Palantir Stock: A Deep Dive Into Q1 2024 Government And Commercial Business Performance

Table of Contents

- Palantir's Government Business in Q1 2024: A Detailed Look

- Government Contract Wins and Revenue Growth

- Key Performance Indicators (KPIs) for the Government Sector

- Future Outlook for Palantir's Government Business

- Palantir's Commercial Business in Q1 2024: Analyzing Growth and Challenges

- Commercial Revenue Growth and Customer Acquisition

- Key Commercial Partnerships and Strategic Initiatives

- Challenges and Opportunities for Palantir's Commercial Growth

- Conclusion: Investing in Palantir Stock After Q1 2024 Results

Palantir's Government Business in Q1 2024: A Detailed Look

Palantir's government business remains a cornerstone of its revenue stream, and Q1 2024 provided further insights into its strength and trajectory.

Government Contract Wins and Revenue Growth

Q1 2024 saw Palantir secure several significant government contracts, demonstrating continued confidence from key agencies. While specific contract details often remain confidential due to national security concerns, publicly available information suggests a positive trend.

- Increased spending from existing clients: Many existing government clients expanded their usage of Palantir's platforms, leading to increased contract values and revenue. This speaks to the value proposition and strong client relationships.

- New contracts with agencies: While specific details are limited, reports indicate new contracts were awarded in areas such as defense, intelligence, and cybersecurity, further solidifying Palantir's position in the market.

- Geopolitical impact: The ongoing geopolitical landscape has resulted in increased demand for advanced data analytics solutions, benefiting Palantir and leading to significant revenue growth in the government sector. This increased demand can be directly attributed to the need for improved intelligence gathering and national security.

Compared to previous quarters, Palantir's government revenue showed robust growth, outpacing earlier projections in several key areas. This success demonstrates Palantir's adaptability to the evolving needs of government agencies.

Key Performance Indicators (KPIs) for the Government Sector

Several key performance indicators illuminate Palantir's government sector success in Q1 2024:

- Revenue Growth: Significant year-over-year and quarter-over-quarter growth was observed, exceeding analysts' expectations.

- Contract Backlog: The contract backlog remains substantial, signaling a healthy pipeline of future revenue and long-term stability.

- Customer Retention: Palantir reported high customer retention rates, indicating strong satisfaction among government clients.

The strong performance of these KPIs underscores the resilience and growth potential of Palantir's government business.

Future Outlook for Palantir's Government Business

The future looks bright for Palantir's government business. The continued need for sophisticated data analytics within national security and defense suggests sustained demand.

- Expanding existing contracts: Existing clients are likely to continue expanding their reliance on Palantir's solutions, contributing to predictable and consistent revenue streams.

- New opportunities: Palantir is well-positioned to capture new government contracts as agencies invest further in advanced technologies.

- Potential risks: Government budget constraints and shifting political priorities could pose challenges, requiring Palantir to maintain adaptability and demonstrate consistent value.

Palantir's Commercial Business in Q1 2024: Analyzing Growth and Challenges

While the government sector is a significant driver of revenue, Palantir's commercial business is also crucial for long-term growth.

Commercial Revenue Growth and Customer Acquisition

Palantir’s Q1 2024 commercial performance showcased mixed results. While revenue growth was observed, it didn't match the momentum seen in the government sector.

- Revenue growth: Commercial revenue growth was positive but slightly below projections.

- New customer acquisitions: Several new clients were added, spanning diverse industries, signaling continued progress in market penetration.

- Industry focus: Palantir focused on key industries like finance, healthcare, and energy to maximize its impact and achieve higher conversion rates.

Compared to previous quarters, the commercial sector's growth was more moderate, indicating challenges in market penetration and competition.

Key Commercial Partnerships and Strategic Initiatives

To accelerate growth in the commercial sector, Palantir has been actively pursuing strategic partnerships and initiatives.

- Technology integrations: Integrating Palantir's platform with other leading technologies enhanced its appeal and usability for commercial clients.

- Industry-specific solutions: Developing targeted solutions for specific industries has allowed for improved market penetration and customer relevance.

The success of these initiatives will significantly influence Palantir's future commercial growth.

Challenges and Opportunities for Palantir's Commercial Growth

The commercial market presents both challenges and opportunities for Palantir.

- Competition: The market is competitive, with established players and emerging startups vying for market share.

- Market saturation: Some sectors may show signs of market saturation, requiring Palantir to explore new verticals and expand its offerings.

