Palantir's Stock Price Surge: New Analyst Predictions And Implications

Table of Contents

Key Factors Contributing to Palantir's Stock Price Surge

Several key factors have converged to propel Palantir's stock price to new heights. Analyzing these contributing elements is crucial for understanding the current market sentiment and forecasting future performance.

Strong Q[Insert relevant Quarter, e.g., Q2 2024] Earnings Report

Palantir's [Insert relevant Quarter, e.g., Q2 2024] earnings report significantly exceeded expectations, boosting investor confidence and driving the stock price upward. The report showcased impressive growth across key metrics, signaling a positive trajectory for the company.

- Revenue growth percentage: Palantir reported a [Insert Percentage]% increase in revenue compared to the same period last year, surpassing analyst predictions of [Insert Percentage]%.

- Improved profit margins: The company demonstrated improved profitability, with [Insert Metric, e.g., operating margins] reaching [Insert Percentage]%, showcasing increased efficiency and cost management.

- Significant new contract wins: The earnings report highlighted several significant new contract wins, both in the government and commercial sectors, demonstrating strong demand for Palantir's data analytics platform. These contracts represent substantial revenue streams and solidify Palantir's position in the market.

Increased Government & Commercial Contracts

Palantir's success is fueled by a robust pipeline of contracts from both government and commercial sectors. The expansion into diverse sectors underlines the versatility of its platform and its potential for future growth.

- Examples of key government clients and contracts: Recent large contracts include deals with [mention specific government agencies or departments, e.g., the US Army, a specific intelligence agency]. These contracts often involve long-term partnerships and substantial revenue streams.

- Examples of significant commercial partnerships: Palantir has forged strategic alliances with leading companies in various industries, including [mention specific companies and sectors, e.g., financial institutions, healthcare providers]. These partnerships expand Palantir's reach and access to new markets.

- Growth potential in specific sectors (e.g., healthcare, finance): The healthcare and finance sectors present significant growth opportunities for Palantir, given the increasing need for advanced data analytics in these industries. Palantir's platform is well-positioned to capitalize on these trends.

Positive Analyst Upgrades and Price Target Increases

The recent stock price surge has been accompanied by a wave of positive analyst upgrades and increased price targets. This positive sentiment from market experts reinforces the bullish outlook for Palantir.

- List of analysts who upgraded their rating and the reasons behind the upgrade: [List analysts and their firms, e.g., Analyst X at Firm Y upgraded their rating to "Buy" citing strong Q2 earnings and increased contract wins].

- Summary of average price target increases: The average price target for Palantir has increased by [Insert Percentage]%, indicating a significant upward revision in expectations for the company's future performance.

- Mention any dissenting opinions: While the overall sentiment is positive, some analysts maintain a more cautious outlook, citing potential risks and challenges (discussed in the next section).

Implications of the Stock Price Surge for Investors

The surge in Palantir's stock price presents both opportunities and challenges for investors. A careful assessment of both the positive and negative factors is essential for informed decision-making.

Potential Risks and Challenges

Despite the positive momentum, investors need to consider several potential risks and challenges that could impact Palantir's future performance.

- Identify key competitors and their market share: Palantir faces competition from established players and emerging startups in the data analytics space. Understanding the competitive landscape is crucial for assessing the company's long-term sustainability.

- Discuss potential regulatory hurdles or legal challenges: The nature of Palantir's business, particularly its work with government agencies, may expose it to regulatory scrutiny and potential legal challenges.

- Highlight economic factors that could negatively impact Palantir's growth: Macroeconomic factors, such as economic downturns or changes in government spending, could negatively influence Palantir's growth trajectory.

Investment Strategies and Considerations

Investors considering Palantir stock should carefully evaluate their risk tolerance and investment horizon before making any decisions.

- Suggestions for long-term vs. short-term investors: Long-term investors may view the recent surge as a buying opportunity, while short-term investors might consider taking profits depending on their individual risk profiles.

- Recommendations for diversification within a portfolio: Diversification is crucial to mitigate risk. Investors should consider diversifying their portfolio beyond Palantir stock.

- Consideration of alternative investments: Investors should compare Palantir's potential returns and risks with other investment options before committing significant capital.

Conclusion

Palantir's recent stock price surge is a result of strong financial performance, increased contract wins, and positive analyst sentiment. This positive momentum reflects the company's growing market presence and the increasing demand for its data analytics solutions. However, investors must also consider the potential risks and challenges before making investment decisions. Understanding the drivers behind the Palantir stock price surge is crucial for informed decision-making.

Call to Action: Stay informed about the latest developments in Palantir's performance and analyst predictions to make sound decisions regarding your Palantir stock investments. Continuously monitor the Palantir stock price and related news to capitalize on opportunities in this evolving market. Thorough research and a well-defined investment strategy are key to navigating the complexities of the Palantir stock price and maximizing your investment potential.

Featured Posts

-

West Hams 25m Financial Hole Potential Solutions And Implications

May 09, 2025

West Hams 25m Financial Hole Potential Solutions And Implications

May 09, 2025 -

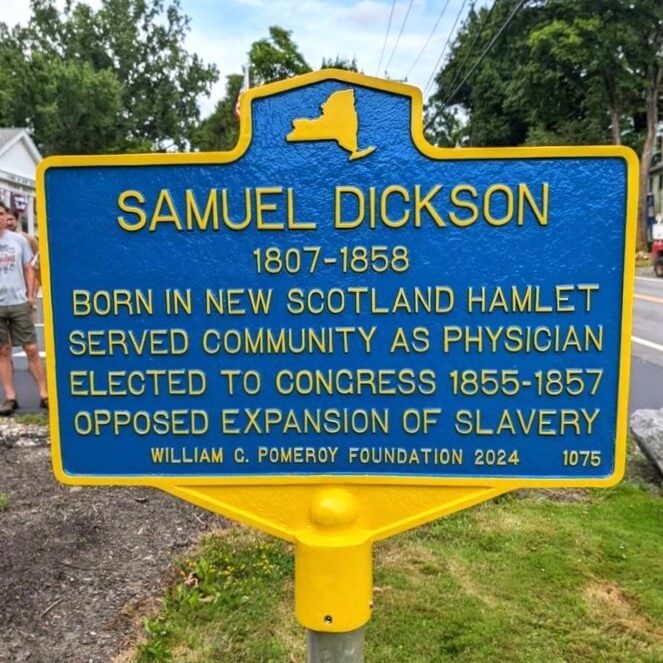

The Life And Times Of Samuel Dickson A Canadian Industrialist

May 09, 2025

The Life And Times Of Samuel Dickson A Canadian Industrialist

May 09, 2025 -

High Potential Season 1 When Morgan Wasnt So Smart

May 09, 2025

High Potential Season 1 When Morgan Wasnt So Smart

May 09, 2025 -

Samuel Dickson A Canadian Lumber Barons Legacy

May 09, 2025

Samuel Dickson A Canadian Lumber Barons Legacy

May 09, 2025 -

Tracking The Billions Musk Bezos And Zuckerbergs Net Worth Decline Post Trump Inauguration

May 09, 2025

Tracking The Billions Musk Bezos And Zuckerbergs Net Worth Decline Post Trump Inauguration

May 09, 2025