Operation Sindoor Impact: KSE 100 Plunge And Trading Halt Explained

Table of Contents

What is Operation Sindoor and its Alleged Role in the Market Crash?

Operation Sindoor, the name given to a series of alleged actions, remains shrouded in some ambiguity. While official details remain limited, reports suggest it involved coordinated actions impacting the KSE 100. These actions, according to various sources, potentially involved market manipulation and the coordinated selling of specific stocks. The alleged goal of Operation Sindoor remains unclear, but its consequences were undeniably severe. The connection between these actions and the subsequent KSE 100 crash remains a subject of ongoing investigation and debate. Key terms associated with this event include Operation Sindoor, KSE 100 crash, market manipulation, and regulatory response.

- Alleged Actions: Reports suggest coordinated selling of specific stocks, potentially leveraging insider information or other forms of market manipulation.

- Unverified Claims: Various unsubstantiated claims circulated regarding the motives and players involved in Operation Sindoor. It is crucial to rely on verified sources and avoid speculation.

- Regulatory Scrutiny: The Securities and Exchange Commission of Pakistan (SECP) and other regulatory bodies are reportedly investigating the matter.

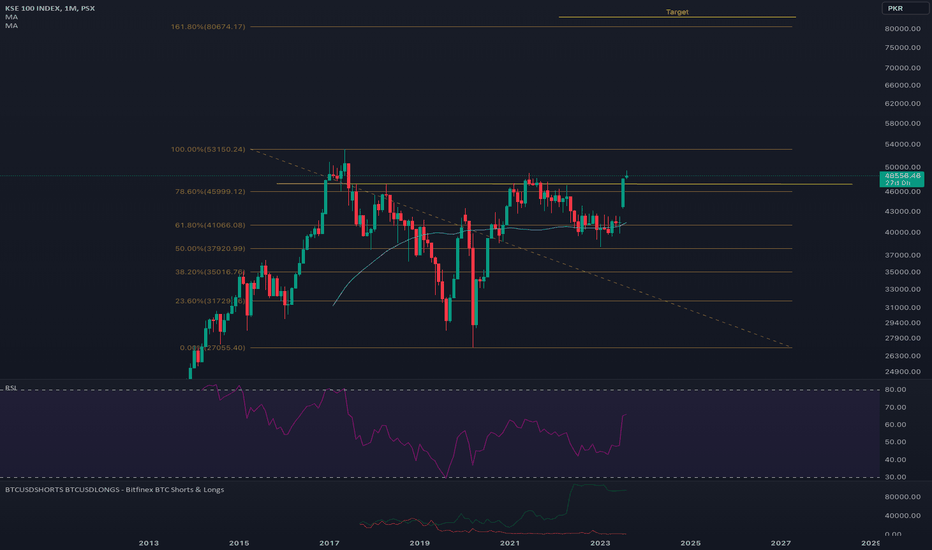

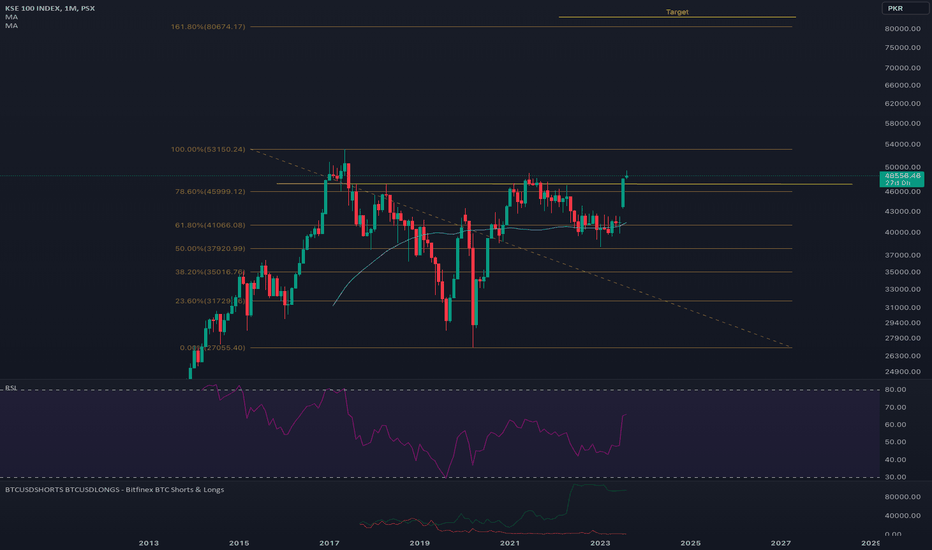

The KSE 100 Plunge: A Detailed Analysis

The KSE 100 experienced a dramatic drop, plummeting by [Insert Percentage]% in a single trading session – a historically significant decline. This sharp fall reflects a dramatic loss of investor confidence and a significant increase in market volatility. The swiftness and magnitude of the decline indicate a sudden and forceful pressure on the market. The impact extended across various sectors, creating widespread uncertainty. Understanding the KSE 100 index’s behavior during this period is crucial to comprehending the overall Operation Sindoor impact.

