Palantir Stock: Is It A Good Investment Right Now? A Detailed Look

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir operates on a two-pronged approach, offering two primary platforms: Gotham and Foundry. Gotham caters to government clients, providing advanced data analytics solutions for national security and intelligence applications. Foundry, on the other hand, serves commercial clients across various sectors, offering a flexible platform for data integration, analysis, and operational improvement.

A crucial aspect of Palantir's business model is its recurring revenue stream. This model, characterized by long-term contracts and high switching costs, contributes significantly to its long-term growth potential.

- High Switching Costs: Palantir's platforms become deeply integrated into clients' operations over time. Migrating to a competitor's platform is often complex, time-consuming, and expensive, creating significant barriers to switching. This sticky relationship ensures predictable revenue streams.

- Increasing Adoption: Palantir's platforms are witnessing increasing adoption across diverse sectors, including finance, healthcare, and manufacturing. This diversification mitigates risk and fosters sustainable growth.

- Market Expansion Potential: Palantir continues to explore new markets and applications for its technology, offering significant potential for future revenue expansion.

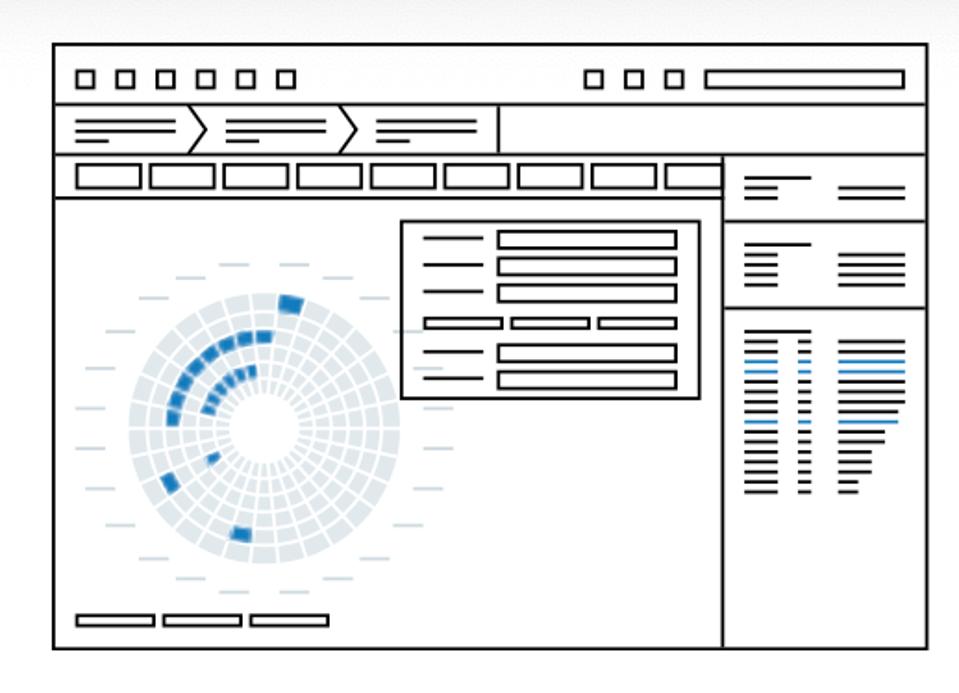

Analyzing Palantir's financial performance reveals substantial growth in recent years. While profitability has fluctuated, the company has demonstrated consistent revenue growth, particularly in the commercial sector. For example, Q2 2024 showed a significant increase in Palantir revenue growth compared to the same period in 2023 (specific figures would need to be sourced from the latest financial reports). This upward trend in Palantir revenue growth points towards a healthy and expanding business. (Charts and graphs visualizing this data would enhance this section.) Examining Palantir's profitability alongside its Palantir revenue growth provides a fuller picture of its financial health.

Market Analysis and Competition

The big data analytics market is fiercely competitive, with several major players vying for market share. Palantir faces competition from companies like Databricks, Snowflake, and others specializing in cloud-based data warehousing and analytics. These competitors possess strengths in specific areas, such as scalability and specific functionalities.

However, Palantir holds several key advantages:

- Unique Selling Propositions (USPs): Palantir's strength lies in its ability to handle complex, unstructured data sets and provide actionable insights for its clients. Its user-friendly interface and robust security features set it apart from competitors.

- Market Share and Growth: Although precise market share figures are difficult to obtain, Palantir maintains a strong position in the government and increasingly in the commercial sectors. The continued growth of the big data analytics market presents a vast opportunity for Palantir to expand its market share.

