Pakistan, Sri Lanka, And Bangladesh Sign Agreement To Deepen Capital Market Cooperation

Table of Contents

The South Asian region is witnessing a significant step towards economic integration with Pakistan, Sri Lanka, and Bangladesh signing a landmark agreement to deepen capital market cooperation. This collaborative effort, focused on Capital Market Cooperation (CMC) in South Asia, promises to unlock substantial economic benefits for all three nations, fostering growth and stability within their respective capital markets. This article will delve into the key aspects of this agreement and its potential impact on the region's financial landscape.

Enhanced Investment Opportunities through Capital Market Cooperation

This agreement aims to significantly increase cross-border investments among Pakistan, Sri Lanka, and Bangladesh. The enhanced capital market cooperation will facilitate a more seamless flow of capital across borders, leading to several key improvements:

-

Reduced bureaucratic hurdles for foreign investment: The agreement simplifies investment processes by streamlining regulations and reducing paperwork. This will make it easier for investors from one country to invest in the others, fostering a more dynamic investment environment. For example, the agreement might involve the harmonization of registration processes or the establishment of a single window system for cross-border investments.

-

Increased transparency and regulatory harmonization: Greater transparency in regulations and a harmonized approach to regulatory frameworks will build trust and encourage investment. This includes standardizing accounting practices and disclosure requirements, making it simpler for investors to understand the risks and opportunities in each market.

-

Facilitated access to a wider pool of capital for businesses: Businesses in all three countries will gain access to a much broader pool of capital, allowing them to expand their operations, invest in new technologies, and create jobs. This access to diverse funding sources strengthens their financial resilience.

Details: The agreement includes specific provisions for simplifying processes. For instance, it might involve mutual recognition of securities or the establishment of a joint regulatory body to oversee cross-border transactions. Information sharing agreements will also foster transparency and help mitigate risks. This will create a more level playing field for investors from Pakistan investing in Sri Lanka and Bangladesh, and vice-versa.

Strengthening Regional Financial Stability via Capital Market Cooperation

The agreement's focus on CMC in South Asia promotes a more stable and resilient financial environment across the region. This is achieved through several collaborative initiatives:

-

Shared risk management strategies and expertise: The countries will share best practices and expertise in risk management, helping to mitigate potential financial crises. This collaborative approach leverages the strengths of each nation's financial sector.

-

Collaboration on regulatory frameworks to prevent financial crises: By working together to establish robust regulatory frameworks, the countries aim to prevent future crises and enhance the stability of their financial systems. This will involve coordinated regulatory responses to emerging risks and vulnerabilities.

-

Increased resilience against external economic shocks: A more integrated regional financial system is better equipped to withstand external economic shocks. By diversifying investment and sharing resources, the countries can cushion the impact of global economic downturns.

Details: The agreement may include mechanisms for joint regulatory supervision of cross-border financial activities or the establishment of a regional crisis management fund. Collaboration on combating financial crime through information sharing and joint investigations will also be a crucial element in enhancing financial stability.

Boosting Economic Growth through Capital Market Cooperation

Increased capital flows stimulated by enhanced capital market cooperation will significantly boost economic activity and job creation across the region. Several key benefits are expected:

-

Access to cheaper capital for businesses leading to expansion and innovation: Easier access to a wider pool of capital will lower borrowing costs for businesses, fostering expansion and investment in innovation. This will create a more competitive business landscape.

-

Improved investor confidence attracting foreign direct investment (FDI): Increased transparency and regulatory harmonization will attract greater foreign direct investment (FDI), further stimulating economic growth. Foreign investors will be more confident in investing in a stable and regulated environment.

-

Development of a more robust and integrated financial sector: The agreement fosters the development of a more sophisticated and integrated financial sector, capable of supporting sustained economic growth. This strengthening of the regional financial architecture will have long-term benefits.

Details: Easier access to capital will facilitate infrastructure projects, support the growth of small and medium-sized enterprises (SMEs), and lead to technological advancements. These initiatives will drive job creation and contribute to higher overall economic growth rates.

