchases, leading to fewer credit card transactions.

- Decreased average transaction value: Even when consumers do make nonessential purchases, they are often smaller and less frequent, lowering the average transaction value processed by credit card companies.

- Impact on merchant fees: Merchant fees represent a primary revenue source for credit card companies. A decrease in overall transactions directly reduces the fees collected, impacting profitability.

The core business model of credit card companies relies heavily on transaction volume. A significant drop in nonessential spending directly diminishes this crucial element, impacting profitability and potentially leading to reduced shareholder returns. This necessitates a proactive review of business models and the exploration of alternative revenue streams. The decline in discretionary spending represents a major headwind for the industry's financial performance.

Increased Risk of Defaults and Delinquencies

As consumers tighten their belts and prioritize essential spending, the risk of credit card defaults and delinquencies increases dramatically. This poses a considerable threat to the financial stability of credit card companies.

- Consumers may struggle to meet minimum payments: Reduced disposable income makes it harder for consumers to meet even the minimum payments on their credit card balances.

- Higher likelihood of missed payments: Missed or late payments become more frequent as consumers struggle to manage their finances amidst a nonessential spending decline.

- Increased charge-off rates: Credit card companies face higher charge-off rates, meaning they have to write off more bad debt, impacting their bottom line significantly.

The financial health of consumers is directly linked to the credit card industry's stability. A nonessential spending decline often precedes a rise in financial hardship, increasing the burden on credit card companies through higher provisions for loan losses. This necessitates a more robust risk assessment and credit scoring methodology.

Strategies for Credit Card Companies to Adapt

Credit card companies must adapt and innovate to navigate this challenging landscape created by the nonessential spending decline. Proactive measures are crucial for maintaining profitability and customer loyalty.

- Diversify revenue streams: Offering additional financial services, such as personal loans, investment products, or insurance services, can help diversify revenue streams and reduce reliance on transaction fees alone.

- Targeted marketing campaigns: Focusing marketing efforts on essential spending categories, such as groceries and utilities, can help maintain transaction volumes even amidst a decline in nonessential spending.

- Flexible repayment options: Providing customers with more flexible repayment options, such as extended payment plans or reduced interest rates, can help reduce delinquency rates and maintain customer relationships.

- Leverage data analytics: Using sophisticated data analytics to identify and mitigate risks associated with increased delinquencies is vital for proactive risk management.

Proactive measures are crucial for credit card companies to maintain profitability and customer loyalty amidst a nonessential spending decline. Innovation and adaptability are key to weathering this economic storm.

The Role of Interest Rates and Inflation

High interest rates and inflation exacerbate the nonessential spending decline, creating a perfect storm for credit card companies.

- Higher interest rates increase the cost of borrowing: This discourages discretionary purchases and puts pressure on consumers already struggling with debt.

- Inflation reduces purchasing power: Inflation reduces the real value of income, forcing consumers to prioritize essential goods and services over nonessential items.

- The interplay of these factors intensifies the challenge: The combined impact of high interest rates and inflation significantly intensifies the challenges faced by credit card companies.

Macroeconomic factors play a significant role in shaping consumer behavior. Addressing the impact of inflation and high interest rates is essential for both credit card companies and policymakers.

Conclusion

The nonessential spending decline presents a complex and evolving challenge for credit card companies. Reduced transaction volumes, increased default risks, and the broader economic context all demand a strategic and adaptive response. By diversifying revenue streams, proactively managing risk, and understanding the interplay between inflation, interest rates, and consumer behavior, credit card companies can navigate this period of economic uncertainty. Ignoring the impact of the nonessential spending decline could lead to significant long-term consequences. Proactive planning and adaptation are vital for credit card companies to thrive, even amidst a decrease in nonessential spending. Understanding and mitigating the risks associated with this decline is crucial for the future success of the credit card industry.

Featured Posts

-

Cassidy Hutchinsons Fall Memoir Insights From The January 6th Hearings

Apr 24, 2025

Cassidy Hutchinsons Fall Memoir Insights From The January 6th Hearings

Apr 24, 2025 -

Russias Natural Gas Eu Weighs Spot Market Action

Apr 24, 2025

Russias Natural Gas Eu Weighs Spot Market Action

Apr 24, 2025 -

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025

Hisd Mariachi Groups Viral Whataburger Video Sends Them To Uil State

Apr 24, 2025 -

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 24, 2025

Legal Battle E Bay Banned Chemicals And The Limits Of Section 230

Apr 24, 2025 -

Exclusive High Rollers Poster And Photos A New John Travolta Action Movie Preview

Apr 24, 2025

Exclusive High Rollers Poster And Photos A New John Travolta Action Movie Preview

Apr 24, 2025