- Opportunities: Significant untapped potential exists across various industries, offering ample opportunities for expansion and growth.

Overcoming these challenges requires a strategy focusing on innovation, targeted partnerships, and consistent value delivery.

Conclusion: Investing in Palantir Stock After Q1 2024 Results

Palantir's Q1 2024 results reveal a mixed bag. While the government sector demonstrated robust growth, the commercial sector showed more moderate progress. The substantial government contract backlog points towards a strong future, but the commercial sector requires sustained focus to maintain momentum. The ongoing geopolitical climate continues to benefit Palantir's government contracts, driving consistent revenue. However, the competitive commercial landscape requires a focused strategy for ongoing growth. Investors should carefully consider these factors when evaluating Palantir stock.

To make informed investment decisions, conduct thorough due diligence, analyzing Palantir's financial reports, competitive landscape, and future growth prospects. Stay informed on future Palantir stock performance by following our regular updates and analyses. Understanding the nuances of both the government and commercial sectors is key to a successful Palantir stock investment strategy.

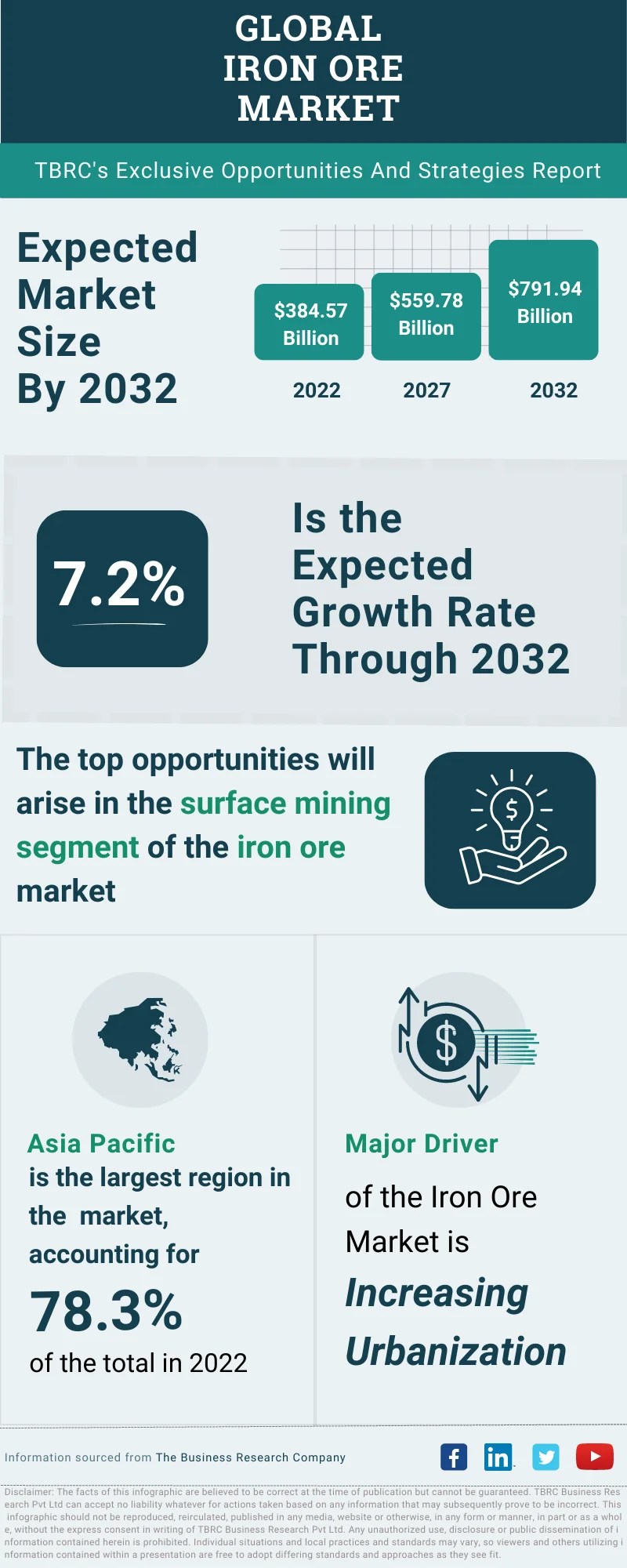

Iron Ore Market Volatility Understanding Chinas Steel Production Cuts

Iron Ore Market Volatility Understanding Chinas Steel Production Cuts

Uk Immigration Rules Tightened Fluent English Now Mandatory For Residency

Uk Immigration Rules Tightened Fluent English Now Mandatory For Residency

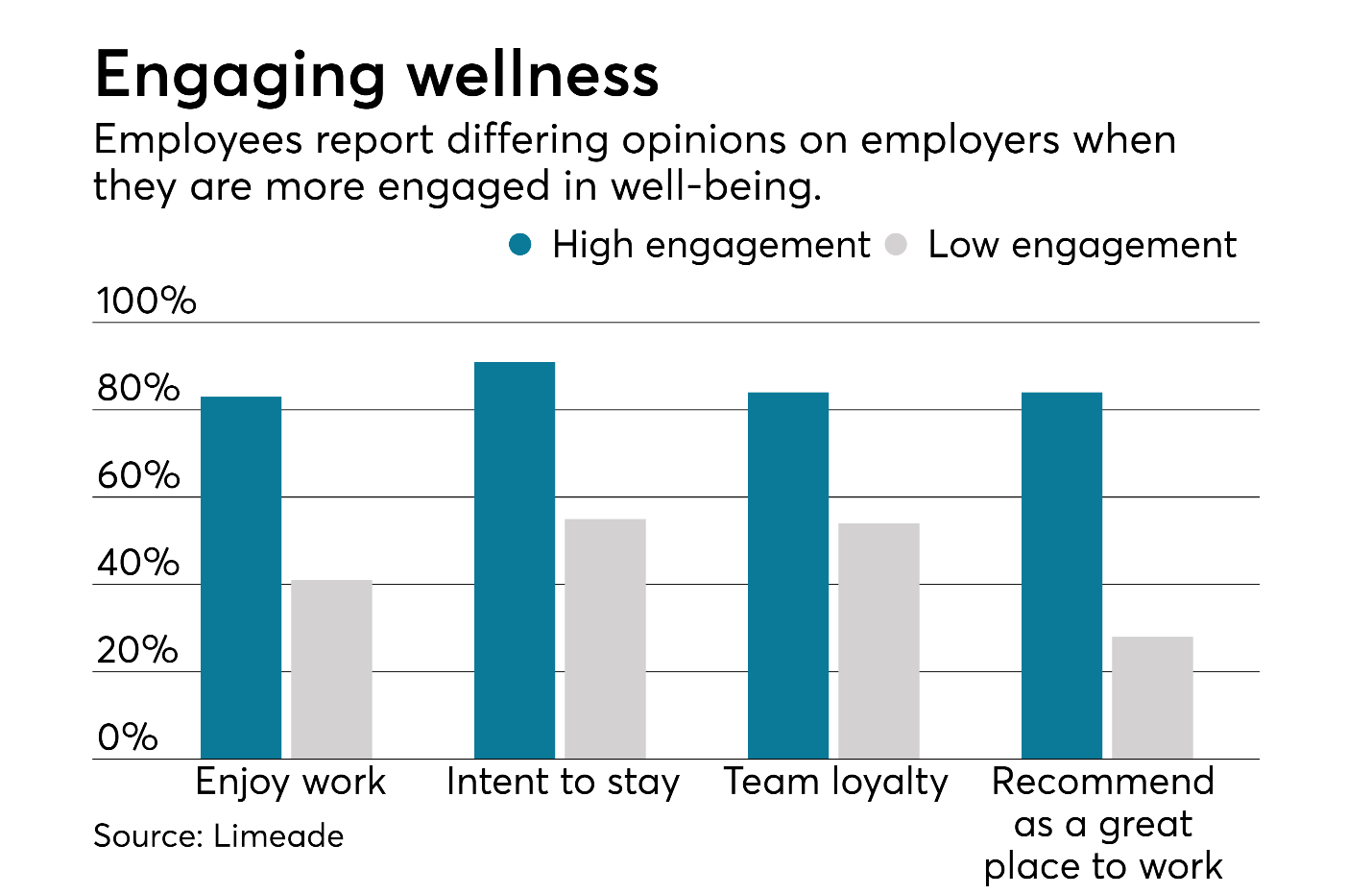

The Importance Of Middle Management A Key To Employee Engagement And Productivity

The Importance Of Middle Management A Key To Employee Engagement And Productivity

Debate Jessica Tarlov Vs Jeanine Pirro On Us Canada Trade Dispute

Debate Jessica Tarlov Vs Jeanine Pirro On Us Canada Trade Dispute

India And Us Engage In Talks For New Bilateral Trade Agreement

India And Us Engage In Talks For New Bilateral Trade Agreement