- Magnitude of the Drop: The [Insert Percentage]% decline represents one of the largest single-day drops in the KSE 100's history.

- Investor Sentiment: The plunge severely damaged investor confidence, prompting widespread panic selling.

- Sectors Affected: [List the most affected sectors, e.g., banking, energy, technology]. The impact varied across sectors, with some experiencing far steeper declines than others.

The Trading Halt: Reasons and Implications

The trading halt on the KSE 100 was implemented by the regulatory authorities to prevent further market instability and to allow for an assessment of the situation. This regulatory intervention aimed to restore some level of order and prevent a more catastrophic collapse. The KSE 100 trading suspension was a necessary measure to mitigate the immediate damage. The decision reflects the seriousness of the situation and the regulators’ commitment to maintaining market integrity.

- Duration of the Halt: The trading halt lasted for [Insert Duration].

- Regulatory Role: The SECP played a central role in deciding and implementing the trading halt.

- Impact on Investors: The halt caused significant disruption for investors, impacting trading strategies and potentially leading to further losses.

Potential Long-Term Effects of Operation Sindoor on the Pakistani Economy

The Operation Sindoor impact extends far beyond the immediate KSE 100 plunge. The potential long-term effects on the Pakistani economy are significant and multifaceted. The erosion of investor confidence could deter foreign investment, hindering economic growth. The event raises serious questions about the robustness of regulatory mechanisms and could impact Pakistan’s overall economic outlook. Analyzing the long-term consequences is crucial for understanding the full scope of this crisis.

- Foreign Investment: The incident could discourage foreign investors, impacting capital inflows and hindering economic growth.

- Economic Growth: The decline in market confidence could negatively affect overall economic growth and development.

- Investor Confidence: Restoring investor trust will be critical for the long-term health of the Pakistani stock market.

Government Response and Future Regulatory Measures

The Pakistani government’s response to the situation has included [Insert details of the government's response, e.g., investigations, statements, promises of reform]. The government's actions will be crucial in determining the long-term impact of Operation Sindoor. Proposed market reforms and strengthened investor protection measures are likely to be implemented to prevent similar incidents in the future. The government's commitment to transparency and accountability will be vital for rebuilding investor confidence.

- Investigations: Official investigations are underway to determine the full extent of the market manipulation and identify those responsible.

- Regulatory Changes: The government is expected to announce changes to enhance regulatory oversight and prevent future market manipulation.

- Communication Strategy: Clear and transparent communication to investors and the public is essential for restoring confidence.

Conclusion: Understanding and Navigating the Operation Sindoor Impact

The Operation Sindoor impact on the KSE 100 resulted in a significant market plunge and a trading halt, primarily due to alleged market manipulation. The incident highlighted vulnerabilities in the regulatory framework and significantly impacted investor confidence. The long-term effects on the Pakistani economy remain uncertain, but the government’s response and planned regulatory changes will play a vital role in mitigating the damage and restoring stability. Stay updated on the evolving situation and the impact of Operation Sindoor on the Pakistani stock market by following our future articles and analysis. Understanding the Operation Sindoor impact is crucial for navigating the KSE 100.

Featured Posts

-

Palantir Stock Price Prediction And Investment Strategy

May 10, 2025

Palantir Stock Price Prediction And Investment Strategy

May 10, 2025 -

Elon Musk Net Worth 2024 The Influence Of Us Economic Policies

May 10, 2025

Elon Musk Net Worth 2024 The Influence Of Us Economic Policies

May 10, 2025 -

Caso De Estudiante Transgenero Arresto Por Uso De Bano Femenino Genera Indignacion

May 10, 2025

Caso De Estudiante Transgenero Arresto Por Uso De Bano Femenino Genera Indignacion

May 10, 2025 -

Go Compare Ad Campaign Changes After Wynne Evanss Sex Slur Revelation

May 10, 2025

Go Compare Ad Campaign Changes After Wynne Evanss Sex Slur Revelation

May 10, 2025 -

Ajaxs Brobbey Strength And Skill Set To Challenge Europa League Rivals

May 10, 2025

Ajaxs Brobbey Strength And Skill Set To Challenge Europa League Rivals

May 10, 2025