- Strategic Partnerships: Palantir's strategic partnerships with technology giants enhance its capabilities and reach, expanding its market position and access to new technologies.

Analyzing the competitive landscape reveals that while Palantir faces strong competitors, its unique approach, focus on complex data analysis, and strategic partnerships provide a sustainable competitive advantage within the big data analytics market.

Risk Assessment and Potential Downsides

Investing in Palantir stock carries inherent risks:

- High Valuation: Palantir's stock valuation remains high relative to its current earnings, making it vulnerable to market corrections. A drop in investor sentiment could significantly impact its stock price.

- Government Contract Concentration: A substantial portion of Palantir's revenue comes from government contracts. This concentration makes it susceptible to changes in government spending and geopolitical factors.

- Emerging Technologies and Competition: The rapid evolution of technology presents a constant threat from emerging competitors and disruptive technologies. Failure to adapt and innovate could hinder Palantir's growth.

Understanding these Palantir risk assessment factors is crucial for informed investment decisions. The impact of geopolitical risks, such as changes in international relations and regulatory changes, can also affect Palantir's government contracts and overall performance.

Future Outlook and Growth Potential

Palantir's long-term growth strategy centers on innovation and expansion into new markets. The company is actively investing in its AI and machine learning capabilities, enhancing its platform's analytical power.

- New Markets and Sectors: Palantir is actively targeting new sectors, particularly in the commercial space, to diversify its revenue streams and reduce its dependence on government contracts.

- AI and Machine Learning: Integrating AI and machine learning will improve the accuracy and speed of Palantir's data analysis capabilities, enhancing its value proposition for clients.

- Projected Growth: Based on current trends and Palantir's innovation pipeline, future revenue growth and profitability are projected to be substantial (specific projections would require further detailed financial analysis). Palantir's future outlook looks promising given its commitment to innovation in AI and its expanding commercial client base.

Conclusion

Whether Palantir stock is a good investment for you depends on your risk tolerance and investment goals. While Palantir demonstrates strong revenue growth and a unique position in the big data analytics market, risks associated with its high valuation, government contract concentration, and competitive landscape need careful consideration. The potential for long-term growth driven by technological advancements and market expansion is significant. However, thorough research and potentially consulting a financial advisor are crucial before investing in Palantir stock. Learn more about Palantir's financial performance and future plans on their investor relations page [link to Palantir's investor relations page].

Featured Posts

-

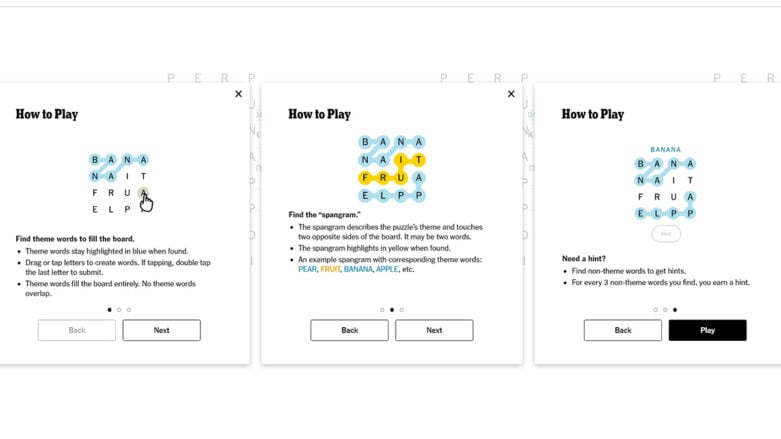

Nyt Strands Answers For Saturday March 15th Game 377

May 10, 2025

Nyt Strands Answers For Saturday March 15th Game 377

May 10, 2025 -

Air Traffic Safety Crisis Internal Warnings Ignored Before Newark System Failure

May 10, 2025

Air Traffic Safety Crisis Internal Warnings Ignored Before Newark System Failure

May 10, 2025 -

Elizabeth Hurleys Bikini Clad Maldives Escape

May 10, 2025

Elizabeth Hurleys Bikini Clad Maldives Escape

May 10, 2025 -

Double Trouble In Hollywood Wga And Sag Aftra Strike Brings Industry To Standstill

May 10, 2025

Double Trouble In Hollywood Wga And Sag Aftra Strike Brings Industry To Standstill

May 10, 2025 -

The Palantir Nato Deal A Deep Dive Into The Future Of Public Sector Ai

May 10, 2025

The Palantir Nato Deal A Deep Dive Into The Future Of Public Sector Ai

May 10, 2025