Palantir Stock: A 2024 Investment Strategy For Potential 2025 Gains

Table of Contents

Understanding Palantir's Business Model and its Growth Potential

Palantir's success hinges on its unique data integration and analytics platforms, offering powerful solutions to both government and commercial clients. This dual-pronged approach diversifies its revenue streams and mitigates risk, making it an attractive investment prospect.

Palantir's Government Contracts: A Stable Revenue Stream

Government contracts form a significant and stable portion of Palantir's revenue. These contracts, often long-term, provide a predictable income stream, crucial for consistent growth and financial stability.

- Significant Revenue Contributor: Government contracts represent a substantial portion of Palantir's overall revenue, providing a reliable base for future projections.

- Recent Contract Wins: Recent contract wins with key government agencies demonstrate continued demand for Palantir's data analytics solutions in the defense and intelligence sectors. These contracts often involve substantial funding and long-term partnerships.

- Key Government Clients: Palantir boasts a portfolio of high-profile government clients, indicating the trust and reliability associated with its services. This client base demonstrates the company's ability to deliver critical data solutions to meet stringent government requirements.

- Government Spending on Data Analytics: Increased government spending on data analytics and national security initiatives directly fuels Palantir's growth trajectory.

Expanding into the Commercial Sector: Fueling Future Growth

While government contracts provide stability, Palantir's expansion into the commercial sector is crucial for long-term growth. This market offers significantly larger potential revenue streams.

- Commercial Client Growth: Palantir is actively pursuing and acquiring new clients in various commercial sectors, including finance, healthcare, and energy. This diversification reduces reliance on government contracts.

- Successful Implementations: Successful implementations of Palantir's platforms in commercial settings demonstrate the applicability and effectiveness of its technology across diverse industries. These case studies showcase the value proposition for potential clients.

- Strategic Partnerships: Collaborations with leading technology companies further expand Palantir's reach and capabilities within the commercial market, opening up new avenues for growth. These partnerships enhance the overall value proposition and market penetration.

- Big Data and AI Solutions: Palantir's advanced AI-powered solutions are particularly attractive to commercial clients seeking to leverage big data for improved decision-making, operational efficiency and competitive advantage.

Technological Innovation and Competitive Advantage

Palantir's technological edge is a critical component of its success. Its proprietary platforms, Foundry and Gotham, offer unmatched capabilities in data integration, analysis, and visualization.

- Foundry Platform: Palantir Foundry is a comprehensive data integration and analytics platform designed to consolidate data from disparate sources, providing actionable insights for both government and commercial clients.

- Gotham Platform: Palantir Gotham focuses on national security applications, offering powerful data analytics capabilities to government agencies involved in intelligence gathering and counterterrorism efforts.

- AI-Powered Solutions: Palantir continuously invests in AI and machine learning, enhancing its platforms' capabilities and providing a significant competitive advantage in the rapidly evolving data analytics market. This ensures its solutions remain at the forefront of technological innovation.

- Data Integration Capabilities: Palantir's ability to seamlessly integrate data from diverse sources is a key differentiator, enabling organizations to derive meaningful insights from complex datasets.

Analyzing Palantir's Financial Performance and Valuation

A thorough assessment of Palantir's financial performance and valuation is essential for any prospective investor. This includes examining revenue growth, profitability, and key valuation metrics.

Revenue Growth and Profitability Trends

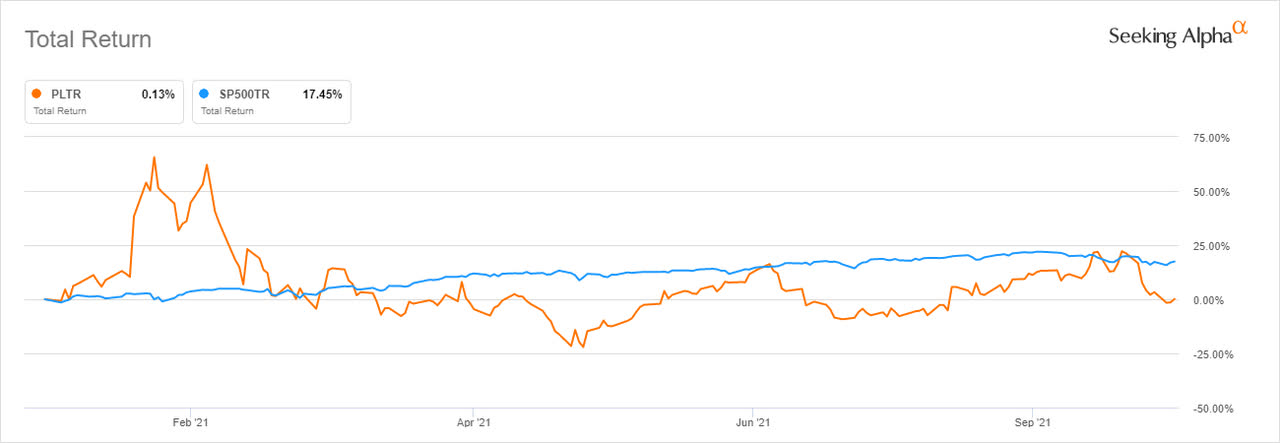

Palantir has demonstrated significant revenue growth, though profitability remains a key area of focus. Analyzing historical trends provides valuable insights into the company's financial health.

