Russia's Natural Gas: EU Weighs Spot Market Action

Table of Contents

The Current State of EU Dependence on Russia's Natural Gas

The EU's energy landscape has been historically shaped by long-term contracts with Russia, making it heavily reliant on Russian gas supplies. However, this reliance presents significant vulnerabilities.

Long-Term Contracts and Their Limitations

For decades, the EU has relied heavily on long-term contracts with Russia for natural gas supplies. These contracts, while providing a degree of supply security in the past, have proven inflexible and vulnerable to geopolitical pressures.

- Pricing Mechanisms: These contracts often involve complex pricing formulas linked to oil prices or other indices, leaving the EU susceptible to price manipulation.

- Lack of Diversification: The heavy reliance on a single major supplier limited the EU's options for diversifying its energy sources.

- Geopolitical Vulnerability: Russia has used its control over these contracts to exert political influence, leveraging gas supplies as a tool in diplomatic negotiations.

For example, disputes over transit routes and pricing have repeatedly led to supply disruptions, highlighting the risks associated with this model.

The Risks of Continued Reliance

Continued dependence on Russia's natural gas carries substantial economic and security risks for the EU.

- Potential Supply Cutoffs: Geopolitical tensions can lead to abrupt reductions or complete cessation of gas supplies, causing significant economic disruption.

- Price Manipulation: Russia's dominance in the market allows it to manipulate prices, potentially causing energy price spikes within the EU.

- Impact on EU Energy Security: This reliance undermines the EU's energy security, making it vulnerable to external pressures and blackmail.

Data shows that Russia historically supplied over 40% of the EU's natural gas imports, emphasizing the critical need for diversification.

The Potential of the Spot Market for Natural Gas

Shifting towards spot market purchases of natural gas presents a pathway to mitigate the risks associated with long-term contracts and reduce the EU's dependence on Russia's natural gas.

Benefits of Spot Market Purchases

Spot markets offer several advantages compared to long-term contracts:

- Price Discovery: Prices are determined by real-time supply and demand dynamics, creating a more transparent and competitive market.

- Increased Flexibility: The EU gains greater flexibility in sourcing gas from various suppliers, reducing reliance on any single entity.

- Enhanced Negotiation Power: The ability to purchase gas on the spot market provides stronger leverage in negotiations with suppliers.

By diversifying its sourcing strategy, the EU can reduce its reliance on a single supplier, like Russia, and enhance energy security.

Challenges of Transitioning to a Spot Market Model

While the spot market offers significant advantages, transitioning to this model presents challenges:

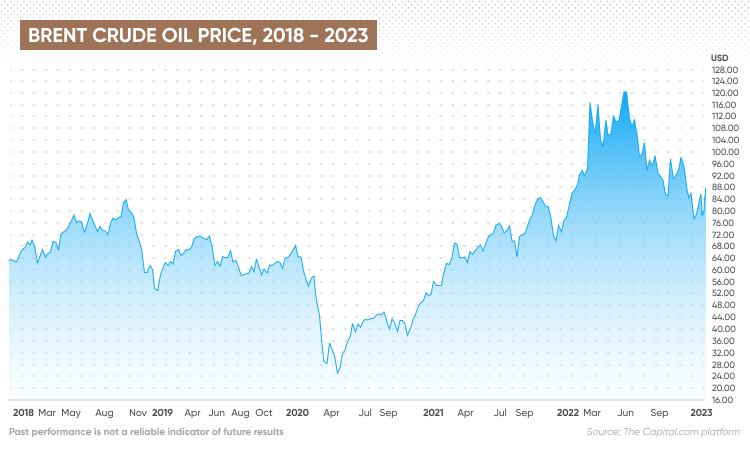

- Price Volatility: Spot prices are inherently volatile and susceptible to sudden price swings due to market fluctuations.

- Increased Storage Capacity: The EU needs to increase its natural gas storage capacity to buffer against price spikes and supply disruptions.

- Potential for Price Spikes: Periods of high demand or low supply can lead to significant price increases, potentially impacting consumers and industries.

Analyzing potential scenarios of supply shortages and their impact on EU energy security is crucial for effective planning and risk mitigation.

EU Strategies for Diversification Beyond Russia's Natural Gas

The EU is pursuing a multi-faceted strategy to reduce its reliance on Russian gas and enhance its energy security. This includes increasing LNG imports and accelerating the transition to renewable energy.

Increased LNG Imports

Liquified Natural Gas (LNG) imports play a crucial role in diversifying the EU's energy supply.

- LNG Terminal Infrastructure: Investing in additional LNG terminals is essential for receiving and processing imported LNG.

- Geopolitical Considerations: The EU needs to consider the geopolitical implications of sourcing LNG from various suppliers globally.

- Cost Implications: The construction and operation of LNG terminals require significant investment, and the price of LNG itself can fluctuate.

Investment in Renewable Energy Sources

Investing in renewable energy sources is a long-term strategic imperative for the EU to achieve energy independence.

- Long-Term Benefits: Renewable energy sources offer sustainable and environmentally friendly alternatives to fossil fuels.

- Initial Investment Costs: The transition to renewable energy requires significant upfront investment in infrastructure and technology.

- Government Policies: Supportive government policies are critical for accelerating the deployment of renewable energy sources.

Conclusion

The EU's reliance on Russia's natural gas presents significant economic and geopolitical challenges. A strategic shift towards spot market purchases is a crucial step in diversifying energy sources and enhancing the EU's energy security. While transitioning to a predominantly spot market model presents challenges, the benefits of increased flexibility, price competitiveness, and reduced vulnerability to geopolitical pressure outweigh the risks. By aggressively pursuing a multi-pronged approach encompassing spot market engagement, increased LNG imports, and rapid development of renewable energy sources, the EU can successfully reduce its dependence on Russia's natural gas and build a more secure and sustainable energy future. To learn more about the intricacies of the EU's strategy and the potential implications of its shift toward spot markets, further research into Russia's natural gas market dynamics is recommended.

Featured Posts

-

Eu Targets Russian Gas Spot Market Phaseout Discussion

Apr 24, 2025

Eu Targets Russian Gas Spot Market Phaseout Discussion

Apr 24, 2025 -

Harvard University And The Trump Administration Is A Settlement Possible

Apr 24, 2025

Harvard University And The Trump Administration Is A Settlement Possible

Apr 24, 2025 -

Minnesota Attorney General Files Lawsuit Against Trumps Transgender Athlete Ban

Apr 24, 2025

Minnesota Attorney General Files Lawsuit Against Trumps Transgender Athlete Ban

Apr 24, 2025 -

Oil Prices Today April 23rd Market Update And Analysis

Apr 24, 2025

Oil Prices Today April 23rd Market Update And Analysis

Apr 24, 2025 -

Indias Stock Market Surge A Deep Dive Into The Niftys Rally

Apr 24, 2025

Indias Stock Market Surge A Deep Dive Into The Niftys Rally

Apr 24, 2025