Challenges and Opportunities in Capital Market Cooperation

While the agreement offers immense promise, several challenges need to be addressed to fully realize its potential:

-

Addressing differences in regulatory frameworks: Harmonizing the diverse regulatory frameworks across the three countries is crucial for seamless cross-border investment. This will involve overcoming discrepancies in legal and accounting standards.

-

Overcoming infrastructural limitations in certain areas: Improvements in technological infrastructure are necessary to facilitate efficient cross-border transactions and information sharing. This includes strengthening digital payment systems and data security.

-

Ensuring equitable benefits for all participating nations: Mechanisms must be in place to ensure that all three countries benefit equitably from the agreement, preventing any one nation from dominating the cooperative structure.

Details: Potential obstacles such as differing legal systems, varying levels of technological development, and the need for capacity building within regulatory bodies need to be actively addressed. Strategies for equitable benefit sharing, perhaps involving targeted support for less developed sectors or regions, will be vital for the long-term success of the agreement.

Conclusion

The agreement to deepen capital market cooperation between Pakistan, Sri Lanka, and Bangladesh marks a significant step towards regional economic integration. This initiative promises enhanced investment opportunities, strengthened financial stability, and boosted economic growth. While challenges remain, the potential benefits of strengthened CMC in South Asia are substantial. To learn more about this groundbreaking agreement and its implications, continue to explore resources on South Asian economic cooperation and capital market integration. Further exploration of South Asian capital market cooperation will reveal the vast potential of this collaboration.

Featured Posts

-

Strictly Come Dancing Wynne Evans Unexpected Career Change

May 09, 2025

Strictly Come Dancing Wynne Evans Unexpected Career Change

May 09, 2025 -

Dijon Faire Un Don De Cheveux

May 09, 2025

Dijon Faire Un Don De Cheveux

May 09, 2025 -

1509

May 09, 2025

1509

May 09, 2025 -

Matchday 27 Bundesliga 2 Colognes Victory Hamburgs Setback

May 09, 2025

Matchday 27 Bundesliga 2 Colognes Victory Hamburgs Setback

May 09, 2025 -

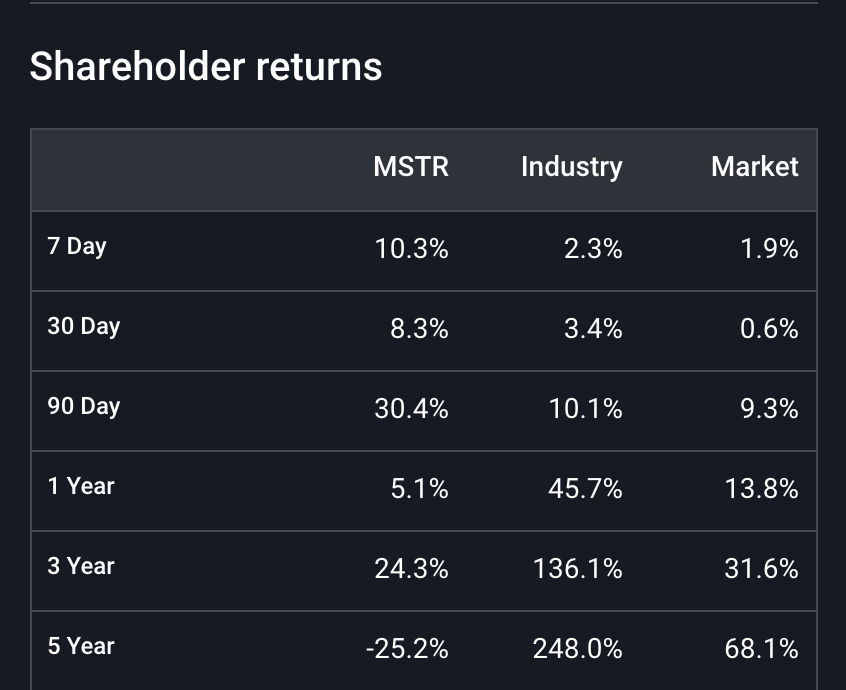

Bitcoin Or Micro Strategy Stock The Better Investment For 2025

May 09, 2025

Bitcoin Or Micro Strategy Stock The Better Investment For 2025

May 09, 2025