- Revenue Growth Trajectory: Charting Palantir's revenue growth over time reveals its consistent expansion, highlighting the underlying strength of its business model.

- Earnings Per Share (EPS): Analyzing EPS trends indicates the profitability and return on investment for shareholders. This is a key metric for understanding the company's financial performance.

- Free Cash Flow: Monitoring free cash flow demonstrates Palantir's ability to generate cash after covering operating expenses and capital investments. This indicates financial health and sustainability.

- Financial Reporting Analysis: Careful review of Palantir's financial reports, including income statements, balance sheets, and cash flow statements, provides a comprehensive understanding of its financial performance.

Assessing Palantir's Valuation Metrics

Evaluating Palantir's valuation relative to its peers and historical performance is crucial in determining its investment attractiveness.

- Price-to-Sales (P/S) Ratio: Comparing Palantir's P/S ratio to industry averages and competitors provides valuable insight into its relative valuation.

- Price-to-Earnings (P/E) Ratio: Analyzing Palantir's P/E ratio helps determine whether its stock price is overvalued or undervalued compared to its earnings.

- Market Capitalization: Understanding Palantir's market capitalization helps investors assess its overall size and position within the market.

- Comparative Valuation Analysis: Comparing Palantir's valuation metrics to those of competitors in the data analytics space provides a more complete picture of its investment potential.

Identifying Potential Risks and Challenges

While Palantir presents significant potential, investors must acknowledge potential risks and challenges.

- Competition: The data analytics market is highly competitive, with established players and emerging startups vying for market share. This competition puts pressure on pricing and profitability.

- Economic Downturns: Economic downturns can negatively impact government spending and commercial investment in data analytics, impacting Palantir's revenue growth.

- Regulatory Risks: Changes in regulations or government policies could affect Palantir's ability to operate in certain markets or secure contracts.

- Dependence on Key Clients: Concentrated reliance on a few key clients could pose a risk if those clients reduce their spending or switch providers.

Developing a 2024 Investment Strategy for Potential 2025 Gains

A successful Palantir investment strategy requires careful consideration of your individual circumstances and risk tolerance.

Determining Your Investment Timeline and Risk Tolerance

Before investing in Palantir stock, define your investment goals and assess your risk tolerance.

- Long-Term vs. Short-Term Investment: Determine whether you're a long-term investor looking for sustained growth or a short-term trader aiming for quick returns.

- Risk Tolerance Assessment: Honestly evaluate your comfort level with potential losses. High-growth stocks like Palantir carry inherent risk.

- Investment Goals: Align your investment strategy with your overall financial goals, such as retirement planning or wealth accumulation.

Setting Realistic Expectations and Defining Exit Strategies

Establish clear expectations and define exit strategies to manage risk and maximize potential returns.

- Realistic Return Expectations: Avoid unrealistic expectations of overnight riches. High-growth stocks experience volatility.

- Price Targets and Stop-Loss Orders: Set price targets for potential profits and stop-loss orders to limit potential losses.

- Market Conditions Assessment: Regularly assess market conditions and adjust your strategy accordingly.

Diversification and Portfolio Management

Diversification is key to managing risk. Palantir should be part of a broader, diversified investment portfolio.

- Asset Allocation Strategy: Allocate your investments across different asset classes to minimize risk and enhance potential returns.

- Portfolio Rebalancing: Regularly rebalance your portfolio to maintain your desired asset allocation.

- Professional Advice: Consider seeking guidance from a qualified financial advisor.

Conclusion: Investing in Palantir Stock for 2025 Growth

Investing in Palantir stock presents a potential opportunity for significant returns by 2025. However, success hinges on a well-informed investment strategy that considers Palantir's business model, financial performance, and potential risks. Remember to conduct thorough research, assess your risk tolerance, and diversify your portfolio. The Palantir stock outlook for the long term remains positive, driven by its innovative technology and expansion into new markets. While this article provides valuable information on Palantir investment strategy, it is crucial to consult with a financial advisor before making any investment decisions. Consider the Palantir long-term investment potential and develop a comprehensive Palantir investment strategy tailored to your specific financial goals. The future of Palantir and the opportunities it presents for investors are promising, but careful planning and due diligence are paramount.

Featured Posts

-

Novi Zayavi Stivena Kinga Pro Trampa Ta Ilona Maska

May 10, 2025

Novi Zayavi Stivena Kinga Pro Trampa Ta Ilona Maska

May 10, 2025 -

Palantir Stock Buy Before May 5th Earnings Report A Detailed Look

May 10, 2025

Palantir Stock Buy Before May 5th Earnings Report A Detailed Look

May 10, 2025 -

Exploring New Business Opportunities A Map Of The Countrys Hot Spots

May 10, 2025

Exploring New Business Opportunities A Map Of The Countrys Hot Spots

May 10, 2025 -

Us Deportations To El Salvador Jeanine Pirros Views On Due Process

May 10, 2025

Us Deportations To El Salvador Jeanine Pirros Views On Due Process

May 10, 2025 -

The Transgender Community And Trumps Executive Orders A Personal Account

May 10, 2025

The Transgender Community And Trumps Executive Orders A Personal Account

May 10, 2025